Credit Sesame on the latest economic news: inflation is up, or maybe it’s down, depending on how you interpret the data.

The end of February 2024 brought news of an upturn in the inflation rate. It also featured stories saying that the inflation rate was slowing. Both perspectives referenced the same data. How the data was interpreted is a reminder that understanding economic events can come down to an individual’s point of view.

Last week’s key inflation measure

On February 29, 2024, the Bureau of Economic Analysis released its report on Personal Income and Outlays for January 2024. This report is widely referenced for its information on consumer income and spending and data on trends in consumer prices.

Inflation has been a hot topic over the last few years, and the information on consumer prices is interesting. The BEA report includes information on the Personal Consumption Expenditures (PCE) price index. The PCE price index is significant because it is the measure of inflation that the Federal Reserve focuses on in making interest rate decisions.

The PCE price index reflects roughly the same inflation trends as the more widely-known Consumer Price Index (CPI). However, the PCE price index adjusts more rapidly to what consumers are actually buying. This is thought to reflect actual consumer behavior better. One way consumers deal with inflation is by substituting lower-priced goods for ones that have become more expensive.

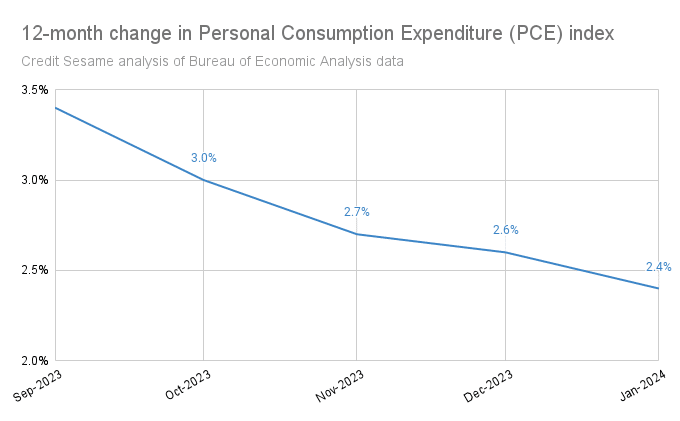

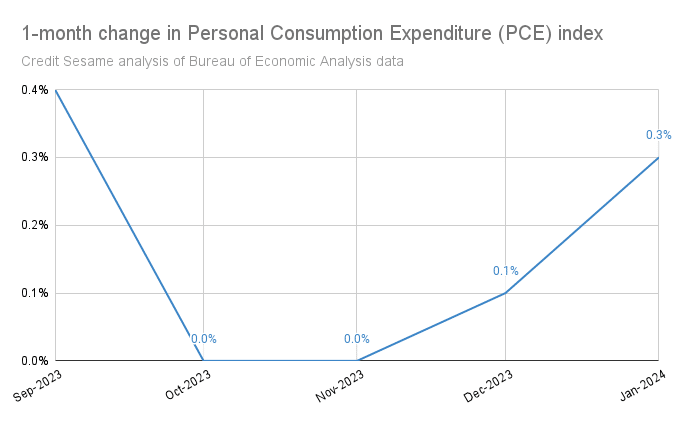

The latest PCE price index data highlights that inflation had risen by 0.3% in January and by 2.4% over the past 12 months. Core inflation, which excludes the food and energy sectors, was up by 0.4% in January and by 2.8% over the past year. Core inflation is interesting because it measures how widely it has spread throughout the economy.

These numbers are not in dispute. Where opinions differ is in what they mean about the latest inflation trend.

Year-over-year inflation has slowed

One school of thought is that the numbers mean that inflation continues to slow down. This interpretation is based on the numbers for the past 12 months. The 2.4% inflation rate for the past 12 months was an improvement over the 2.6% rate for calendar year 2023. The 12-month number has fallen steadily, as illustrated by a series of recent reports on the PCE price index. Viewed this way, the trend is pretty clear: inflation is slowing. That’s good news for consumers and investors.

Recent inflation has sped up

However, not everybody sees it the same way. The 12-month numbers contain a lot of information that came out months ago. For example, the main reason the 12-month change in the PCE price index was lower through January 2024 than it was through December 2023 is that the January 2023 number dropped out of the 12-month period. The January 2024 number replaced it.

That’s significant because the January 2023 increase in the PCE price index was 0.6%, a big number for a single month. As the measurement period rolled forward, the January 2023 number was replaced by the January 2024 number. Since that more recent number was much lower (0.3%), the 12-month total went down. However, looking back 12 months doesn’t tell you what’s happened recently. Looking at the 1-month numbers for the PCE price index tells a different story. Viewed from this perspective, it seems as though inflation has been rising recently after falling to 0% in October and November 2023.

So is inflation up, or is inflation down?

The 12-month perspective may be too optimistic because it largely reflects old news rather than recent developments. However, 1-month numbers tend to jump around a lot, so it’s too soon to draw conclusions from the January 2024 number.

The bottom line is that inflation is roughly where it has been for the past several months. It has fallen but remained stubbornly above the Federal Reserve’s 2.0% target. The uptick in January is no reason for panic, but it is reason for caution. The February 2024 number, to be released toward the end of March 2024, will lend some perspective on whether that uptick was the beginning of a trend or just a one-month outlier.

What’s at stake

That need for caution may prompt the Fed to hold off cutting interest rates at its March 19-20 meeting. For consumers, that means the cost of borrowing is likely to remain high. This is a good time to rein in credit card balances and work on improving your credit score. Those moves can reduce the price you pay for high interest rates.

For investors, this is a good time to keep in mind that a lot of the stock market’s optimism is based on the belief that interest rates will come down. That may not happen as quickly as Wall Street expected a month or two ago.

If you enjoyed Inflation is up or inflation is down, which is it? you may like,

Disclaimer: The article and information provided here are for informational purposes only and are not intended as a substitute for professional advice.