Credit Sesame analyzes the cost of bad credit to consumers.

Bad habits can be hard to break and often require the right motivation. Poor credit habits are no exception.

Money is a good motivator for some people. If you were offered $7,000 or $8,000, or $9,000 to change your credit habits, could you do it? No one is going to hand you $9,000, but you may pay that much more in interest charges if you have a low credit score and do not take steps to raise it.

A new Credit Sesame analysis found that bad credit can cost thousands of dollars annually. Bringing your credit score up could put that money in your pocket year after year.

To demonstrate the high cost of bad credit Credit Sesame examined how much people with lower and higher FICO credit scores pay for mortgages, car loans and credit cards.

The numbers may motivate you to work on raising your credit score and effectively pay yourself many thousands of dollars.

The cost of bad credit – mortgages

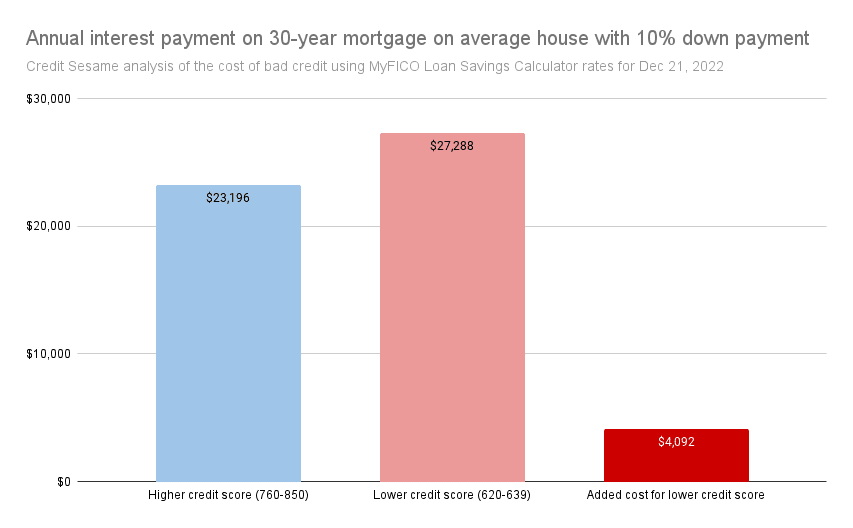

According to the real estate website Zillow, in December 2022 the average house in the United States cost $357,589. Buying such a house with a 10% down payment requires a mortgage of $321,830. The interest rate on that mortgage depends on your credit score. The interest rate for individuals with a high credit score may be significantly lower than for people with low credit scores. This can make a big difference to monthly payments. Credit Sesame used FICO’s Loan Savings Calculator to determine how much difference this would make using interest rates published on December 21, 2022.

The FICO calculator showed 30-year mortgage rates ranging from 6.017% for people with higher credit scores to 7.606% for people with lower credit scores.

On a typical mortgage of $321,830, higher credit scorers with the lower mortgage rate pay $23,220 per year. Lower credit scorers with the higher rate pay $27,300 per year. Lower credit scorers pay an extra $4,092 per year. Over a 30-year mortgage, you pay an extra $122,629 for a weaker credit score.

In addition, home insurance rates may also vary depending on your credit score. This assumes of course that you can get a mortgage. If bad credit prevents you from getting a mortgage, there may be an even bigger opportunity cost. In that case, you may have to rent instead of building equity in a home.

The cost of bad credit – car loans

The price of a new car has soared in recent years. Higher vehicle prices mean bigger auto loans, and that increases the cost of bad credit.

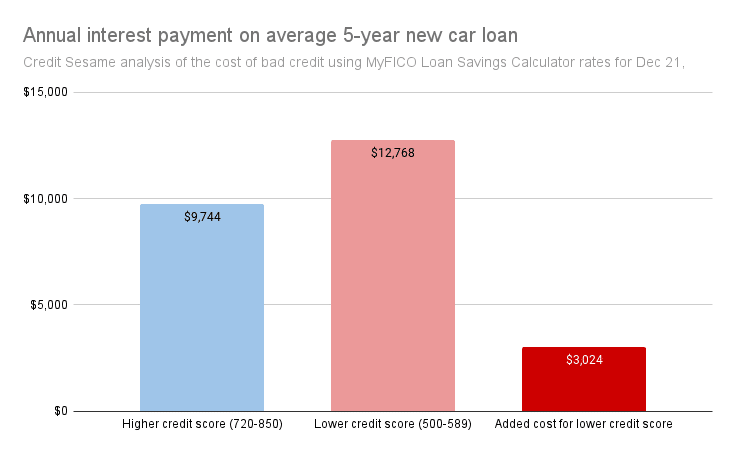

According to Experian’s State of the Automotive Finance Market Report: Q3 2022, the average new car loan is now $41,665.

