Credit Sesame discusses the recent downturn in home prices and what this may mean for home buyers.

According to a recent report by the Federal Reserve Bank of New York, total mortgage debt in the United States increased by $1 trillion dollars over the past year, to reach a record level of $11.67 trillion. A hot market has led to many new mortgages, and high home prices have boosted the size of those mortgages.

Lately, the dynamics have shown signs of changing. Home prices may falter after a long rally, just as rising mortgage rates make housing harder to afford. Still-high home prices and rising mortgage rates remain a barrier for new home-buyers, but the change could hint at the beginning of a new opportunity to buy a home more affordably.

The long rally in home prices

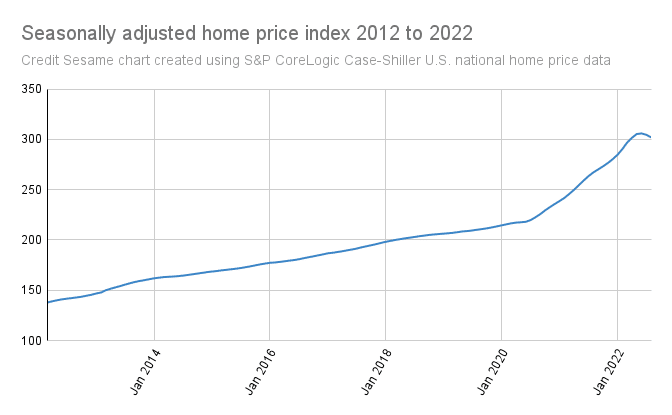

To understand what home buyers are up against, a good place to start is by looking at home prices over the past decade. The chart shows the S&P CoreLogic Case-Shiller U.S. National Home Price Index (a proxy for how prices have changed) for just over ten years.

The index shows an uninterrupted streak of 124 consecutive months of rising home prices from from March of 2012 through June of 2022. Home prices rose monthly for ten years without a single step back. The housing market celebrated the tenth anniversary of the start of that streak, with the largest monthly gain of all in March of 2022.

In total, home prices gained 124% during that winning streak. Of course, that’s not great news for current home buyers who are coming into the market at higher prices following that streak.

Mortgage rates hurt affordability

It’s not just higher prices that today’s home buyers are up against. 30-year fixed mortgage rates have more than doubled this year. According to data from mortgage finance company Freddie Mac, they now stand at their highest level since early 2002.

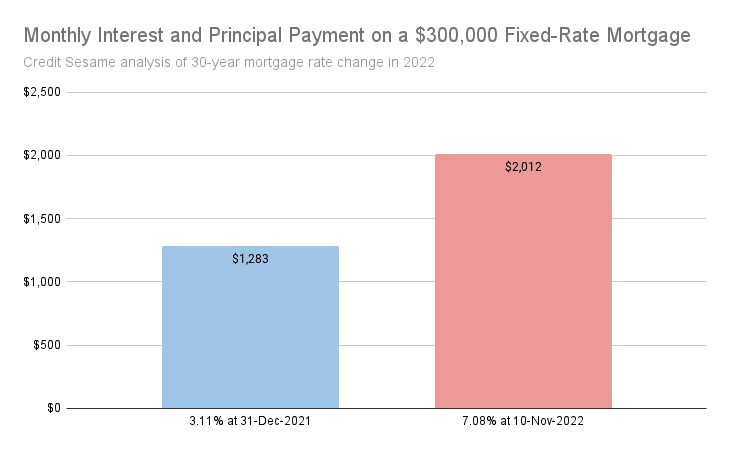

Such a steep rise in mortgage rates may cause a severe change in home-buying plans. Credit Sesame calculated the impact the change in 30-year mortgage rates so far this year would have on the monthly payment for a $300,000 loan.

A $1,282.68 monthly principal and interest payment at the start of this year is a $2,012.05 payment for someone buying now.

That kind of change drastically affects the price of the home you can afford, or even if you can afford a home at all.

The impact of higher interest rates can be seen in recent mortgage origination trends. According to the New York Fed, for two years mortgage originations ran at historically high levels. However, in the third quarter of 2022, they slowed to a pre-pandemic pace.

During the home price rally, buyers bought at steadily higher prices. However, most of that rally occurred during a time of unusually low mortgage rates.

When you layer this year’s sharply higher mortgage rates on top of those elevated home prices, fewer people are able to afford to buy. Recent data shows this is starting to have an impact on housing demand.

Home prices seem to be turning first

If home prices and mortgage rates make housing unaffordable, something’s got to give. If demand keeps falling, either mortgage rates or home prices must drop.

There’s reason to believe that housing prices that fall first. In fact, the start of that trend can be seen at the very end of the home price chart shown earlier in this article. For the first time in over ten years, home prices declined in each of the two most recent months of data.

While that’s noteworthy after such a long, interrupted run of rising prices, two months is not enough to be considered a trend. However, there are other reasons to expect home prices to fall before mortgage rates do.

Interest rates are heavily influenced by inflation. In order for the principal and interest payments they get back on their loans to be worth more than when they lend the money, lenders generally have to charge interest rates that are higher than the rate of inflation.

There can be temporary exceptions to this, if lenders believe a surge in inflation will be short-lived. However, mortgage rates have been below the inflation rate for over a year and a half now. Many of the loans made during that time have locked lenders into rates well below today’s rate of inflation.

Mortgage rates are still below the current inflation rate, though the gap has reduced in recent months. However, after spending such a long time playing catch-up, lenders are likely to be hesitant to start significantly lowering rates until inflation has slowed down much more than it has so far.

Thus, high mortgage rates may continue to cool off the housing market. That’s why home prices are starting to fall before mortgage rates.

Putting yourself in a position to benefit

Even if home prices continue to slide, this doesn’t make conditions easy for home buyers. High mortgage rates may continue to make monthly loan payments steep. But if home prices continue to fall before mortgage rates do, there are three things you can do to benefit:

- Save for a larger down payment. A larger down payment means you borrow less and may qualify for a lower interest rate.

- Work on your credit. While you are saving, why not build your credit score? This could also help you qualify for a lower mortgage rate when the time comes.

- Keep a close eye on your local market. Follow trends in your target neighborhoods closely, so you can be early to spot when prices become affordable. Some local markets and especially individual properties may react to changing conditions sooner than others.

You may also be interested in:

- Guide to Buying a House and Getting a Mortgage

- Why ARMs Can Be Good for First-Time Homebuyers

- When Will Things Get Better for Home Buyers?

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.