When it comes to credit health and credit score management, one of the biggest topics many people ask about is their credit report. Your credit report is an important tool for when you want to make a number of important transactions, like getting a mortgage for a house purchase, getting approved for a new credit card, and auto loans. Some employers may even request a report to check your credit history.

In this article we aim to give more clarity and dispel the misconceptions around your credit report. Use the table of contents below to navigate to the specific question you want to get the answer to!

Table of Contents

- What is a credit report?

- What’s the difference between your credit report and your credit score?

- Credit reports from different vendors

- How do they differ?

- Equifax Credit Report – Beacon Score model

- How do they differ?

- Your credit report and late payments

- How long does a late payment stay on your credit report?

- How do late payments affect your credit score?

- How to deal with late payments on your credit report

- Tips to avoid late payments

- Your credit report and collections

- How long does a collection stay on your credit report?

- Do different types of debt get treated differently?

- How to dispute an error on my credit report

- How to file a dispute with a credit bureau

- How to file a dispute with a creditor

- What happens when I dispute something on my credit report?

- What happens if a dispute isn’t corrected?

- How to get medical debt off your credit report

- Three steps to remove a medical debt from your credit report

What is a credit report?

As defined by the government’s Consumer Financial Protection Bureau, your credit report is “a statement that has information about your credit activity and current credit situation such as loan paying history and the status of your credit accounts.”

The credit report that’s typically referred to is an annual report that one of the three national credit reporting bureaus — Equifax, Experian or TransUnion — can provide to you for free once every 12 months. This is a service established by the Fair Credit Reporting Act (FCRA), a federal law passed in 1970. When a loan provider, credit card company, or car dealer requests a credit report, this is the document that they’re referring to.

Are credit reports free?

The FCRA states that everyone has the ability to request a credit report from Equifax, Experian, or TransUnion for free once every 12 months. Additional report requests may incur a fee, but the free nature of that initial annual credit report is enshrined in law.

What’s the difference between my credit report and my credit score?

It’s surprisingly easy to get mixed up between your credit report and your credit score. Your credit report is a full report provided by one of the three major credit bureaus. According to the Consumer Financial Protection Bureau, your credit report documents a number of data points about your credit:

- Your full name

- Your current and former residential addresses

- Your birth date

- Your Social Security number

- Phone numbers listed under your name

- Any current and former credit accounts under your name

- Your overall credit limit and current total credit balance

- Your credit account balances

- Your credit payment history

- Dates you opened and closed credit accounts

- The names of your creditors

- Any public records on liens, foreclosures, bankruptcies, civil suits, and judgments filed against you

- Names of any other companies that have made requests for your credit report

While getting access to your free credit score is a very important piece of information for creating a baseline for improving your credit health, it isn’t a substitute for an actual credit report. Be sure to keep this in mind when you’re signing up for services so that you’re aware of exactly what you’re getting. This helpful Investopedia article breaks down the exact differences between the two.

If you want to obtain your annual free credit report online, the only legitimate vendor providing that service is AnnualCreditReport.com, a site operated by Central Source, LLC., a company co-sponsored by Experian, TransUnion, and Equifax. There are a number of disreputable sites that try to spoof the look and feel of AnnualCreditReport.com.

Credit reports from different vendors

Generally speaking there are three credit bureaus seen as the major providers of credit score reporting: Equifax, Experian, and TransUnion.

While the Fair Isaac Corporation’s FICO Score is perhaps the most recognizable, the three main credit bureaus created a “more predictive scoring model” in 2006. It’s called the VantageScore model. A good VantageScore generally means you also have a good FICO, but the different items that make up your credit score (and the weight each of those items have on your score) are a bit different.

Using the VantageScore model, here are some of the factors that contribute to the calculation of your score:

- Payment History. Your payment history is the single biggest factor that contributes to your score. Make all of your payments on time, every time, and you’re well on your way to a better score.

- Length of Credit Use & Variance of Credit. The age of your credit history, as well as the variation in your credit, accounts for a portion of your credit score. Always keep your oldest accounts open and in good standing, and make sure your credit report reflects different types of credit (e.g., credit cards AND an auto loan).

- Credit Utilization. Your credit utilization is another large factor that contributes to your credit score. Simply put, your credit utilization is the percentage of your total credit limit that you are currently using. You should always aim to keep this number below 30 percent.

- New Credit Applications. Applying for too many lines of credit can make it appear to potential lenders as if you are in desperate need of funds — a big red flag. Keep the number of new credit applications to a minimum for the best score.

- Credit Utilization. Your credit utilization is another large factor that contributes to your credit score. Simply put, your credit utilization is the percentage of your total credit limit that you are currently using. You should always aim to keep this number below 30 percent.

- Balance. Lastly, your current credit balance also plays a part in your credit score. Keep the balances you carry as low as possible to see the best score.

