How to improve your credit score

Achieving a good credit score should not be an intimidating prospect. If your score isn’t where you want it to be, you can work to improve it. You can take some simple steps that can help build your score enough to get better interest rates on credit cards, make it easier to qualify for loans, and save money in insurance premiums, among other things.

Get your free credit score

Start today. The sooner you know your baseline score, the sooner you can start to build credit history.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

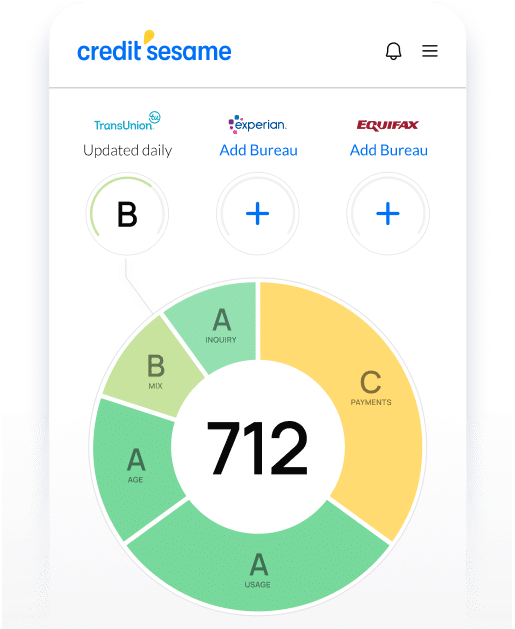

How credit scores are calculated

The average FICO credit score was 714 in 2021, according to data from Experian, one of the three major credit bureaus. FICO is the most widely used credit score in the United States, ranging from 300 to 850. A 714 score is considered good.

Another major credit score, called VantageScore, averages 698 in the United States, according to Equifax, another credit bureau. That’s considered a good score on VantageScore’s range of 350 to 850. VantageScore was developed by the three major credit bureaus, also known as credit reporting agencies, as an alternative to FICO.

Knowing how credit scores are calculated can help you decide which areas you can work on to raise your score. Here are the main factors that go into computing credit scores, along with ways to improve your score in each area:

Payment history

Paying your bills regularly on time is the best way to improve your credit score. It accounts for 35% of a FICO score, so late or missed payments can hurt your score more than any other one action.

Amount owed

How much money you owe at any one time across your lines of credit is the second-biggest factor in a credit score, accounting for 30% of a FICO score. It’s best to pay off all of your balances every month if you can.

Credit utilization

Credit utilization shows how much you’re using the credit available to you. It’s calculated by dividing the amount of revolving credit you use by your total available credit across those accounts. If you owe $5,000 on your credit cards and your credit limit is $20,000, then your credit utilization rate is 25%.

A good goal is to use less than 30% of your available credit, though some experts say 10% is best and will raise a credit score more.

Credit age

Credit age is a record of how long you’ve had established lines of credit. The longer your credit age, the better. Even if you’re not using some credit accounts, it can be worthwhile to keep them open because closing them could shorten the length of your credit history.

Credit mix

A variety of account types helps show lenders you know the fundamentals of credit, especially if you manage all of them well. Accounts include credit cards, mortgages, car and student loans, and personal loans.

New credit

Getting a new credit card can lower your credit score temporarily, though it shouldn’t stop you from opening a new line of credit if you need it. But bear in mind that opening too many accounts at around the same time is seen as risky behavior and that you are desperate for cash.

Applying for new credit can hurt a credit score through what are called hard inquiries. These are when a lender or creditor checks your credit after you apply for a new line of credit. Too many hard inquiries can cause a credit score to fall.

How improving your credit can improve your life

Improving your credit score can make a lot of things a lot cheaper. Low-interest rates are often given to people with the best credit scores, making auto, home, and other types of loans less expensive over years of payments. Credit card users can also get lower rates and better credit card perks, such as cashback or reward points for travel.

How to take steps to improve your credit

You should be able to use the list above on how credit scores are calculated to change your money habits and improve your score. Here are some specific ways to follow those rules and raise your score more:

Pay bills on time or early

Automatic payments and reminder alerts when your bills are due are two easy ways to pay your bills on time, which is the biggest thing you can do to help your credit score. An emergency fund can also be handy if big bills pop up.

Along with not having late payments, avoid repossessions, foreclosures, defaults, third-party collections, and bankruptcy.

If you can, pay your bills early, especially credit card bills. Credit card balances and credit utilization aren’t shown in real time on credit reports but are reported once a month after your monthly statement closes. If you pay your credit card bill early, the balance reported to the credit bureaus will be lower than it would be for the full month.

