How to get a credit report

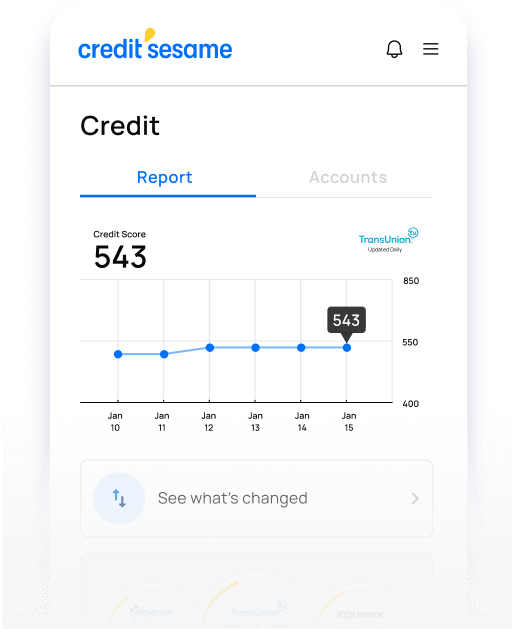

You can obtain a credit report from credit bureaus such as Equifax, Experian, and TransUnion. Visit their official websites or use authorized platforms like AnnualCreditReport.com to request a free copy of your credit report once a year. Some financial institutions and monitoring services, including Credit Sesame, also provide access to credit reports.

Get your FREE credit report summary

See the factors impacting your credit score and what you can do about it. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- Where to get a credit report

- What is a credit report?

- What are credit reporting bureaus?

- Credit score vs. credit report

- What's in a credit report?

- How are credit reports used?

- Why you should regularly check your credit report

- How to request a credit report

- What to do if there are problems on your credit report

- Using credit monitoring to keep an eye on your credit record

- In a nutshell

Share this

Where to get a credit report

- Credit Monitoring Services. Many credit monitoring services offer access to credit reports as part of their subscription. These services often provide regular credit monitoring, alerts for changes in credit information, and access to credit reports from one or more credit bureaus.

- Financial Institutions. Some banks, credit unions, and credit card issuers provide their customers with free access to credit reports. Check with your financial institution to see if they offer this service.

- Online Credit Report Providers. There are several online platforms that provide credit reports from one or more credit bureaus. These services may charge a fee for access to credit reports, and it’s important to ensure they are reputable and reliable before providing personal information.

- Credit Counseling Agencies. Non-profit credit counseling agencies may offer credit report access as part of their financial counseling services. These agencies can provide guidance on credit management and help consumers understand their credit reports.

- Credit Score Apps. Some mobile applications and online platforms provide free access to credit reports and scores. These apps may offer additional features like credit monitoring and personalized financial recommendations.

What is a credit report?

A credit report summarizes your current and past use of credit.

It shows how you are using credit now, including your credit accounts, how much you owe, and your payment history. It also highlights specific credit problems you may have had in the past.

A credit report does not give a complete picture of your financial situation. It focuses on your use of credit and does not deal with your income or expenses. The idea is to show how much history of using credit you have and whether that history has been positive or negative.

What are credit reporting bureaus?

Credit reporting bureaus are independent organizations that compile credit reports.

The three major credit reporting bureaus are Equifax, Experian, and TransUnion. They compile information about consumers based on reports from a variety of creditors. Those creditors may include banks, credit unions, credit card companies, and other lenders.

The credit reporting bureaus provide credit reports to organizations with a business interest in your credit history. Generally speaking, an organization needs your permission to get a copy of your detailed credit report. However, there are situations where credit bureaus may provide your credit report without your consent. Most often, these involve legal circumstances such as:

- A court order

- Grand jury subpoena

- Application for a government-issued license or permit

- A child support determination

Credit reporting policies vary from one company to another. For example, some creditors routinely report information to all three major credit bureaus, while others may only report to one or two. The information reported and how the credit bureaus process that information may vary.

This means that your credit report may differ from one credit bureau to another. The takeaway is that just because you have looked at a credit report from one credit bureau, you cannot safely assume that someone who checks your report from another bureau will see the same thing.

Credit score vs. credit report

A credit report is not the same as a credit score. They are somewhat related, so people often refer to them as if they were the same. However, they provide different information.

A credit score is a three-digit number that summarizes your overall creditworthiness. It is based on the information in your credit report but does not give any details about your credit record.

Your credit report is much more detailed, though it does not give an overall score or assessment of your creditworthiness. Credit scores vary because they may be calculated in different ways by different organizations and also based on the type of credit sought.

The additional detail in a credit report allows for a deeper understanding of your credit activity than a single number score. That detail also clarifies what has been reported about you that might help or hurt your credit score.

What's in a credit report?

The following are details you find in a credit report:

Personal information

- Name

- Address

- Birth date

- Social Security Number

- Phone Number

Information about past and present credit accounts

- Type of account

- Name of creditor

- Credit limit or loan amount

- Current account balance

- Payment history

- Account opening and closing dates

Collection accounts

- If you fail to pay a bill, the account may be sold to a collection agency

- Collection accounts are listed separately on credit reports and have a very negative effect on credit scores

- Collection accounts will stay on your credit report for seven years from the date the account first became permanently delinquent

Public records of financial actions

- Liens against your property

- Foreclosures

- Bankruptcies

- Civil suits and judgments against you

- Government records on overdue child support payments

Inquiries

- Companies that have requested your credit report

- Insight into what types of credit you may have applied for recently

How are credit reports used?

