Photo Credit: Hero Images Inc. / Alamy Stock Photo

Prices in big cities have been skyrocketing, with many coastal cities becoming completely unaffordable. According to data from Zillow, in San Francisco, for example, the median list price for a home in the first half of 2019 was $1,359,800, with San Jose’s median price of $1,022,300. While housing prices have soared, incomes have struggled to keep pace; the result is that many of the country’s most popular cities, such as Los Angeles, New York, San Francisco, and Boston, are completely unaffordable for the average family.

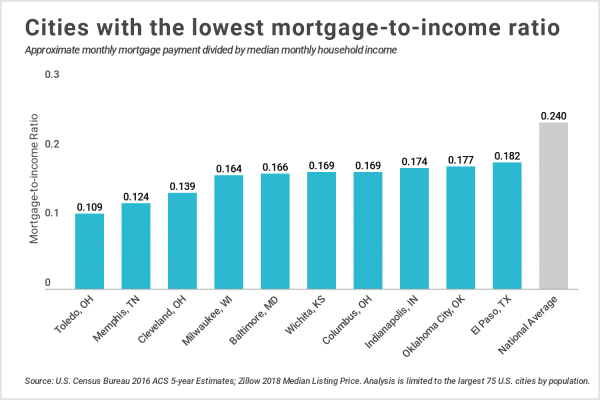

The U.S. Department of Housing and Urban Development (HUD) considers families who pay more than 30 percent of their income on housing to be cost burdened—meaning they may have difficulty affording other necessities such as transportation, healthcare, food, and clothing. When looking at current median list prices and household incomes, all of the cities mentioned above have a mortgage-to-income ratio above 50 percent, more than twice the national average of 24 percent, and two-thirds more than HUD’s guideline. This is an unsustainable trend that increases the risk of homeowners defaulting on their mortgages, and one of many reasons why homeownership rates, especially among people in big cities, is so low.

But big cities offer myriad benefits that small towns cannot, including a more diversified economy, broad selection of jobs, and various cultural activities to choose from. To help first-time home buyers find more budget-friendly options without sacrificing the opportunities afforded by big city living, Credit Sesame wanted to find the most affordable cities, among the largest 75 in the U.S., for people looking to buy.

Related: Mortgage Loan Calculator

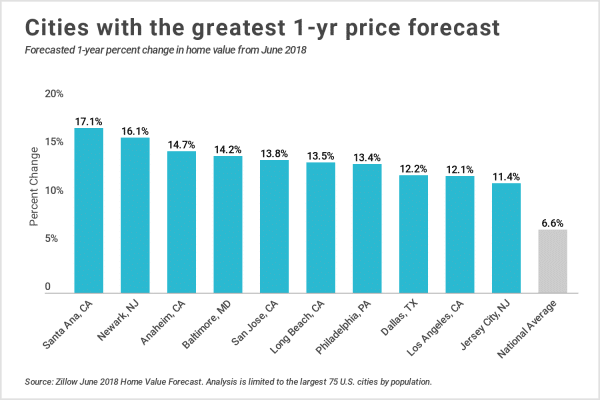

Using data from the U.S. Census Bureau and Zillow Group, Credit Sesame calculated a composite score based on affordability as measured by mortgage-to-income ratio (weighted 60 percent), forecasted one-year change in home value (35 percent), and previous five-year change in home value (5 percent). The latter two metrics were included to filter out stale markets.

How the Cities Stack Up

Takeaways

- Taking these three factors into account, all of the highest-scoring cities have a mortgage-to-income ratio below the 30 percent guideline, and most also fall significantly below the national average of 24 percent, with Toledo coming in lowest at 11 percent.

- Not surprisingly, almost all of the highest-scoring cities have a median list price and monthly mortgage below the national median of $271,383 and $1,090 respectively. In general, these cities also have lower monthly incomes than the national median of $4,610, but this is largely offset by lower home prices.

