What affects your credit score?

Knowing what goes into computing your credit score can be the first step to getting better credit. The higher your credit score, the more likely you are to qualify for low-interest rates on credit cards, lines of credit such as personal loans, home loans, auto loans, and credit card offers with all kinds of perks.

Get your free credit score

Start today. The sooner you know your baseline score, the sooner you can start to build credit history.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- The fundamentals of credit score

- Five Factors that make up your credit score

- Other data that may be used to determine loan eligibility

- What cannot be used to calculate a credit score

- What can I do if my credit application is denied?

- Why credit scores can differ among credit bureaus

- How do I check my credit score?

- What are the best ways to improve my score?

- In a nutshell

Share this

The fundamentals of credit score

Credit scores vary widely from person to person, depending on how they manage their debt in five main areas. There are three main credit bureaus, Equifax, Experian, and TransUnion, each collecting information. Depending on exactly how your credit score is calculated, you may have several different credit scores, but they are likely to be similar. For example, you are unlikely to have an excellent credit score with the information provided by Experian and a poor credit score with the information provided by TransUnion. However, the fundamentals of information used to calculate credit scores are common to all credit bureaus. It is worth understanding the principles before you work to improve your scores and hopefully get better credit terms and offers.

The four principles to understand about credit scores are:

- What is a credit score?

- What makes up a credit score?

- Why is a credit score is important?

- How is a credit score different from a credit report?

What is a credit score?

A credit score is a 3-digit number used by lenders to decide how likely you are to pay back a loan in full and on time. Your credit score is calculated using the information in your credit report. Someone with a high credit score is considered to be more likely to repay loans on time and in full. They are considered to be an excellent credit risk. Someone with a low credit score is considered to be less likely to repay debt, and so is a poor credit risk. Typically, people with high credit scores are offered more favorable terms and lower interest rates than individuals with low credit scores. This difference amounts to thousands of dollars over the life of a loan.

- 300-579 Poor

- 580-669 Fair

- 670-739 Good

- 740-799 Very Good

- 800-850 Excellent

What makes up a credit score

Credit scoring systems calculate credit scores using proprietary algorithms. FICO, developed by the Fair Isaac Corporation in 1989, and VantageScore are widely used credit scoring models. Lenders, banks, credit card issuers, and other financial institutions often rely on these scores to assess an individual’s creditworthiness when making lending decisions. While FICO has been the more traditional and dominant credit scoring model, VantageScore has gained popularity as an alternative in recent years.

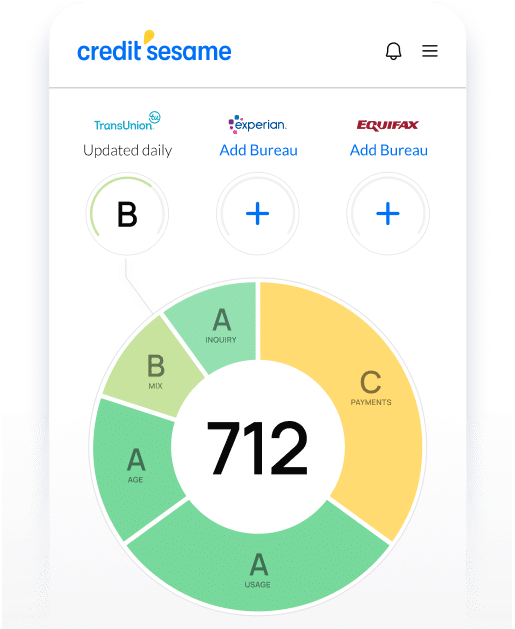

Both credit scoring models consider your payment history, amount of money owed, length of credit history, credit mix, and new credit. In other words, your credit score represents your history of repaying the money you borrowed, how much total debt you owe, how long you’ve had a specific line of credit or loan, and what types of loans you’ve had.

Why a credit score is important

A credit score is important because it may influence financial opportunities and transactions.

Lenders assess credit scores to determine the likelihood of borrowers repaying loans. Higher scores are associated with a better chance of timely repayment.

Good credit scores result in favorable loan terms, such as lower interest rates and more favorable borrowing conditions, saving money over the loan’s life.

Various entities, including employers, landlords, banks, and service providers, use credit scores to assess your creditworthiness. It affects decisions on job offers, rental applications, and service agreements.

Some insurance companies use credit information to predict the likelihood of claims. A higher credit score may lead to lower insurance premiums.

Understanding and managing your credit score positively can help you access financial products and services on favorable terms and can impact various aspects of your financial life.

How a credit score differs from a credit report

Credit scores are numbers calculated using the data and information on your credit reports. The credit scores themselves do not appear on your credit reports. Creditors use credit scores to measure how likely you are to repay debt.

The three major credit bureaus, Experian, Equifax, and TransUnion, collect data for their credit reports from public records and from data they receive from creditors on how you use credit. Each credit bureau, also known as a credit reporting agency, uses different formulas to compile a credit report and set your credit score. This gives you at least three different credit reports.

Most information stays on credit reports for seven to 10 years, and credit scores can change daily as new information comes in.