- Available Credit. While only contributing to a relatively small percentage of your credit score, the amount of credit you have available can make a difference. Keeping your credit utilization low ensures that your available credit will reflect positively.

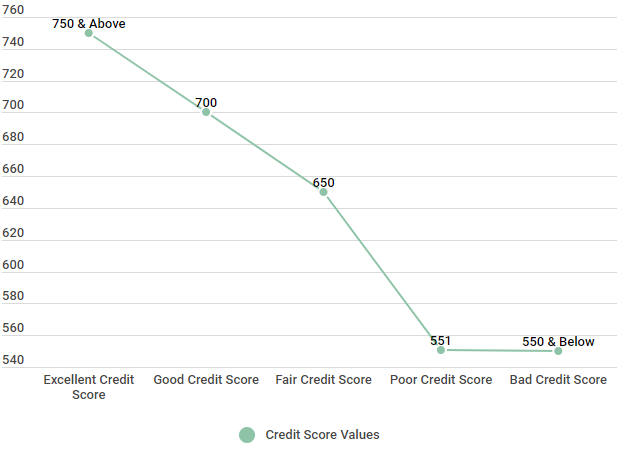

The graph below breaks down how the VantageScore model classifies credit score ranges.

| Credit Score Ranges | Credit Score Values |

|---|---|

| Excellent Credit Score | 750 & Above |

| Good Credit Score | 700 - 749 |

| Poor Credit Score | 650 - 699 |

| Fair Credit Score | 551 - 649 |

| Bad Credit Score | 550 & Below |

Source: TransUnion VantageScore 3.0 model.

Despite the similarities, it’s worth it to know how the bureaus differ from each other. Not every lender pulls your credit report from the same bureau, so it pays to know what your lender could be looking at. Here’s a breakdown of the three major credit bureaus.

Experian

Experian is a major consumer credit reporting agency. The company collects and aggregates consumer information on more than one billion individuals and businesses worldwide (including 235 million individual US consumers and more than 25 million US businesses). Experian is based in Dublin, Ireland and currently operates in 37 countries worldwide, with headquarters in the United States, the United Kingdom, and Brazil.

In addition to credit services, Experian sells business services, including analytic and marketing assistance. It also offers direct-to-consumer services, including online access to your credit history and products designed to protect you from identity theft and fraud. Along with all other credit reporting agencies, Experian is required by United States law to present an individual with one free credit report every year, upon request.

TransUnion

TransUnion is an American agency based in Chicago, IL that collects and aggregates information on more than one billion individual consumers worldwide, including 200 million files that profile nearly every credit-active consumer in the US. Its customer base also includes more than 65,000 businesses. Of the three TransUnion is the smallest but at times the most important.

In addition to its credit reporting services, TransUnion also markets credit reports, as well as other credit and fraud protection services, directly to consumers. And, as is the case with all credit reporting agencies, TransUnion is required by United States law to provide you, when requested with a free copy of your credit report every year, at no charge.

Despite the uniformity established by the VantageScore model, there are still a few key differences, with Equifax’s scoring model in particular. We look at Equifax’s model in more detail below.

Equifax

Equifax collects and aggregates information on more than 800 million consumers — and more than 88 million businesses — all over the world. It was founded in 1899 and is headquartered in Atlanta, GA.

But Equifax is now more than just a credit reporting agency. In addition to its credit and demographic data services (that it sells business-to-business), Equifax also sells credit monitoring and fraud detection/prevention services directly to consumers. And, like all credit reporting agencies, Equifax is required by United States law to provide all consumers upon request with one credit report every year, at no charge.

Equifax Credit Reports

Equifax went one step further and merged FICO and VantageScore together to make its own “Beacon Score” model. As you can see from the chart below, each of these factors are weighted differently, although they closely resemble FICO versus VantageScore —meaning they each contribute to your score calculation in a different way. Payment history is clearly the most important at 35 percent, while your amount owed, length of credit history, types of credit, and new credit have a smaller impact.

For a more detailed look at the credit bureaus, what they do, and how they calculate your credit score, check out our guide to credit reports from the three major credit bureaus.

Your credit report and late payments

If you’ve made a late payment on one of your credit cards, or even a loan, it’s important to know that you’re not alone. There are a number of different reasons that people make late payments — the loss of a job, large unexpected expenses that pop up, or sometimes we just forget. After all, we’re all human.

More than half of Millennials report making late payments, so it’s important to know how this can affect your credit report and your credit score. In this article, we’ll explore how long a negative mark from a late payment will stay on your credit report, as well as how it can affect your everyday life.

How long does a late payment stay on your credit report?

