Fixed and variable rate loans explained

Fixed-rate loans and variable-rate loans are two common types of loans in the United States. A fixed-rate loan in the US has an interest rate that remains unchanged throughout the loan term, providing borrowers with stability and predictability in their monthly payments. On the other hand, a variable-rate loan in the US has an interest rate that can fluctuate over time based on changes in a specified reference rate, such as the prime rate or an alternative benchmark rate like the Secured Overnight Financing Rate (SOFR). Variable-rate loans in the US may offer lower initial rates but come with the risk of increasing payments if the reference rate rises.

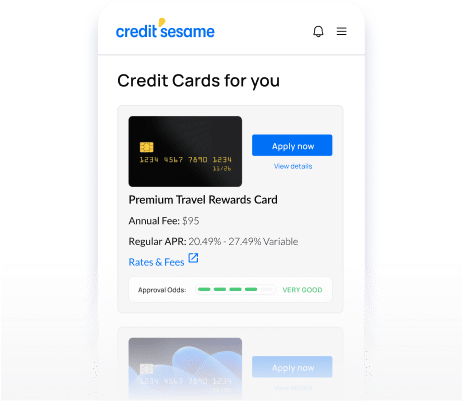

Find the right loan for you

Gain access to personalized loan recommendations based on your credit profile and approval odds. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- What is a fixed-rate loan?

- What are the advantages of a fixed-rate loan?

- What are the drawbacks of a fixed-rate loan?

- What is a variable rate loan?

- How does a variable rate loan work?

- What are the advantages of a variable rate loan?

- Types of fixed rate and variable rate loans

- Can you switch from a variable rate to a fixed rate?

- In a nutshell

Share this

What is a fixed-rate loan?

A fixed-rate loan is a loan where the interest rate remains consistent throughout your loan repayment period. This means that the interest rate agreed upon at the time of borrowing will not change, regardless of any fluctuations in the market or changes in the economy. Whether you’re getting a mortgage, personal loan, or auto loan, a fixed-rate loan offers you stability and predictability as you can rely on a fixed monthly payment amount over the life of your loan.

What are the advantages of a fixed-rate loan?

Fixed-rate loans come with several advantages for you as a borrower. One of the primary benefits is the sense of financial security and peace of mind they offer. With a fixed interest rate, you can effectively plan your budget as you know the amount you need to allocate towards your monthly loan payments. This predictability is particularly beneficial if you prefer a steady and consistent repayment plan. Furthermore, fixed-rate loans are an excellent choice in a low interest rate environment. By locking in a favorable interest rate at the time of borrowing, you can enjoy the benefits of that rate even if market rates rise in the future. This protection against rising rates provides stability and can save you money over time.

Another advantage of fixed-rate loans is that they are straightforward and easy to understand. You don’t need to worry about fluctuations in interest rates, making it easier to plan your finances and stay on top of your loan obligations. Additionally, fixed-rate loans are widely available from various financial institutions, making them more accessible.

What are the drawbacks of a fixed-rate loan?

While fixed-rate loans have their advantages, there are some drawbacks for you to consider. One potential disadvantage is that fixed-rate loans typically come with slightly higher interest rates compared to variable-rate loans. This means that you may end up paying more in interest over the life of your loan compared to those with variable-rate loans if interest rates remain low or decrease further in the market. Additionally, fixed-rate loans lack the flexibility to adjust to lower interest rates during the loan term. If market rates significantly drop after you borrow, you may only benefit from potential savings if you refinance the loan, which often incurs additional costs and fees. Lastly, some fixed-rate loans may impose penalties or fees for prepayment or early loan closure, limiting your ability to pay off the loan ahead of schedule without incurring additional expenses.

Despite these drawbacks, fixed-rate loans remain a popular choice for borrowers like you who prioritize stability, predictability, and the peace of mind that comes with knowing what your monthly payments will be over the life of the loan. Choosing a fixed-rate loan or another type depends on your financial circumstances, market conditions, and personal preferences.

What is a variable rate loan?

Variable rate loans are also called adjustable-rate loans, which are more complicated than fixed rate loans. Variable rate loans have interest rates that can change during their terms. Their rates may rise or fall according to the rules listed in their loan agreements. You’re obligated to your loan agreement terms once you borrow, so it’s crucial to understand them before committing to a loan.

Your loan documents provide several key pieces of information about your interest rate

- Your start rate (or introductory rate) is the interest rate you pay when you first take out your loan.

- The amount of time your start rate is in effect (also called an introductory or promotional period).

- The formula the lender uses to calculate your rate when it adjusts. Most formulas base the rate you pay on an index, a published financial measure. Common indexes include the prime rate, T-bill, and LIBOR. Lenders then add a margin to this index to determine your interest rate.

- How often your rate can adjust.

- Limitations to how high or low your rate can go at any single adjustment and over the life of the loan. These are called ceilings and floors.

How does a variable rate loan work?

Here’s an example of how a variable rate loan works. Home equity lines of credit (HELOCs) are often variable rate loans. Suppose that you take out a HELOC with a start rate of 5.99% for six months.

In the seventh month, your introductory period ends, and your rate varies according to the formula in your loan documents. In this example, it’s the prime rate plus 3%. If the prime rate is 7.5%, your new interest rate would be 10.5%. And if the prime rate were to drop to 5.5%, your HELOC rate would fall to 8.5%.

