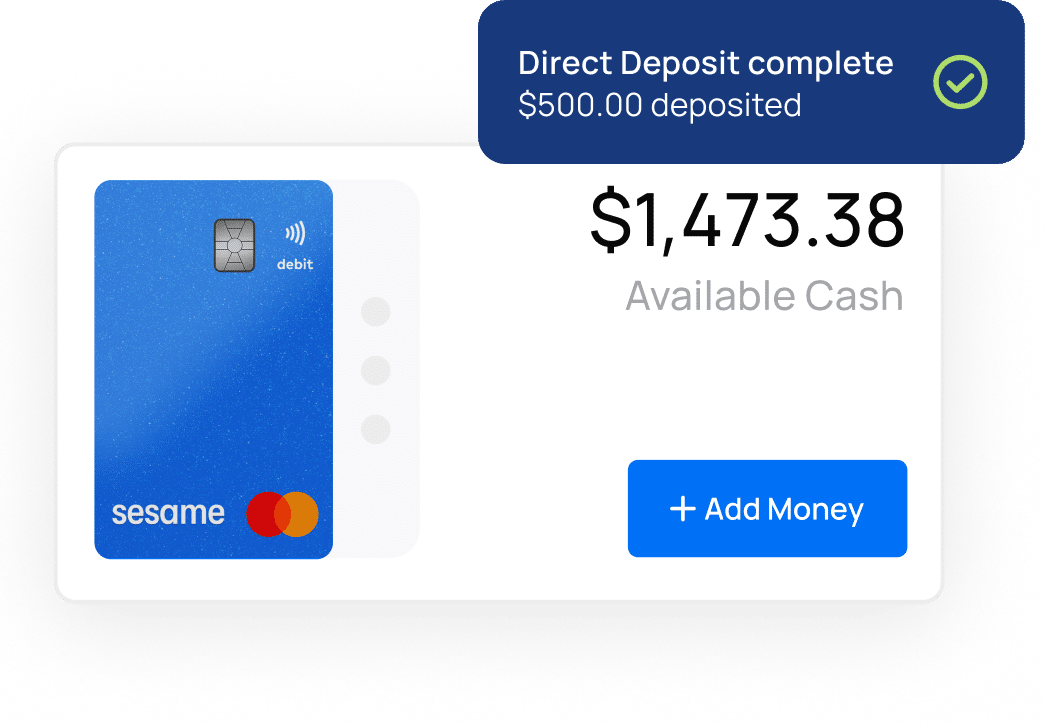

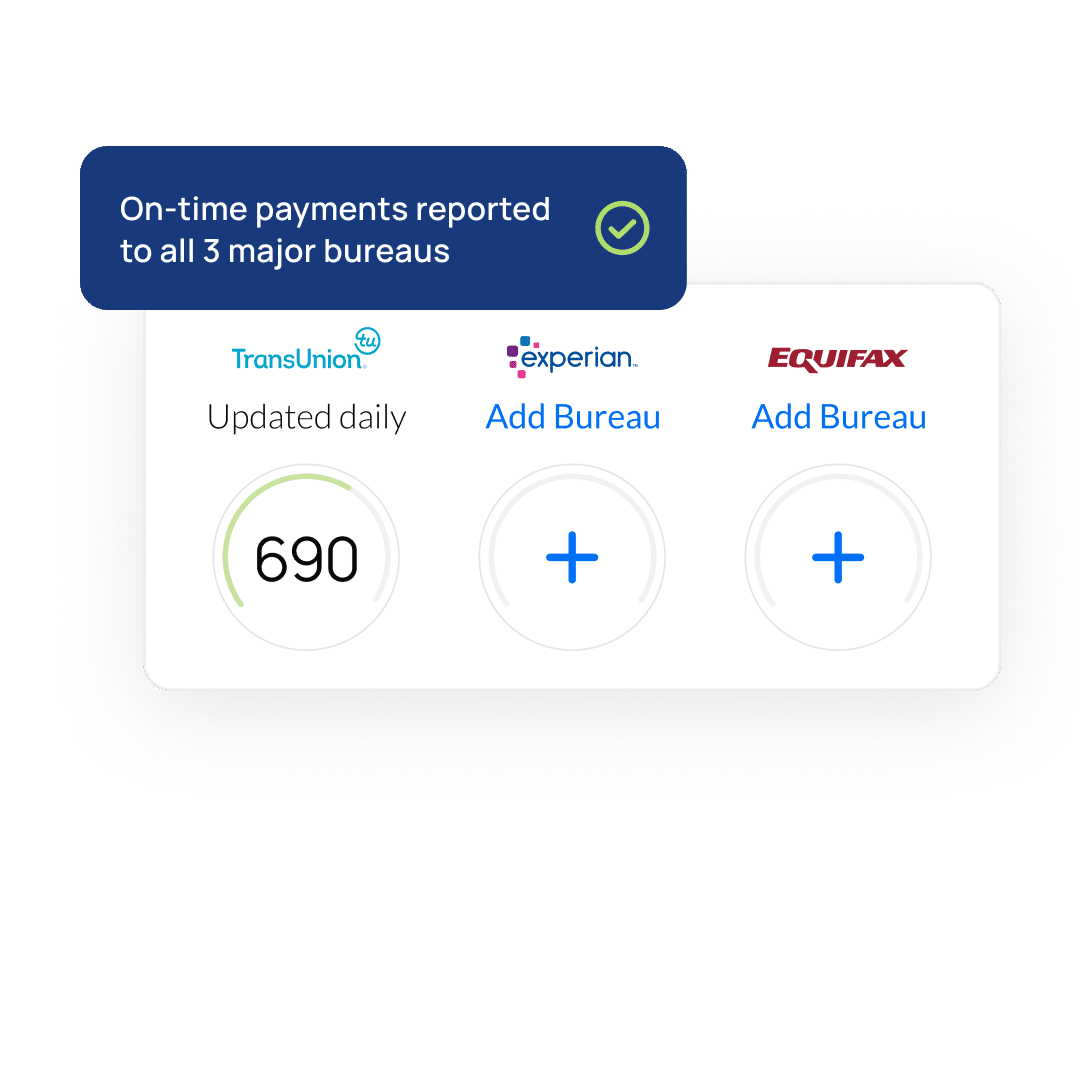

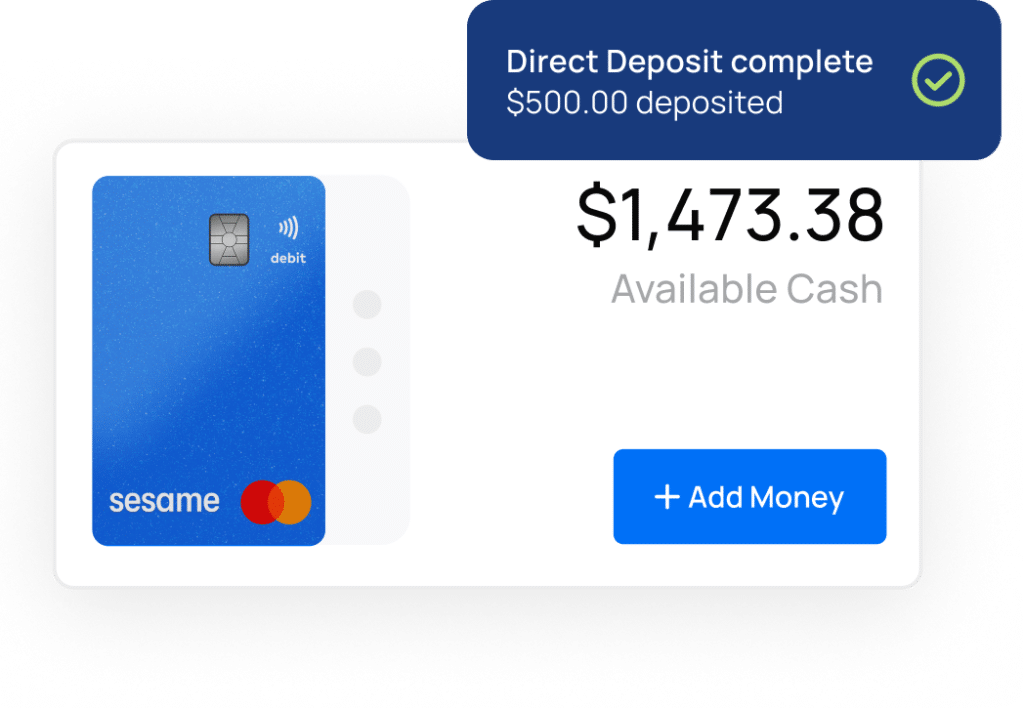

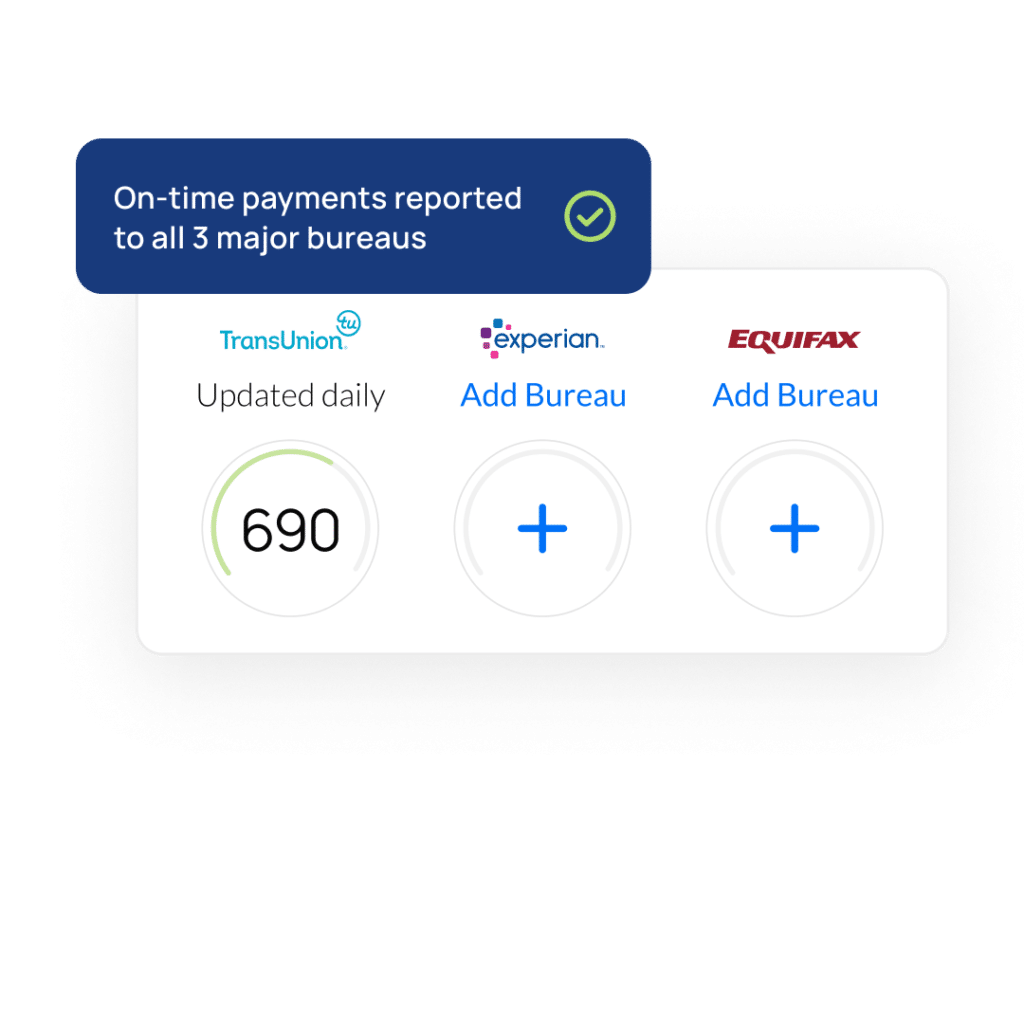

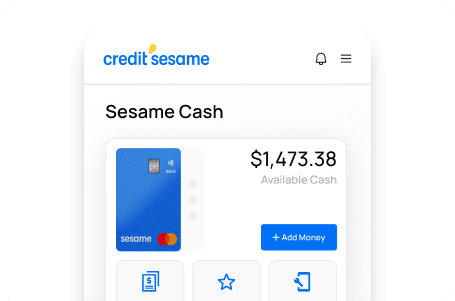

Your virtual Secured Credit Card gives you the credit building benefits of a traditional secured card through the use of your Sesame Cash debit card—there’s no separate plastic card! Fund your security deposit from your Sesame Cash debit card, and start making purchases to help to build your credit history.

