Editor’s note: Credit Sesame staff member Kari recently moved from Canada to the U.S. and shares the reality of starting her credit profile from zero, while also obtaining her Social Security Number. Here’s her story…

I recently moved from Vancouver, Canada to San Francisco and have discovered that credit plays a much more active role in life in America than in Canada. Credit is important to get a phone, rent an apartment and even get a job.

Unfortunately, as a new resident of the states, I had no credit at all! Luckily, my friends and staff members at Credit Sesame helped me get on track to excellent credit.

Here are four important steps I took when I began my credit journey from zero.

1. I got my Social Security Number

In Canada, we have a similar number called your SIN (Social Insurance Number). Essentially, this number helps the government track your finances and the taxes you pay. It’s also the way your credit score is tracked.

To get my SSN I first needed to make sure I had all the right documents. I needed:

– My TN visa (the form is called an I-94)

– Passport

– Drivers license

– Application form (which you can find at the Social Security office)

Unfortunately, I couldn’t make an appointment, so the process took a couple of hours.

2. I needed to open a bank account

I’ve heard this can be tricky. Luckily, my bank in Canada (RBC) has an affiliate bank in America so this was actually super easy for me.

They were happy to open an American account for me. This also meant I could transfer money between my Canadian and American accounts for no fee, via online banking. It’s wonderful! Several other banks offer this service, including PNC Bank and TD Bank.

I definitely recommend going this route, if you’re considering a move overseas. Choosing a bank that has locations in other countries is probably the easiest way to avoid the hassle of opening a new bank account.

3. I got a phone on credit

Next, I needed a new phone. I thought about buying a phone outright but since I was already juggling student debt, it made more sense for me to finance it.

I went to Verizon and talked to them about my options as a Canadian citizen. They said they could do a foreign credit check for me. After answering a number of questions and showing my passport, I was offered three lines at Verizon with my credit I had built up in Canada. Other cross-border carriers may be able to do the same.

Several companies offer prepaid phone plans with no credit check, but having this phone and service will help build up my credit in the U.S.

4. Track your credit

Even though I had great credit in Canada, as a new resident of America, I essentially had no credit.

Luckily, because of RBC’s affiliate bank, I was able to get an American credit card. (My next best option would have been a secured credit card.)

I plan to use this credit card responsibly to build my credit. After a few months I should be able to check my credit score for free on Credit Sesame, which will also give me recommendations on how to improve my credit score.

Credit from around the world

If you’ve just moved here from outside the U.S. like me, or you’re planning to go and live abroad for any length of time, you should know that your credit score doesn’t typically travel with you.