- Insurance companies sometimes use credit reports to rate applicants. This can affect whether you are approved for insurance and what you are charged for it.

- Potential employers look at credit reports to assess a job candidate’s reliability and to identify potential distractions due to financial problems.

- Landlords and property managers may use credit reports to assess how likely a potential tenant is to keep up with rental payments.

- Communications and utility companies may consider credit reports when deciding whether someone can open an account with them.

- Casinos and other gaming organizations extending customers’ credit may make decisions based on credit reports.

- A soft pull is a routine check of your credit. For example, when an existing creditor reviews your account, a financial firm does a preliminary evaluation before an application, or you request your credit report. These should not affect your credit score.

- A hard pull is typically made in connection with an application for new credit. These affect your credit score because creditors want to know how much credit you may have applied for lately.

Why you should regularly check your credit report

As you can see, your credit report contains some very important information about you. That information may impact not only whether you can get credit but also whether you get hired for a job you want, where you can live, how much you pay for insurance, and your access to other types of services.

Because so much is at stake, it is a good idea to regularly check to see what your credit report says about you. In particular, you should consider checking your credit report:

- When planning an important business decision. This includes any time you plan to apply for credit. You should also check your credit before applying for a new job, apartment, or insurance. Since your credit report may affect any of these things, you should review that report well before applying.

- To see how you can improve your credit. It is often difficult to fix bad credit in a hurry. So, instead of waiting until you are about to apply for something important to do something about your credit, it is better to work on maintaining good credit at all times. Knowing what is in your credit report will inform you about what may hurt your credit and how you might improve it.

- To watch out for fraud. Credit reports can give you warning signs of fraud. A sudden jump in an account balance or the appearance of a new account you did not apply for could alert you that someone is using credit in your name.

How to request a credit report

You can request a credit report to see what information it contains about you.

Under the federal Fair Credit Reporting Act (FCRA), you are entitled to receive one free credit report from each of the three major credit bureaus every 12 months. Since information compiled by each bureau may differ, it is a good idea to check reports from all three bureaus periodically.

- You receive notice that an adverse action, such as denial of an application, has been made against you due to information on your credit report. The FCRA requires that anyone who makes a negative decision about you based on your credit report must inform you of that fact and provide you with the name, address, and phone number of the agency that issued the report.

- You believe your credit information is inaccurate due to fraud.

- You are unemployed and intend to apply for a job within 60 days.

- You receive public welfare assistance.

In addition to having access to a free credit report under the circumstances above, the three major credit bureaus put in place a temporary program that allowed consumers to check their credit reports as often as once a week to see if they have been adversely affected by the economic impact of the COVID pandemic.

You can request a credit report by contacting any of the three major credit bureaus directly or online at AnnualCreditReport.com. That is a website sponsored by the three credit bureaus to provide consumers with a single source for their credit report requests.

You can also request a credit report by calling (877) 322-8228 or by mailing a request to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

What to do if there are problems on your credit report

If you check your credit report and do not like what you see, you should take action to fix it.

Problems on your credit report may be due to inaccurate information or actual issues with how you have used credit. In either case, there are things you can do to address the problems and improve your credit score.

Inaccurate information

- Your name, street address, email address, and telephone number.

- The report confirmation number, if available.

- The credit account number for any account you believe has been reported inaccurately.

- Details of what information you believe is incorrect – ideally, send a copy of the credit report with any incorrect information noted on the page.

- Documentation such as receipts, account statements, etc. that show the information on the report is inaccurate. ALWAYS SEND COPIES – not originals.

Equifax, Experian, and TransUnion each have an online form for disputing information. If you contact them by regular mail instead, keep a copy of your correspondence and request a record of receipt when sending. Also, check for contact information on the copy of the credit report you receive for the correct contact details.

Bad marks on your credit record

Besides errors, you may find various legitimate things on your credit report that are hurting your credit score. From missed payments to high credit utilization to a lack of balance in the types of credit accounts you have, once you identify what is wrong, there are a variety of ways you can work to address those problems over time.

Credit Sesame offers a Credit Report Summary that can help you understand what is hurting your credit so you can take steps to fix those problems.

Using credit monitoring to keep an eye on your credit record

Checking credit reports from all three credit bureaus is a good idea. However, credit problems can arise anytime, and it can be burdensome to constantly request credit reports.

Credit Sesame offers free credit monitoring that will alert you to significant changes in your credit report. Finding out about potential problems more quickly will help you fix them sooner – before they have a chance to cost you.

In a nutshell

Regularly checking your credit report is not just about monitoring your financial history; it's a proactive step toward safeguarding your financial well-being. By staying informed about your credit standing, you empower yourself to make better financial decisions and address issues promptly. View your credit report as a valuable tool in your financial toolkit, providing transparency and enabling you to take control of your creditworthiness.

In the realm of personal finance, knowledge is power. Your credit report serves as a mirror reflecting your financial behavior. Make it a habit to review this mirror regularly, ensuring its accuracy and identifying areas for improvement. A well-maintained credit report can open doors to favorable opportunities. Guard your financial reputation, and let your credit report demonstrate your responsible financial behavior.

Get your FREE credit report summary

See your credit score and get insight into what’s impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Get your FREE credit report summary

Understand your credit better with a free credit report summary

What's a credit report?

Value of credit reports

Reporting to credit bureaus

See your score and

credit report

summary.

See your score and credit report summary.

See the factors impacting your credit score

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.