Unfortunately, there is no single “set” rule for all creditors when it comes to how long a late payment will stay on your credit report. Each lender has their own threshold for what counts as a late payment, as well as at what point they decide to report these late payments to the credit bureaus. While this can be frustrating, it’s important to know that there are some tried and true industry averages that can be applied.

In most cases, once your payment gets to be 30 days past due, lenders will consider your payment “late” and will report it to the credit bureaus. Once this happens, the late payment will almost likely show up on your credit report. But why is this important? Simple — even a single late payment can have a big impact on your credit score.

How do late payments affect your credit score?

As you know, your credit score is more than simply a number — it’s an at-a-glance reflection of your creditworthiness to potential lenders and creditors. Your credit score can affect a number of things in your everyday life: whether or not you are approved for that new credit card, the interest rate you will pay on your credit cards, whether or not you can get approved to purchase a new car or home, or even whether or not you get hired for a new job.

How to deal with late payments on your credit report

If you already have late payments on your credit report, you may or may not be able to have them removed. If your bills are past due, it’s important to understand that the sooner you can pay them off, the better off you will be.

However, if you want to take this a step further and remove a late payment that is already on your credit report, you have a few options:

- Write a letter of goodwill. There’s no guarantee that this tactic will work, but you can always try writing a letter of goodwill, outlining your history with the lender and explaining the situation that led to your late or missed payment. In some cases, owning up and taking responsibility for your missed payment will be enough to get you off the hook — but don’t count on it. You will likely have a better chance of success if your history with the lender is otherwise spotless (or close to it).

- Negotiate with your lender. There have been some reports of success by negotiating with your lender. Perhaps they will agree to remove the late payment from your credit report if you agree to stick to a set payment plan, or if you pay off the debt entirely. Whatever terms they agree to, be sure to get it in writing — and have it in hand before you pay off your debt.

- Dispute any errors on your credit report. If you find outdated or inaccurate information on your credit report regarding late payments, you have the right to dispute the error with the reporting credit bureau. If your lender isn’t able to verify the negative information contained in your credit report, they are legally obligated to remove it.

Tips to avoid late payments

Believe it or not, avoiding late payments doesn’t have to be difficult or complicated. One of the easiest ways to make sure your payments are on time is to set up automatic recurring payments each month for the minimum amount due. That way, you can be sure that your payments are always on time, and you can always make any additional payments you want throughout the month, to lower your balance to a comfortable number.

Of course, not everyone wants funds automatically drafted out of their account each month — and that’s okay. If you would rather, simply set up a recurring monthly calendar reminder to make your payment, and then stick to the schedule. Some people even make a budget they look at on a monthly basis, it shows how much to pay and when to pay it. That way nothing is forgotten.

Another tactic to reduce the likelihood of a late payment is to simply reduce the number of bills you have to pay each month. Think about it… are you more likely to miss a payment for one credit card — or for four?

Your credit report and collections

One of the biggest causes for concern when it comes to credit reports is the fact that previous collections filed against can show up in the report. These can be a negative mark on your credit history and potentially decrease your chances of getting approved for a loan or other service.

How long does a collection stay on my credit report?

If you find a collection account on your credit report, you may be wondering what happened. Most often, this happens when your original creditor owed, such as your credit card company, “writes off” your debt as bad debt and then sells the debt to a debt collection agency. Typically, creditors will only sell your debts after you have become seriously delinquent in your payments, usually after 3 to 6 months of nonpayment.

If you find a collection account on your credit report, it is important that you act quickly and not ignore it. Why? Because collections can have a huge negative impact on your credit and your credit score, it is crucial that you understand how to handle them.

Do different types of debt get treated differently?

For the most part, debts that get turned over to collections are usually treated in the same way, and therefore the same rules apply. Typically, this means that these types of debts will remain on your credit report for 7 years before falling off.

However, that doesn’t mean that all debt is treated the same when it comes to your credit. Medical collection debt does have a few differences when it comes to how it is reported.

In accordance with the National Consumer Assistance Plan, medical debt can’t be reported on your credit report until after a 180 day waiting period, in order to give substantial time for any insurance payments to be applied to the debt. Additionally, credit reporting agencies are also required to remove any previously reported medical collections that either have been or are being paid by insurance.

What’s more, even if you have medical collection debt on your credit report, it may not impact your credit score to the same degree other collection debt would. Different credit scoring models vary in their factors, but there are some models that give less weight to medical-specific debt. For more information on how to keep medical debt from hurting your credit standing, jump to our section on how to remove medical debt from your credit report.

With this in mind, let’s take a look at the scoring model calculation factors for the FICO credit score and the VantageScore credit score.

