Is there really “good debt” and “bad debt”

Becoming a great money manager requires learning about debt and managing payments responsibly. It takes time to learn the ins and outs of debts, payment plans, and effects on credit. A common question is whether there is such a thing as good debt and bad debt. Borrowers understandably want good debt that can build their credit while avoiding bad debt that might hurt their ability to get credit or make purchases. In most cases, debt is neither good nor bad. Instead, it’s a tool borrowers use to manage their financial needs.

Get your FREE credit report summary

See the factors impacting your credit score and what you can do about it. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Understanding Types of Debt

Debt is money owed to a lender, typically incurred through transactions with banks, car dealers, or credit card companies. Terms like “good debt” and “bad debt” are commonly heard but often lead to unnecessary confusion. In reality, most debt is a financial tool and cannot be neatly categorized as inherently good or bad. Instead, the financial habits associated with debt management determine its impact on credit health.

Good Debt

This category comprises debts that contribute to maintaining and improving credit standing. Examples include credit card balances, car loans, student loans, and mortgages. Effective debt management involves making timely payments, avoiding excessive credit inquiries, and maintaining a healthy balance-to-limit ratio on credit cards. When borrowers adhere to these practices, they demonstrate responsible debt management and strengthen their credit profile.

Bad Debt

The concept of bad debt is nuanced and context-dependent. Sometimes, it refers to debts that become unmanageable due to high interest rates or unsustainable repayment terms. As the balance accumulates rapidly, borrowers may be unable to keep up with payments, eventually leading to debt collection efforts or even bankruptcy. Alternatively, bad debt may also denote poor money management habits exhibited by borrowers. For instance, falling behind on car loan payments or neglecting credit card balances can negatively affect credit reports and scores, resulting in long-term credit challenges that take considerable time to rectify.

The distinction between good and bad debt is not about the debt itself but rather the borrower’s financial behaviors and habits. Individuals can effectively leverage debt to build and maintain a healthy credit profile by cultivating responsible money management practices and prioritizing timely payments.

How to secure and maintain good debt

Understand the parts of a credit report

Understanding credit reports is important to determine whether debt is good or bad. Three credit reporting firms, Equifax, Experian, and TransUnion, put borrower data into these reports. A credit report shows the types of debt a borrower holds. It can also list other financial transactions, such as apartment or housing rentals. Common categories in a credit report include:

- Types of debt on file (both active and paid off or closed accounts)

- Payment history

- Age of debt

- Debt utilization

- Newly opened accounts

- Inquiries or requests to review the credit report

- Any concerns or issues, such as delayed payments, bankruptcies, or debts sent to collections

People who manage these components well maintain good debt. They take out loans they can afford, have a mix of debt types, and pay the balances they owe. If such borrowers experience financial problems, they work to resolve them and rebuild their credit.

Know how a credit report translates into a credit score

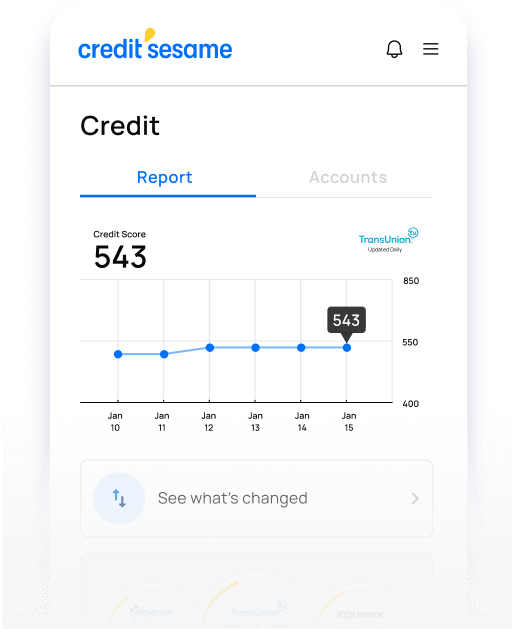

Every credit reporting agency calculates credit scores slightly differently. Free tools such as the Credit Sesame app can collect this information in a single location for borrowers to review. Good debt management practices are often reflected in mid-to-high-range credit scores.

A credit score in the 200s to 400s means there’s plenty of opportunity to practice better money habits. For example, focusing on a bad debt that’s behind on payments, paying off the outstanding balance, and making timely payments going forward.

A credit score in the 500s to 600s might mean a person is improving with more growth to come. For example, adding a new debt type for a better credit mix or using a smaller portion of available credit for a better credit utilization ratio.

A credit score in the 700s to 800s generally suggests good debt management practices. There could be additional opportunities to improve, such as reviewing credit reports monthly, ensuring reports are error-free, and continuing to pay balances on time.

Evaluate credit mix

People with higher credit scores and good credit reports tend to hold two or more types of debt. This shows lenders the borrower can manage expenses and pay back lenders across debt types.

Consider opportunities to add good debt

Good debt isn’t just an existing account on a credit report. It can also be a new loan that adds greater diversity to a borrower’s credit mix. For example, if a person only has a credit card, they could add a student loan or a car loan. This new loan remains good debt as long as the borrower makes timely monthly payments and continues to cover their other expenses.

