For years, my student loan debt freaked me out. My wife and I collectively had about $100,000 in student loan debt, the majority being mine at over $75,000.

It’s not that I thought about it constantly (though it rarely left my mind) or that I had collectors pounding on my door (we paid our bills on time). Rather, I figured debt would always be a part of my life. Like Uncle Eddie in “National Lampoon’s Christmas Vacation,” student loans had parked themselves in front of my house with no intention of leaving until they had drained whatever resources they could find in the vicinity.

[You may also want to read about how I recently bought a house with a 15-year mortgage.]

Here’s the kicker: I made the choice to take on those loans. I signed on the dotted line. And if I wanted my parents, who co-signed on my loans, to have a good quality of life, I needed to do everything in my power to take care of every bill and every remaining penny to ensure they never paid a dime more than they had already generously given to my education. This was our agreement: Mom and Dad would support my college choice and help fund my degree, but I’d be responsible for the balance.

Conversations like this happen across the U.S., as a new Google Consumer survey from Credit Sesame shows. We asked 5,400 people about student loans, and more than 20 percent — or one in five — report having one or more. Like me, those with loans face fears about paying them back.

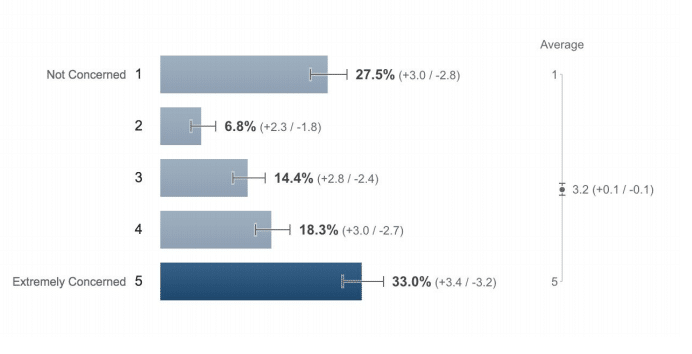

Those who have student loans responded in the following ways:

Two-thirds are concerned about repayment, and yearly one-third are extremely concerned. To the 27.5 percent who say they’re not concerned, I would argue they should be.

Debt levels vary widely. The most commonly reported loan amount in the survey ranges between $20,000 and $100,000, with nearly 39 percent of respondents identifying that level of debt. Meanwhile, 30.6 percent reported $5,000 to $20,000; 21 percent reported under $5,000; and just under 10 percent reported $100,000 or more, the category that most accurately describes my situation.

Like me, these respondents expressed some conflicted feelings about the degree they earned in the context of how much money they borrowed to complete it. Only 41 percent feel that their degree was worth the debt. The other 59 percent were either ambivalent or felt that their degree was definitely not worth the debt.

How we hit rock bottom

Couple student loan debt with the other consumer debt the average American holds and you’ve got conditions that are perfect for deer-in-the-headlights syndrome. You see the debt but your brain doesn’t register the danger, and your paralysis can easily allow the debt to run over you like a mack truck.

