Credit Sesame discusses possible consumer overspending in 2024 and what that means for households.

The Federal Reserve Bank of New York’s monthly Survey of Consumer Expectations asks people questions about how they expect economic developments to affect them in the year ahead. Beyond what the responses say about the overall economy, analyzing the survey results can provide insights into how people manage their household finances.

Recent results suggest that record levels of consumer debt will continue to rise. With interest rates at elevated levels, people may do well to consider bucking the trend.

Summarizing New York Fed survey results

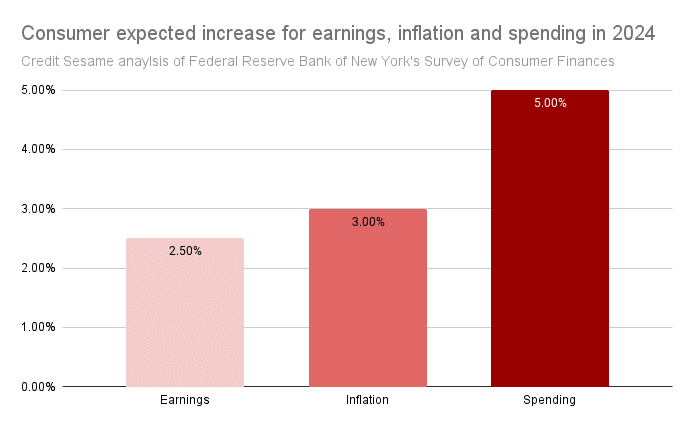

The New York Fed’s December 2023 Survey of Consumer Expectations included an outlook for the year ahead. Despite a robust labor market, people generally have modest expectations for how much they’ll earn in 2024. Wage growth is expected to be just 2.5% this year.

After inflation peaked at 8.9% in mid-2022, consumers have noted that it’s been easing lately. The survey found that consumers expect inflation to be 3.0% over the next 12 months, down from the 3.4% expected in the November survey.

Survey respondents expect household spending to rise by 5.0% over the next year. This figure remains elevated from its pre-pandemic level of 3.1%.

Spending outpaces inflation and inflation outpaces earnings

A chart of these three consumer expectations helps to put them in perspective.

People expect to continue to increase spending at a faster rate than their wages are rising. When inflation was running especially hot, this could be blamed on rising prices. However, now that inflation has cooled, the rise in spending can only be partially blamed on higher prices. While people expect prices to increase by 3%, they plan to spend 5% more this year. Whatever the reason, the numbers show that people expect their spending to grow twice as fast as their wages in 2024.

The result is more dependence on high-interest debt

The elevated rate of spending growth is nothing new. American consumers have been on a spending spree since pandemic restrictions were loosened. While this has helped keep the economy going, it has also resulted in rising consumer debt levels.

At one time, some of this spending was attributed to the savings built up during the pandemic. However, rising debt levels suggest those savings have been depleted. The Federal Reserve recently announced that non-mortgage consumer debt crossed the $5 trillion mark for the first time.

The Fed’s figures show that revolving debt, most of which is credit card balances, is growing especially fast. This is disturbing for two reasons:

- Fast-rising credit card debt suggests people are reaching for the convenience of what’s in their wallets rather than engaging in planned, long-term spending.

- Credit card debt carries a hefty burden because it has interest rates that generally far exceed those of loans.

The New York Fed’s survey included a result that shows how this debt is taking a toll. In December, 12.4% of respondents said they would probably miss a minimum debt payment over the next three months. That figure was up from the November survey and well above the average of 11.5% over the past 12 months. In short, many consumers are dealing with debts they can’t handle.

These credit problems will only worsen as cash-starved households add late fees to their debts. Also, as credit conditions have worsened recently, banks have tightened lending standards. This is likely to mean a widening gap between interest rates on credit cards for poor credit customers and those issued to customers with stronger credit.

Increasing spending faster than income growth and taking on ever-greater debt are not sustainable financial habits. Households going down that path need to find alternatives to change those habits.

Alternatives to planned consumer overspending

If you’re relying on borrowing to fund increased spending, here are some changes to consider:

- Careful budgeting to fit your means. When prices were rising very fast, it was tough to budget. Now that the rate of price increases has slowed, this would be a good time to look at your spending and income and come up with a budget you can afford.

- Seek to boost your top line. The New York Fed survey found that people expect their wages to grow more slowly than inflation. In a strong job market, you may not have to accept that. Be assertive about asking for a raise, and also check the employment ads to see if there are better-paying jobs for people with your skill set.

- Reduce borrowing costs. Even if people rein in borrowing now, it will take a while to work through all the debt they’ve accumulated. If you have high credit card balances, look for ways to lower the interest on that debt. Personal loans and balance transfer credit cards might be good options for refinancing your debt. The less interest you have to pay, the sooner you’ll be able to pay off those balances.

For many, the New York Fed survey is like looking in a mirror. It shows people are generally planning on continuing the same bad spending and borrowing habits they developed over the past few years. Now’s the time to recognize what’s wrong with that picture and do something about it.

If you enjoyed Consumer overspending planned for 2024 you may like,

- 2024 credit conditions worsening for consumers

- Consumer finances 2023 year in review

- How to build credit

- Get your free credit score

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.