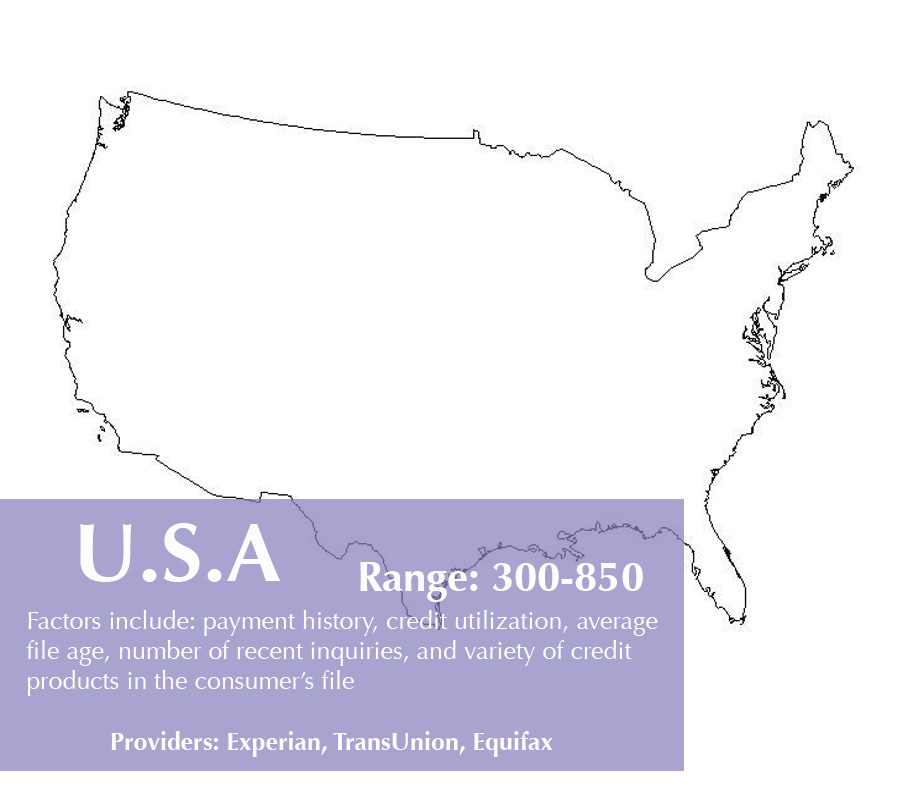

The U.S. credit scoring models

FICO and VantageScore are distinctly American. Your credit score won’t mean much, if anything, to a lender in another nation. In most cases, when you relocate to a new county, you must start the credit-building process all over.

