When you have a bankruptcy or collections on your credit report, you probably know exactly what’s dragging down your credit score. But other subtle items might be weighing you down even if, in general, you feel like you are on top of your finances.

Do this first: check your credit

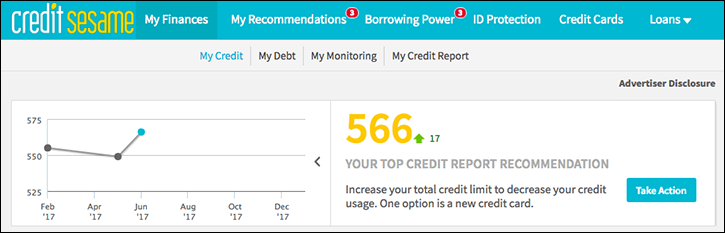

Before you apply for credit and risk the unpleasant surprise of denial, take a look at your credit score to see where you stand. You can get a free credit score, updated monthly, on Credit Sesame. Your member dashboard also features tools to help you identify potentially surprising things that could be dragging down your credit score. Once you understand what’s causing problems, you can work to fix the issue.

Do this next: evaluate your credit score factors

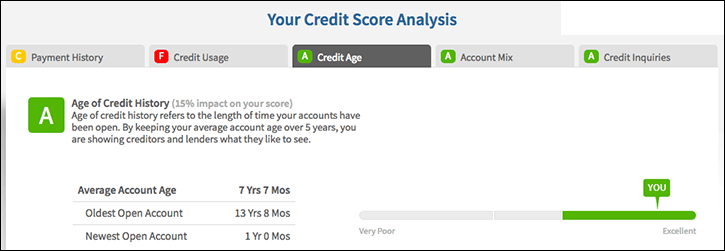

Let’s talk about inquiries. How much damage can they really do to your score? Many experts caution against making too many applications in a short time. However, the truth is that for both FICO® and VantageScore®, inquiries make a minimal impact on your credit score. In fact, your average file age has a greater effect on your score (15 percent) so you’ll help yourself more by leaving accounts open. The number of recent applications and/or new accounts only counts for about 10 percent of your overall score.

The minimal impact of inquiries is especially true if you have good credit and a long-standing credit history. One credit inquiry for the purpose of obtaining credit might take five points off your credit score, or it might take zero points off your score. Also, not all inquiries are weighted equally. The second inquiry on your credit report probably has a greater impact than the 10th or 20th inquiry.

Then there’s rate shopping for student loans, mortgages and auto loans. The first inquiry is completely ignored for30 days. Then if you make multiple applications with the same type of lender within a set period of time, all of the inquiries only count as one where your score is concerned. The time period is 14 to 45 days, depending on the scoring model used.

None of this is to say you should apply willy-nilly. Apply only when you need credit. Some lenders will automatically reject an application from a consumer with too many inquiries on his or her credit report – more than two in the last six months, or more than five with the same bank, for example.

The bottom line is that although inquiries do affect your credit, they are small fish in the credit sea and probably not responsible for keeping you in a low credit score range.

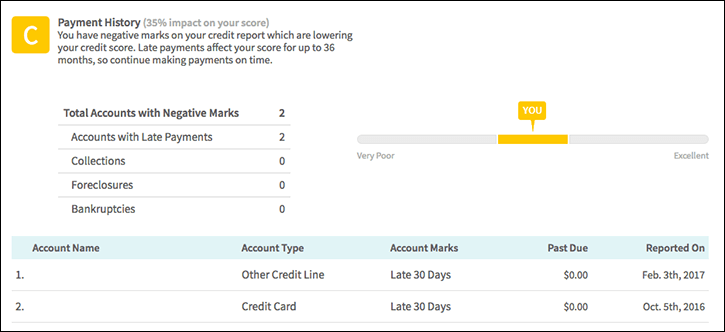

Check your payment history

It’s no surprise that your payment history is the most important factor when figuring your credit score. It accounts for about 35 percent of your score. What might surprise you is how significantly one or two late payments can drag down your score, especially if you currently have good credit.

