What is pre-approval for credit cards and loans?

Pre-approval for a credit card or loan puts borrowers one step closer to securing new credit they can use to make future purchases. It’s important to understand that not all pre-approvals are the same, and none guarantee credit will be extended. Learn what pre-approval means, how it works, common steps needed to get pre-approval, and ways to make pre-approval more likely.

Find the right credit card match

Let the experts help pick the right card based on your credit profile and approval odds. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- What pre-approval means for credit cards and loans

- How pre-approval works

- How pre-approval works for different loan types

- How to make pre-approval more likely

- Does pre-approval guarantee the borrower will get a loan?

- How does pre-approval work for people with bad credit?

- What's the difference between pre-approval and pre-qualification?

- Does pre-qualification or pre-approval require a credit check?

- What strategies can boost income for pre-approval?

- What are pre-approval watchouts?

- In a nutshell

Share this

What pre-approval means for credit cards and loans

Pre-approval means a lender such as a credit card company or a bank has done some initial homework on a borrower’s financial history. After this review, they’ve concluded the borrower is likely a good candidate for new credit. Lenders reach this decision in a few ways. They have studied the borrower’s credit report, which indicates reliability, timely payments and good credit habits. The borrower likely has a good to strong credit score.

Having pre-approval in writing from a lender benefits borrowers in a few ways. It can reduce the hassle, paperwork, and time needed to get a new credit card or loan. Pre-approval does this because it signals to any people involved in a financial transaction that the borrower is a good fit for a loan. For example, if a bank pre-approves a car loan up to a certain dollar amount, it gives the car dealer greater confidence to make the sale. They can have confidence they’ll be paid back on time. In the case of a mortgage, pre-approval reassures the seller of a house that the buyer has the financial capacity to make such a major purchase.

How pre-approval works

The process of pre-approval involves a thorough review of the borrower’s financials. Often, lenders have trained financial professionals who review a borrower’s credit history, income statements, and tax returns. Not every pre-approval is this thorough. Some lenders require less information than others. Remember, pre-approval isn’t a guarantee that credit will be given. Additional documentation and signatures will be required before any offer of credit becomes official.

How pre-approval works for different loan types

Although the basics of pre-approval remain the same, borrowers might experience some nuances along the way. Here are a few examples.

With credit cards

In some cases, borrowers might get a mailer, a push notification to their phone, or an email stating they are pre-approved for a credit card. The borrower doesn’t have to contact the credit card vendor. The credit card company comes to them. In other cases, borrowers might research which credit cards seem to be a good fit and apply for pre-approval. They will input basic details about their credit, financial profile, and income. The process is generally straightforward.

With car loans

Many car buyers first visit their bank to seek pre-approval for an auto loan. Assuming the borrower works with the bank already, the financial institution will have many of the required documents on file. These allow the bank to assess the borrower’s level of risk. It helps them decide the right credit amount to extend. The bank generally provides papers the car buyer can take to a dealer. This makes the purchase go faster and gives the auto dealership the security it needs to complete the sale.

With mortgages

If borrowers are looking for a home, they will often get pre-approval quotes from several lenders. This could include a quote from a personal bank and other lenders to see which will offer the best interest rates and payment terms. To provide formal pre-approval, banks will need a combination of signed tax returns, W-2 forms about the borrower’s employment, and bank and investment account documents.

How to make pre-approval more likely

Several activities can help borrowers increase their chances of successful pre-approval. Think of these as good credit habits that can be put to use at any time, even if the borrower won’t seek pre-approval for months.

Studying credit reports and scores

Get familiar with the free annual credit report available to every borrower. Free access is easy to obtain by downloading the Credit Sesame app. In addition to information about a borrower’s debt types, payment history, and loan terms, the app provides an updated credit score. This information can become a baseline for borrowers to improve against. For example, borrowers could aim to add 20 points to their credit score, get current on loan payments, or add a new type of debt for a better credit mix. These types of strategies could result in stronger credit, a better credit score, and a greater likelihood of pre-approval for future credit cards or loans.

Collecting financial paperwork

Borrowers who want pre-approval need evidence they can pay down debt on time, every time. Gather at least the most recent two years of signed tax returns. Compile pay stubs and W-2 income statements. Assemble documents about any other debts or investments such as retirement accounts or education savings funds. This will provide prospective lenders with everything they need to decide whether to extend pre-approval.

Meeting with potential lenders

Automated pre-approval is common. This means a computer analyzes a borrower’s financial details and recommends whether to pre-approve them. Additionally, a phone call, videoconference or in-person meeting between a borrower and a prospective lender can be beneficial. It helps borrowers build relationships with lenders, allows them to ask questions, and gives them more information about the pre-approval process. This is especially true for auto loans and mortgages or for credit cards offered by a local bank in the borrower’s community.

Does pre-approval guarantee the borrower will get a loan?

Pre-approval never guarantees the borrower will get a loan. Instead, pre-approval gives the borrower greater confidence they can secure a loan at some level. Meanwhile, it gives the lender greater visibility into the borrower’s financial picture. It provides them with solid data that signals whether a borrower will pay back a debt. Pre-approval should be viewed as one step closer to a loan agreement, even though it’s not guaranteed.

