Credit Sesame discusses National Financial Awareness Day on Sunday August 14, 2022.

Normally, National Financial Awareness day is just be a nice opportunity to remind people about the importance of responsible personal finance habits. This year though, National Financial Awareness Day serves more as an urgent warning of immediate threats to household finances.

2022’s National Financial Awareness Day comes at a time when consumers are being beaten up by high prices and threatened by a possible recession. Under the circumstances, the financial tips that would typically be shared on National Financial Awareness Day seem more like essential survival skills than mere helpful hints.

Credit Sesame has looked at National Financial Awareness Day in the context of 2022’s financial challenges.

1. Inflation is stressing household budgets

Consumer prices rose by nearly 13% from the beginning of 2021 through mid-2022. Most Americans weren’t alive the last time inflation was this high. It’s no wonder that such fast-rising prices have come as a shock.

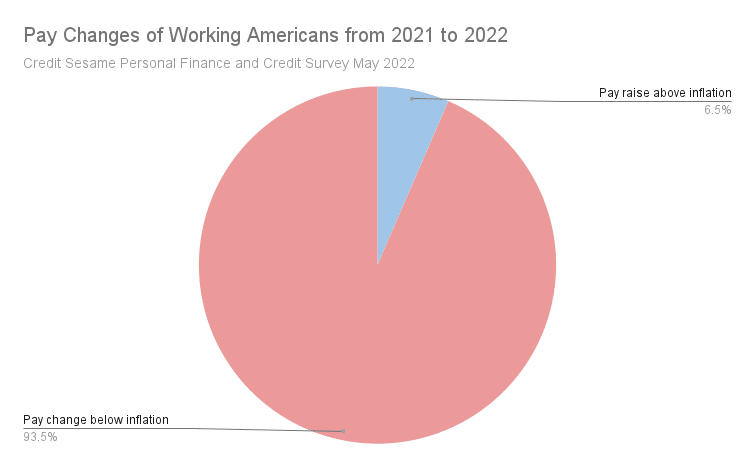

A Credit Sesame survey helps illustrate why rising prices are hitting consumers so hard. It found that just 6.5% of respondents had received a raise in the past year that was big enough to keep up with inflation:

For the 93.5% whose pay hasn’t kept up with inflation, many are finding they can no longer afford the same things they got used to buying from month to month. If you’re one of those many people, resetting your budget right away is a must. Those higher prices aren’t simply going to go away next month.

Key financial lesson:

Budgeting is like a math problem that becomes easier to solve once you break it into a series of simple steps.

You start with your take home pay. Next, list your spending needs in order of importance. Estimate how much each will cost.

Then, subtract those needs from your take home pay one by one. When your pay is used up, everything else has to be cut from your budget.

This may force some hard choices. However, if you spend more than you can afford, the high cost of debt will soon make those choices even tougher.

2. Higher prices can quickly eat up emergency funds

Having an emergency fund can help you absorb temporary financial shocks like the recent surge of inflation. Unfortunately, most Americans lack a sufficient shock absorber in the form of emergency savings. Even for those that have emergency savings, it’s not a permanent solution to a problem like inflation.

Earlier this year, the Consumer Financial Protection Bureau reported that nearly two-thirds of American did not have a month’s worth of income saved for emergencies. That means that any cushion they did have wouldn’t last long in the face of rising prices.

Even for those with more substantial emergency savings, higher prices require a lifestyle adjustment. The reason is that even once inflation cools down, higher prices are probably here to stay.

Key financial lesson:

Living too close to the edge is not sustainable.

When planning on what you can afford, remember that unexpected expenses come up fairly regularly. An emergency fund can help, but then it has to be replaced. Worse, if the problem proves to be long-lived — as higher prices are likely to be — then an emergency fund can only be of temporary help.

Choose a lifestyle that doesn’t stretch your finances to the limit. If you live too close to the edge, it’s too easy for unexpected expenses to push you over it.

