What are private student loans?

Private student loans are loans for education offered by banks, credit unions, and other non-government lenders. The federal government sponsors most student loans in the United States, but private student loans also play a significant role. Limits on government student loan borrowing may make it necessary to supplement a government loan with a private one to fully meet educational expenses.

Find the right loan for you

Gain access to personalized loan recommendations based on your credit profile and approval odds. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- What may private student loans be used for?

- Characteristics of private student loans

- Who uses private student loans?

- Are private student loans affordable?

- Alternatives to private student loans

- Pros and cons of private student loans

- How to choose a private student loan

- Applying for a private student loan

- In a nutshell

Share this

What may private student loans be used for?

Private student loans can be used for a variety of educational expenses, including:

- Tuition

- Room and board

- Fees

- Books

- School supplies

- Transportation

- Computer for school

While the uses of private and federal student loans are similar, the loan terms can have some important differences. Private student loans may be more expensive than government loans, and they do not qualify for the special repayment programs that can make government student loan payments more affordable.

Another key difference is that private student loans do not have federal government sponsorship. Instead, they rely heavily on a credit check to decide if a borrower qualifies.

While private student loans lack some advantages, eligibility for federal student loans is limited. If you don’t qualify for a federal student loan or have exceeded the borrowing limit, a private loan can help fill the gap.

Characteristics of private student loans

Whether or not a loan is a good deal and the right fit for your needs depends on the specific terms of the loan. The following are some of the loan terms you should examine when considering a private student loan:

Interest rate

Interest is the cost of borrowing money. It is a percentage applied to the amount you owe and can significantly increase your loan payments.

Because interest rates play such an important role in determining the cost of your loan, comparing interest rates should be a factor in your decision. It is important to look at loans with the same repayment period when comparing interest rates. Otherwise, the total interest you end up paying can vary, even if the interest rate is the same.

Because private student loans do not have the backing of a government guarantee, their interest rates are often higher than those for federal student loans.

Fixed vs. variable interest rate

Another difference between federal and private student loans is that private loans may have fixed or variable interest rates, while federal student loan rates are fixed.

A variable rate may change over your repayment term, depending on interest rate conditions in the economy. You could benefit from this if interest rates fall. That would cause your interest rates to go down, lowering your payments.

However, if interest rates rise, your payments will become more expensive. Variable interest rates make payments harder to budget because you risk being unable to afford them if interest rates rise significantly.

Repayment term

The repayment term on a loan is the amount of time you have to pay it off. A typical term on a private student loan is ten years, but it may be longer or shorter.

The length of the repayment term impacts the size of your monthly payments and the total cost of your loan over time.

On the one hand, stretching repayments over a longer term results in lower monthly payments.

However, you continue to pay interest on the loan for as long as the repayment period. So, the longer the loan term, the longer you pay interest. This increases the total cost of the loan.

Monthly payments

Student loan payments are due monthly. Each payment includes repayment of some of the amount you borrowed plus interest.

Before taking out any loan, you should look at how much your monthly payments will be. That will give you an idea of whether you can afford those payments.

On most fixed-rate loans, monthly payments stay the same throughout the life of the loan. This means you know in advance how much money you will have to come up with each month.

The one exception is that some student loans have graduated repayment plans. These plans are designed with payments that start low and then increase over time. This can make payments more affordable when you are just out of school and might not be making much money yet. However, because graduated payments mean it takes longer to repay what you borrowed, you will be charged more interest over the full repayment period.

Unlike fixed-rate payments, variable-rate loan payments depend on how interest rate conditions change throughout your repayment period. This makes it more challenging to plan in advance for how affordable the payments will be.

Repayment grace period

This is a key concept for student loans. Federal student loans and some private student loans have a grace period that delays starting repayments until you have left school or have switched to less than half-time enrollment.

This saves you from having to make payments while you are still in school. However, not all private student loans have a grace period.

Also note that even if your loan has a grace period, interest may still accrue during that period. The longer the grace period, the more the loan will cost.

Who uses private student loans?

The federal government sponsors the vast majority of student loans. According to the MeasureOne Private Student Loan Report, in 2021, outstanding student loan balances were split between federal (92.4%) and private loans (7.6%). The 7.6% in private student loans amounts to $131.1 billion. During the 2021/2022 academic year, 89.5% of private loans were for undergraduate degree programs, compared with 10.5% for graduate programs.

Since federal student loans often have advantages over private loans, why do people choose private loans?

A big reason is that federal student loans have dollar limits on how much you can borrow. These limits apply to borrowing for any one academic year and in total. Often, the cost of college may exceed these limits. So, a borrower may use a private student loan to supplement a federal loan. If the cost of college exceeds the federal loan limit, a borrower may use a private loan to make up the funds they need.

Are private student loans affordable?

