Credit Sesame discusses how debt changes retirement funding and financial security.

In mid-2022, the amount of debt held by people aged 60 years and more reached an all-time high. Along with Americans in all age groups, seniors are piling up record amounts of debt. However, a large debt burden can be especially burdensome to retirees.

What are the problems debt creates for people as they approach and pass retirement age?

Debt and aging

According to the Federal Reserve’s Summary of Consumer Finances, household debt levels in the U.S. tend to peak when people are in their late 30s and early 40s, and then drop sharply as they get older.

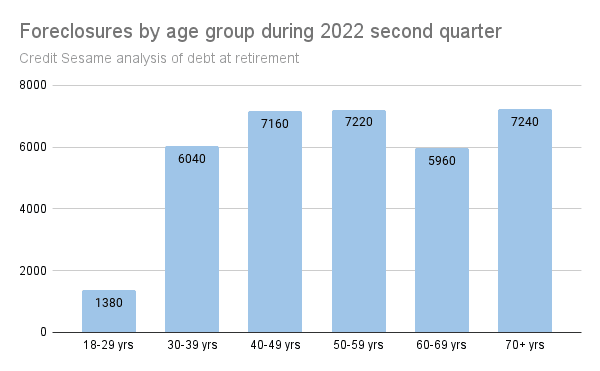

However, there are exceptions to the rule, and when people carry substantial debt levels into retirement, it can put their finances at risk. The Federal Reserve Bank of New York’s Household Debt and Credit Report for the second quarter of 2022 found that there were more foreclosures among people 70 and over than for any other age group:

It’s especially telling that the 70 and over age group had the most foreclosures because it had the smallest population of any of the age groups shown.

Even short of foreclosure, debt can cause various other forms of financial distress in retirement.

Debt slows retirement saving

Even while you’re still working, debt can start to impact your retirement by slowing the pace at which you can save for retirement.

In particular, the interest portion of your debt payments represents an additional cost to your monthly budget. This cost directly reduces the amount of money you have available for savings.

Building up a retirement nest egg is a big job. Saving for retirement has to be spread out over a large number of years. If you’re saddled with debt payments for most or all of your working years, you may never be able to save enough for retirement.

Debt cancels out retirement balances

One flaw of many retirement calculators is that they show savings without also accounting for debt.

For many people, having debt and savings is not an either/or proposition. They often have both. There may be practical reasons for having both debt and savings, but you have to account for it in planning for retirement.

Ultimately, any debt you have should be seen as cancelling out some of your retirement savings balance. In fact, interest rates on debt are often higher than earnings on retirement investments. That means every dollar of debt may cancel out more than a dollar’s worth of the benefit from savings in the long run.

Your retirement plan must account for making the payments on whatever debt you have. That includes finding room in your budget to save for retirement while keeping up with your debt payments. It also includes having enough savings to continue to make payments on any debt you still have in retirement.

Credit may be harder to come by in retirement

Besides the cost of debt, another problem with continued reliance on borrowing as you enter retirement is that it may become harder to get credit.

Income is an important factor in qualifying for credit. According to data from the Bureau of Labor Statistics, income typically falls off sharply once people reach age 65.

This is understandable as people shift from working to retirement. However, that drop in income is likely to make it harder to qualify for credit.

This means you might no longer qualify for a new loan, or at least you may not qualify for as big a loan. A lower income might even affect your existing credit card accounts. If you are overly reliant on credit once you stop working, you may see some of your credit limits reduced.

If relying on credit is part of how you support your lifestyle, you should plan for the possibility of having less of it available once you retire.

Variable interest rates may be risky on a fixed income

If having debt when you retire is a problem, having debt with a variable interest rate can be an especially big problem.

Most loans have fixed interest rates. This helps make their cost predictable. However, credit cards have variable interest rates. When rates rise, you’ll find it quickly becomes more expensive to borrow money on those cards.

As noted earlier in this article, debt levels do generally decline as people get older. However, in some cases the debt that remains may be the wrong kind of debt.

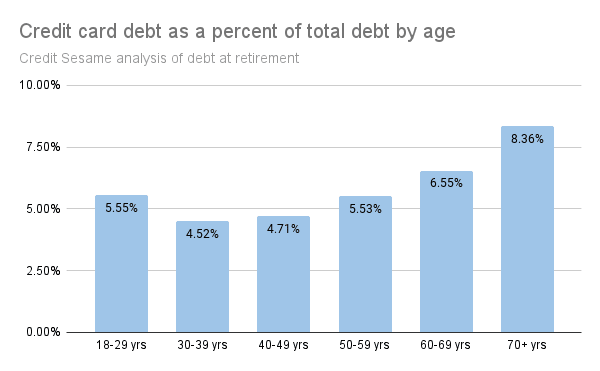

The following chart, based on the Federal Reserve Bank of New York’s Household Debt and Credit Report, shows what percentage of people’s total debt is represented by credit card balances:

As you can see, credit card balances represent a bigger share of total debt for older Americans than for other age groups. That can be a dangerous combination. Variable debt costs when you’re on a fixed or limited income can make it hard to meet other living expenses.

A high debt balance leaves you less room for emergencies

One of the most valuable things about having credit available is that it can give you financial flexibility.

Instead of a sudden, unexpected expense being a crisis, credit can allow you to pay for it over time. This makes it easier for your budget to handle.

However, if you go into retirement with your credit already stretched, you may not have enough borrowing room left to give you that flexibility.

All these examples point to the fact that retirement planning should include a plan for getting out of debt by the time you retire. Continually using debt to support a lifestyle isn’t sustainable, and it can be especially hard on you when the bills come due in retirement.