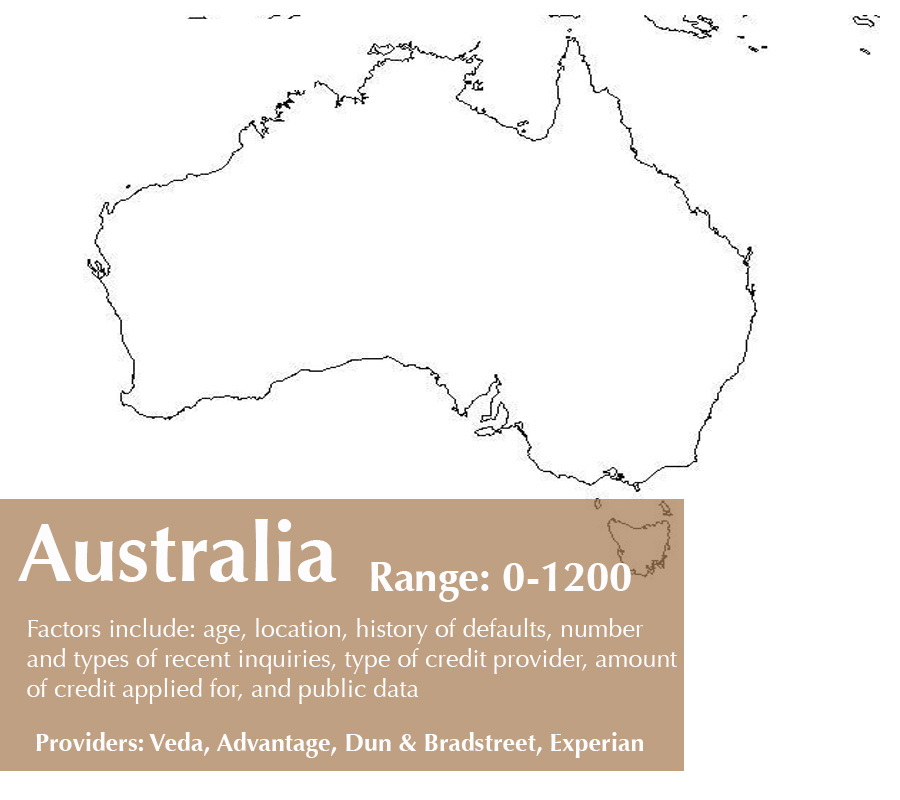

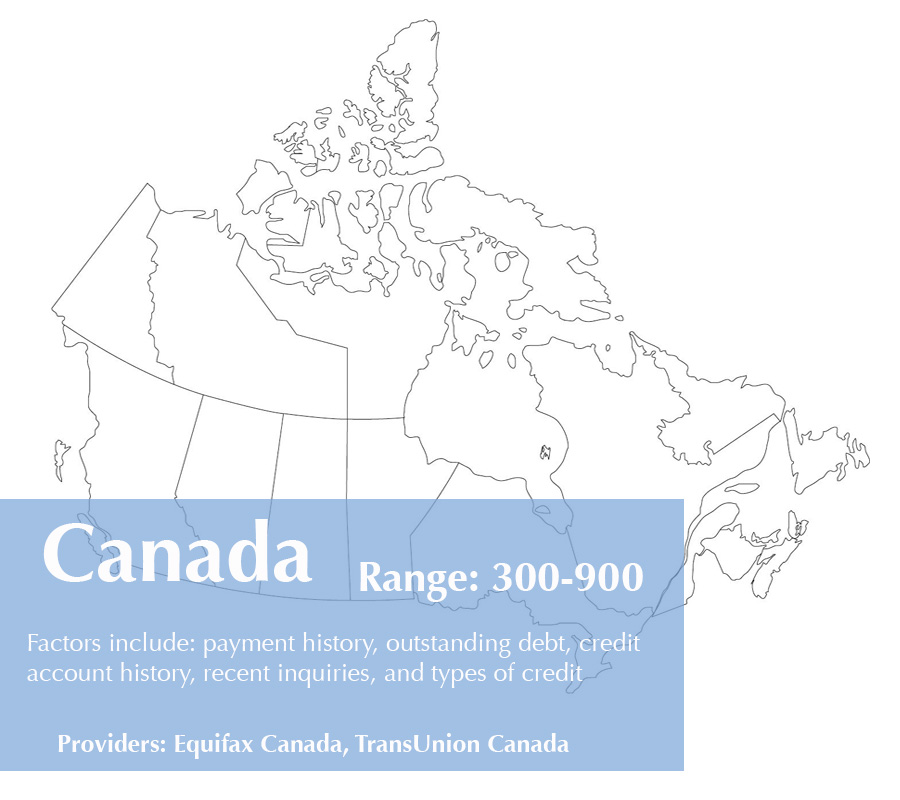

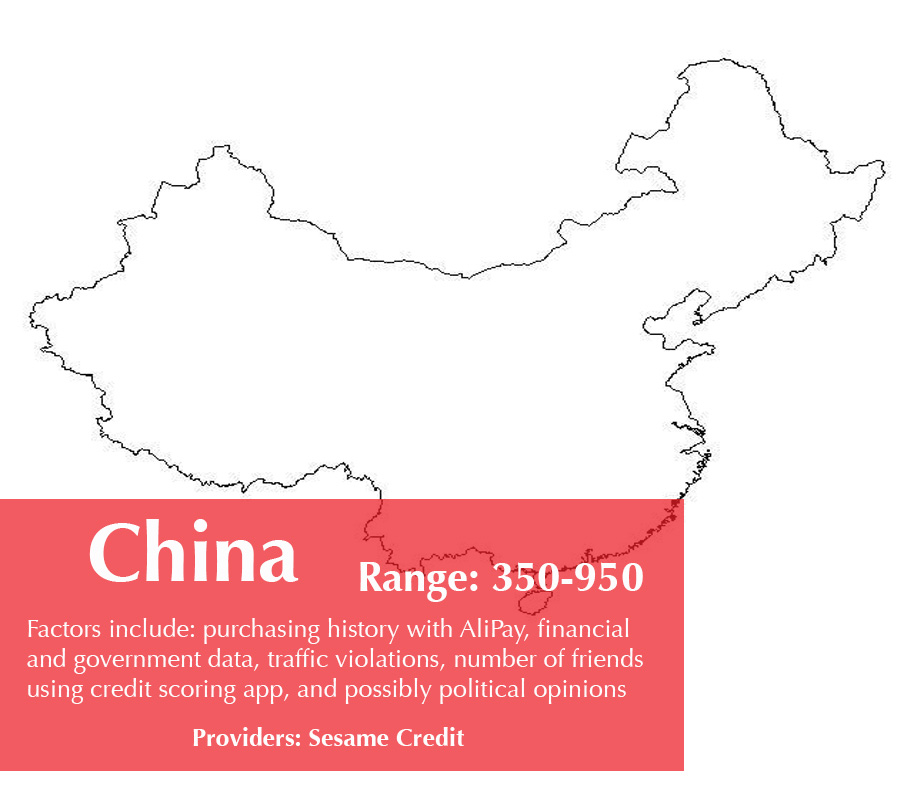