Five Factors that make up your credit score

The five main factors that make up your credit score are:

- 35% Payment history

- 30% Amount owed

- 15% Length of credit history

- 10% Credit mix

- 10% New credit

Payment history

At 35%, payment history influences credit scores the most. Payment history encompasses:

- Payments made on time

- Missed payments

- Late payments

- How recently payments were missed

Generally, lenders report payments made more than 30 days late to the credit bureaus. This can lead to lower credit scores. Account in collections or declaring bankruptcy can also hurt your credit score.

Amount owed

The amount you owe on loans and credit cards accounts for around 30% of your credit score. It includes:

- Total debt

- Number of credit accounts

- Type of credit (installment versus revolving)

- Credit utilization

A good rule of thumb is to use no more than 30% of your available credit and, ideally, to keep it under 10%. High loan balances and maxed-out credit cards can lower a credit score. Smaller balances may raise credit scores if the bill is paid on time.

Length of credit history

The length of your credit history influences 15% of your credit score. The longer you’ve been making timely payments, the better this part of your score will be. If you haven’t had credit for long, paying bills on time and having low balances can offset it.

The average age of your credit is what’s generally looked at. Keeping accounts open and active is important to increase your credit history timeline. New loans may drop your score for a while, but older loans about to be paid off should help a score rise.

Credit mix

A mix of credit accounts makes up 10% of a credit score. Car and home loans, credit cards, retail cards, and student loans are all different types of debt. Having too many credit cards can hurt a score.

The types of credit accounts can also be a factor. Some scoring systems prefer loans to buy a house or car rather than to consolidate debt.

New credit

If you’ve applied for new credit or opened many accounts lately, such “hard inquiries” on your credit report could temporarily lower your score. New credit accounts for 10% of a score.

Applying for or opening several accounts at once can be seen as risky behavior and a sign that you need cash immediately, which lenders want to avoid.

Other data that may be used to determine loan eligibility

Lenders may use information outside your credit report may be utilized to make decisions. A mortgage lender will likely factor in your down payment, total debt, income, and other things in determining your credit score and worthiness for a home loan.

What cannot be used to calculate a credit score

Credit scoring systems are designed to consider specific financial and credit-related factors while excluding certain personal characteristics. Here are key points related to what can’t be used to set a credit score:

Inquiries from prescreened credit offers, where creditors assess your creditworthiness for pre-approved offers, are not factored into your credit score.

Inquiries by creditors who are monitoring your existing account are typically not counted against you.

Federal law prohibits credit scoring systems from using certain personal characteristics, including race, sex, marital status, national origin, or religion when determining creditworthiness.

While an applicant’s age can be considered in a credit scoring system, any system that includes age must treat applicants of all ages equally.

These measures aim to ensure fairness and prevent discrimination in the credit scoring process, emphasizing factors directly related to creditworthiness and financial behavior.

What can I do if my credit application is denied?

If your credit application is denied, including if you’re denied insurance, you have the right to know within 30 days of filing a complete application if it was accepted or rejected.

You also have the right to know specifically why your application was rejected. Reasons can include if your income was too low or you haven’t been employed long enough. You must ask within 60 days of being denied.

You can also learn why you were offered less favorable terms than you applied for, but only if you reject these terms.

If you were denied credit or insurance or were offered less favorable terms because of information on your credit report, then the business must give you a notice. It must include the credit bureau’s name, address, and phone number that supplied the information. If your credit score was a factor, then your credit score must be listed in the notice.

If you get such a notice, you’re entitled to a free copy of your credit report from the credit bureau. Only the creditor or insurance company can tell you exactly why your application was denied or why you weren’t offered more favorable terms.

Why credit scores can differ among credit bureaus

Credit scores are a snapshot of your credit situation at one moment in time. They can change from day to day, depending on many factors.

The two main types of consumer credit scores are the FICO Score and VantageScore.

Credit bureaus don’t share information, so you may have different scores on each credit report on any given day. Not all three reporting bureaus may have the same credit information about you, partly because it comes from various sources and can be updated at different times of the month.

Lenders may use different scoring models, such as one for mortgages, one for auto loans, and another for credit cards. The three main credit bureaus use 28 different FICO credit scores regularly.

How do I check my credit score?

What are the best ways to improve my score?

Improving your credit score doesn’t happen overnight. It takes some time, but you may see positive results within a month or so if you make some good changes.

The best thing to do is pay your bills on time and keep your credit balances low. Those two things account for 65% of a credit score.

Avoiding new debt will also help because new credit shortens your credit history and can indicate that you’re desperate for money.

In a nutshell

Five main factors affect a credit score, and the best way to raise your score is to pay your bills on time and carry low balances. A higher credit score means you’re seen as less of a financial risk to businesses, and they’ll likely charge you less for credit and are more likely to offer credit to you.

Using loans and credit cards responsibly and making on-time payments can improve your credit score so that you get the lowest rates possible when applying for new credit. A car loan, mortgage, new credit card, or renting your first apartment can be much easier if you know the path to a high credit score.

Do more with your FREE score™

Check your score right away and see the factors impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Check your credit score for FREE

Checking your score to see where you stand is FREE and does not impact your credit.

How to establish credit

What is a credit score

How to improve credit score

See your score.

Reach your goals.

See your score. Reach your goals.

Begin your financial journey with Credit Sesame today.

Get your FREE credit score in seconds.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.