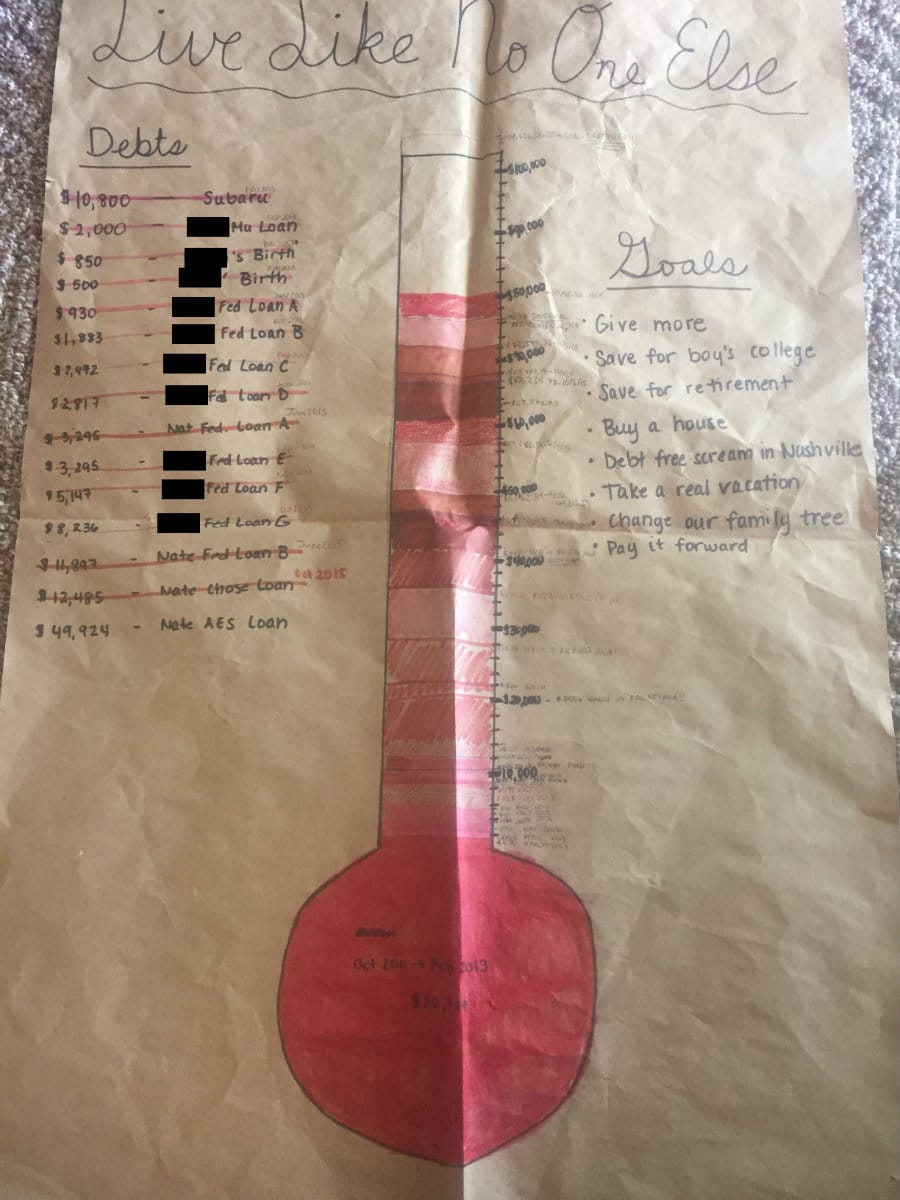

During the early years of student loan repayment, my wife and I also had a $10,000 car loan, several thousand dollars in medical expenses from the birth of our oldest children and about $2,000 in credit card debt. It became almost too much to think about, despite having participated in student loan deferment programs while completing our master’s degree, and despite having reduced payments through a forbearance plan.

Eventually, reality hit us where it hurt. Shortly after the birth of our first son, we found ourselves living in St. Louis for my full-time journalism job. I was earning more than I’d ever anticipated, my wife was able to stay at home with our newborn son, and we loved the region and the friends we had made. But everything we held most dear — family, church, work, entertainment spots — was spread out geographically from one another, so we spent way more on gas than we had anticipated.

Between transportation, other expenses, and monthly minimum student loan payments of $800 to $1,000 (all on a single salary budget), we struggled to keep our heads above water. We could hardly afford monthly groceries. We realized things had to change.

One day, my wife stumbled on Dave Ramsey’s plan, known as Baby Steps, on a discussion board for moms. Many of our friends followed his plan and scored big financial wins, but my view had always been that there’s no plan that can get you out of $100,000 in student loans. It’s just way too much debt.

Nonetheless, we were interested this time. What other solution had we tried with any degree of success? My wife checked out the book from the local library and read it in hours. Within a day or two, I’d finished it, too, and found inspiration I never expected.

What we did to start getting traction

You’ve probably heard about people who have gotten serious about paying off their debt and paid off tens of thousands of dollars in the first 18 months. I’m super happy for those people, but let me be clear: my family and I are not in this club. We eventually made progress, but not without numerous stops and starts along the way.

