What are business credit cards?

Business credit cards are useful cash management tools. Businesses of all sizes, from start-ups to large, established companies, can benefit from using them. The key to any tool is using it correctly.

Find the right credit card match

Let the experts help pick the right card based on your credit profile and approval odds. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- What is a business credit card?

- Background of business credit cards

- Business vs. corporate credit cards

- Characteristics of business credit cards

- Why having a business credit card is useful

- Alternatives to business credit cards

- Business credit card problems to avoid

- Pros and cons of business credit cards

- What to think about when choosing a business credit card

- Business credit cards as a tool for your company

- In a nutshell

Share this

What is a business credit card?

A business credit card works much like a personal credit card but has some crucial differences.

A personal credit card is opened in the name of an individual consumer, while a business credit card is opened in the name of a company. This difference can have important implications for financial liability and credit history. However, a business credit card can still affect a business owner’s personal credit.

Business credit cards also have some distinct characteristics. From the type of rewards they offer to the data tools they provide, they often cater to businesses’ particular needs.

In principle, business credit cards operate like personal credit cards with a credit limit. Authorized users can use the card to pay for things up to the credit limit.

Payments made with the card will add to the balance owed on the card. The business must periodically pay down that balance to stay below the credit limit. Also, any balance outstanding at the end of a statement period will be charged interest.

Background of business credit cards

One reason why business and personal credit cards are so similar is that the providers offer both types.

The overlap between business and personal credit cards makes sense from a financing and marketing standpoint. A broader pool of customers helps keep credit flowing smoothly. Also, business contacts are often good personal credit customers, and vice versa.

Despite this overlap, some differences in business and personal credit cards have evolved based on the needs of each market.

Business vs. corporate credit cards

Interestingly, business credit cards and corporate credit cards are different.

Although business and corporate credit cards may be referred to as business cards, there is a distinction based on the size and history of the organizations using them.

Business credit cards are generally for smaller and newer ventures, such as start-up companies, sole proprietorships, or freelancers. Unless the entity already has a significant credit history, getting approved is likely to depend heavily on the business owner’s credit record. If the company does not pay its bills, liability for payment will be reverted to the owner. Any payment issues will reflect on the personal credit record of the business owner who applied for the card.

In contrast, corporate cards are available only to legally incorporated organizations. They typically must have revenues in the millions and their own credit history. Corporate cards allow more authorized users than business credit cards. Liability for payment rests on the corporate entity rather than the individual owners. The credit card company may require a minimum usage threshold to keep the account active.

Characteristics of business credit cards

Whether you choose a business credit card or a corporate card, they have some characteristics in common. Some may seem familiar to anyone with a credit card, while others differ from personal cards.

Company vs. personal credit history

If the business has a limited credit history, getting approved for a card will depend heavily on the owners’ creditworthiness. Their credit record and ability to pay will be key considerations. If applying for a business credit card requires the credit card company to pull the owner’s credit record, it might negatively affect that person’s credit.

If getting approved for a business credit card depends on your personal credit history, it would be wise to check your credit and clear up any problems before applying. This may qualify you for better terms and thus reduce your credit cost.

The more established a company is, the more a credit card issuer will consider the company’s credit history. This means looking at the company as if it were a person. Both the credit history of the company and its ability to make payments will factor into whether it gets approved for a card. This will also affect the interest rate charged.

Generally higher credit limits

Business credit cards generally have higher credit limits than personal cards. That is because companies generally have higher revenues and spending than individuals.

Still, when setting a credit limit, card issuers consider businesses almost as individuals. The company’s payment track record and ability to make payments will be considered.

Facilitating multiple users

The number of authorized users allowed on a single credit card account depends on the card issuer’s policies. As a general rule, though, business credit cards allow more authorized users than personal credit cards. This is especially true of corporate credit card accounts.

Spending and budgeting input

Many credit card issuers offer their business card customers detailed information on spending by user and category. This may be more detailed than what an individual would see on a credit card statement.

This detailed spending information can help track spending, budgeting by expenditure category, and identifying deductible expenses for tax purposes.

Business rewards

Like many personal credit cards, business cards often offer rewards based on the amount of spending on the card.

Business cards may offer reward programs geared toward business expenses. For example, they may offer bonus points for expenditures in certain business categories, such as office supplies.

Introductory interest rate

As with personal credit cards, it is important to consider the interest rate when signing up. The interest rate for a given account will depend on the customer’s creditworthiness and may differ considerably from the advertised rate.

Some business credit cards offer special low introductory rates – sometimes as low as 0%. These introductory rates will apply for a limited time, such as 12 months. That can be very useful for a start-up business, incurring upfront expenses before revenues kick in.

Annual fee

Business credit card fees are often higher than those for personal credit cards. This is because business credit cards offer features such as enhanced reporting and a higher number of authorized users. Also, as with personal credit cards, the cards with the most generous rewards programs will likely have higher fees.

Why having a business credit card is useful

Even if you are the sole business owner, it is a good idea to have a separate business card instead of a personal card. This is important from the start-up phase until the company becomes a larger established business.

Small businesses

For small businesses and start-ups, having a separate business credit card helps separate business spending from personal spending.

Keeping business spending separate may be necessary for tax purposes. It should also help you track spending and measure profitability and return on investment. The organization’s spending history can be a helpful guide to setting future budgets.

In addition, having a separate business credit card can be a useful step towards the company establishing its own credit history. This will give it more options for obtaining credit in the future.

Larger businesses

For larger businesses, enhanced reporting and the ability to accommodate more authorized users may be essential reasons to choose a business credit card.