- Surprisingly, prioritizing affordability doesn’t necessarily mean sacrificing growth. While significantly more affordable than average, cities like Baltimore, Philadelphia, Greensboro, Milwaukee, and Pittsburgh also have some of the highest one-year growth projections out of all the 75 largest cities evaluated.

- The final list of high-scoring cities are concentrated in the Midwest and the South, rather than on the coasts.

Whether you are a first-time buyer, or just looking to relocate to a big city, here are the 25 best affordable options.

The Most Affordable Cities for First-Time Buyers

25. Minneapolis, MN

- Mortgage-to-income ratio: 0.26

- Forecasted 1-yr change in home value: 6.2%

- Previous 5-yr change in home value: 48.5%

- Median list price: $289,616

- Approximate monthly mortgage: $1,159

- Median monthly income: $4,384

- Population: 331,284

The larger of the Twin Cities, Minneapolis features sculpture parks, bike paths, and more than 22 lakes. The mortgage-to-income ratio of 26 percent is slightly higher than the national ratio of 24 percent, but still below the 30 percent HUD guideline. Minneapolis is known for having cold winters, but the Minneapolis Skyway linking multiple downtown buildings protects city-dwellers from the elements.

24. El Paso, TX

- Mortgage-to-income ratio: 0.18

- Forecasted 1-yr change in home value: 0.1%

- Previous 5-yr change in home value: 4.5%

- Median list price: $165,812

- Approximate monthly mortgage: $658

- Median monthly income: $3,610

- Population: 513,367

Situated on the Rio Grande, El Paso is a stone’s throw away from the Mexico border and is known for its unique confluence of American, Mexican, and Texan cultures. The city is famous for its sunny weather and music festivals, and is widely regarded as a safe place to live. El Paso has the lowest forecasted one-year change and previous five-year change in home value of any cities on this list

23. Madison, WI

- Mortgage-to-income ratio: 0.23

- Forecasted 1-yr change in home value: 5.8%

- Previous 5-yr change in home value: 30.7%

- Median list price: $274,933

- Approximate monthly mortgage: $1,099

- Median monthly income: $4,705

- Population: 207,873

With 207,874 residents, Madison is the least populous city on this list. Madison is home to four large lakes, the largest of which is Lake Mendota, which provides entertainment from fishing to ice skating all year round. Madison is also a well-educated city, with 95.2 percent of residents holding at least a high school diploma and 56.3 percent holding at least a bachelor’s degree.

22. Bakersfield, CA

- Mortgage-to-income ratio: 0.22

- Forecasted 1-yr change in home value: 4.6%

- Previous 5-yr change in home value: 50.0%

- Median list price: $268,766

- Approximate monthly mortgage: $1,067

- Median monthly income: $4,889

- Population: 269,062

Located in San Joaquin Valley, the “breadbasket of the world,” Bakersfield has a largely agricultural economy. The city is also the center of oil production in California, and jobs in this field are plentiful too. Culturally, Bakersfield’s nickname is the “country music capital of the West Coast” due to its influence on the genre. Home prices in Bakersfield grew 50 percent in the past five years, but are expected to slow to 4.6 percent over the next year.

21. Kansas City, MO

- Mortgage-to-income ratio: 0.19

- Forecasted 1-yr change in home value: 3.2%

- Previous 5-yr change in home value: 10.2%

- Median list price: $192,325

- Approximate monthly mortgage: $769

- Median monthly income: $3,957

- Population: 372,598

You’ve probably heard of both Kansas City, MO and Kansas City, KS. Geographically, Kansas City is located on the Missouri River and is split between these two states. Kansas City, MO has a more urban feel and is home to the “downtown” districts, while Kansas City, KS has more in common with the suburbs. Kansas City is known for jazz, barbecue, and its professional sports teams. While affordable, the changes in home value in Kansas City are significantly slower than the national growth rates.

