That sounds like a ridiculous thing to do, right?

If you’ve ever heard or read anything about credit, you know that bad credit behavior, even just one missed payment, can dump your score faster than a 10-second sleigh ride lands you face-first in a snow pile. Even worse, rebuilding that credit score through responsible credit use could have you trudging up from the bottom of the Grand “bad credit” Canyon for what seems like forever.

Credit scores have an air of mystery about them and I wanted to find out personally if there are some ways to improve your credit score substantially and quickly after an isolated credit mistake, for example.

So, I designed a credit score experiment the way I was taught for the 5th grade science fair using the Scientific Method.

Here’s a chart, to give you a quick refresher in case it’s been a while since you were in the 5th grade.

Purpose: My credit score experiment

I wanted to find out exactly how quickly and how low my score would drop if I maxed out a credit card, made a late payment and carried a balance over a month.

In addition, I wanted to track how quickly my score would rebound to its starting point once I brought the account current and paid it down to zero.

Research: Here’s the conventional wisdom on credit behaviors

According to FICO’s website, “It’s important to note that repairing bad credit is a bit like losing weight: It takes time and there is no quick way to fix a credit score.”

You have to slog on making payments on time, checking your credit reports for errors, paying down balances and keeping your utilization (dividing your total credit card debt by your total credit card limits) under 30%, which they call “gardening” your score.

But I wanted to know more specifically how long it actually takes for a credit score to drop as a result of negative credit behavior or improve as a result of positive credit behavior.

Luckily, I came across a 2011 FICO chart and a 2012 VantageScore report which actually tracked good and bad credit behaviors and listed specific score drop ranges and rebound time frames depending on specific credit behaviors.

Here, from the more recent VantageScore report:

How scores can vary

– Most people’s scores typically will vary by about 20 points in any 90-day time period which may or may not push you up or down into a different credit score level and can make a big difference in interest rates.

– With responsible credit management, you can typically improve your score 10-15 points in just a few months, which can definitely push you up into a higher credit level when you’re on the edge.

– Scores will drop steepest and fastest in the month following a negative credit event such as missing a payment, when a collection is added to your report or maxing out a credit card.

– The higher your starting credit score, the larger the score drop for a negative credit behavior.

– For one negative credit behavior (and no other negative events are added to the report), its impact diminishes over time. For additional negative events, the score will continue to drop.

Specific credit behaviors and their impact on credit score

– New credit: Applying for and receiving new credit might cause a small score drop in the 5-10 point range, which bounces back within three months.

– Amounts owed: Maxing out just one credit card can decrease your credit score by 55-110 points and spreading credit usage over several cards can decrease your credit score by 30-80 points. The single card drop can also be recovered within three months if paid off completely and paying down amounts owed (credit balances) to 30%-50% of credit limit can improve your score by as much as 50 points in about three months.

[Related: Does Paying More Than the Minimum on My Bills Help My Credit?]

– Payment history: One late credit payment can decrease your credit score 60-120 points depending on what type of payment was missed. Auto loan payments and mortgage payments carry more weight than credit card payments and cause a greater negative impact on scores.

A missed payment (more than 30 days late) causes continuing score drops until the account is brought current. It can take the better part of a year to recover from a missed payment. Once the account is brought current and paid on time you could notice a score increase of 1-3 points every month.

– Public records: Bankruptcies and public records such as tax liens or judgments from a collections agency can cause the largest score drops and take the longest to recover from, up to 10 years. A charge-off, foreclosure or account placed in collections can decrease your credit score by 80-185 points and a bankruptcy can decrease your credit score by 200-350 points.

– Age of accounts: Closing an old, paid-off credit account can decrease your credit score by 10-40 points.

Hypothesis: Here’s what I think will happen to my credit score

I am applying the perfect storm of poor credit behavior to my credit score: paying late, maxing out a card and carrying the balance so I think my score will drop substantially more than 100 points and I might have to suffer with a low credit score, possibly below 600 for the better part of a year or more.

[Related: 10 States With the Worst Credit Habits]

I’m thinking this might turn out to be a dumb experiment.