In particular, try to ensure that fixed expenses like rent, mortgage payments or car payments don’t max out your budget. You have little flexibility for cutting these costs if things get tight, so be careful about overcommitting on those expenses.

3. Credit card debt is rising fast

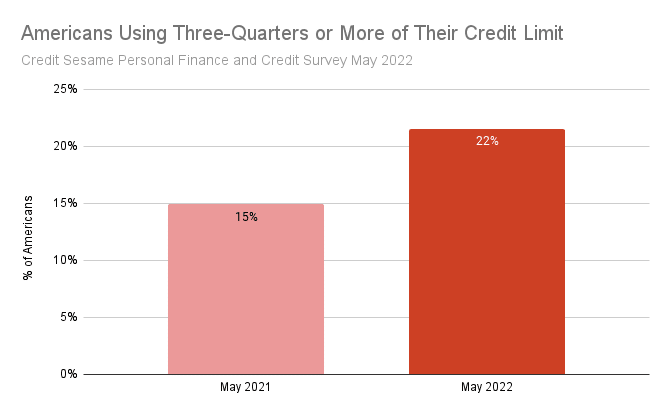

The New York Fed recently reported the largest year-over-year rise in credit card debt in over 20 years. A Credit Sesame survey found that the number of people using at least three quarters of their credit limit increased sharply over the past year:

Key financial lesson:

Try to use less than a third of your credit limit

Using a high percentage of your credit limit could cause your credit score to drop. It also means you may soon run out of room to continue borrowing.

Credit card debt is very expensive. Credit cards work best when you pay their balances off quickly. If your balance is continually rising faster than you can pay it off, it’s a sign you need to rein in spending.

4. Falling credit scores could raise borrowing costs

As people lean more heavily on their credit cards, they risk damaging their credit scores.

Using a high percentage of your credit limit can hurt your credit score. If living beyond your means causes you to start missing credit card payments, that could really cause your score to nosedive.

Your credit card interest rate is tied to your credit score. If your credit score goes down, it could cost you more to carry a balance on your card.

Key financial lesson:

Manage your credit score carefully.

Understand that credit scores are determined by five things:

- Payment history

- Credit usage

- Age of credit accounts

- Mix of loan and credit card accounts

- Recent credit applications and new accounts

Be aware that any action that affects one of these five factors could make using credit more expensive. Managing those five factors carefully can raise your credit score and lower your costs.

5. A recession could threaten incomes

There’s been a lot of debate lately about whether or not the economy is in a recession. Either way, a recession in the near future is certainly a threat.

High prices are tough enough to deal with when you have a steady job. If a recession causes you to lose your job or have your hours cut, it would be even tougher.

Key financial lesson:

Build reserves when you can.

The economy goes through cycles. This includes the job market.

Recently, workers have been in demand. Even so, don’t take your job for granted. Employment conditions can change very quickly.

Do what you can to improve your job security. Also, while you’re still earning, try to build up a reserve of savings. Right now, employees have the upper hand, but that won’t always be the case.

6. Buying a home has never been tougher

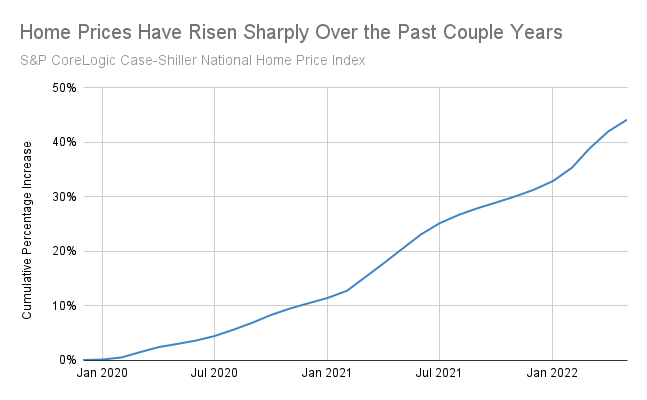

A boom in housing has pushed home prices to record highs. Now higher interest rates are making mortgages more expensive.

