How to Know When It’s Time to Upgrade From Your ‘Basic’ Credit Card

When you opened your first credit card, chances are you didn’t have a ton of options. Many credit card companies require applicants to have a decent credit score and credit history in order to qualify for a credit card product. Unsure if your score is decent? Compare your credit score to those in your generation […]

10 Best Big Cities Worth Considering if You’re Ready to Move in the New Year

Update: Take a look at the Best Midsize Cities to Relocate to in 2017! If 2015 hasn’t been the best year, starting over in different surroundings can help you turn things around in the New Year. Packing up and moving to a brand-new city could be a great opportunity to kick your career into high-gear […]

5 Reasons Why a 20 Year Mortgage is a Great Option

Whenever people talk about mortgages it is almost always a discussion between a 30 year and a 15 year mortgage, but what about the middle road? In 2013 a whopping 89% of mortgage borrowers went with a 30 year mortgage, while 8% went with a 15 year mortgage, 3% went with an adjustable rate mortgage, […]

6 Millennial-Friendly Robo-Advisors for Investing & Growing Your Money

Millennials are progressive when it comes to technology, embracing all things technology related. But when it comes to investing, they’re much more conservative than most would probably like to admit. According to a recent survey about millennials from Capital One’s ShareBuilder survey on CNN, 93 percent of Gen Ys say that they’re less confident about […]

Common Reasons Why Buyers Are Denied A Mortgage

One of the most important steps in buying a home is obtaining pre-approval for a mortgage. To shop effectively, and within your price range, you need to know what that price range is. For most home buyers, the amount they can spend is set by the lender they choose. By talking with a lender, or […]

Bad Credit Mortgage

Unless you’ve got a tidy sum of cash stashed away in the back, buying a home means taking on a mortgage loan. That can be a daunting proposition for someone who doesn’t have the best credit, since it likely means paying a higher interest rate or possible getting denied altogether. One of the myths people […]

How to Improve Credit Score After Bankruptcy

There’s a certain stigma that goes along with filing bankruptcy and the negative impact is something that’s felt long after your case is discharged. There is, however, a silver lining since bankruptcy can provide you with a fresh financial start but it’s important to make sure you’re using the opportunity wisely. Aside from keeping your […]

How Do I Improve My Credit Score After Collections?

With payment history accounting for 35% of your credit history, it’s important to pay your bills in full and on time to maintain a positive credit score. Sometimes, however, life has other plans and it’s not always possible to get your payments in by the due date. Making even one payment 30 days late can […]

The Struggle is Real: Gen Xers Juggle Student Loan Burden from Kids, as Well as Their Own

Generation X (those who are now aged 37 to 50) is often called the sandwich generation because they are growing their families while caring for their aging parents at the same time. But I’m going to call baloney on another sandwich this generation is forced to eat. More than any other generation, they are still […]

The Best Bay Area Community Colleges for Transferring to a University

These days, an undergraduate degree is almost a requirement for a decent career. The problem is that universities charge a fortune with the average year costing between $23,410 and $46,272, depending on the school. In addition, if your academic record isn’t perfect out of high school, you might not be accepted into your top choice. […]

The Best Alternatives to MIT for Computer Science Programs in Boston

If you are looking for the best computer science choice there is one obvious choice: Massachusetts Institute of Technology, better known as MIT. But here at Credit Sesame we are not about obvious choices. As one of the nation’s top universities, MIT can afford to be choosy. MIT has the 8th lowest student acceptance rate […]

How Marriage Affects Your Credit

You’re engaged, or thinking of tying the knot? Congratulations! Hopefully you’ve already had at least one conversation about credit and financial planning. For those of you who are concerned about how marriage might affect your credit, this information might help. Let’s first get a few facts straight about marriage and credit. Your credit files don’t […]

Experian vs. TransUnion vs. Equifax: What’s the Difference?

Credit reports can be quite confusing to people because there are three credit reporting agencies that provide different credit scores. The main agencies in the United States are Experian, TransUnion and Equifax. Any time you go to the bank and apply for a loan, they will check your social security number through one of these […]

Can I Get Credit With a Bad Credit Score?

After being laid off and struggling financially, a Credit Sesame reader writes in for advice on getting credit and qualifying for a loan with a bad credit score. John Ulzheimer, credit expert for Credit Sesame, answers.

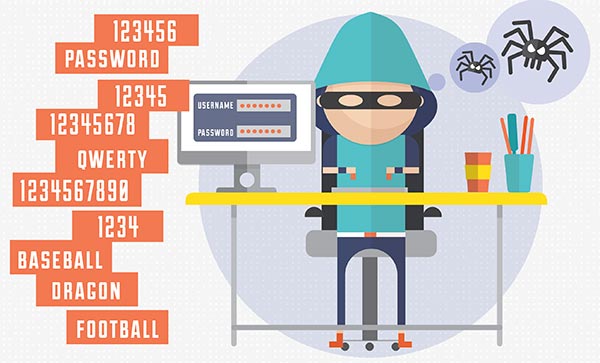

What’s a Hackers Favorite Password?

Ever seen that meme with Steve Carrell from the TV show “The Office” proclaiming that he changed all his passwords to “incorrect” so that if he forgets his password his computer will remind him that his password is “incorrect”? And that’s just perfect — if you’re the kind of lovable idiot he portrays. But if […]