Credit Sesame discusses the pros and cons of buy-to-rent.

Buy-to-rent sounds like a dream. You buy a property, rent it out and the income you receive more than covers the mortgage. Most people imagine a solid investment with little risk. You probably plan to keep your existing job, so income from a buy-to-rent property (or properties) is frosting on the cake. One day, you may be able to retire early and enjoy an amazing lifestyle from the income on your rental empire.

Plenty of people have achieved that. You may even know someone who’s living that precise dream. But many people who started out with similar high hopes have seen their plans crash and burn.

One of their reasons for failure may have been that they didn’t recognize the possible pitfalls of buy-to-rent. Before you commit yourself to life as a landlord, take stock of the pros and cons.

Buy-to-rent pros

What are the strengths of building a rental business? Here are some of the main ones:

- It can be a solid investment. By October 2021, hundreds of thousands of homes with a total value exceeding $60 billion had been snapped up by Wall Street, according to The New York Times (paywall). Clearly, the nation’s top professional investors think being a landlord is good business

- In can generate cash flow. The difference between your mortgage and other costs is yours for the spending.

- You can get tax breaks. You don’t have to pay tax on the costs of owning, operating and managing the property.

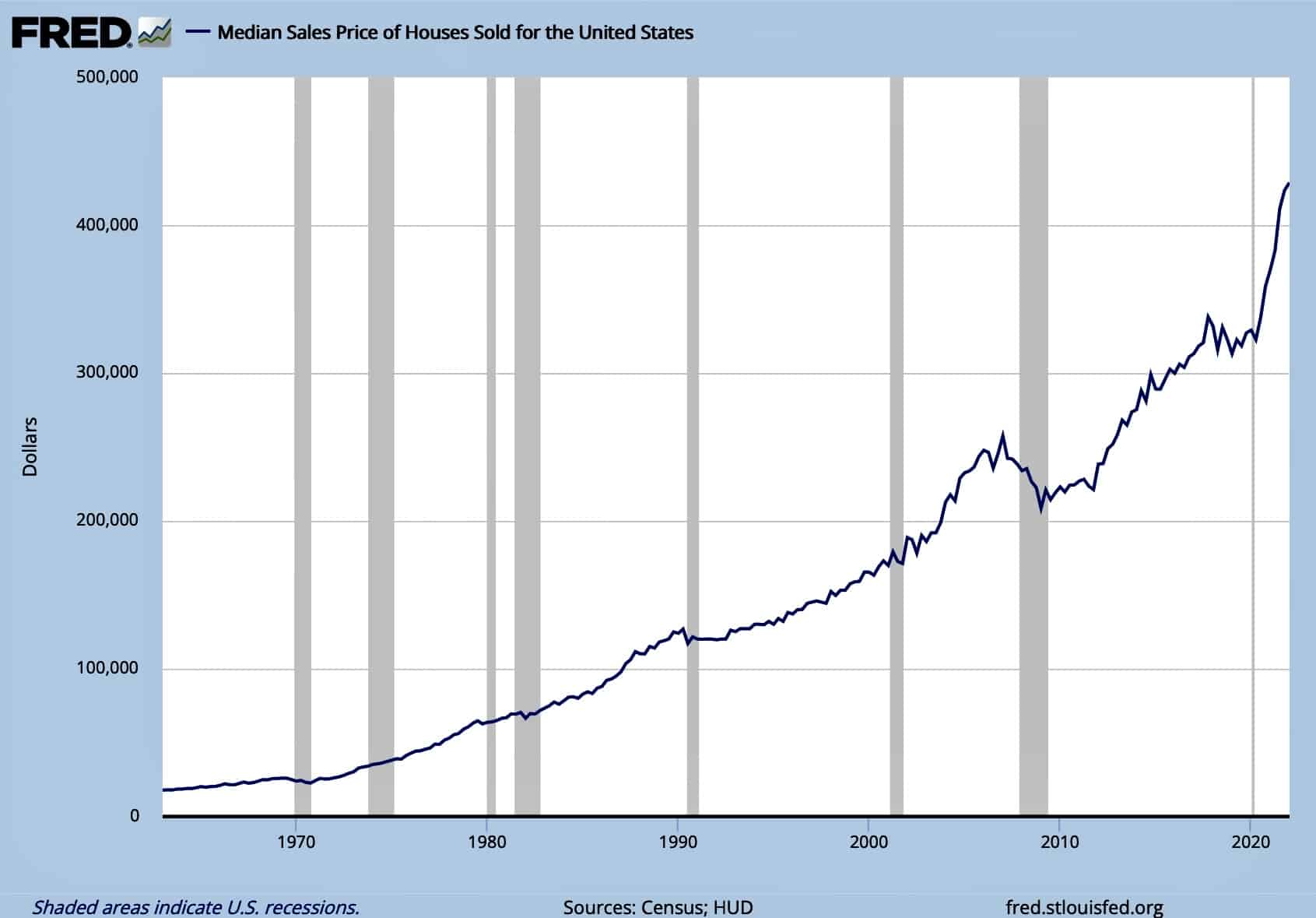

- Home price appreciation can make you rich. Check out the chart below. Home prices rise nearly all the time. Periods when they do fall tend to be shallow and relatively brief

- Owning one, two or a few rental properties isn’t necessarily a full-time job. So, you may not have to give up work until your empire has grown and become stable

- You can use “sweat equity.” If you have the time and skills, you can do much of the work yourself, cutting your costs for tradespeople’s and professionals’ work

Sounds good? Don’t make up your mind until you’ve read about the downsides.

Buy-to-rent cons

What are the possible downsides of buy-to-rent?

- You have to find tenants. Then screen them, prepare and sign leases, chase rents, collect rents, evict bad tenants and keep on top of accounting and admin.