Review credit reports

Get your credit reports for free each year from each of the three consumer reporting agencies — Equifax, Experian, and TransUnion. Or go to AnnualCreditReport.com to get your free reports. Check for errors and signs of identity theft and fraud and if any accounts have gone into collections. Dispute any mistakes you find. Pay off collections accounts, dispute them if they’re inaccurate, and if they’re older than seven years ask that they be removed from your credit reports.

Watch your credit utilization rate

As discussed earlier, a credit utilization rate is the percentage of available credit you use. Use less of your credit limit, such as 10%, as this is better for your credit score than using 30% of your available credit.

Two ways to lower a credit utilization rate are to pay down balances or ask your credit card company for a credit limit increase. A higher credit limit, however, won’t lower your utilization rate if you spend more of it.

Limit new accounts

Not applying for new lines of credit won’t necessarily raise your credit score, but too many credit inquiries can lower your score. These are called hard inquiries, and stay on credit reports for 24 months and may impact a credit score for the first 12 months.

Before applying, check your credit score to see if you’re likely to be approved. A denied application could lower your score.

Keep old accounts open

It’s tempting to close old accounts that you’ve paid off and no longer use. That makes sense if a credit card charges an annual fee and you’re not using the card at all. But if an account doesn’t charge fees, keeping it open will help your credit history remain long. A long credit history can help a credit score.

Become an authorized user

Credit can be difficult to get when you’re young. That can make establishing a credit history difficult since older accounts can help raise a credit score.

Instead of waiting years for your credit history to improve while you pay your credit card bills on time and keep accounts open for years, you can ask a relative if you can become an authorized user of their card when you’re young. If their account is in good shape, then your score may improve as an authorized user.

Fix credit report errors

How long does it take to improve your credit?

Don’t expect your credit score to go up overnight. Work and patience are required to solve many credit report issues.

It shouldn’t take long to improve your credit if you have one late payment or a few hard inquiries to overcome. Catch up on the payment and your score could improve in a month. Hard inquiries should lessen after a month or so, though too many could lower a score for a year or so. Fixing errors on your credit report can raise a score in a month or so.

Big problems such as foreclosure, an account going into collections, and bankruptcy can affect a score for years. A big jump in your score could happen when they’re resolved.

How do you build credit?

If you’re young or new to credit, building credit can seem difficult. You can’t build a good credit profile until you have good credit; it can take good credit to be approved for a credit card.

We discussed earlier how to become an authorized user on a friend or family member’s credit card as a way to improve and build your credit when you don’t have much, if any, credit history. Here are a few others:

Secured credit cards

A secured credit card requires depositing money that’s equal to the credit limit on the card. It works like any other credit card; on-time payments will help build a positive credit history.

Student credit cards

A steady income from at least a part-time job and proof that you’re enrolled in school are often the main requirements for getting a student credit card that’s aimed at helping students build credit.

Co-signer

A co-signer is someone who agrees to legally be responsible for a debt if the borrower doesn’t repay the loan. You may be able to get better loan terms or qualify for a car or student loan with the help of someone who already has good credit. You’ll build credit as you repay the loan.

Rent and utility payments

If you pay your rent and utility bills on time, you can ask your landlord and utility companies to report your payments to the credit reporting agencies.

Self-report banking data

A free program called UltraFICO allows consumers to improve a thin credit profile by self-reporting their banking information such as checking and savings accounts for Experian to use in calculating UltraFICO scores.

Another free program called Experian Boost is similar. Online banking data permission is given to the credit bureau so that telecommunications and utility payment history are added to a credit report.

In a nutshell

Improving your credit requires time and patience. By knowing the main factors that go into a credit score, you should be able to start financial habits that can raise a score. Paying your bills on time is the biggest step, so start with that if you can. Checking your credit reports annually is also important and may lead to you finding errors that are unnecessarily causing a score to drop.

The sooner you start improving your credit, the better. Even if you have good or excellent credit, you can keep your score high by constantly working on ways to keep it there. Young consumers can gain the most by building a strong credit history, potentially getting the best credit terms and interest rates for life.

Do more with your FREE score™

Check your score right away and see the factors impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Check your credit score for FREE

Checking your score to see where you stand is FREE and does not impact your credit.

What is a credit score

How to establish credit

What affects credit score?

See your score.

Reach your goals.

See your score. Reach your goals.

Begin your financial journey with Credit Sesame today.

Get your FREE credit score in seconds.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.