Think that years of on-time payments and a score in the 700s will insulate you from a late or missed payment? Not quite.

Two late payments can bring you down quickly. Indeed, if you have a high credit score before a late payment, you’ll see a bigger impact than someone whose score was already lower to begin with.

If you are 30 days late on a payment, your 780 score can drop 90 to 100 points. The same consumer with a 680 score might see a drop between 60 and 80 points.

How to fix late payments

You’ve got a few options when it comes to fixing late payment credit score damage.

If you have a strong payment history and the blemish was unusual, you can call your creditor and ask them to stop reporting the late payment (they’ll probably require that you bring the account current).

If you can’t get the late payment removed by the creditor, set up automatic payments so that you never miss another due date. If you’re uncomfortable with automatic payments, set calendar reminders or use a bill pay app that alerts you to upcoming due dates.

Your Credit Sesame dashboard shows you which accounts report late payments. If you think you see an error, contact the creditor to request correction.

You can also file a dispute directly with TransUnion, the source of the data you see on Credit Sesame. To do that, you need to get a copy of your credit report. You can request on for free every twelve months from each of the consumer credit reporting agencies – Equifax, Experian and TransUnion – by visiting AnnualCreditReport.com. While viewing your report online, you will see a button to click to initiate the dispute process. You can also file a dispute by mail. Click the link at the beginning of this paragraph for detailed instructions. The creditor must respond to your dispute and validate the information within 30-45 days or the reporting agency will remove the item from your file.

Late payments can impact your score for up to 36 months but the damage diminishes over time. They will remain on your credit report for seven years past the date of delinquency.

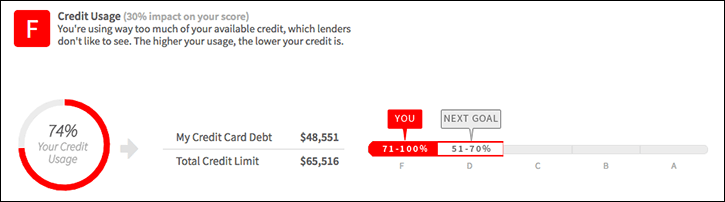

Check your credit utilization

Your utilization is how much revolving debt you carry in relation to your credit limits. It’s expressed as a percentage or ratio. If you have a $500 balance on a card with a $1,000 limit, your utilization is 50 percent. Utilization is almost as important as payment history, and accounts for 30 percent of your credit score.

Utilization is inversely proportional to credit score. In simple terms, the higher your ratio, the lower your score. You’ll have a higher credit score if you have credit but don’t use it much. There is no magic number, but people with top credit scores have utilization ratios between zero and about 7 percent.

Once again, the better your score to begin with, the more it can fall if your utilization rises.

How to fix utilization

The most obvious way to lower your utilization is to pay off your debt. Easier said than done, right? If you can’t afford to do that, you can improve this number other ways.

One is to get a new credit card but keep the balance at zero. If you have a $500 balance but you have TWO cards with $1,000 limits, your utilization is just 25 percent, which is pretty healthy.

Another twist is to look for a card with a zero percent balance transfer offer. That could allow you to save hundreds of dollars or more in interest charges during the interest-free period. When your entire payment is applied to the principal balance, you will see the amount owed go down much faster than it does when a huge chunk of each payment goes toward interest.

If you do get a new credit card, spread your balance out and don’t max out any one card. Utilization is calculated for each account, and overall.

You can find recommendations for credit cards that may be a good fit for you on your Credit Sesame dashboard.

Look at your overall credit analysis

Use your free credit report to find out exactly what’s dragging down your score. If you don’t have straight As, and most of us don’t, find your low grades and decide what steps you can take to improve them.

Start with payment history and utilization, as those have the biggest impact. This consumer started with a 719 credit score and then missed a payment. When a second payment was missed a few months later, the score dropped further. Rising utilization brought this consumer to a new low in the 500s.

Use the trend tool to track your progress. On-time payments and aging accounts, even with high utilization, resulted in a 17-point jump from May to June.

Here’s a challenge for you. Check your credit report card today and identify one thing you can do to improve your score.