20. Henderson, NV

- Mortgage-to-income ratio: 0.27

- Forecasted 1-yr change in home value: 7.0%

- Previous 5-yr change in home value: 75.1%

- Median list price: $362,233

- Approximate monthly mortgage: $1,449

- Median monthly income: $5,356

- Population: 224,659

Located in the southern tip of Nevada and a mere fifteen minutes away from Las Vegas, Henderson is a desert city with a hot climate. Henderson is perfect for outdoorsy types, with its 80 miles of trails for walking, hiking, biking and horseback riding. Henderson has the highest five year change in home value, with a 75.1% increase in price.

19. Oklahoma City, OK

- Mortgage-to-income ratio: 0.18

- Forecasted 1-yr change in home value: 1.9%

- Previous 5-yr change in home value: 29.6%

- Median list price: $184,910

- Approximate monthly mortgage: $739

- Median monthly income: $4,173

- Population: 475,826

Oklahoma City is the capital of Oklahoma and is known for its low cost of living. Oklahoma City is prone to extreme weather, especially tornadoes and hailstorms. Aviation, energy, and biotechnology are some of the major economic sectors in the city. The forecasted change in home value over the next year is low, at only 1.9 percent.

18. Las Vegas, NV

- Mortgage-to-income ratio: 0.27

- Forecasted 1-yr change in home value: 8.2%

- Previous 5-yr change in home value: 85.9%

- Median list price: $289,049

- Approximate monthly mortgage: $1,157

- Median monthly income: $4,240

- Population: 481,996

Las Vegas is known for more than just casinos. With an average annual temperature of 80 degrees, Las Vegas is perfect for people who love the summer heat. The Las Vegas Valley boasts 52 peaks, making it an ideal location for people who love hiking, mountain biking, and being in the mountains. Unlike many of us in the U.S., Las Vegas residents don’t pay state income taxes.

17. Wichita, KS

- Mortgage-to-income ratio: 0.17

- Forecasted 1-yr change in home value: 3.1%

- Previous 5-yr change in home value: 15.0%

- Median list price: $164,341

- Approximate monthly mortgage: $659

- Median monthly income: $3,898

- Population: 297,709

With a population of 297,709, Wichita is the largest city in Kansas. The city is known as the “Air Capital of the World” for its important role in aircraft manufacturing, which is still a major sector of the economy. The city experiences four seasons, including a hot summer and a cold winter, as well as extreme weather such as thunderstorms and tornadoes.

16. Lexington, KY

- Mortgage-to-income ratio: 0.24

- Forecasted 1-yr change in home value: 8.0%

- Previous 5-yr change in home value: 20.0%

- Median list price: $253,118

- Approximate monthly mortgage: $1,012

- Median monthly income: $4,222

- Population: 252,060

Lexington is situated in the center of Kentucky’s bluegrass region and is the state’s second-largest city. The city’s diversified industries include manufacturing, education, government, and trade, transportation, and utilities, offering ample job opportunities. Horse racing is a major pastime, and there is a thriving arts, sports, and culture scene. The 24 percent mortgage-to-income ratio is the same as the national average.

15. Jacksonville, FL

- Mortgage-to-income ratio: 0.20

- Forecasted 1-yr change in home value: 4.8%

- Previous 5-yr change in home value: 64.1%

- Median list price: $204,733

- Approximate monthly mortgage: $813

- Median monthly income: $4,021

- Population: 678,356

With 678,356 people, Jacksonville is the most populous city in Florida. The city is situated along the bank of the St. Johns River and is close to the Atlantic coast, making it perfect for residents who enjoy watersports and beach-going without wanting to live in a beach town. Jacksonville is also home to the nation’s largest urban public parks system, which encompasses 337 locations and more than 80,000 acres.

14. Plano, TX

- Mortgage-to-income ratio: 0.21

- Forecasted 1-yr change in home value: 6.2%

- Previous 5-yr change in home value: 51.5%

- Median list price: $383,333

- Approximate monthly mortgage: $1,521

- Median monthly income: $7,090

- Population: 220,888

Part of the Dallas-Fort Worth greater metropolitan area, Plano is a hub of wealth and business activity. At $7,090, Plano has the highest median monthly income on this list. Plano also has the highest monthly mortgage payment on this list, at $1,521. With parks, an energetic downtown, and proximity to two other major cities (Dallas and Fort Worth), there is no shortage of things to do. The five-year home value change of 51.5 percent is significantly higher than the national growth rate.