Alternatives to private student loans

Another way to judge the affordability of private student loans is to compare them to various alternatives:

- Federal student loans. These will generally have lower interest rates, but borrowers (or their parents) with excellent credit may qualify for a competitive private student loan rate.

- Home equity loans. Borrowers (or their parents) who own equity in a home may find a home equity loan to be a cheaper form of credit than a student loan.

- Scholarships and grants. These may be provided based on need or various kinds of merit. Since this money does not typically have to be repaid, it is wise to fully explore any scholarship or grant possibilities before borrowing for school.

Pros and cons of private student loans

Below are some pros and cons of federal student loans.

Pros

- Allow a student to borrow beyond federal student loan limits

- Available with a variety of repayment periods to best suit the borrower’s needs

- Offered by a large number of banks, credit unions, and other lenders, so there is plenty of opportunity to shop around for good terms

- Offered at lower interest rates than credit cards

Cons

- Interest rates are usually higher than for federal student loans

- Not eligible for federal repayment assistance programs

- Often do not have a grace period, which may mean having to make payments while still in school

- May have variable interest rates that make payment amounts unpredictable

How to choose a private student loan

Here are some things to look for when shopping for a private student loan:

- Compare interest rates

- Check whether the interest rate is fixed or variable

- Look at the repayment schedule to see how affordable the monthly payments will be and whether they are subject to change over time.

- Look at the total repayment amount, remembering that longer-term loans may have lower monthly payments but generally result in greater costs over the long run.

- See whether there is a grace period before loan payments start

Applying for a private student loan

Getting a private student loan depends a great deal on the credit of the borrower. Because most students have little or no credit history, private student loans generally require a cosigner. The MeasureOne Private Student Loan Report found that as of the 2021/2022 academic year, 89% of private student loans had a cosigner. Undergraduate student loans are especially likely to have a cosigner.

A cosigner is someone (often a parent) whose credit history and financial means are good enough to qualify for a loan. A cosigner takes financial responsibility for the loan if the borrower does not make all the payments.

To apply, you must provide the lender with financial information such as income, assets and expenses. You will also have to give permission for the lender to check your credit record. If you have a cosigner, they must also provide this information and permission.

It is wise for borrowers and cosigners to check their credit before applying for a loan. This can provide an opportunity to clear up any problems before a lender evaluates the credit history. This can not only help you get approved for a loan but may also allow you to qualify for better terms.

As part of the application process, lenders generally require the school’s financial aid office to confirm that you need additional financing to meet the cost of your education. Working with a school’s financial aid office is a good idea even without a lender requirement. They may help you identify potential lenders or other forms of financial aid that could save you money.

In a nutshell

Understanding the intricacies of private student loans is essential for students and their families navigating higher education financing. While federal loans provide significant support, private loans serve as vital supplements, filling gaps that federal aid may not fully cover. Borrowers must carefully assess the terms of private loans and compare them with federal loans to ensure they make informed decisions that align with their financial capabilities and educational needs. By exploring both options comprehensively, students can construct a financing plan that optimally supports their academic pursuits without undue financial strain.

Navigating the complexities of student loans demands diligence and careful consideration. While private student loans offer flexibility and fill financial gaps, borrowers must approach them cautiously. Assessing interest rates, repayment terms, and overall affordability is crucial. Moreover, leveraging federal aid and exploring alternative funding sources can help mitigate the financial burden associated with higher education. By making informed decisions and seeking comprehensive financial guidance, students can pursue their academic goals while safeguarding their long-term financial well-being.

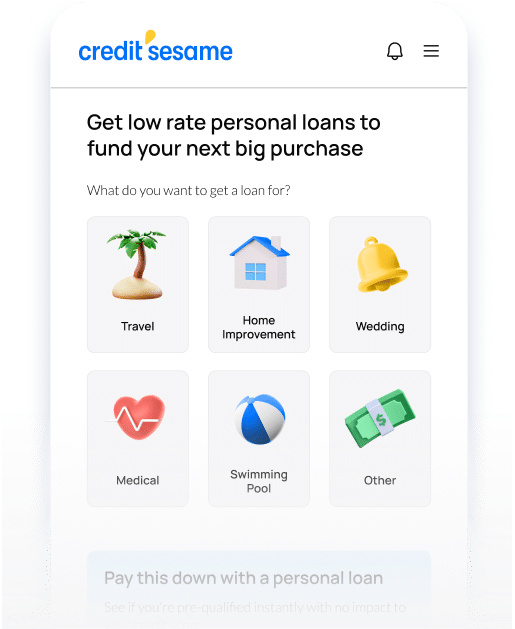

Get approved for the right loan

See loans with the highest chance of approval based on your credit profile

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Ready to find the right loan?

See your score.

Get the right loan options.

See your score. Get the right loan options.

See cards with the highest chance of approval based on your credit profile

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.