Credit Sesame looks at the reality of financial stress and offers suggestions on how to cope.

May is Mental Health Awareness month, and this year it’s more important than ever to be mindful of things that cause a strain on mental health.

The past couple years saw the arrival of a deadly pandemic, a fraught Presidential election and a series of false hopes and setbacks as the COVID virus went through cycles of apparent decline followed by new and persistent variants.

As the health crisis moves into its third year, Americans find themselves battling another assault on their psyches in the form of financial stress.

It is helpful, perhaps, to understand the effect financial stress can have on your health, and actively pursue strategies for easing that stress.

2022 Is a Tough Year for Financial Stress

Just a few months into the year, 2022 is already shaping up as a tough year for financial stress.

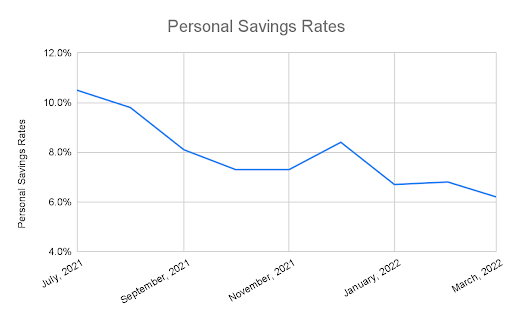

High inflation, the likes of which most of today’s Americans have never seen, is making it difficult to make ends meet. Those higher prices seem especially cruel coming at a time when many forms of emergency government support are expiring.

To ease the financial sting of the pandemic, the federal government doled out emergency assistance to Americans: more generous unemployment benefits, stimulus checks and expanded tax credits for earned income and parents.

In addition, the government suspended payments on federally-backed student loans and declared a moratorium on evictions.

These programs helped the economy at large and individual families weather the immediate financial pressures of the pandemic. But now, all the direct financial benefits have expired, the Supreme Court has struck down the moratorium on evictions and student loan payments are set to resume in September.

This could all be seen as a return to normal, except that just as those forms of assistance are going away, inflation is making increases in the cost of living anything but normal.

Signs of Rising Financial Pressures

For millions of Americans, making ends meet is a weekly challenge. There’s little cushion between being able to pay the bills and getting caught short.

When inflation rises quickly, it can quickly shrink that cushion. For some that means borrowing just to pay the bills. For those already in debt, it can mean defaulting on those debt obligations.

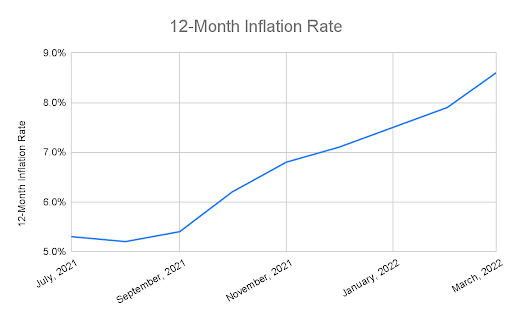

One measure of the cushion people have between making ends meet and going into debt is the Personal Savings Rate. This is the amount households save as a percentage of their income. As inflation has soared that cushion of Personal Savings Rates has gotten thinner and thinner over the past nine months. See charts below.

The savings rates shown above represent the nationwide average for individuals. For many who are on the wrong side of that average, the cushion is long gone.

Already this year, default rates on auto loans, mortgages and bankcards are up.

Also, while default rates measure payments that are already months overdue, many more Americans are increasingly concerned about missing a payment in the near future. According to the Federal Reserve Bank of New York’s Survey of Consumer Expectations, 11.1% of Americans with debt now see a probability of being late with a payment over the next three months.

There may be worse to come. Not only are the above trends heading in the wrong direction, but they don’t reflect the ticking time bomb of student loan debt.

Federal student loan repayments were suspended because of the COVID-19 pandemic. That has temporarily hidden the problem of just how many borrowers were struggling with student loan debt before the pandemic.

Those loan repayments are scheduled to resume after August 31 of this year. The Consumer Financial Protection Bureau (CFPB) studied the credit records of student loan borrowers to see how many were at risk of having problems making those payments when they start coming due again.

The CFPB identified five risk factors that indicated a student loan borrower might have difficulty resuming their payments. They estimate that 15 million borrowers have at least one risk factor, and 5 million borrowers have at least two.

Impact on Physical and Mental Health

The personal finance situation in 2022 tells us that growing numbers of people are already unable to make ends meet, and indications are that many more have reasons to worry that they will have trouble keeping up with their financial obligations in the near future.

This is not just a dollars-and-cents problem. Several academic studies have identified a link between debt and health problems. Here are some examples:

- A Northwestern University study of young adults (24 to 32 years old) found that those with high debt levels showed an increase in blood pressure, an 11.7% higher perceived stress levels than people with low debt levels and 13.2% more incidence of depressive symptoms.

- It’s not just younger people who feel debt pressure. A study of Americans over 50 years old published in the Journals of Gerontology found a correlation between unsecured debt and depressive symptoms.

- A paper in the European Journal of Health reported that people with debt were three times as likely as those without to exhibit common mental disorders.

Of course, if you’ve ever been deep in debt or struggled to pay your bills, you probably don’t need an academic study to tell you there are physical and mental health consequences to financial stress.

Use Mental Health Awareness Month as motivation to take actions that will start to relieve that stress.

Take Control of Your Financial Situation

One characteristic of financial stress is a feeling of helplessness. It’s that sense that your debts and your bills have gotten away from you, and there’s no catching up.

The way to fight that feeling of helplessness is to get organized. Make a plan to deal with your financial problems. Start making your finances better instead of allowing them to keep getting worse. Here are some steps you can take to start taking control of your financial situation:

- Set up a budget to make essential payments your top priority and eliminate unnecessary expenses.

- Rank your debts from highest to lowest interest rates, and look for opportunities to pay down the most expensive debts fastest.

- Look into whether you could refinance or consolidate high interest debt into lower interest debt, or restructure the debt to reduce your monthly payments.

- If you see no way of keeping up with payments, contact your creditors to see if different payment plans can be worked out.

- If you have federally-backed student loans, look into programs that will base what you have to pay each month on how much money you make.

- Consider whether debt counseling might be a necessary step.

There is no instant cure to debt problems. But with time, patience and willpower you can improve your financial situation and eventually rise above it.

From a mental health standpoint, just starting that process can feel empowering. Knowing there’s a way out, and that you have some control over the solution, can give you a healthier outlook towards life.

Of course, financial suggestions are no substitute for psychological help if that’s what you need. However, whether you concentrate solely on fixing your finances or do so in conjunction with mental health therapy, attacking the sources of your financial anxiety is a step in the right direction.

And remember, you are not alone.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.