13. Tulsa, OK

- Mortgage-to-income ratio: 0.18

- Forecasted 1-yr change in home value: 4.9%

- Previous 5-yr change in home value: 24.2%

- Median list price: $165,716

- Approximate monthly mortgage: $662

- Median monthly income: $3,587

- Population: 311,139

Tulsa is part of the region informally known as the Bible Belt. Tulsa’s economy has relied on the energy industry for the past century, but is diversifying to include sectors in finance, technology, manufacturing, and media. State fairs, zoos, aquariums, and a variety of museums and art galleries are perfect for families to enjoy on the weekends.

12. Pittsburgh, PA

- Mortgage-to-income ratio: 0.24

- Forecasted 1-yr change in home value: 9.0%

- Previous 5-yr change in home value: 58.7%

- Median list price: $215,098

- Approximate monthly mortgage: $855

- Median monthly income: $3,538

- Population: 262,292

This western Pennsylvania city is known as the “Steel City” due to its strong steel manufacturing presence and as the “City of Bridges” due to its 446 bridges, the highest number in the world. Prestigious universities, including the University of Pittsburgh and Carnegie Mellon University, attract students from many different states and countries. Ample green spaces, parks, and cultural institutions have marked Pittsburgh as a desirable place to live.

11. Philadelphia, PA

- Mortgage-to-income ratio: 0.25

- Forecasted 1-yr change in home value: 13.4%

- Previous 5-yr change in home value: 31.9%

- Median list price: $205,033

- Approximate monthly mortgage: $815

- Median monthly income: $3,314

- Population: 1,251,243

With a population of 1,251,243, Philadelphia is the largest city on this list. Steeped in the history of the American Revolution and home to museums, concert halls, and the Philadelphia Eagles, it is easy to find entertainment and culture. Unlike most major metropolitan areas, Philadelphia has a lower cost of living than many of its surrounding suburbs.

10. Cleveland, OH

- Mortgage-to-income ratio: 0.14

- Forecasted 1-yr change in home value: 3.4%

- Previous 5-yr change in home value: 34.4%

- Median list price: $77,224

- Approximate monthly mortgage: $308

- Median monthly income: $2,215

- Population: 309,771

While New York is known for Broadway shows, Cleveland has the second-largest theater district in the U.S. Cleveland is located on Lake Erie, which helped the city to develop into the commercial and manufacturing center it remains today. The proximity to the water also means it has numerous beaches and opportunities for watersports. At $2,215, Cleveland has the lowest median monthly income on this list.

9. Saint Paul, MN

- Mortgage-to-income ratio: 0.21

- Forecasted 1-yr change in home value: 7.3%

- Previous 5-yr change in home value: 56.1%

- Median list price: $221,846

- Approximate monthly mortgage: $888

- Median monthly income: $4,235

- Population: 229,615

Saint Paul is the capital of Minnesota, despite being the smaller of the Twin Cities. The city responds to its extremely cold weather by throwing an annual winter carnival. Saint Paul is also known for its parks and lakes, including Indian Mounds Park, Battle Creek Regional Park, Harriet Island Regional Park, Highland Park, Lake Como, Lake Phalen, and Rice Park, which is older than Central Park in New York. The 56.1 percent change in home value over the past five years is significantly higher than the national average of 34.1 percent.

