Credit Sesame discusses the value of an inflation strategy to stay ahead of rising prices.

Does inflation make you feel like you’re always trying to play catch-up? Like rising prices are always one step ahead of your budget?

It’s no surprise. One of the disruptive things about high inflation is that it moves so fast. Individuals and businesses alike struggle to plan their finances effectively when prices can change noticeably from week to week.

Most people have no experience with inflation like this, so they do not have an inflation strategy. If you were born after 1981 – which most Americans were – you weren’t alive the last time inflation was this high. Unless you were born in the early 1960s or earlier, you’ve probably never had to wrestle such fast-rising prices into your budget.

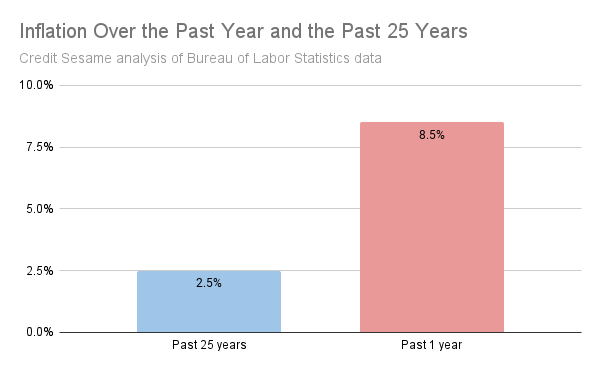

In fact, over the past 25 years, Americans have enjoyed unusually low inflation. Using Bureau of Labor Statistics figures, it is clear the past year has been very different:

This kind of jump in inflation is not a subtle change. It’s a game changer. When the game changes, your strategy has to change with it.

What kind of financial changes do Americans need to make to live within their means despite the recent bout of high inflation?

Inflation may not be done yet

One reason why it’s necessary to make serious changes in your financial strategy is that there’s no telling how long high inflation may stick around.

In late August, Fed Chair Jerome Powell made it clear in a speech that he expected the Fed to have to continue to raise rates to fight inflation. Even though consumer prices actually declined in July for the first time in over two years, Powell clearly views that as a short-lived exception rather than a change in the inflationary trend.

A fundamental reason to expect high inflation to resume is the direction of oil prices. One reason why inflation eased during July is that oil prices fell by 6.7% that month, according to data from the Energy Information Administration.

However, after bottoming out in mid-August, oil prices have started to rise again. Where oil prices lead, other prices often follow. So the rebound in oil prices may signal that more inflation is on its way.

Even after inflation eases, higher prices may be here to stay

The thing about inflation is that it tends to leave a lasting mark. Once consumer prices rise, they generally don’t fall back down to their previous level. Historically, sustained periods of deflation – which is when prices fall – are very rare.

So, even once inflation slows down, the price increases of the past couple years are probably here to stay.

For example, suppose we had no more inflation for the rest of this year. Prices would still be nearly 13% higher than they were at the start of 2021. Most households would still be trying to figure out how to afford those prices.

Borrowing is a band-aid, not a cure

For many households, the immediate response to inflation was to borrow more. When prices rose faster than their income, consumers reached for their credit cards to fill the gap.

According to the Federal Reserve Bank of New York, consumer debt reached a record high in the second quarter of 2022, and is rising fast.

Borrowing to cope with rising prices is a natural short-term response, but it’s not a long-term solution. For one thing, it isn’t sustainable. As debt levels rise, more and more consumers will hit their credit limits and won’t be able to borrow any more.

For another thing, borrowing only makes the inflation problem worse. High inflation pushes interest rates higher. That makes borrowing more expensive. Interest on money you borrow this month will just make it tougher to make ends meet next month.

5 actions for your inflation strategy

Before you run up too much debt, you need to switch from borrowing to more lasting solutions to high inflation. Here are some possibilities:

1. Cut back on what you buy

This is never easy, but the sooner you do it the more impact it will have.

The math is simple. If prices are higher, the same amount of money buys less stuff. Something has to give. Unless you have an unlimited budget, you need to figure out which things you can do without.

2. Shop around

As you’ve probably heard, one cause of inflation has been disruptions in supply chains. For a variety of reasons, retailers are having trouble getting products from their usual sources. This has made some items scarce, and their prices have risen as a result.

Some retailers may have more supply trouble with a particular item than others. This can widen the price differences between different stores. That can mean you have more to save by shopping around for the best price.

3. Substitute

While inflation may force you to cut some things out of the budget, there are some essentials you can’t do without. However, you may find a substitute that’s better than nothing.

Examples might include a less expensive cut of meat, or using a store brand rather than a high-priced national one. With a little planning and some changes in your shopping habits, you could soon be saving money while still buying all the essentials.

4. Use credit less

As noted earlier, inflation pushes interest rates higher. If you routinely carry a credit card balance, you could save money by reducing that balance.

Just as borrowing more magnifies the impact of inflation, borrowing less increases the savings of your budget cuts. You can save on the front end by buying fewer or cheaper goods, and on the back end by paying less interest.

5. Manage your credit score

Your credit score has a huge impact on the interest rates you pay. Therefore, improving your credit score can greatly reduce the cost of borrowing.

With prices high and interest rates rising, this is a great time to work on bringing your credit score up. Doing that could allow you to buck the trend of rising interest rates and make borrowing more cost-effective.

Again, high inflation is a game-changer, and the game isn’t easy. Changing your inflation strategy with good financial practices is the best chance you have of coming out ahead.

If you enjoyed reading about how to change your inflation strategy, you may be interested in:

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.