Credit Sesame on financial reasons to be thankful this Thanksgiving.

It seems not a day goes by without some bad news about the economy. High inflation and rising interest rates have been putting pressure on consumers all year. Meanwhile the threat of a recession could create a new set of problems.

As serious as these challenges are, it isn’t all bad news for the economy. In fact, there are several bright spots for household finances.

So, while day-to-day headlines tend to focus on the negative, as you approach the Thanksgiving holiday here are six financial reasons to be thankful:

1. Unemployment remains low

Few things cause as much genuine pain to families as joblessness. However, after a brief interruption during 2020, the job market has continued to gather strength.

Though unemployment spiked at 14.7% in April of 2020, by June of this year it had recovered to its pre-pandemic level of 3.5%. That equals the lowest unemployment rate in over 50 years.

Despite concerns about rising interest rates slowing the economy, over 4 million jobs were added in the first 10 months of 2022.

Having a relatively low number of Americans out of work does more than just help people make ends meet from week to week. A healthy job market also gives people an opportunity to prepare for more challenging times.

When work is steady, it’s a good time to build up savings. That could help see you through a future financial setback such as an unexpected expense or a period of joblessness.

Having a steady income is also an ideal opportunity to work on your credit. Paying your bills on time and reducing your debt can help you parlay those regular paychecks into a higher credit score.

2. Job openings are plentiful

Not only is the unemployment rate low, but there are plenty of job openings out there for people who are seeking a job – or a change.

According to the Bureau of Labor Statistics, there were over 10.7 million job openings in the United States as of the end of September. That represents roughly two job openings for every person seeking work.

The availability of jobs does more than simply help keep people employed. It represents an opportunity for employees to find a better work situation.

Job mobility gives people a chance to improve their lives in a few different ways:

- People who feel stuck in a dead-end job have a chance to find a career with advancement prospects

- Employees of companies with poor business outlooks or bad management can find a more positive work environment

- Families that want to relocate because of the cost of living, crime or other factors can use the strong job market to find a better place to live

- Workers struggling to make ends meet with high inflation can look for opportunities to earn more

- Even people who don’t want to change jobs have more leverage to ask for a raise in an environment where their employers know they would be hard to replace

The high demand for labor is something individuals can use to their advantage in fighting inflation. It creates chances to raise earnings to keep up with rising prices.

3. Debt service ratios are reasonable

Debt levels and interest rates are both rising. And yet, monthly payments on debt are still a relatively low percentage of household income.

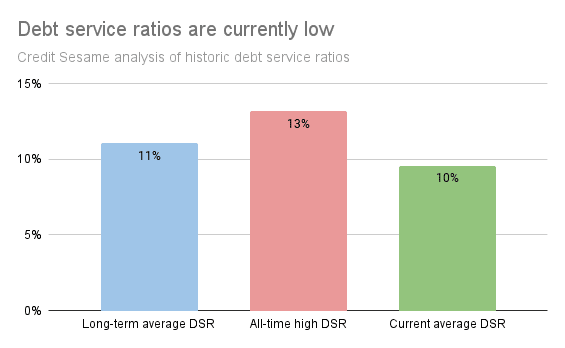

The Federal Reserve measures a statistic called debt service ratio (DSR). This measures the monthly payments consumers owe on their debts as a percentage of household income. Thus, DSR shows how big a burden debt payments are on household budgets.

The Fed has data on DSRs going back to 1980. In that time, DSRs have averaged 11.08%. They peaked at 13.17% at the end of 2007.

As of the latest Federal Reserve figures, the average household DSR was 9.58%. So, debt payments are a smaller than-usual burden as a percentage of household income.

DSRs have been creeping up in recent months, so that is certainly something for consumers to keep an eye on. For now though, as the chart below shows these debt burdens are still lighter than average, and far from the worst they’ve ever been.

4. Payment delinquency rates are relatively low

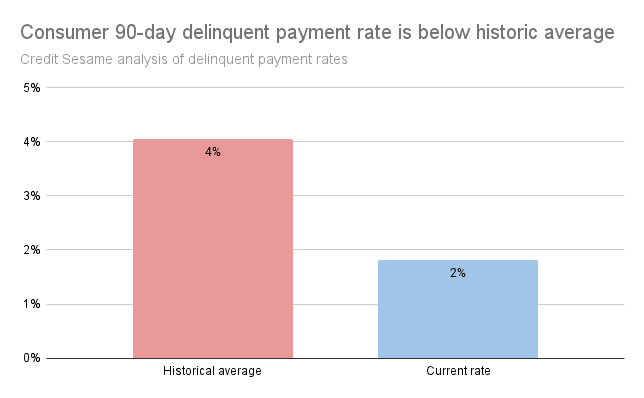

DSRs measure how big a burden debt payments are as a percentage of household income. Delinquency rates measure how hard a time consumers are having meeting those burdens.

Debt payments that are late by 90 days or more are considered seriously delinquent. The Federal Reserve Bank of New York has data on serious delinquency rates that goes back to 2003. Based on this data, here’s now the current percentage of consumer debt payments that are at least 90 days late stacks up with the historical average:

The debt payments that make up these averages include mortgages, HELOCs, auto loans, credit card debt and student loans. Of these, the only trouble area is auto loans, whose delinquency rates are slightly above their long-term average.

In each of the other categories delinquency rates are clearly below their long-term averages. Overall, the rate of serious delinquencies is less than half its historical average.

As challenging as inflation has been for household budgets, consumers are not yet having an especially hard time meeting their debt payments.

5. Credit scores remain solid

Despite all of this year’s economic challenges, the average FICO credit score has held steady at 716. That’s actually higher than it was before the pandemic.

Good credit is a valuable ally during tough economic times. It can help you get credit when financial needs arise. It can also help you qualify for lower interest rates, which is especially helpful at a time when rates generally are rising.

Maintaining a good credit score can help you meet financial challenges. Signing up for credit monitoring can help you make sure your credit score stays in top shape to meet those challenges.

6. The economy is still growing

A drop in economic activity in the first six months of this year raised fears that the economy was sinking into a recession. However, economic growth returned in the third quarter of the year.

The Bureau of Economic Analysis announced that the U.S. economy grew at a 2.6% annual rate in the third quarter of 2022. That’s after adjustment for inflation, so economic growth has been resilient enough to outpace fast-rising prices.

To be sure, there are real problems in the economy. High prices, rising interest rates and a bear market for stocks and bonds all create hardships. However, as easy as it is to focus on the bad news, there continue to be some bright spots for the economy as 2022 draws to a close.

If you enjoyed 6 Financial Reasons to be Thankful This Thanksgiving you may also be interested in:

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.