Are you in the market for a home? Your timing is good because you can still lock in a low rate on a mortgage. But this opportunity will not last forever. The U.S. is coming out of an historically low interest rate period, and the Federal Reserve has already begun increasing rates.

To help you get ready, here’s what you need to know about rate increases and how they might affect how much home you can afford.

The Federal Reserve and Mortgage Rates

The Federal Reserve is the central banking system in the U.S. The Fed Rate is the interest rate banks pay to each other to borrow money from other banks that is maintained at the Federal Reserve. This rate influences the interest rates bank pay on savings and the rates they charge to borrowers. If the Fed rate goes up, mortgage rates go up and vice versa.

Over the past 8 years, the Federal Reserve rate has been at or near historic lows. Since the economy was weak, the Fed kept rates low to make it less expensive for businesses and people to borrow money. Now that the economy is recovering, the Fed is increasing rates to stop inflation, when prices go up.

In December 2015, the Fed raised rates for the first time in nearly 10 years. They increased the interest rate range from 0% to 0.25% to a new range of 0.25% to 0.5%. They raised rates two more times in 2016 and the range is now 0.75% to 1.00%.

If the economy continues to strengthen, the Fed will continue to increase rates. To put things in perspective, the Fed rate was at 5.25% in 2006, five times higher than today’s rate.

How Higher Rates Affect Your Mortgage

What does this mean for your monthly mortgage payment? According to our Credit Sesame data, members aged 30 and under with a mortgage have an average balance of $192,751. At today’s 4.2% rate on a 30-year mortgage, the monthly principal and interest payment is $943.

However, if rates go back up to 6.76%, the monthly payment on the same mortgage is about $1,251, a difference of over $300 a month. That’s why it’s important to move fast and lock in a low rate.

Let’s look at it another way. If your maximum budget for this payment is $1,000 per month and the rate is 6.76%, you can only borrow $154,000. You’ve just lost nearly $40,000 in buying power.

Interest Rates and Your Housing Budget

If your pre-tax household income is $6,000 a month, your housing payment should be no more than $1,680 a month.

The amount you can borrow depends on many factors, including the size of your down payment. Your HOA fees, taxes and insurance will vary depending on where you choose to buy. These costs can easily add several hundred dollars to your principal and interest payment.

Here’s an example:

If:

- You can pay 20% down and avoid PMI

- Your mortgage rate is 4.2%

- Property taxes are 1.02%

- Homeowner’s insurance is $600 per year

- You don’t have to pay any HOA fees

Then:

- You can shop for a home with a $312,000 price tag

- You’ll pay $62,400 down (not including closing costs)

- You’ll pay $312 toward property taxes each month

- You’ll pay $50 toward insurance each month

- Your total monthly payment will be $1,583

If interest rates go up to 5.2%, the total monthly payment is $1,733 and the mortgage lender might not approve the loan because it doesn’t pass the DTI test. That means you could be priced out of your dream home because of a rate increase of just one percent!

Of course, approval and denial depend on the lender and the applicant. Every lender sets its own cutoffs for DTI, and some lenders are willing to be flexible on one application factor if the other factors are strong.

Using Credit Sesame to Prepare for Your Purchase

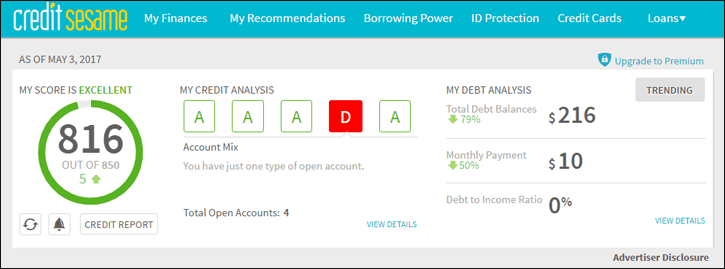

Your free Credit Sesame account can be a big help in planning your purchase. Before you apply for a loan, use your dashboard and the tools Credit Sesame provides to learn what your credit score is and how to it as high as it can be. This will help you qualify for the best possible rate on your loan.

For example, even though my score is a strong 816, Credit Sesame points out that I might be considered more creditworthy if I had more types of debts. Right now, I only have credit cards. The healthiest credit histories include a mix of revolving debt and installment debt. Once you pay off a debt and close an account in good standing, for example a student loan or a mortgage, it will stay in your file and help your score for ten more years.

