How to establish credit history

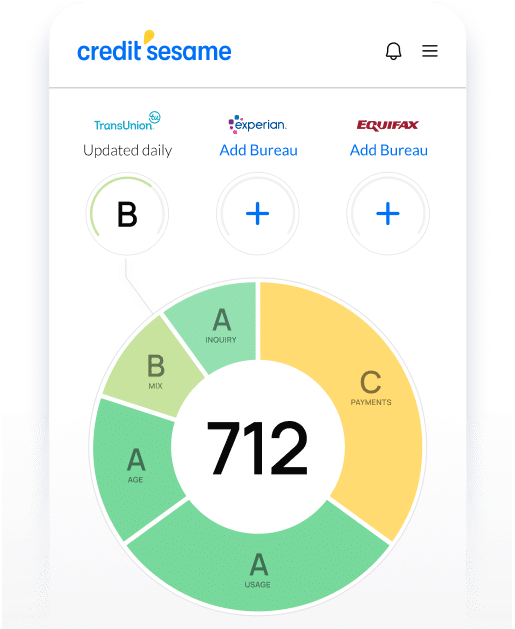

Get your free credit score

Start today. The sooner you know your baseline score, the sooner you can start to build credit history.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

The fundamentals of credit history

- Credit report

- Credit score

Credit Report

- Current and past loans and lines of credit

- Amounts owed

- Available credit

- Payment history including late payments

- Delinquent accounts

- Collections, repossessions, foreclosures and bankruptcies

- Recent credit applications

Credit Score

Your credit score is calculated using a mathematical formula that takes into account your previous credit history and behavior. It is a measure of how likely you are to repay debt. Lenders want to know if there is a poor, fair, good or excellent chance of you repaying a personal loan, student loan, home loan, line of credit, credit card or other loan regularly and on-time.

Your credit report may or may not show your credit score. By law, the credit bureaus must allow you to see the information in your credit report, but there is no legal requirement for them to make your credit score available. You can get your credit score for free from Credit Sesame or many banks and credit card issuers.

A credit score is an analysis of all the data listed on your credit report. Lenders use your credit score to figure out how likely you are to repay the borrowed funds, either from a loan, line of credit, or credit card. Some credit scoring companies charge to access your personal score, or you can enroll in a free credit score service from Credit Sesame.

You may have several credit scores. The two main credit scores are FICO and VantageScore. VantageScore was developed by the three major credit bureaus as an alternative to FICO. Your score may also vary depending on the bureau gathering the data, TransUnion, Equifax and Experian source data slightly differently and so scores may not be identical. If there is a large difference between your various credit scores, you may wish to check for errors that have lowered your score. Credit Sesame provides the VantageScore 3.0 score from TransUnion for free.

Your credit report

- How often you’ve applied for credit, even if you did not succeed

- Credit accounts that you have opened and closed

- Repayments made on time, late, or missed completely

- How much you owe

Your credit score

The items in your credit report paint a picture of how you use credit, and how you’ve used it in the past. That record is summed up in a credit score, a three-digit number typically ranging from 300 to 850. The higher the credit score, the more you are considered trustworthy with credit.

How to start your credit history

If you do not have an established credit history, you may wonder how to get started. There are a number of ways to establish and add to your credit history.

Apply for a credit card

The absence of a credit history may make it difficult to get a typical unsecured credit card. However, a secured credit card is another possibility. With a secured credit card you place an initial security deposit in a special account with the same lender. You then use the card and pay off every month just like an unsecured card. If you manage your secured credit card responsibly, you create a credit history and may qualify for an unsecured credit card within a year.

Become a credit card authorized user

As an authorized user on the credit card of a close friend or relative, you benefit from the credit history of that credit card. You both need to use the card responsibly, keep credit utilization under 30%, make monthly payments on-time every month and commit to maintaining a low or zero balance. This can be one of the quickest ways to start or boost your credit history and score.

Get a student credit card

If you are enrolled in college, university, or certification program, you may qualify for a student credit card. The credit limit is usually low when you start off, but so are the fees. You may, however, need at least a part-time job in order to qualify.

Take out a credit builder loan

A credit builder loan requires you to repay the loan in full before the funds are released. Each month, you make payments including interest to the lender that are reported to the credit bureaus. This allows you to build a positive credit history.

Get a joint account with a co-signer

A co-signer with a solid credit history can help you get approved for a loan that may be unavailable to you on your own. A common example is a student loan that has both the student and parent as co-borrowers, but other loans may also be available with a co-signer. Remember that you are both responsible for making payments and negative actions can affect the co-signer’s credit and your credit.

Add data and information to your credit report

How quickly can you start your credit history?

Individuals with no credit history or score are known as “credit invisible.” When you first start building your credit history you have a “thin” credit file. Taking any of the steps above helps to “thicken” your credit history and increase your credit score, providing you pay your debts regularly and on-time. It does not happen overnight. Expect to wait between three and six months before your credit history begins to appear on your credit reports. This is because the creditors are responsible for reporting the financial data to the credit bureaus and this may not happen right away.

- Making on-time payments each month

- Keeping credit card balances low

- Avoiding too many credit applications in a short time period

Although you can start your credit history quickly, it takes many months or even years to build a great credit history and high credit score. There are no short-cuts, but the sooner you establish your credit history and stick to good credit habits, the sooner you can reap the rewards.

Why is credit history important?

Your credit history is important because it is a record of your responsibility with debt. It is a way for creditors and lenders to assess the risk of extending credit to you. These financial institutions use your credit report and score to figure out if you’re at high-risk of defaulting on a loan, meaning they get less or none of the money back. Someone who has a poor credit history is likely to qualify for less money at higher interest rates than someone with a good or excellent credit history. The higher interest rate compensates the lender for the additional risk they take with a poor credit individual. If you have no credit history, lenders don’t know what to expect from you and may use similar approval guidelines as for someone with a bad credit history. Starting and building a positive credit history is the best way to secure loans and credit cards in future.

What is the best way to start my credit history?

Apply for one type of credit designed for people with no or limited credit history. Apply for one only, because every application requires a “hard pull” on your credit history and may hurt your credit score. It’s not so dramatic when you have established credit, but it can be harmful when you’re already working on building your credit score from scratch.

Take actions that show you are reliable but do not involve going into debt. For example, reporting your to a credit bureau or becoming an authorized user on someone else’s credit card.

How do secured credit cards work?

A secured credit card requires that you deposit funds in a separate secured account with the same lender or bank. You then receive approval for a credit card with a limit usually equal to the amount deposited. Thereafter, you should spend on your secured credit card and, ideally, repay the balance in full each month. Failing to pay in full incurs interest charges. If you manage your card responsibly for six months to a year, you may qualify for a traditional credit card and get that security deposit back.

Can I really start from scratch?

Yes, even if you have a very thin credit file or no credit history, you can establish your credit score and start building your credit history.

In a nutshell

In order to start your credit history you need to have a credit history. This sounds like an impossible situation, but it’s not. If you have no credit history or a thin credit file, there are actions you can take to start your credit history without going into debt.

The sooner you start your credit history the sooner you can have a good credit score. A good credit score opens doors to credit and loan possibilities. If you want to get a student loan, lease a car or secure a mortgage, it’s easier with a good credit history.

Do more with your FREE score™

Check your score right away and see the factors impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Check your credit score for FREE

Checking your score to see where you stand is FREE and does not impact your credit.

What is a credit score

How to check credit score

Understanding credit score

See your score.

Reach your goals.

See your score. Reach your goals.

Begin your financial journey with Credit Sesame today.

Get your FREE credit score in seconds.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.