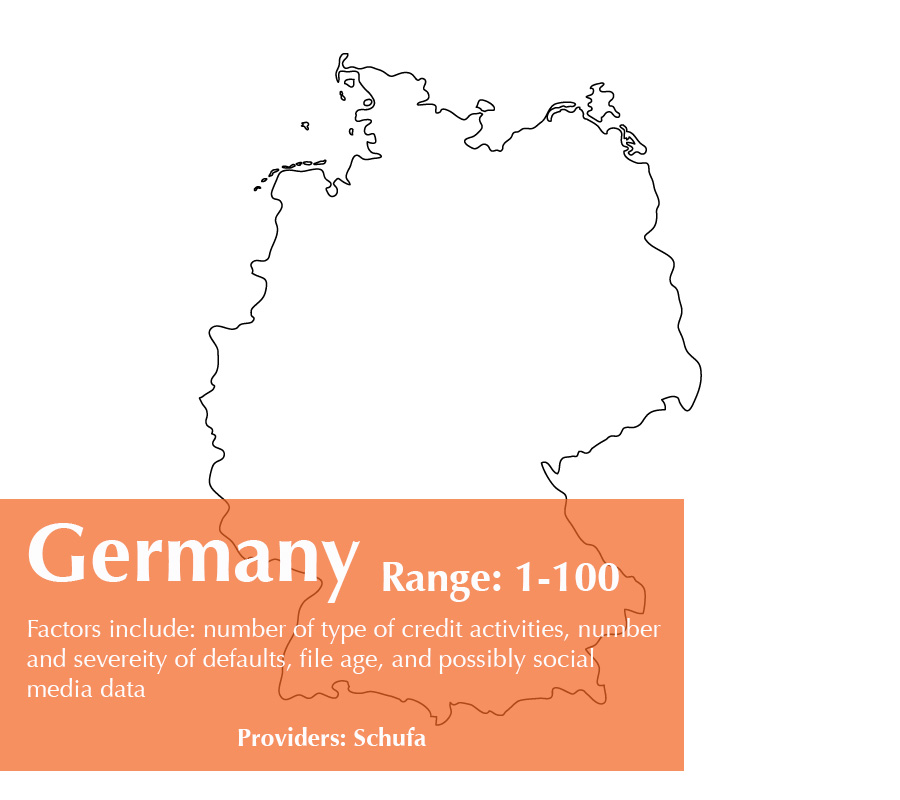

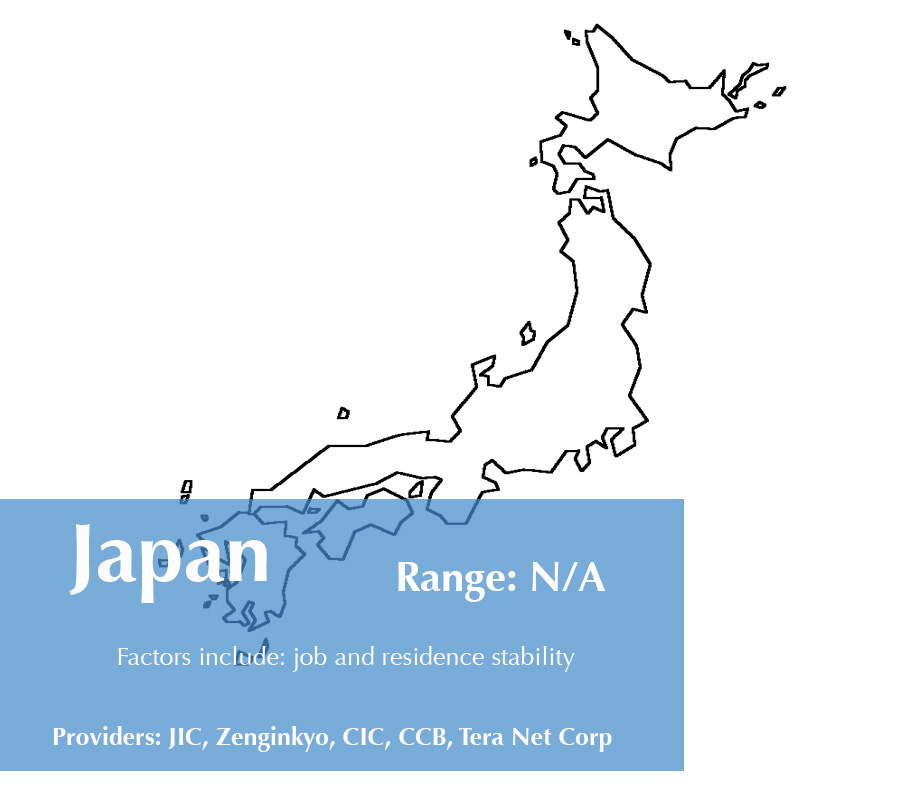

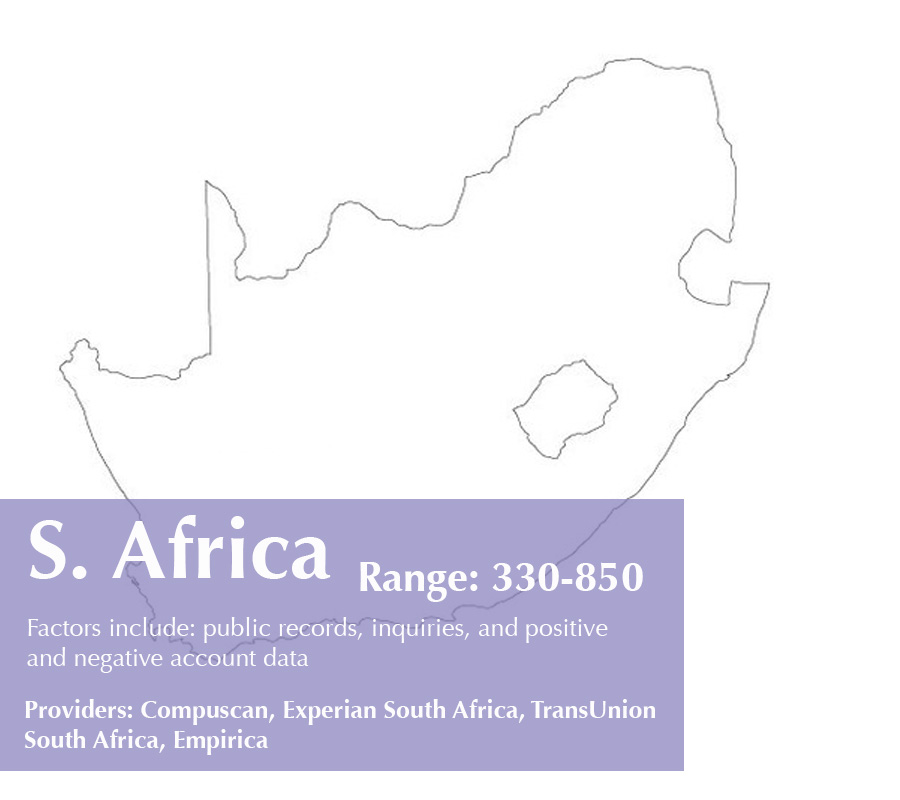

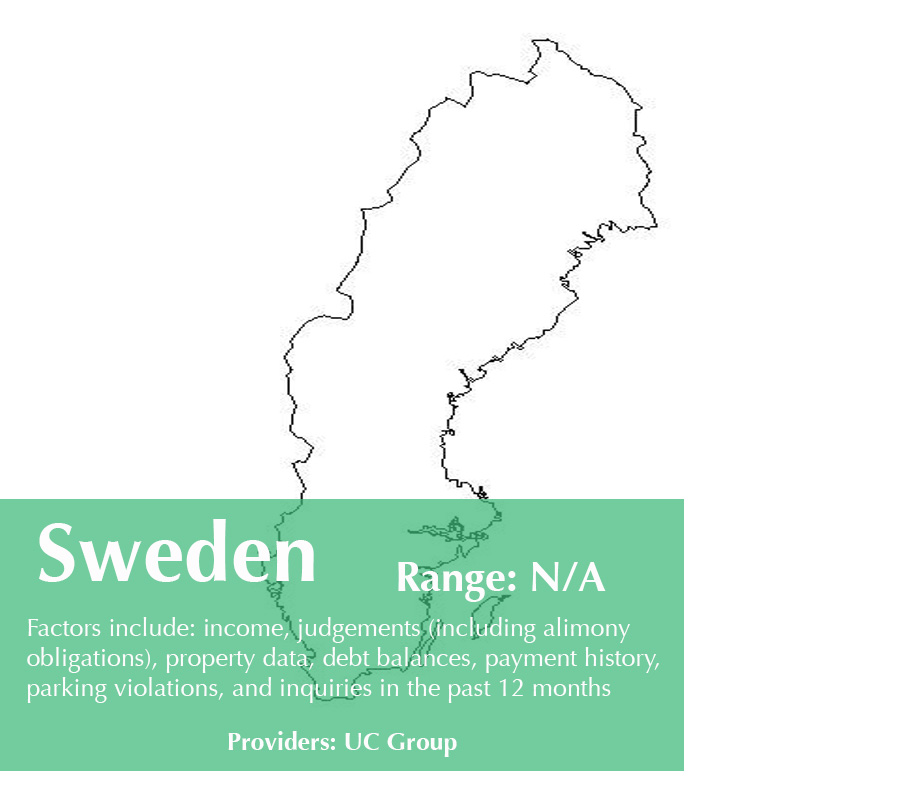

