What do you think when I say the word “budget”? Do you roll your eyes? Cringe?

I want to help you see your budget in a new light. A budget is freedom. It’s the path to getting what’s most important to you. Most of us wouldn’t consciously trade in a home or the opportunity to travel with loved ones for a lifetime of takeout meals and interest charges. But that’s the unconscious choice we make when we waste our hard earned dollars on low-priority expenditures. A budget can help you make your dreams a reality.

But what if you’re one of millions who are in debt or living paycheck-to-paycheck? Those qualifications add a special layer to your budget, but in fact, a good budget is more important to consumers who have the least financial resources than to anyone else. The budget is still your ticket out of an indebted and chaotic financial life.

Let’s break it down.

How much money do you earn each month?

The first step is to figure out how much money you bring in each month. Add it all up, including wages, alimony, child support, and other types of income.

This amount is important because this is how much you have to work with each month. You can’t spend more than this number, or you’ll go further into debt.

List your necessary expenses

Cable TV, Spotify, and other niceties should not be on this list. This is where we focus on the absolute must-have expenses. The things you need to pay to keep creditors off your back and a warm roof over your head.

Analyze past spending

A budget must be realistic. Sure, you might want to spend just $50 per month dining out, but if you actually spend $800 per month, what’s the likelihood that a $50 monthly budget will work for you? You’ll probably go two weeks before calling it quits.

Instead, look at your actual spending patterns so you can start with the current budget and then look for ways to trim it. You’ll need to go through the transactions on your bank account or credit card statements. If you are a cash spender, you’ll have to get receipts or keep a daily log for at least two weeks, and preferably one whole month.

I promise you this step will be worth your time.

List your non-essential expenses

Now that you have a grasp on how you actually spend, assemble a list of all of your non-essential expenses. We’re not making judgments or cuts yet, just a list. Some categories you might use include:

- Dining out

- Entertainment

- Gym fees

- Pet expenses

- Health expenses

- Fuel

- Clothing

- Toiletries

Assemble your budget

Now we’ll draft an actual budget. This is just a list of categories with a dollar amount allocated to it each month. Call it a spending plan if you like; that’s a more accurate description of what it actually does.

First, on a piece of paper, a spreadsheet, or in a software program, write your total income and your necessary expenses, including how much money goes to each category. It might look like this, for example:

- May Income – $4,000

- Rent – $995

- Electricity – $100

- Student Loans – $370

- Credit Card – $75

- Groceries – $500

- Gas – $50

- Childcare – $400

Now list your non-essential expenses, and be sure to take your current spending patterns into account.

This is where you can challenge yourself. Take a look at your numbers and decide if there are any that can be reduced. For example, if you normally spend $500 a month on groceries, could you commit to shopping sales and bringing that amount down to $450?

If you think you can cut back your spending in some areas, go ahead and list the new number.

The rest of your budget might look like this:

- Netflix – $10

- Pets – $75

- Fun Money – $100

- Hair appointment – $60

- Restaurants – $150

After you’ve written everything down, add all the expenses up together. How much are you spending? Is it less than your income? If not, you’ll need to find more places to cut your spending.

How much should be left over?

Many financial experts say you should have a 20% buffer between your expenses and your income for savings/paying off debt. If you take home $4,000 per month, your goal is to have $800 left over to add to savings or accelerate debt payoff. That’s a lofty goal, especially if you’re living paycheck-to-paycheck, but it’s a worthwhile one to shoot for.

What if you don’t have a buffer?

If that describes your situation, you have two options. You can either find a way to make more money, or you need to lower your expenses. Ideally, you can do both.

You can get a second job, do side hustles and odd jobs for cash, sell your stuff, ask for a raise at work, and consider changing jobs, if that’s an option.

Take a good hard look at each of you monthly expenses. Do you really need Netflix or that latest box subscription? Can you spend less on food, either on groceries or dining out? Can you get a roommate, or move to cheaper housing? Each one of your expenses needs a cold, hard look. Ask yourself if you are willing to give this expense up to improve your financial situation.

Set up an emergency fund

Let’s make sure you stay out of debt in the future. The single best way to do this is with an emergency savings account. If there’s anything you’ve probably learned by now, it’s that emergencies will happen, and probably when you’re least expecting it.