Monitor credit regularly

It’s important to know how to navigate and strengthen a credit report to maintain good debt. Occasionally, errors occur on credit reports. Keep good records of debts and other financial transactions, such as a list of past rentals. Compare this information to the details listed on credit reports. If an error appears, file a dispute by following the process each reporting agency outlines on its website.

How to identify and avoid bad debt

In some cases, debt damages a credit report and lowers a borrower’s score. Watching for warning signs can help borrowers manage their money well and fix problems.

Understand how a debt can become bad

In most cases, bad debt becomes bad because it needs better management. For example, this could include:

- Holding a loan with a high or variable interest rate that becomes too large to pay

- Falling behind on a payment

- Having a debt that goes to collections after persistent missed payments

- Declaring bankruptcy

Debt is a tool that can have harmful consequences if regular management and good credit practices aren’t applied.

Monitor credit regularly

A few practical steps can help avoid bad debt – or turn a bad debt into good debt. These might include:

- Review the latest available credit report from the three reporting agencies. Identify any problem areas listed on those reports.

- Determine the cause of any issues. This could include a missed payment, a series of late payments, or even a bankruptcy.

- Decide to make changes that help fix the bad debt. For example, to remedy a missed payment, a borrower might pay their latest balance in full plus extra to cover the full cost of the missed payment. To address late payments, a borrower might contact the lender and work out a plan to pay a little extra each month until the difference is resolved. In the case of bankruptcy, a borrower might work with a trusted financial adviser to develop good money management habits for years. Eventually, the bankruptcy will come off the report, and good habits used in the meantime will build credit.

Adjust plans as needed to manage debt and improve credit

Money management decisions should adapt to the borrower’s circumstances. A new job might help a borrower make payments more quickly to resolve outstanding debts. Meanwhile, a job loss might mean some plans get put on hold. This ensures the borrower can cover essential expenses such as food, utilities, and housing.

It can take months and even years to address and fix bad debt. Don’t let an unexpected life event throw off a well-thought-out plan to improve credit. Review the plan regularly, assess the steps in progress, and make adjustments as needed.

What factors separate good debt from bad debt?

Good debt helps borrowers maintain and even build their credit reports. Over time, it can lift a credit score higher. The presence of good debt on a credit report shows lenders the borrower can make timely payments. It shows the borrower is a responsible money manager. Good debt reveals good money management habits.

Bad debt does the opposite. Remember, debt is a tool. In most cases, it’s neither good nor bad. Instead, bad debt reveals less-than-optimal habits, such as falling behind on payments, or defaulting on the debt.

How does a borrower get rid of bad debt?

The first step to take is to understand the causes of bad debt. The best place to start is the borrower’s credit report. See what the credit reporting agencies list as problems or issues. Then, make a corresponding plan to begin addressing each. This could include getting caught up on payments, working on better money management after a bankruptcy, or reducing how much available credit gets used each month.

Meanwhile, ensure the basics of good credit – paying monthly balances, having multiple debt types, and only using a portion of available credit – get applied daily.

These steps can help borrowers address bad debt and turn debt into a tool with good outcomes.

What are the risks of having bad debt?

Bad debt can mean a person struggles to make payments. This could be an ongoing problem or a problem that took place in the past.

As a result, a lender might be unlikely to extend new credit. A banker might decline to make a personal loan. A private education loan business might not provide a student loan. A car dealer might not agree to a proposed vehicle purchase.

Other types of financial activities might be affected, too. For example, if a landlord sees bad debt on a credit report, they might not let the borrower rent from their apartment complex.

What are the benefits of having good debt?

Good debt reflects good money management habits. It reflects a person’s ability to spend within their means, successfully pay down several types of debt, and continue good money habits over months and years.

This could result in better interest rates on new debt and more favorable loan terms. It could make it more likely for the borrower to secure a rental unit or a mortgage for a house purchase.

In a nutshell

The idea of good debt and bad debt can be misleading because debt is a neutral tool. People use debt to fund various life activities including education, housing, and transportation. Borrowers should understand that there are good and bad debt management practices. Good habits keep borrowers current on payments, enable them to strengthen their credit report (and often their score) and achieve their financial goals. Bad habits can result in debts that stick around longer than expected, result in missed payments, and, in the most challenging cases, be a factor in declaring bankruptcy. Good habits can be learned and practiced by any borrower to create better financial security in the long term.

Good debt helps borrowers meet their financial goals and maintain strong credit. Regardless of what a credit report says today, borrowers can take steps to turn bad debt into good debt. This can lead to long-term benefits for borrowers, no matter their financial past.

Get your FREE credit report summary

See your credit score and get insight into what’s impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Get your FREE credit report summary

Understand your credit better with a free credit report summary

Good and bad debt

Value of credit reports

Reporting to credit bureaus

See your score and

credit report

summary.

See your score and credit report summary.

See the factors impacting your credit score

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.