The S&P CoreLogic Case-Shiller U.S. National Home Price Index has risen by 44% since the end of 2019:

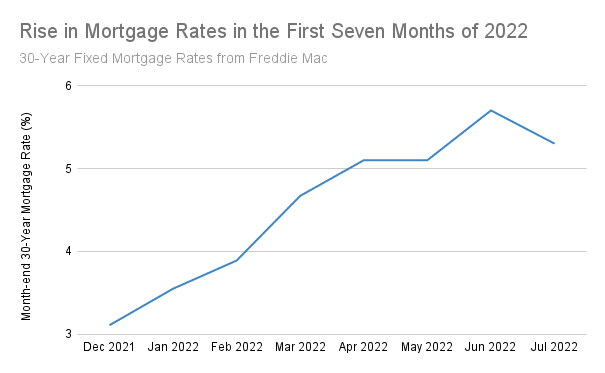

Meanwhile, according to mortgage finance company Freddie Mac, 30-year mortgage rates rose from 3.11% to 5.3% in the first seven months of this year:

A combination of more expensive homes and higher mortgage rates has sharply increased the cost of buying a home.

Key financial lesson:

A larger down payment can lower the long-term cost of buying a house.

With home prices and mortgage rates already up, you shouldn’t feel the need to rush into this market.

Instead, take your time to build a larger down payment. A bigger down payment can qualify you for a lower mortgage rate. It also means you won’t have to borrow much when you do get a mortgage, which will also reduce your interest cost.

7. Retirement saving is under attack

With budgets being stretched, one of the first things to get neglected may be your retirement savings.

When times are tight, people tend to reduce the amount they put into retirement plans. Or worse, they borrow against their retirement savings to meet current needs.

Cutting back on retirement saving is a decision you’ll come to regret. Inflation is a key factor in determining how much money you’ll need to retire comfortably. High inflation means you should be saving more, not less.

Key financial lesson:

Review and adjust your retirement savings plan at least once a year

Even though retirement may be a long way off, you should regularly revisit your savings plan. Run calculations to see how things like inflation and investment returns have impacted your assumptions.

Revisiting your plan regularly will help you adjust to the changes that are bound to happen between now and retirement. It will also remind you not to neglect your retirement savings, even when today’s needs seem more pressing.

8. Consumers have one edge they should make the most of

With all the challenges lined up against you these days, you have one important thing going for you: the job market remains very strong.

The U.S. unemployment rate is at a 50-year low. That means employees are in demand. This is a good time to make the most of your career opportunities.

Key financial lesson:

Your career may be your biggest asset

Over the decades you are likely to be working, your earning power will probably be more valuable than any investment you will ever make. So make the most of that earning power.

Manage your career as carefully as you would manage an investment portfolio. Keep your skills up to date. Know your value in the marketplace, and be able to clearly detail for your employer how you add value.

This doesn’t mean you have to change jobs. It also generally isn’t a good idea to confront an employer by threatening to quit. Just be able to make a strong business case for earning what you are worth.

Now’s a good time to do it, because employers are desperate for talent and anxious to hold on to good employees.

Given current conditions, 2022’s National Financial Awareness Day is much more that a routine teaching moment. It’s a call to action that can help consumers apply sound financial lessons to meet today’s direct threats to their long-term security.

You may also be interested in:

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.

Survey methodology

The Credit Sesame Personal Finance and Credit Survey 2022 was designed and executed by Credit Sesame using the Momentive Inc. survey tool. General population data was collected online May 20-21, 2022. The survey sample comprised 1,222 U.S. residents aged 18 to 99 years balanced for age and gender using U.S. Census data. The sample data is accurate to within + 2.88 percentage points using a 95% confidence level.