If you have a nice little sum of cash tucked away for just these events, then you’ll be able to weather the storm just fine. If you don’t have an emergency fund, you’re risking financial collapse each time your car breaks down or you have to go to see a doctor.

The best place to keep an emergency savings account is in an interest-earning savings account so that you can earn at least a little bit of interest while you save. It won’t be much – the best savings rates are about 1% currently. You can use your Credit Sesame account to find the best savings accounts for you. Once you log in, simply hover your mouse over the Loans tab at the top of the page and click on the Banking button to see the latest recommendations.

Analyze your debt

Most people think debt payments are fixed expenses. That’s true, but we might be able to shape them to fit your budget better, or even pay them off early so you don’t have to worry about making debt payments at all.

First take stock of your debt. We already listed them above, but now we’ll see how your debt payments figure into your overall financial picture. Go to your Credit Sesame profile. You’ll see a section at the right of your screen entitled MY DEBT ANALYSIS. Click on the VIEW DETAILS button at the bottom of this box. Here’s what that screen looks like for me:

Are your debts entered correctly?

You’ll go to a page that lists all of your debts. Make sure each one is correct, and that all of them are here. You don’t want to find any surprises on this page—if so, you may be a victim of identity fraud.

Is your debt-to-income ratio low enough?

Your debt-to-income ratio is just a measure of what percent of your monthly income goes towards debt payments. Lenders like to see a low debt-to-income ratio—after all, how would they be guaranteed to get their money back if you’re already obligated to spend it elsewhere?

In general, a lower debt-to-income ratio is better, and the best debt-to-income ratio would be zero (no debt). It can be scary to see what percent of your income goes towards debt payments, but don’t worry; if you’re not happy with it (and who would be?), we’ll come up with a plan to pay it off in the next section.

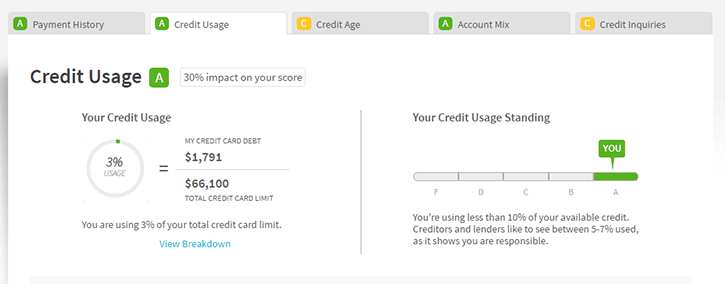

Is your credit utilization ratio under 10%?

Lenders like to see that you can manage your credit cards well. One measure of that is your credit utilization ratio, or what percent of your available credit you’re using. Most lenders like to see a credit utilization of 10% or less. A high utilization ratio can torpedo an otherwise healthy credit score.

To check your credit utilization ratio, click on the My Credit button at the top of the screen. You’ll be taken to a page with several tabs. Click on the one labelled Credit Usage.

If your credit utilization is above 10%, don’t worry: we’ll come up with a plan to lower it in the next section.

Should you pay off debt or save?

Money is often tight, and it can be hard to balance paying off debt and saving. Here’s the answer: save your emergency fund first.

Once your debt is paid off, you can save an even larger emergency fund.

Tailor your debt to fit your budget

Lower your credit utilization ratio

If your credit utilization ratio is above 10%, one of the first things you’ll want to do is to lower it. Your credit utilization ratio has a big impact on your score, and lowering it will help you in the long run because your credit score will go up, your debt will go down, and you’ll start qualifying for better rates and terms on credit cards and loans.

Note your Total Credit Limit on the Credit Usage tab. Then divide that number by 10. This is your target: pay off as much of your credit card debt as you can to reach this number (and, ideally, pay it all off).

For example, let’s say you have a $10,000 total credit limit. An ideal amount of debt would be $1,000 or less ($10,000/10). If you owe $3,000 on your credit cards, work to pay off the first $2,000.

Investigate refinance options

The best way to lower your cost of debt in the short or long term is to refinance your debt to a lower interest rate, and there are a few ways to do this. Before you start, though, ask yourself: do you want lower monthly payments, or to be free of debt faster?

Sure, you might be able to get a really low monthly payment for your debt if you refinance into a super-long-term loan, but over the life of that loan you may pay far more money in interest payments. On the flip side, you could scrimp, save, and earn more money to spend a huge amount towards your debt each month and be free of that debt much faster, at minimal cost. It all depends on what your goals are.

