Rising interest rates affect day to day living for everyone, but what is the relationship between inflation and interest rates?

How High Could Interest Rates Rise?

If you’ve shopped at the grocery store or filled up your gas tank recently, you may have noticed that prices are rising quickly. If you’ve made a major purchase like a car, the sticker shock may have been even greater.

Unfortunately, there may be an even more unpleasant surprise in store for consumers, rising interest rates. Interest rates — used to calculate the amount you pay for borrowing money — have not yet fully adjusted to the current sharply-higher rate of inflation.

If interest rates adjust to inflation, the cost of borrowing for everything from credit card balances to mortgages could be several percentage points higher than today’s levels.

To understand just how high interest rates could go in this inflationary environment, Credit Sesame studied the relationship between interest and inflation rates over the past 25 years. If interest rates adjust to a normal cushion over inflation, America may be in for double-digit car loan and mortgage rates, and average credit card rates above 20%.

The Relationship Between Inflation and Rising Interest Rates

Inflation cuts into the future value of money. For example, if prices double over the next ten years because of inflation, a dollar today is worth the equivalent of 50 cents in ten years.

If you lend someone money, you expect to get back at least what you lent them. Lenders lend money for a living. They expect to get back a little extra (aka interest) as payment for giving you the use of their money.

Lenders want the purchasing power of the money they lend to be the same or even greater by the time they get it back. So, they charge interest rates that are at least as high as they expect inflation to be, plus a little extra to cover their risk and provide a profit margin.

Think of the amount lenders charge above the rate of inflation as a cushion that ensures lenders make a profit and are protected against risk.

Lenders adjust their interest rates to changing inflation, but adjustments can lag behind inflation. As a result, interest rates can be a little out of whack with inflation until lenders readjust.

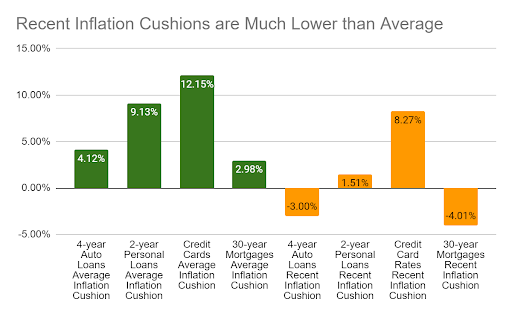

You can get a sense of whether rising interest rates are out of whack by looking at the inflation cushion, and comparing today’s cushion with what it’s been historically.

What’s a Normal Inflation Cushion?

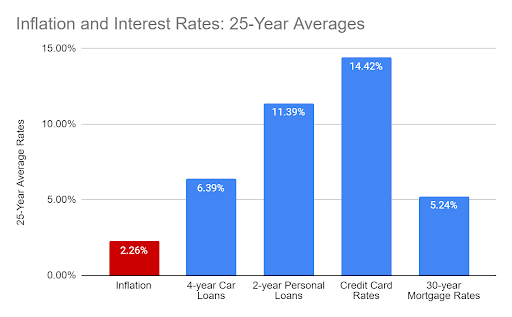

Credit Sesame looked at data from the past 25 years to calculate what a normal inflation cushion would be. It did this by looking at inflation data from the Bureau of Labor Statistics, car loan, personal loan and credit card rate data from the Federal Reserve, and mortgage rate data from Freddie Mac.

Remember, if a lender’s interest rates don’t exceed inflation, that lender will lose purchasing power by the time they get repaid by the borrower. So, as you would expect, historically car loan rates, personal loan rates, credit card rates and mortgage rates have all been above the average inflation rate (red), as you can see from the chart:

However, recently inflation has jumped much higher than the 2.26% average of the past 25 years, and lenders haven’t yet caught up. Inflation for the year ending March 31, 2022 was 8.5%.

In the chart below, the green bars show average inflation cushions over the past 25 years. The yellow bars show where they are now. Across the board, the inflation cushion built into interest rates is much lower than normal. In some cases it’s actually negative. If these rates continue, lenders will lose future purchasing power.

Today’s Interest Rates with a Normal Inflation Cushion

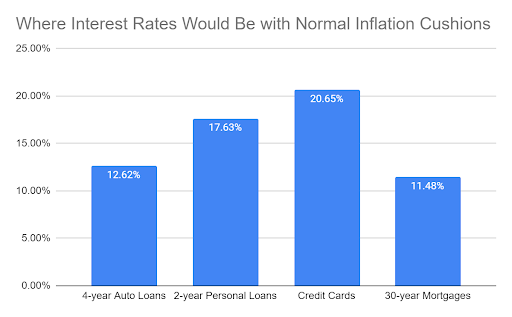

Lenders aren’t going to accept a below-average inflation cushion for long. They will be anxious to get those cushions back into positive territory. They will want to raise interest rates to ensure that firstly, they don’t lose money and second, they make a profit.

What would it look like if interest rates rise to reflect a typical relationship with inflation? In other words, how high would interest rates have to go to provide a normal cushion over today’s 8.5% inflation rate? The answer is quite shocking. With inflation at 8.5%, loan and credit card rates would all have to move much higher than they are today to provide a normal cushion over inflation.

One reason interest rates haven’t yet moved to these levels is a general assumption that the recent spike in inflation is temporary. However, inflation is proving to be quite stubborn. The longer it persists, the more lenders will keep edging rates up towards the levels shown in the chart above.

Dos and Don’ts of Rising Interest Rates Environment

No-one has a crystal ball so it is not possible to predict with certainly that inflation will continue to stay high or rise. But given the possibility of rates moving sharply higher than they are already, here are some dos and don’ts for consumers:

- Don’t hesitate on major purchases. If you’re planning on buying something like a house or a car that will require a big loan, you might be wise to pull the trigger on your decision as soon as possible. Each day you delay increases the risk of rates moving higher.

- Do pay down debt. Interest rates have been unusually low over most of the past 25 years, meaning it hasn’t been a bad time to have debt. That could now change radically as lenders adjust interest rates to higher inflation.

- Do look to refinance or consolidate high interest debt. Even as rates move higher, there are opportunities to reduce what you pay by shifting debt balances away from high-interest debt like credit cards. Using lower-interest loans or zero balance credit cards might be especially timely as average credit card rates start to climb.

- Don’t choose variable interest rate debt. Debt that doesn’t lock in a fixed interest rate is especially dangerous when rates are rising. So avoid variable rate mortgages. Also, while there are restrictions on how credit card companies can raise rates on existing balances, these balances tend to turn over fairly quickly, meaning debt from new purchases replaces debt on old balances as it gets paid off. So this would be an ideal time to work on bringing your credit card balances down.

- Do shop for rates. When rates were generally low, some people didn’t bother shopping around for the best credit card and loan rates, because the differences seemed relatively small. As rates rise though, the stakes get higher. Since lenders react to rising inflation at different times and to different degrees, you can find bigger variances in rates in a fast-changing environment.

Historical norms suggest that lenders have not yet caught up to today’s inflation environment. But they will before long. It is consumers who run the biggest risk of getting caught out by sharply rising interest rates, unless they adjust the way they use debt.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.