[You May Also Like: 10 Simple Tactics I Used to Save $18,000 for My 6-Month Dream Trip]

Step #1: Build a rainy day fund. It took a year or more for us to complete the first baby step, which is to save up a $1,000 emergency fund. Invariably, some unexpected expense would crop up that kept us from reaching our goal, and with so much money going out each month in minimum payments on student loans, we had to build a watertight and ultra-lean budget to make progress.

If you want to get out of student loan debt, it’s absolutely achievable. But it will be a slog, and it might last longer than you expect.

Step #2: Bulk up income. The next step we took was to tack on extra jobs to our family’s income. As Ramsey is apt to say, sometimes you need a bigger shovel, aka income, to dig your way out of debt. Again, my wife led the charge by taking on additional work that she could do from home at night while our son was in bed.

My wife, a scientist who is now pursuing her Ph.D., started by reaching out to professors with whom she had built relationships in the past. She then widened her circle and reached out to many she’d never met. In addition to extra income opportunities, she even made contacts that eventually led to generous funding for her current degree program.

Meanwhile, I took on a new job in a rural part of the state and we moved. Relocation proved to be one of our best decisions. The cost of living in our new place was extremely low and every amenity we needed was within a short distance, rather than 20 or 30 minutes away. Within a year of the move, I began freelance writing and editing. I’m grateful for those opportunities and for my full-time job with and the promotions I’ve received along the way.

Step #3: Eat a healthy, low-cost diet. We cut our monthly grocery bill, for quite a long time, to about $100 a month for a family of three. We still ate healthy and well, and though we’ve only got about $24,000 left to pay on our student loans as of this writing, we still consume a fair number of peanut butter and jelly sandwiches to stave off the temptation to eat out.

[Need budget meal inspiration? Here’s a great cookbook designed for people who live on a $4 per day food stamp budget. It’s a free download!]

Step #4: Build momentum with loan payments and below-retail purchases. My family began paying off debts smallest to largest, though it took well over a year to actually be able to pay much more than the minimum each month. We paid $100 here or $300 extra there, until we worked our way up to paying $3,000 or more per month. We’ve learned to negotiate big purchases. For example, our first two vehicles had sizable loans, but we bought our family’s van with cash that we saved because we anticipated needing a car that could hold more people.

[Related: Charging $10K on a New Car Down Payment & Credit Card Insights to Boost Rewards]

Without question, there are risks in buying things that aren’t new or have a little wear. To our family, though, the short-term sacrifices translate to long-term wins.

Why it’s hard to stop once you start

I’m here to tell you that once you start to make regular student loan payments beyond the minimum, you will feel a sense of excitement you’ve never experienced. Even better are the “paid in full” notices you’ll eventually read.

The ability to pay down student loans is a blessing. If you’ve been given amazing opportunities and are using them to change (for the better) your family’s financial trajectory, be immensely proud.

Let’s also give credit where credit is due: I didn’t do this myself. My family, friends and other supportive people helped me reach the finish line. I count my blessings every day. My wife has put up with a lot of craziness. Most of that debt was mine before we said, “I do.” But we agree that we’re stronger for the experience, and we’re never going back.

These days, we’re marking our calendar for the day we can make that final student loan payment. We’re excited about being able to invest seriously in our retirement, and to save for our kids’ college. After all, they are the ones who really inspired us to change our lifestyle and get rid of our debt. Parenthood showed us that some sacrifices are worth making.

Mixed emotions

I fully acknowledge that I’m extremely privileged to have attended a four-year university, to have a master’s degree, to have parents who sacrificed tremendously and frequently to enable me to go to school. I’m so grateful for them. I’m so grateful for my sweet wife, her hard work and her willingness to pay off what were largely my loans.

I’m still torn about student loans, though. My wife and I do not currently plan to let our children borrow for their education.

[Also Read: How Cosigning on Student Loans Affects Credit for Parents and Their Children]

No matter your circumstances, the burden of debt is a mountain you can climb. You must scrutinize every facet of your financial life, making sacrifices even when it hurts. See the entire forest, not just the trees. Beyond those payments, which are the trees, the forest of a paid-off student loan portfolio looks really, really good, especially when you can say you’ve reached the clearing and can leave those woods behind forever.