Experiment: My crazy credit score test

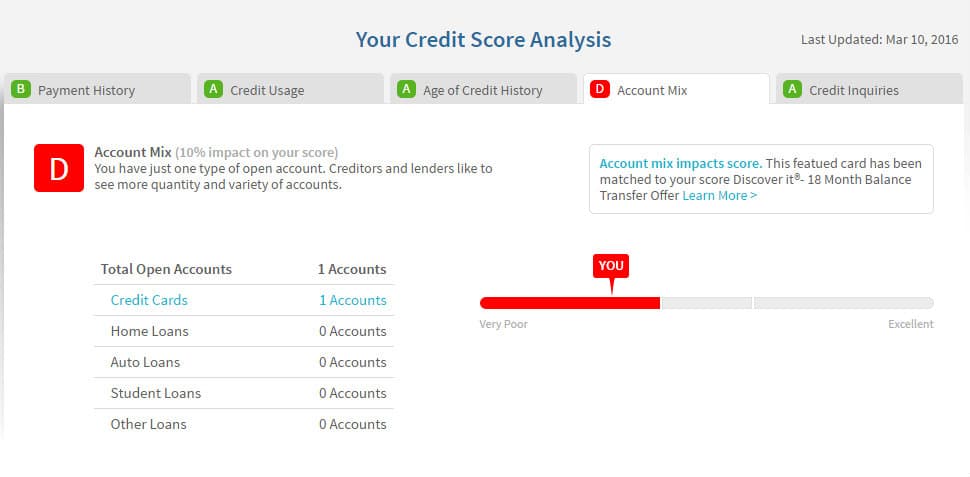

I want to point out that everybody’s credit situation and combination of credit factors making up their score is different. As you can see above, since my mortgage is paid off and I have no other car loans or outstanding credit other than the one credit card, other credit variables in my experiment were limited, making the direct cause and effect of the negative credit behaviors on my credit score more obvious.

In fact, because I have only that one “trade line” on my credit report, it’s possible my credit score did not start out as stellar as some of my higher scoring friends and family who have more types of credit accounts, but keep their credit utilization very low.

[You May Also Like: Will Paying Off Delinquent Debts Improve My Score?]

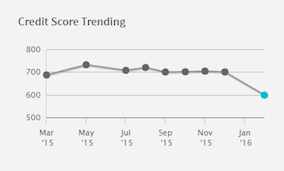

My score started out at 705 in December 2015.

In December, I charged up my one credit card to its $500 limit. Then in January, I missed the payment due date and paid $100 at the end of January. I carried the rest of that balance into February. Just before my February payment was due, I paid the balance completely down to $0.

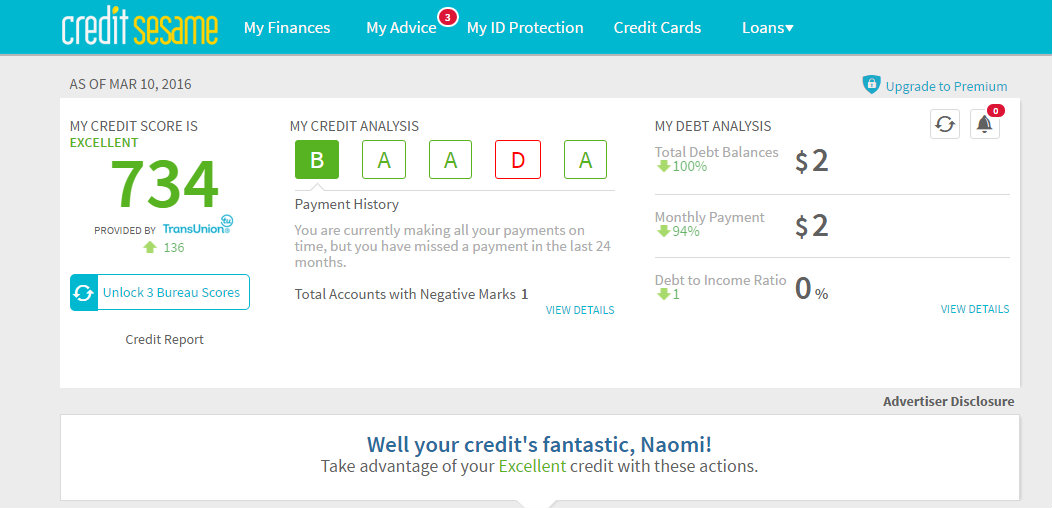

Analysis: My score actually jumped higher than my original score

In February, I received a credit score alert email from Credit Sesame, notifying me of a score decrease. When I logged in, I saw it dropped 107 points, to 598. I went directly from a good credit score to a bad credit score over the one month. But that was not surprising part.

Here’s what surprised me: When I received my credit score in March, it rose 136 points to top out higher than it was before by 30 points, now at 734, which means I’m well on my way to excellent credit, as you can see above.

So, I called up Jeff Richardson, spokesperson for VantageScore Solutions, which is the model behind the Credit Sesame credit score, to find out why my score rebounded to higher than when I started this crazy credit score experiment.

Richardson said making on-time payments when carrying a high balance over several months will not improve your score much and if you miss payments or pay late your score will keep dropping.

“A delinquency’s negative impact on your credit score can lag for a number of months but if you cure it quickly, in 30 days, your score is going to rebound just as quickly,” said Richardson. “In fact, the negative score drop of running up the balances on your credit card can also be corrected very quickly by just a payoff, when there are no other negative credit events on your report. ”

He says all the better if you can clear it all the way to zero, as I did, and that it’s a possible reason for my happy credit score bump.

Final thoughts

I wanted to show first-hand that you really can improve your credit score quicker than you think. You really can make big changes in your credit score through specific positive credit behaviors, and when you do that, checking your credit score every month is fun.

Now, take that tax refund and go pay down your debt.

Stay tuned for my next Credit Sesame credit score experiment… I applied for another credit card to see how my credit score will be affected, since a new account means a credit pull and an increase in my overall credit limit.