Get your free

credit score

No credit card required and it won't impact your score.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

As featured in:

How Credit Sesame works

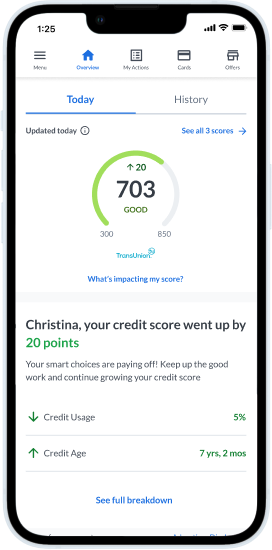

See your credit score right away

Check your score for free without impacting your credit. No commitment. No credit card required.

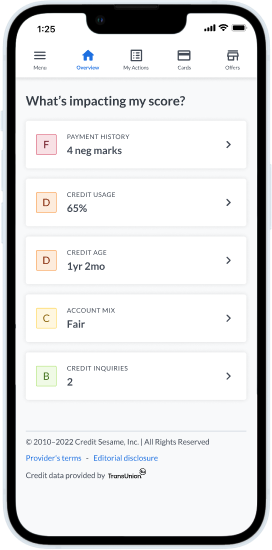

Keep up with your credit

Your monthly credit report shows you what’s impacting your score. We’ll show you steps you can take to improve it.

Build credit with Sesame Cash1

Get a Sesame Cash debit account and activate credit builder to grow your credit score for free.

Do more with your score®

Building, rebuilding, or looking to leverage your credit? We’ll help you find the right credit products.

Get yourFREE

score in 90 seconds!

No credit card needed

Won’t impact your score

No commitment, no cost

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Credit Sesame members get MORE for free

Daily

credit score

Credit

report card

Credit

monitoring alerts

Credit

builder1

Credit and

debt analysis

Personalized

actions and offers

1 Sesame Cash is a prepaid debit card issued by Community Federal Savings Bank (CFSB). Building credit with Sesame Cash requires you to also open a virtual secured credit card with CFSB that is reported to the credit bureaus. Use money from your Sesame Cash account to create a virtual secured credit card. Your debit card purchases are then added up to create a balance on your virtual secured credit card. As you make these purchases, an amount equal to the balance on your virtual secured credit card is also set aside in your Sesame Cash account to ensure you can make timely payments to pay off the balance on your virtual secured credit card at the end of each month, allowing you to build a positive payment history. Credit Sesame does not guarantee credit score improvement. Any predicted credit improvement from the use of your virtual secured credit card assumes that you will maintain healthy credit habits, including paying bills on time, keeping credit balances low, avoiding unnecessary inquiries, appropriate financial planning, and more.