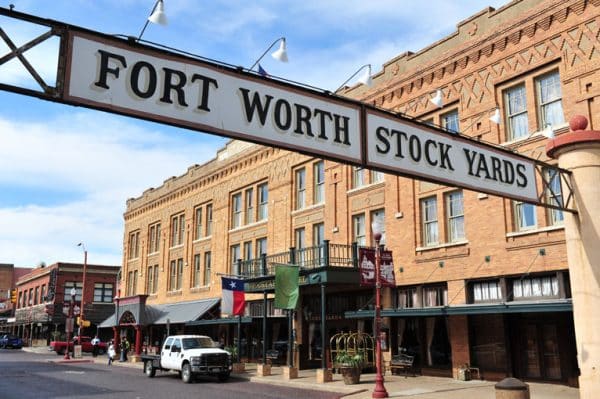

8. Fort Worth, TX

- Mortgage-to-income ratio: 0.22

- Forecasted 1-yr change in home value: 8.2%

- Previous 5-yr change in home value: 47.5%

- Median list price: $250,124

- Approximate monthly mortgage: $993

- Median monthly income: $4,573

- Population: 605,116

Fort Worth has one of the highest median monthly incomes on this list, at $4,573. Fort Worth boasts a cultural district with five art museums designed by famous architects, a vibrant downtown surrounding the Sundance Square Plaza, and the Texas Motor Speedway for car racing. Fort Worth also maintains strong ties to its Western cowboy heritage through attractions like the Stockyards National Historic District and live rodeos at Cowtown Coliseum.

7. Saint Louis, MO

- Mortgage-to-income ratio: 0.19

- Forecasted 1-yr change in home value: 7.4%

- Previous 5-yr change in home value: 8.7%

- Median list price: $146,575

- Approximate monthly mortgage: $586

- Median monthly income: $3,067

- Population: 258,657

Known as “the Gateway to the West” and the home of the Gateway Arch, this Midwest city is located at the intersection of the Mississippi and Missouri Rivers. With the exception of Washington D.C., St. Louis is the U.S. city with the most free attractions for tourists and residents, including a history museum, a science center, and a zoo. Residents can also enjoy watching baseball games and cheering for the St. Louis Cardinals.

6. Greensboro, NC

- Mortgage-to-income ratio: 0.21

- Forecasted 1-yr change in home value: 9.6%

- Previous 5-yr change in home value: 17.0%

- Median list price: $187,241

- Approximate monthly mortgage: $745

- Median monthly income: $3,567

- Population: 226,807

Greensboro is called the “Gate City” due to its history as a transportation hub and easy access to larger cities in the southern and western United States. Today, Greensboro is home to attractions such as the Wet ‘n Wild Emerald Pointe water park and cultural institutions like the International Civil Rights Museum, the Weatherspoon Art Museum, and the Greensboro Coliseum Complex, where various sporting events, concerts, and other events take place. Greenboro also has 170 parks and gardens open to the public.

5. Arlington, TX

- Mortgage-to-income ratio: 0.21

- Forecasted 1-yr change in home value: 8.0%

- Previous 5-yr change in home value: 47.6%

- Median list price: $232,383

- Approximate monthly mortgage: $922

- Median monthly income: $4,465

- Population: 295,468

Arlington is located just outside of the Dallas-Fort Worth metropolitan area, and its inter-city public transportation and highway systems give residents of this mid-sized city multiple options for commuting to work or traveling for pleasure. Arlington is called the “Entertainment Capital of Texas” due to the Dallas Cowboys’ stadium, the Texas Rangers’ Globe Park, Six Flags, and other attractions.

4. Toledo, OH

- Mortgage-to-income ratio: 0.11

- Forecasted 1-yr change in home value: 5.8%

- Previous 5-yr change in home value: 20.6%

- Median list price: $78,636

- Approximate monthly mortgage: $314

- Median monthly income: $2,879

- Population: 222,172

Known as the “Glass City” due to its storied history of glass manufacturing, Toledo is a small city in northwest Ohio. Toledo has a thriving music and arts scene, with multiple museums and music venues operating year round. At $314, Toledo has the lowest monthly mortgage payment on this list. Toledo also has the lowest mortgage-to-income ratio at 11 percent.