Where do ceilings and floors come in? Let’s say the economy goes into a recession, and the prime rate falls to 2%. According to your HELOC formula, the new rate would be 2% plus 3%, totaling 5%. But if your loan agreement contains an interest rate floor of 5.99%, that’s the lowest your rate will go. Conversely, suppose that the economy becomes extremely hot, general interest rates rise, and the prime rate increases to 10%. Your loan formula says your new rate would be 10% plus 3% — 13%. But if your loan has an interest rate ceiling of 9%, you will only pay that much, no matter how high the prime rate goes.

What are the advantages of a variable rate loan?

One advantage of variable rate financing is its lower start rate, which can save you money in the first months or years of your loan term. For instance, a popular variable rate mortgage is the “5/1 ARM.” The “ARM” stands for adjustable rate mortgage. The “5/1” means the start rate is fixed for the first five years and can be adjusted yearly.

If 30-year fixed mortgages have 7% interest rates and 5/1 ARMs have 5% interest rates, you’d pay much less interest in the first five years of your loan term. In the sixth year, your rate might increase, reversing some of your savings. But if you sell your home before higher rates wipe out what you saved in the first five years, you’re ahead. It’s also important to remember that your rate might stay the same and could also go down.

This brings up the second advantage of variable rate loans — when interest rates fall, you pay less. And you don’t have to refinance to get a lower rate.

Types of fixed rate and variable rate loans

Some loans are more likely to be fixed, while others are more commonly variable. Here’s how they stack up.

Fixed rate loans:

- Fixed rate mortgages (FRMs). The most common have 15- and 30-year terms.

- Home equity loans usually have fixed rates.

- Financing for automobiles, boats, and other vehicles almost always comes with fixed interest rates.

- Personal loans are typically offered with fixed rates.

- Student loans backed by the government (since July 2006) always have fixed interest rates.

Variable rate loans:

- Adjustable-rate mortgages (ARMs). While the 5/1 ARM is most popular, you can find ARMs with introductory periods as short as one month and as long as ten years.

- Home equity lines of credit (HELOCs) typically have adjustable rates.

- Private student loans can have variable interest rates.

- Credit cards always have variable rates. But introductory periods can be as long as two years.

Can you switch from a variable rate to a fixed rate?

The rules of some loans allow you to switch from a variable to a fixed rate. These are often called “convertible” loans. Expect to pay a fee to convert your loan, and there may be additional rules for conversion. Another option for converting a variable rate loan to a fixed rate loan is to refinance it. However, refinancing costs money, so make sure that you will save enough to recoup those charges.

In a nutshell

Fixed rate or variable rate loans are right (or wrong) for different borrowers and situations. When trying to decide between a fixed rate or variable rate loan, ask yourself a few questions:

- How long will it take me to repay the loan? (The longer the loan term, the harder it is to predict what interest rates will do in the future.)

- How much could I save during the introductory period with a variable loan?

- What's the worst-case scenario with a variable loan (assuming the rate hits its ceiling)? Can I live with that?

- Am I good at budgeting? Or do I struggle to manage my debts?

- How comfortable am I with risk? Will I sleep at night knowing that my payments could increase?

- How much am I borrowing? (Larger loan amounts mean greater savings when rates are low, but payments can get unaffordable if rates increase.)

- Do I expect interest rates to increase or decrease during my loan term?

Once you've gathered your thoughts, it's time to decide.

Consider fixed-rate loans if you're uncomfortable with risk and can't absorb a significant rate increase. For example, fixed rate mortgages are common because home loans have long terms and large loan amounts. Predicting interest rate changes over many years is extremely difficult, and payments can change drastically when you borrow hundreds of thousands. Homebuyers generally want to minimize the risk of being unable to afford their homes.

On the other hand, you might prefer a variable rate to maximize possible savings. It's safer if you can make higher payments when necessary -- perhaps because the loan amount is lower, you expect your income to rise or have substantial savings. You might also prefer a variable rate loan if you plan to pay it off fairly quickly or if you believe interest rates will go down or at least not increase too much during your loan term.

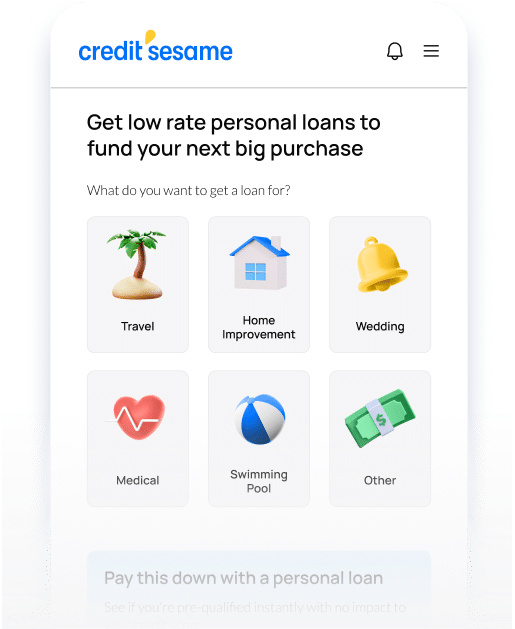

Get approved for the right loan

See loans with the highest chance of approval based on your credit profile

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Ready to find the right loan?

See your score.

Get the right loan options.

See your score. Get the right loan options.

See cards with the highest chance of approval based on your credit profile

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.