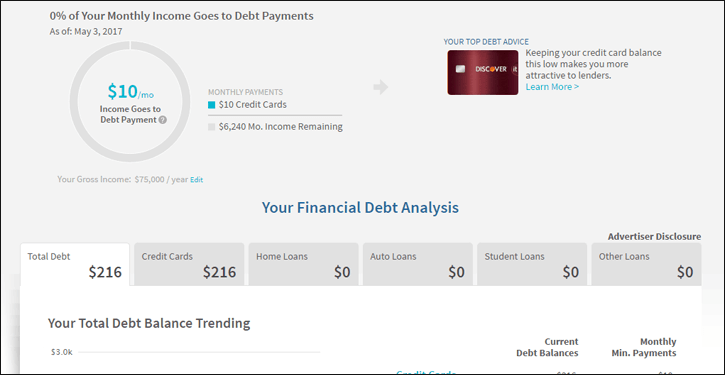

You can also use your Credit Sesame dashboard to estimate your monthly budget for a mortgage. Enter your income and the dashboard will show how much goes to your current debts every month. The sum of all of your debt payments (credit cards, loans, child support, your total monthly housing payment and any other debt) is called your back-end ratio, and most conventional lenders want it to be 36% or less. In some cases, borrowers are approved with a back-end ratio of up to 50%. I am fortunate to have no debt at the moment, so as long as I meet the DTI requirements (also called the front-end ratio), I will easily pass the back-end ratio test.

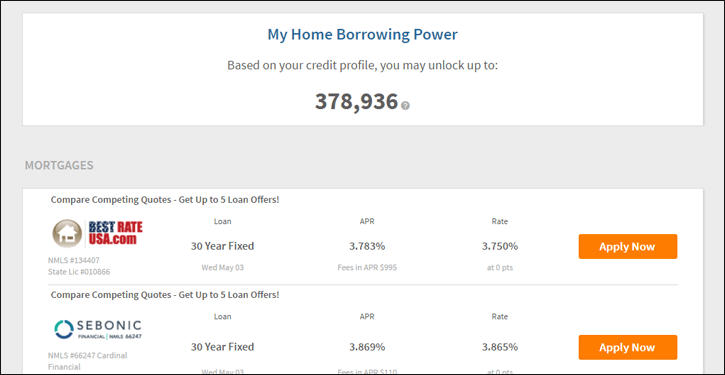

Finally, Credit Sesame’s algorithms show your borrowing power based on your credit score and income. This is one more way to estimate your budget before you shop for a home. My account says I might qualify for a mortgage up to $378,936.

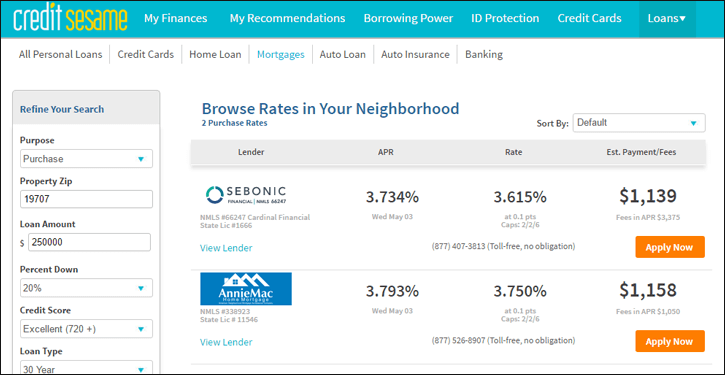

I can also browse mortgage rates with lenders in my area through my Credit Sesame account.

A note about borrowing power. You do not have to shop for a home at the top of your price range. In fact, even if a lender says you can afford the loan, it might be too much for your comfort and lifestyle. Remember to factor in maintenance and other home ownership costs, and some breathing room for improvements, travel, hobbies, a new car and other expenses you might encounter over the next three decades.

Real estate agents and mortgage brokers earn commission based on the amount of the sale. It’s in their best financial interests to get you into the biggest loan you qualify for. That’s not to say that every agent and broker is unscrupulous. Far from it. But most earn a percentage, not a flat fee. Put this warning in your pocket and go forward with the knowledge that YOU are the best one to decide how much house you can afford. Also, keep in mind there are digital mortgage sites like Lenda.com and Clara.com that streamline the process and don’t charge broker fees because they cut out the middle man and are direct lenders.

Most mortgages last decades, so protect your hard earned money by doing the legwork to get the best deal possible. Do the work now before the Fed increases interest rates again, and you might save yourself thousands of dollars in interest on your home loan.