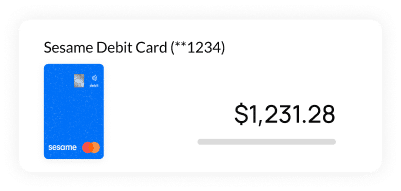

Sesame Cash Mastercard® Prepaid Debit Card

Sesame Cash

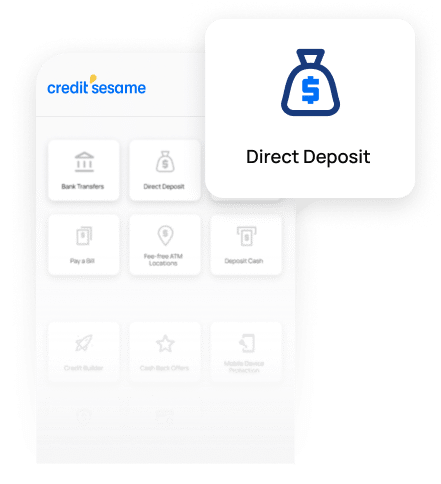

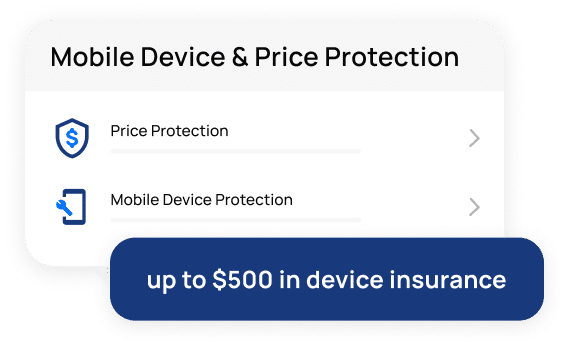

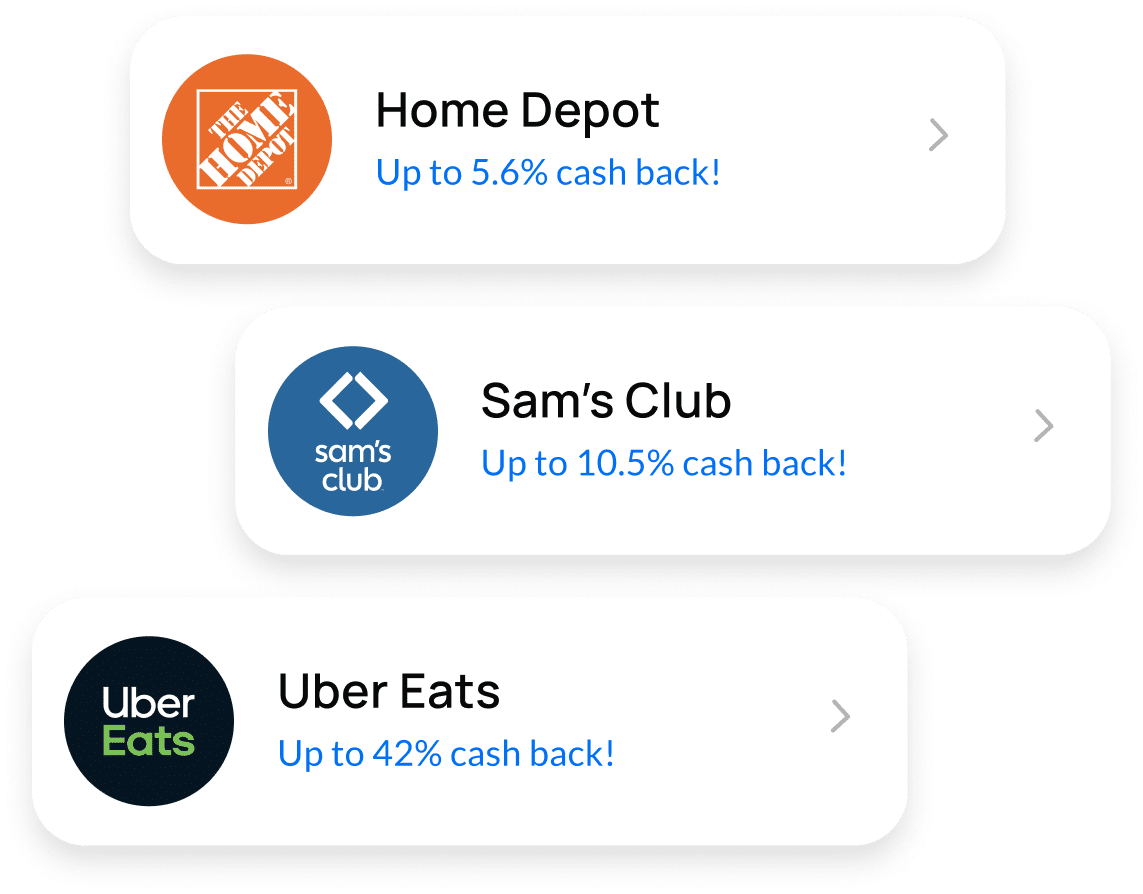

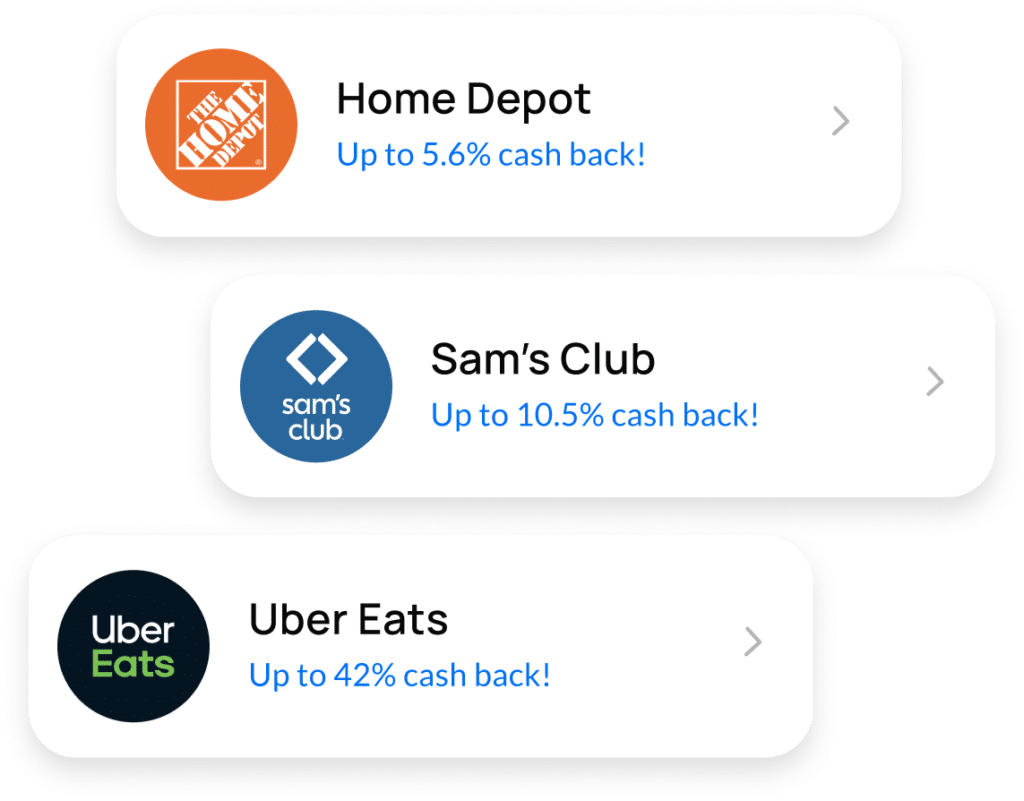

A convenient debit account with cash back on purchases,¹ 2-day early direct deposit,² and

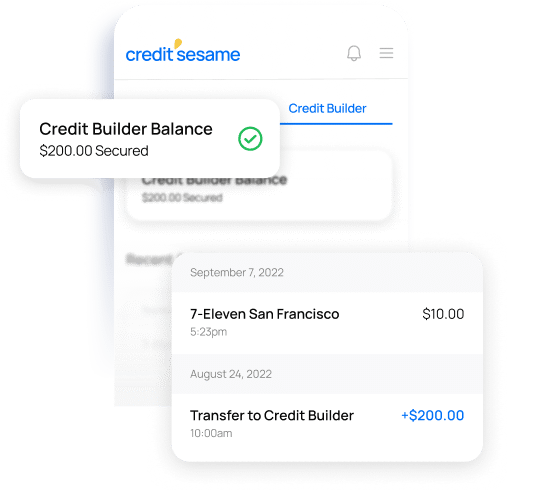

much more. Looking to build credit history?³

It can do that, too. Fees may apply.4

A convenient debit account with cash back on purchases,¹ 2-day early direct deposit,² and

much more. Looking to build credit history?³ It can do that, too. Fees may apply.4

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.