3. Columbus, OH

- Mortgage-to-income ratio: 0.17

- Forecasted 1-yr change in home value: 7.0%

- Previous 5-yr change in home value: 46.3%

- Median list price: $166,799

- Approximate monthly mortgage: $665

- Median monthly income: $3,930

- Population: 664,580

Columbus is the capital of Ohio and home to the flagship campus of Ohio State University. Buckeyes fans and other sports aficionados will fit in well here, with the city’s love of tailgating and support of their college sports and professional sports teams. For those who prefer other outdoor activities, the Columbus Park of Roses, Glen Echo Park, and Olentangy Trail are excellent spots to enjoy nature.

2. Milwaukee, WI

- Mortgage-to-income ratio: 0.16

- Forecasted 1-yr change in home value: 9.2%

- Previous 5-yr change in home value: 27.2%

- Median list price: $126,183

- Approximate monthly mortgage: $504

- Median monthly income: $3,067

- Population: 456,506

Milwaukee has extremely hot summers and extremely cold winters. Industries like education, manufacturing, business services, and government diversify the economy and offer many job opportunities in this Rust Belt city. Milwaukee boasts family-fun activities such as state fairs, festivals, and bowling. The monthly mortgage of $504 is one of the lowest on this list, and the median list price of $126,183 is less than half the national median.

1. Baltimore, MD

- Mortgage-to-income ratio: 0.17

- Forecasted 1-yr change in home value: 14.2%

- Previous 5-yr change in home value: 21.3%

- Median list price: $153,799

- Approximate monthly mortgage: $612

- Median monthly income: $3,689

- Population: 502,739

The largest city in Maryland and one of the few coastal cities on this list, Baltimore is a port city that is home to a variety of universities, historical sites, and diverse industries in education, tech, science, government, and more. Baltimore is about an hour north of Washington, D.C., making it an excellent commuter hub in addition to being its own exciting city. Bucking the trend of coastal cities being less affordable, Baltimore’s mortgage-to-income ratio is only 17 percent, and the median list price for a home is $153,799, significantly lower than the national median of $271,383.

Methodology

To identify the most affordable cities for first-time home buyers, Credit Sesame calculated a composite score based on the following metrics:

Mortgage-to-income ratio (60%): Mortgage-to-income ratios for each city were calculated using the most recent six months of median list price and mortgage rate data from Zillow Group, as well as median household incomes from the U.S. Census Bureau 2016 American Community Survey 5-year Estimates. Approximate monthly mortgage payments were calculated using the median listing prices and state-specific mortgage rates according to the following formula: [R/(((1 + R)^M) – 1)] x [(1 + R)^M] x L, where R is the monthly interest rate, M is the number of monthly payments, and L is the loan amount. For this calculation we assumed a 30-year fixed mortgage with a 20% down payment.

Forecasted 1-year change in home value (35%): The forecasted 1-year change in home value was sourced from the Zillow Home Value Forecast for cities in July 2018.

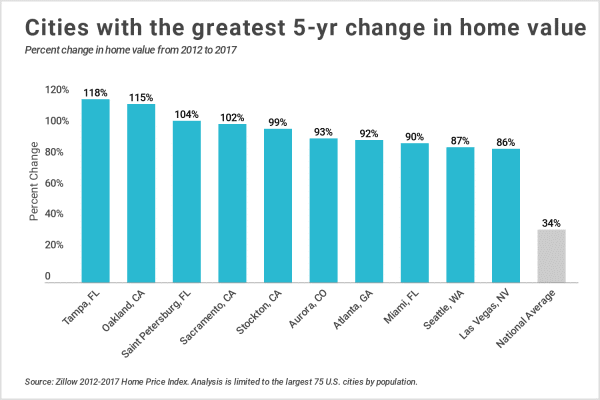

Previous 5-year change in home value (5%): Changes in home value were calculated using the historical Zillow Home Value Index. The 5-year change in value compares the average ZHVI for 2012 to the average ZHVI for 2017, which is the most recent complete calendar year of data available.

The largest 75 cities in the U.S. were ranked by their composite score. For the final list, only cities with positive forecasted changes in home value were included.