Eventually, getting a corporate credit card can draw a clear legal distinction between the financial activities of the company and those of its owners. This is important for tax, liability, and credit reporting purposes.

Alternatives to business credit cards

In addition to credit cards, businesses have other forms of financing available. None of these are mutually exclusive—a business may find all of them useful for different situations.

Here are some common types of business financing other than credit cards:

- Business loans. For borrowing that will take several months to pay off, a loan may be a better alternative than simply adding to the company credit card balance. Loans typically have lower interest rates, and their structured repayment schedule helps with budgeting.

- Business line of credit. A line of credit operates like a credit card in that you can spend against it when needed and pay it down flexibly. However, by negotiating a line of credit with a lender, a business might obtain a higher credit limit and/or a lower interest rate than they could get with a credit card.

- Vendor credit. A business that makes large, recurring purchases from a supplier could get credit from that supplier. This can allow the business to pay for those purchases over time rather than all at once. A supplier might offer a regular customer more favorable terms than other lenders.

Business credit cards offer more day-to-day flexibility than these other forms of credit. They are ideal for smaller expenses that will be quickly paid off. However, the above options may be more cost-effective for larger expenses that will be paid off over a longer time.

Business credit card problems to avoid

While business credit cards offer great convenience for short-term cash flow needs, some common problems should be avoided:

- Carrying balances for extended periods. Credit cards are an efficient substitute for cash. However, there are more cost-effective ways to borrow money. Consider a loan or other source of credit instead for larger expenses that you will have to pay off over several months.

- Mixing personal and business spending. Once you open a business credit card, you should avoid using it for personal spending. Doing so could muddy the distinction between personal and business spending, making it harder to budget and measure your business’s profitability. At worst, it could cause legal and tax problems.

- Allowing too many authorized users. While letting multiple employees use company credit cards can give your organization more flexibility, it can also lead to headaches. You need to be able to track each individual’s usage separately to ensure it is appropriate. You also need to coordinate overall usage so the company does not exceed its credit limit.

Pros and cons of business credit cards

The following are some of the chief pros and cons of business credit cards:

Pros:

- Flexibility for short-term cash flow needs

- Separation of business from personal spending

- More ability to accommodate multiple users

- Business-oriented reporting tools and rewards

Cons:

- Higher interest cost than other forms of borrowing if you carry long-term balances

- Annual fees, in many cases

- Their flexibility can make off-budget spending too easy

- Requires regular monitoring of usage

What to think about when choosing a business credit card

Business credit cards offer different terms and features. Trying to weigh the overall attractiveness of the various characteristics of a business credit card depends on how your company is going to use it.

Before choosing, consider how your business will use its credit card. That will help you evaluate the following:

- Interest rate. Consider both the introductory rate and the ongoing rate. The relevance depends on whether you expect to carry a month-to-month balance that will incur interest charges.

- Annual fee. The lowest fee is not necessarily the best deal for your needs. You have to measure the cost of the fee against the interest charges you are likely to incur and any rewards you are likely to earn. Other features may also justify a higher fee if you find them useful.

- Rewards. The type of rewards offered (cash back vs. points for specific types of purchases), how you earn them, and the amount of the rewards all contribute to how much those rewards will be worth to your business.

- Credit limit. Make sure you choose a card with a limit that is more than adequate for your needs. Having a card declined because you have hit the credit limit can be a logistical headache and damage the company’s reputation.

- Reporting tools. Consider what information the account will provide and how this will help you with expense tracking, budgeting, and taxes.

Business credit cards as a tool for your company

The best way to use a business credit card is as a short-term cash substitute rather than a long-term borrowing source. With careful management, a business credit card can help you manage cash flow more efficiently. It does this by making credit readily available, consolidating expense payments, and providing a straightforward way to track business spending.

In a nutshell

Business credit cards can be beneficial for managing short-term finances and building creditworthiness. Their dual functionality facilitates expense consolidation and fosters responsible spending habits. However, prudent oversight is crucial to prevent overspending and maintain a positive credit standing.

Harnessing the potential of business credit cards demands strategic planning and disciplined execution. Leveraging their benefits while mitigating associated risks ensures sustainable financial health for your enterprise.

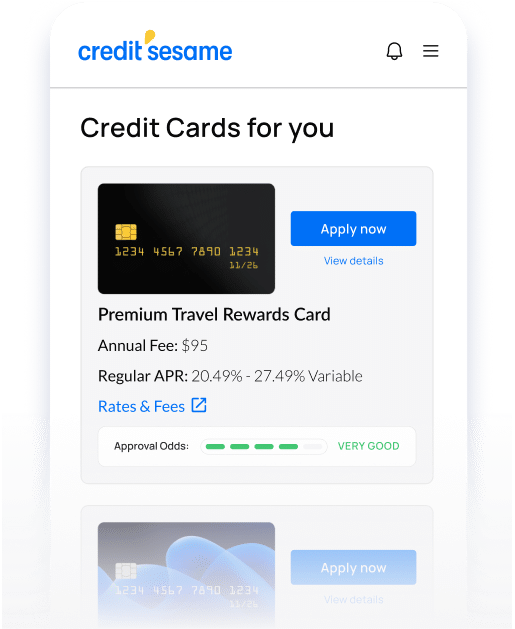

See your approval odds before you apply

See cards with the highest chance of approval based on your credit profile

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Ready to find the right credit card?

See cards with the highest chance of approval based on your credit profile

Credit card pre-approval

Credit card statements

How credit cards work

See your score.

See your card matches

See your score. See your card matches.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.