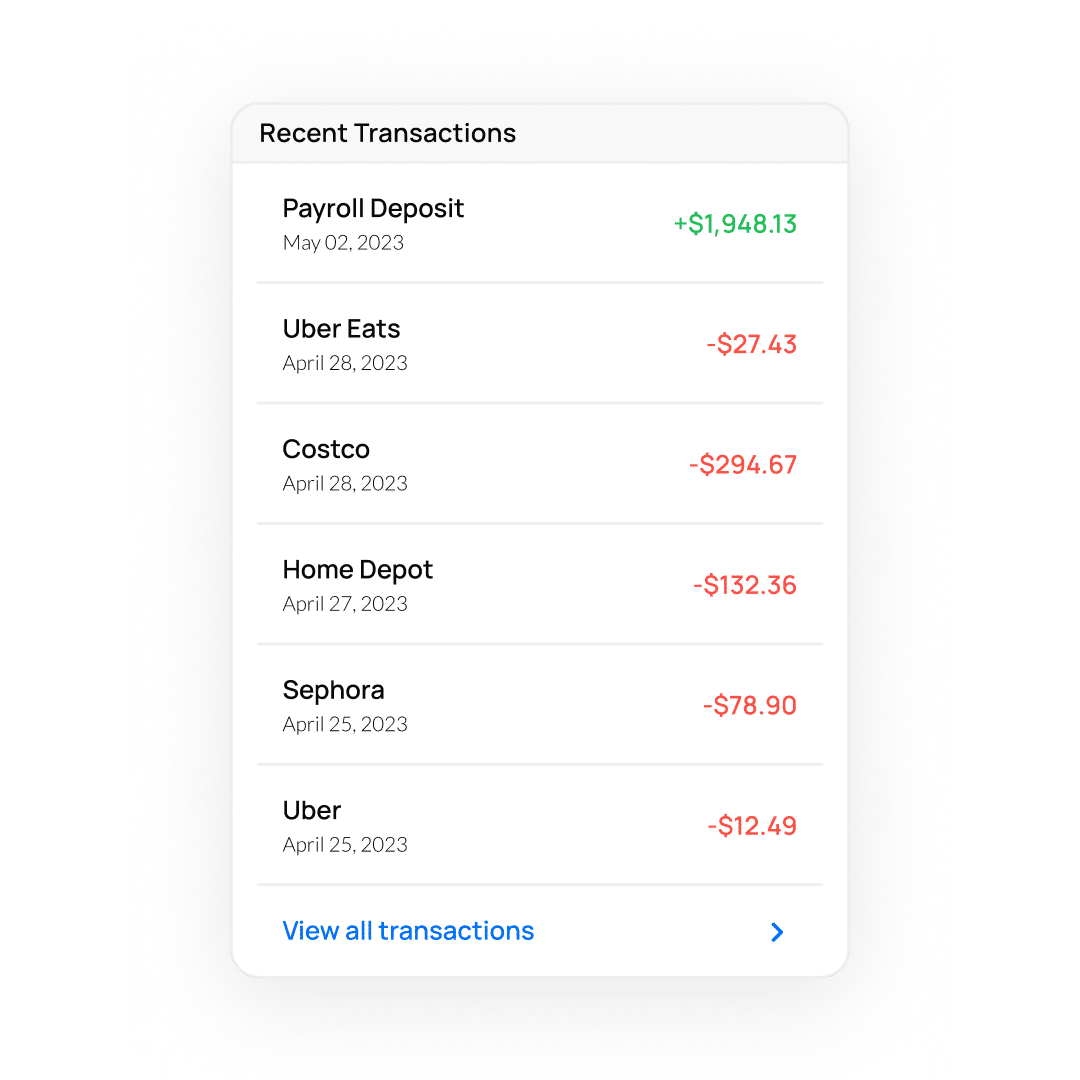

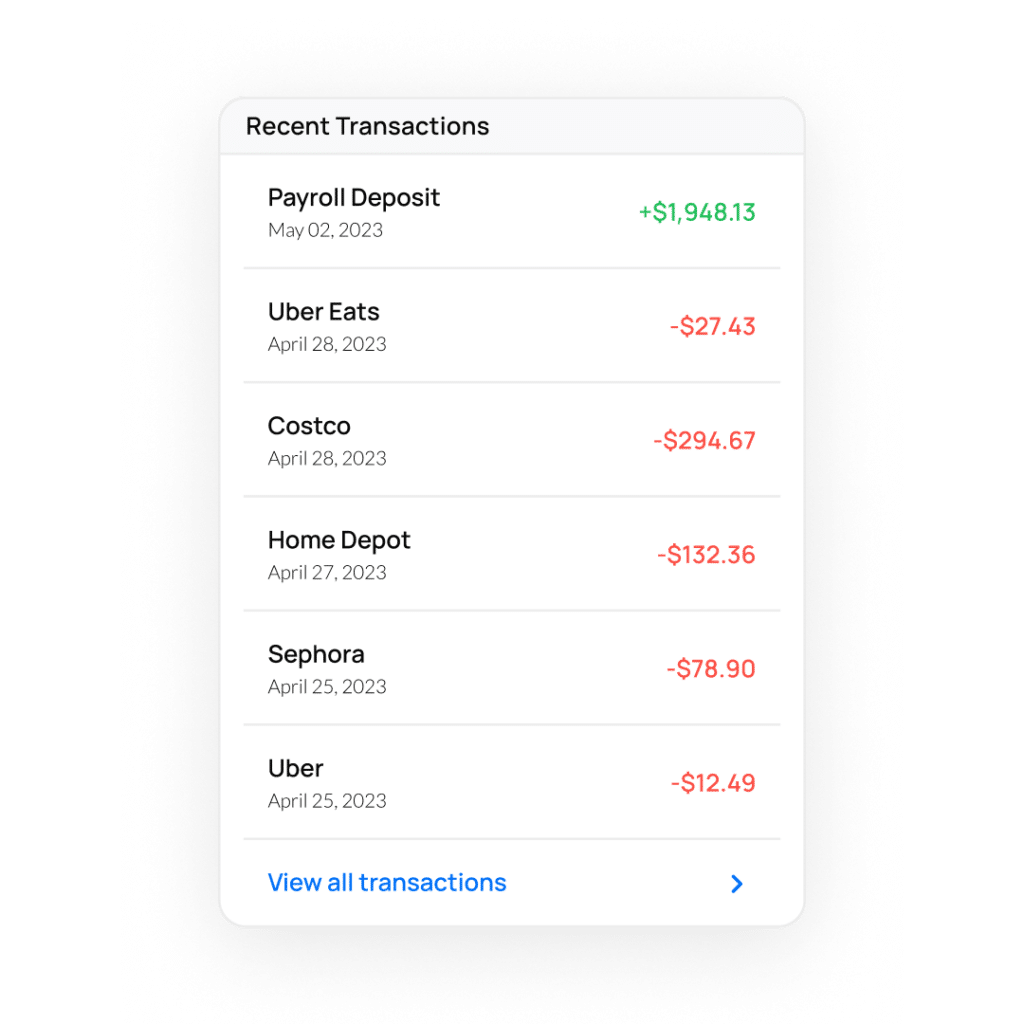

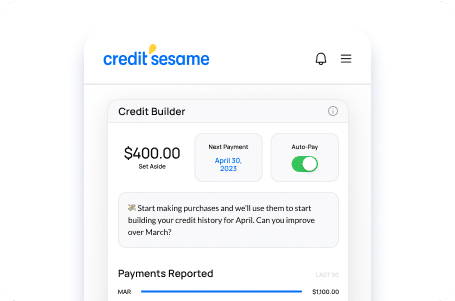

Another benefit of the builder account is your ability to set up your own utilization. With a traditional secured credit card, you can spend all your available credit and unknowingly impact your score. With your virtual Secured Credit Card, you’ll set your credit utilization limit up front and we choose debit purchases that create a credit balance within that amount. No surprises, no interest—just credit building with the daily debit purchases you’re already making!

And with credit builder, there’s less risk with automatic payments enabled! When you set up automatic payments, we’ll pay off your full balance every month. When we tally up Sesame Cash purchases to create a balance on your Secured Credit Card, we’ll set aside money to pay it off too. Since you already paid with debit, we’ll stash this money so it’s ready to pay your full statement on time at the end of each month!