The new tax bill changes that President Trump signed last December was intended to reduce the corporate tax rate from 35 percent to 21 percent, along with reducing the individual tax rate to 37 percent. Other notable changes include doubling the standard deduction, reducing income tax rates and doing away with personal exemptions.

So, what does this all mean?

Credit Sesame decided to poll 1,000 people and ask if they expect to pay more or less in taxes this year.

Their response was concerning, as 42% said they simply didn’t understand the bill enough to even make that determination.

Here are results from our survey:

Do you expect to pay more or less in taxes as a result of the new tax bill?

- I don’t know (I don’t understand the new tax bill): 42%

- I expect to pay less in taxes: 34%

- I expect to pay more in taxes: 24%

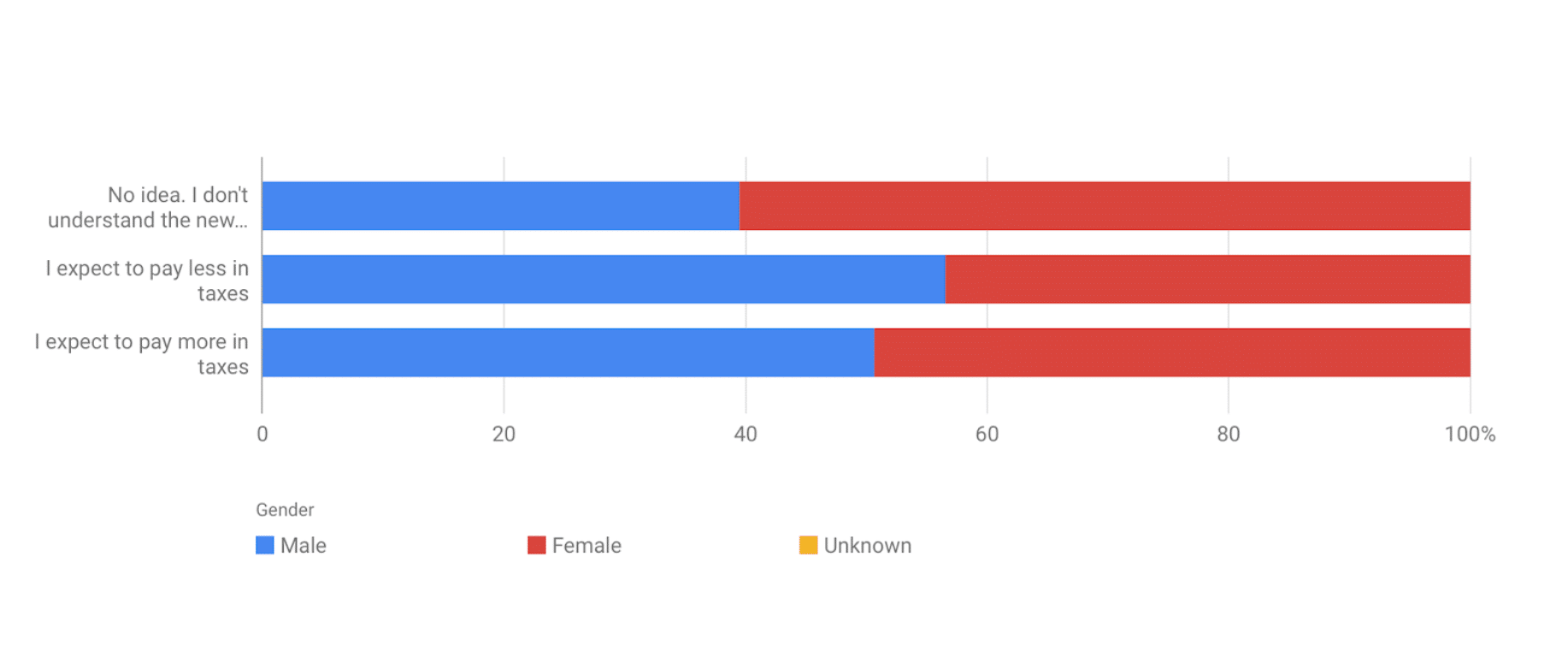

Men vs. Women: Who understands the new tax bill more?

Women are more likely than men to say they do not understand the new tax bill while men are more likely to say they expect to pay less taxes.

| Male | Female | |

|---|---|---|

| I expect to pay less in taxes | 40% | 28% |

| I don't understand the new tax bill | 35% | 49% |

| I expect to pay more in taxes | 25% | 23% |

Generational Differences

Millennials are most likely to say they do not understand the tax code while

middle-age generations (those 45 to 64) are more likely to say they expect to pay less taxes.

| I Don't Know | Less Taxes | More Taxes | |

|---|---|---|---|

| Millennials (18-34) | 47% | 31% | 22% |

| 35-44 | 40% | 33% | 28% |

| 45-54 | 36% | 37% | 27% |

| 55-64 | 42% | 38% | 20% |

| 65+ | 40% | 35% | 25% |

Midwesterners the Least Likely to Pay More Taxes

We noticed that the regional differences are not as stark as age and gender differences.

Taxpayers in the South are most likely to say they do not know how their taxes will be affected, while those in the Midwest are most likely to expect to pay less in taxes.

Can you guess who will expects to pay the most? That’s right, West Coast residents!

| I Don't Know | Less Taxes | More Taxes | |

|---|---|---|---|

| Midwest | 40% | 36% | 24% |

| Northeast | 43% | 34% | 23% |

| South | 45% | 34% | 21% |

| West | 39% | 32% | 29% |

So, what about your taxes?

Do the survey responses resonate with you? If you’re unsure how to navigate your taxes this year, be sure to get started early with a tax professional so you can have time to gather documents and mitigate any surprises along the way.

Remember, you have until April 17, 2018 to file your taxes or request an extension.

Even if you file for an extension you still need to pay your taxes by April 17. You must estimate and pay by that date, otherwise, you may incur interest and have to pay penalties.

Other tips

- If it’s your first year filing taxes, we wrote a guide for beginners.

- Owing money to the IRS can be scary. Here’s what to do if you owe money and don’t have the funds to pay the IRS.

Methodology

We used a Google consumer survey, which surveyed about 1,000 people.