You can refinance student loans with private lenders, but beware: if you have federal loans, you’ll lose out on a lot of great protections like income-based repayment plans, student loan forgiveness plans, deferment and forbearance options, and so on. A better option for federal student loans is to simply consolidate them into one new federal loan with an averaged-out interest rate. It might not save you money, but it’ll make your financial life simpler.

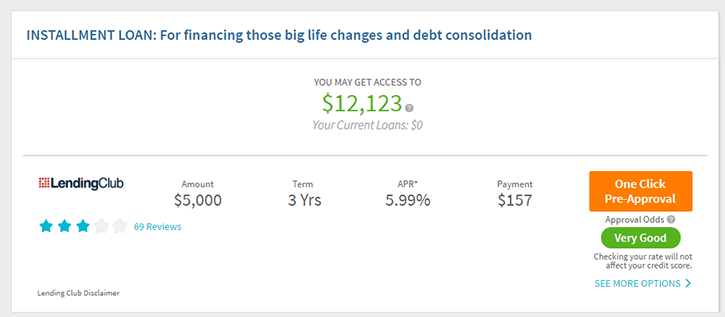

All of your other types of loans are fair game for refinancing. You can refinance your mortgage, your car, your RV, or anything else you have loans for. The best tools for non-mortgage debt are personal loans. Luckily, you can check out what personal loans you might be able to get using Credit Sesame’s tools.

After you log in, click on the Borrowing Power tab at the top of the screen and scroll down until you see the INSTALLMENT LOAN section. This area will contain the information you need to make an informed refinancing decision—APR, monthly payment, term, and loan amount.

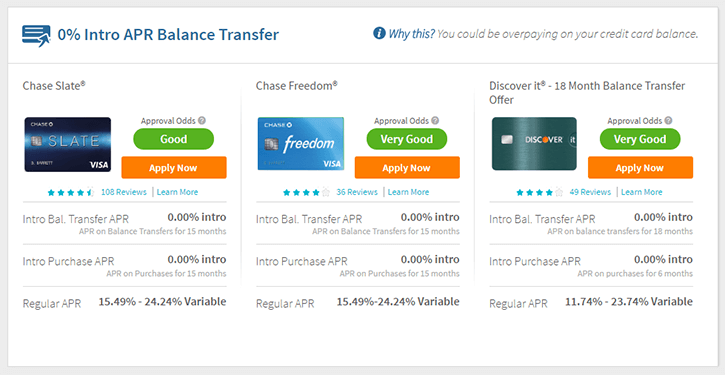

Investigate credit card balance transfer offers

If you have credit card debt, you may be able to pay it off faster using a zero-interest balance transfer card. To do this you would apply for the new card, transfer your existing credit card balance over, and pay down the debt interest-free until the zero percent APR expires. This method can turbo-charge your credit card payoff strategy.

You can see what balance transfer credit cards you’re likely to be approved for using Credit Sesame’s tools. Log in to your account and go to the My Recommendations tab, and scroll down until you see your 0% Intro APR offers.

Choose a debt payoff plan

Once you’ve found relevant refinancing options for your debt and saved up an emergency fund, it’s time to get serious about paying it off. You can blast away your debt with two battle-proven payoff methods: the debt snowball and the debt avalanche.

Each of these methods relies on creating a numbered “hit-list” of debts according to their priority level. The debt snowball method prioritizes the smallest debt first so that you get quick wins faster. The debt avalanche method prioritizes the highest-interest-rate debt first, since this is your most expensive debt.

After you pay off your first debt according to the strategy you choose, you take that freed-up monthly payment and apply it to your next debt on the hit-list. Keep repeating this, increasing your monthly payment on the target debt by an amount at least equal to the payment you made on the last debt. On all other debts, make minimum payments.

Check your budget monthly

Each month do a check-in with your budget. Did you overspend in some areas? Did you spend less than expected? A budget is a living document and you can shift your numbers around each month to make it work for you.

You can also do a quick review each month of loan, refinancing and balance transfer options on your Credit Sesame dashboard. As you lower your debt, your credit choices will increase. Also, the market is always changing, and the rates you were quoted last month might be lower this month.

As long as you keep up-to-date with your budget and make sure you’re making constant progress towards your savings and debt-payoff goals, you will be debt-free before you know it.