- Few rental homes are occupied 100% of the time. Vacancy rates are typically in a 6%-10+% range. You may face a month or two without rent between tenants.

- Repairs and maintenance aren’t cheap. You have to maintain your properties to a minimum standard for occupation.

- Homeowners’ insurance for rental properties is typically higher.

- You must factor in Homeowners’ association (HOA) dues. Or there may be rules about renting out properties, with significant penalties if you break them.

- You may need a 15% or higher down payment. Mortgages on rental properties are considered higher risk

- Ideally you need a good credit score. Not necessarily a con, as having a good score gives you more chance of getting a mortgage and better interest rates. The Mortgage Reports says, “Investment property mortgage rates for a single-family building are about 0.50% to 0.75% higher than for owner-occupied residence loan rates.”

- Your lender might want to see significant liquid assets. Fannie Mae wants you to have “2% of the aggregate [unpaid principal balance] UPB if the borrower has one to four financed properties,” 4% if you have five or six such units, and 6% if you have more

- A local or nationwide recession may cause home values to drop. Ideally, be in a position to weather any temporary price drops.

- Occupied rental properties take longer to sell, usually. Bear this in mind if you want to sell within a particular timeframe.

The good news is that with planning and organization, most of these cons can be overcome and there are good reasons for investing in real estate.

How to succeed in buy-to-rent

There’s no easy formula for success. You should do your homework and write a proper business plan.

- Take time to fully understand your local home sales and rentals market

- Research your competition

- Talk to local real estate agents, landlords, property managers and contractors and so on.

- Complete a SWOT analysis. Examine the strengths, weaknesses, opportunities and threats to you and your proposed buy-to-rent business.

- Build cash flow forecasts for several years ahead and with different scenarios (e.g. if you lost your job).

- Be realistic about what you can do yourself, who you may need to pay (e.g. a letting agency, yard maintenance)

- Don’t apply for a mortgage until you a ready and your credit score is at a point to give you favorable rates.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.