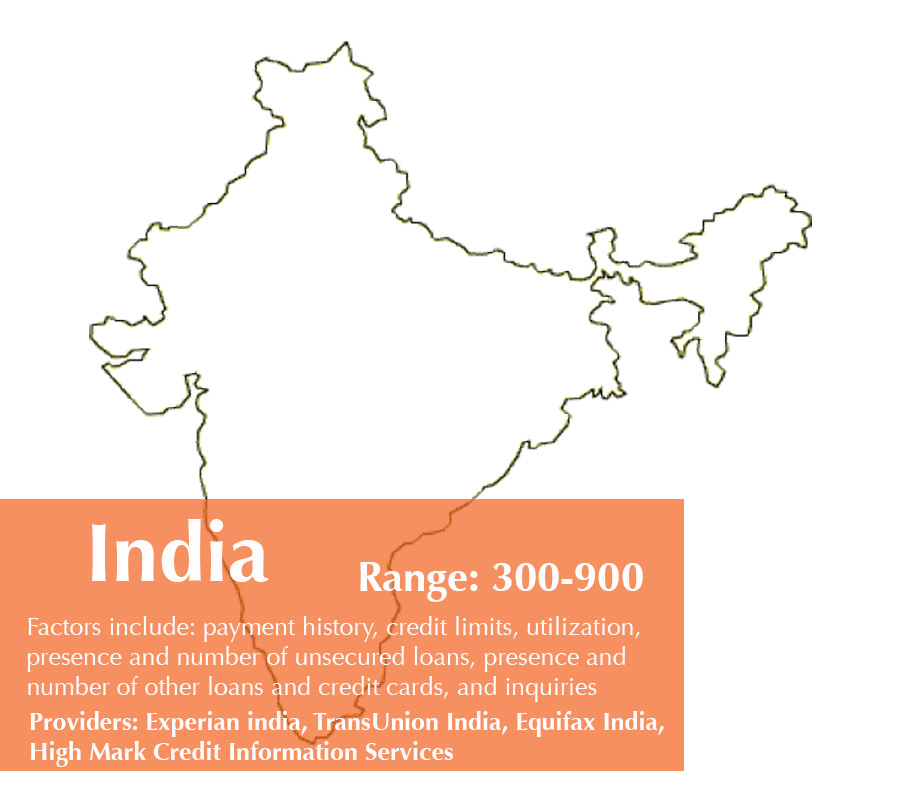

Each nation has its own method for evaluating consumer credit. Here’s what credit reporting looks like around the world. (Click on the image to make it larger, and then hit the “back” button on your browser to go back to the article.)