How does pre-approval work for people with bad credit?

Low credit scores, bankruptcies, or other issues can hurt credit and limit pre-approval opportunities. It might take time for borrowers to build their credit to the point of getting approval. Take care to make timely payments on debt, use a mix of debt types, and maintain a solid income. A new job with higher income or several years of demonstrated ability to make payments on owed balances can produce stronger credit more likely to lead to pre-approval.

What's the difference between pre-approval and pre-qualification?

Pre-qualification is less rigorous and based on fewer data points. Pre-approval generally requires more paperwork and a deeper look at the borrower’s money management experience. Borrowers who are pre-qualified for a loan offer often need to take the next step of pre-approval. Later, they can take the final step of getting an exact loan amount and signing to get the funds.

In other cases, lenders use pre-approval and pre-qualification to mean the same thing. It’s a good idea to read the fine print on any advertising that claims borrowers are pre-qualified or pre-approved. Make sure to understand what this particular lender means and what exactly they’re offering. Investigate the loan’s interest rate, credit cap, and other features to ensure it’s a good fit.

Remember, both pre-approval and pre-qualification are one step of many. They don’t guarantee the borrower will get a loan. Be open to the possibilities and ask lots of questions in case there are strings attached.

Pre-qualification and pre-approval can help streamline decisions about opening new loans. They can point to offers that best fit a borrower’s financial track record. On the other hand, lenders look for ways to market pre-approval opportunities year-round. Borrowers should study their budgets and understand what’s in their best interest rather than pursuing the first pre-approval advertisement to hit their inbox. More opportunities for pre-approval are likely.

Does pre-qualification or pre-approval require a credit check?

Loan pre-qualification typically does not involve a hard credit check. Lenders often perform a soft credit inquiry during pre-qualification, which does not impact credit score. This inquiry provides a general overview of borrower creditworthiness.

Loan pre-approval usually requires a more detailed assessment of a borrower’s financial situation, which may involve a hard credit check. A hard inquiry can have a small, temporary impact on credit score. It’s important to check with the specific lender to understand their process and whether they will perform a soft or hard credit check during pre-qualification or pre-approval.

What strategies can boost income for pre-approval?

Sometimes, borrowers are unable to get pre-approval for a loan because their income is too low. There are several ways to increase income to boost eligibility.

If a borrower holds a steady job, they can look for opportunities for advancement in the business where they work. This could include taking on more responsibilities, working overtime, or applying for a leadership position with management duties.

Other borrowers prefer to supplement their income with side hustles. Popular options include driving for a rideshare service, providing shopping and delivery services for customers, or turning a hobby into products that can be sold online.

Lenders want to see evidence that borrowers can maintain a steady income over a period of months and years. They want to see income staying about the same or grow higher, rather than going sharply higher or lower in unpredictable ways. A steady paycheck suggests the borrower will be able to make timely loan payments.

What are pre-approval watchouts?

Not every pre-approval offer is a good fit for every borrower. Just because a pre-approval offer looks attractive doesn’t mean it makes financial sense. Study the details before committing to sign any agreements.

Ask questions such as:

- Does the loan offer a fixed interest rate, or will it fluctuate with the market?

- Will the borrower get an entry rate that eventually rises to a certain level after a period of months?

- Can the loan be used for certain purchases but not others?

- Will everyone accept the credit card or loan, or can it only be used with specific vendors?

Doing the research and knowing the answers to these questions helps borrowers make an informed financial decision. Understand pros and cons before getting locked into an agreement.

In a nutshell

Pre-approval can sound confusing because so many organizations offer this to borrowers. The process is pretty straightforward with a clear purpose: to give the borrower and lender greater confidence in moving forward to a formal loan offer.

While pre-approval provides a significant step toward obtaining credit, it's crucial to remember that it doesn't guarantee a loan. Stay informed, ask questions, and make well-informed financial decisions to ensure that any pre-approval aligns with needs and goals.

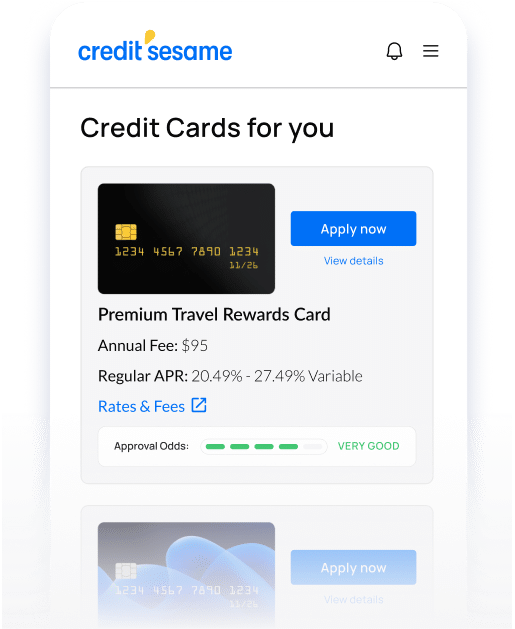

See your approval odds before you apply

See cards with the highest chance of approval based on your credit profile

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Ready to find the right credit card?

See cards with the highest chance of approval based on your credit profile

See your score.

See your card matches

See your score. See your card matches.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.