Using the FICO loan calculator rates for December 21, 2022, Credit Sesame calculated the difference between the annual cost of a loan in that amount for someone with strong credit and someone with weaker credit:

The FICO calculator shows a range of 6.357% to 18.259% for 5-year auto loan rates, depending on the borrower’s credit score.

At an interest rate of 6.357%, annual payments on a $41,665 auto loan total $9,744. At an interest rate of 18.259%, annual payments on the same loan total $12,768 ($3,024 more per year.) Over a 5-year auto loan, a lower credit scorer pays an extra $15,088.

Depending on where you live, you might also pay more for auto insurance if you have bad credit.

The cost of bad credit – credit cards

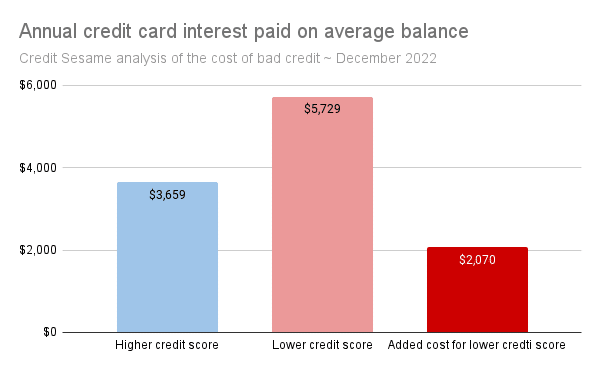

Credit Sesame calculated the average household credit card balance and then looked at the interest rates you might pay on that balance depending on your credit score.

According to the Federal Reserve’s latest Consumer Credit report, American consumers have just over $1.17 trillion in credit card debt. Census Bureau figures indicate there are around 124 million households in the U.S. The latest Federal Reserve Survey of Consumer Finances found that 45.4% (56.3 million) of households owe money on their credit cards. This means that the average household with credit card debt owes $20,802.

To figure out what that would cost annually in interest payments, Credit Sesame looked at credit card rates offered by the top five card issuers by purchase volume (third row, third chart in) and checked the interest rates offered on the respective websites on December 14 and 15, 2022.

On average, credit card rates from these five issuers ranged between 17.59% and 27.54%. It is reasonable to assume that higher interest rates are offered to lower credit scorers and vice versa.

If high credit scorers qualify for the lower interest rate, the annual interest on a $20,802 balance is $3,659 a year. If lower credit scorers pay the higher interest rate the annual interest is $5,729 ($2,070 more per year) on the same balance.

This may understate the cost difference. Typically, people with excellent credit habits do not carry a credit card balance from month to month. If that is the case, they probably escape interest charges completely.

In addition, according to the Consumer Finance Protection Bureau, people with good credit do not usually incur late fees. In contrast, most credit card users with bad credit incur late fees – usually three or more per year.

The average late fee on a general-purpose credit card is $26 for the first occurrence and $35 for each occurrence after that. So, three late fees in a year cost $96. That’s another cost someone with good credit habits could avoid.

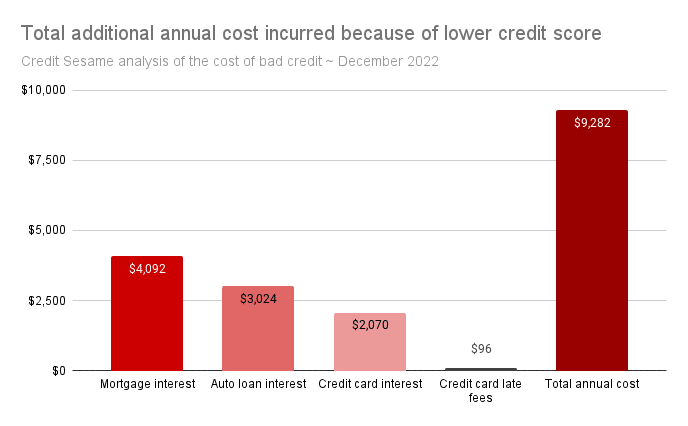

The total cost of poor credit

The cost of bad credit may add up to $9,282 per year.

If you prefer to have an extra $9,282 in your budget each year, you may like to take steps to improve your credit.

- Sign up for free credit monitoring to help track your progress.

- Budget without further borrowing. A household budget that depends on increased borrowing is likely not sustainable. You need to reduce expenses to live within your means.

- Pay down debt on credit cards. This means always paying more than the minimum required payment and paying off credit cards in full as soon as possible.

- Pay down your highest-interest debt first.

- Look for opportunities to lower costs by refinancing debt

Results are not immediate, but as your credit score rises and you qualify for lower interest rates, you should keep more of that $9,282 in your wallet every year and see less taken by lenders and credit card companies in interest payments.

You may also be interested in:

- Maintaining Good Credit has Become a High Stakes Game

- Bankruptcy Recovery Plan: How to Raise Your Credit Score After Bankruptcy

- Joseph’s Story: Rebuilding Credit Means Stability

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.