Credit Factors FICO Credit Score Weight VantageScore

Credit Score Weight

Payment History (Collections) 35% 41%

Credit Utilization 30% 20%

Credit Age 15% 20%

Different Types of Credit 10% X

Number of Inquiries 10% 11%

Available Credit X 2%

Balance X 6%

Source: Data found October 10, 2018. https://www.transunion.com/credit-score, https://money.howstuffworks.com/personal-finance/debt-management/credit-score1.htm , https://www.myfico.com/credit-education/whats-in-your-credit-score

As you can see, both scoring models place the highest emphasis on payment history, which is where collection accounts come into play. Your payment history contributes to 35% of your FICO Score, and a whopping 41% of your VantageScore. As such, it is imperative that you aim to make your payments on time — every time.

Your Credit Report and Judgments

If you’ve ever been involved in a lawsuit that went to trial then you are probably familiar with the term ‘judgment.” A judgment is a formal decision made by a court following a lawsuit. In the world of credit, it’s not uncommon for creditors or debt collectors to sue debtors for nonpayment of their debts and obtain judgments.

Judgments are considered public records, which means anyone has access to view those court filings. Credit reporting agencies commonly obtain judgment records from courthouses and place them on consumer credit report cards. These judgments are allowed to remain on consumer credit files for seven years from the filing date.

For a full breakdown on the three key types of judgments and how to get them off of your credit report, check out our detailed guide to judgments.

How to dispute an error on my credit report

There are two main ways to dispute errors: with the bureau or with the creditor. We’ll look at each of these options so you can decide which is best for your circumstances.

How to file a dispute with credit bureaus

Under the Fair Credit Reporting Act, you can have errors removed by submitting a written credit report dispute. Once you submit your report, the bureau has to investigate within 30 days (another 15 days if you send in additional information). From there, the bureau notifies the furnisher or supplier of the information, who then has five days to dispute your claim. The furnisher must review and investigate and send their findings to the bureau. If the bureau finds the false information found in your credit report to be inaccurate or unverifiable, it will be removed or corrected.

How to file a dispute with a creditor

If your dispute isn’t corrected by the process above, you can also try filing a dispute directly with the creditor or furnisher. By law you might have a right to dispute the accuracy of any information on your credit report with the company that reported the information. To do this, simply send a letter disputing the specified information. The creditor, the company that provided the information to the credit bureaus, must investigate your claim.

Keep in mind that you’ll want to double check that you’re using the correct address, because if the creditor specifies a particular address for receiving disputes, you must send your dispute letter to that address or else they can potentially say that they never received it. It could also take much longer for your letter to get to the correct department.

What happens if your dispute isn’t corrected

If you aren’t satisfied with the resolution of your dispute, you have the option to submit a 100-word statement to be added to your credit report. Think of this as your side of the story and explain what happened. For instance, if a medical issue or setback caused you to make several late payments, you can explain this — and also reassure any potential creditors that you’ve regained financial control.

If this isn’t done properly, however, these statements can actually do more harm than good. For instance, this isn’t the time to try using humor to your advantage, so leave out anything that isn’t relevant to that specific claim, such as the anecdote about how you happened to be at a bachelor party in Vegas and forgot to make your credit card payment.

You also have the right to file a complaint to the Consumer Financial Protection Bureau if you feel the bureau has violated the law while processing your dispute. If you feel you need additional help, consider speaking with a consumer rights attorney.

How to remove medical debt from your credit report

Medical debt on your credit report can be a real pain to get rid of. In order to develop a plan to remove medical debt from your credit report it helps to understand why and how the debt got on your credit report in the first place. This type of debt on your credit report can be a serious problem — and is definitely something you’ll want to resolve. As you can see from the chart below, a single unpaid medical bill can drop your credit score by more than 75 points — and that spikes up to 100 if that bill hits collections.

There are several different approaches to removing a medical debt from your credit report depending on the status of the account. Each individual situation is different, so you need to know your financial picture to understand what you’re working with before you try to fix things. Below are some rapid-fire quick tips that may help depending on your unique situation.

3 steps to remove medical debt from your credit report

If a medical bill is in collections by mistake and is having a negative effect on your credit score, you’re probably wondering if it can be removed, and, if so, how. If your bill is less than 180 days old, or if it has now been paid through insurance, you should be able to dispute the charge and have it removed from your report. Here are the steps to take:

- Gather extensive evidence – Pull together as much information as you can to prove that the debt was paid. Request statements from your doctor’s office, go through cancelled checks, look back through your credit card statements… whatever it takes.

- File your dispute – Next, you’ll want to file your dispute with every credit bureau that is reporting the error. Make sure that you check your report with all bureaus.

- Continue communication – The Fair Credit Reporting Act requires credit bureaus to follow up on any and all credit report error disputes. Continue to communicate with the bureaus to check on the status of your dispute, and be sure to provide any additional documentation that is requested.

Keep in mind that while there’s no guarantee that the debt will be removed from your credit report, it’s definitely worth your effort to try. A poor credit score can have a number of negative impacts (not to mention it can be very expensive).