We all know that your credit score can impact your ability to get a credit card or a mortgage, but it also plays a big role in many other financial decisions —such as the deposit you put down when you turn on utilities at your new apartment or your ability to get car insurance.

Understanding what a good credit score is (and how to achieve it) can mean all the difference in your financial health, as well as your ability to secure the best interest rates and terms. Keep reading as we explore what a good credit score it, how to achieve it, and what it can get you.

What is a good credit score?

There is no doubt that you’ve aspired to have good credit throughout your adult life. But, do you really know what that means? What score is really a good credit score? And, what’s the impact that a good credit score can have on your wallet?

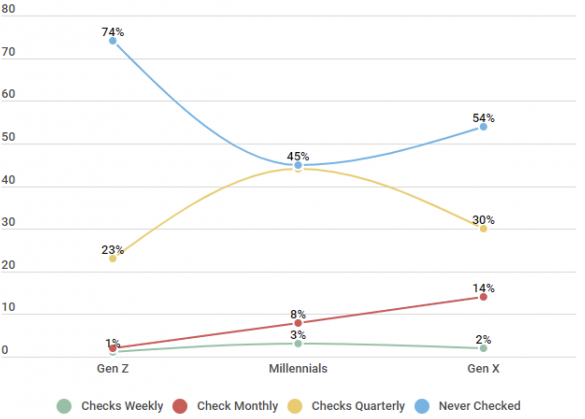

Although the first step in knowing whether your score is good or bad is checking your credit report, you can see from the data below that a vast majority of Gen Z’ers have never checked their credit score.

How Many Americans Check Their Credit Scores?

| Generation | Checks Weekly | Check Monthly | Checks Quarterly | Never Checked |

|---|---|---|---|---|

| Gen Z | 1% | 2% | 23% | 74% |

| Millennials | 3% | 8% | 44% | 45% |

| Gen X | 2% | 14% | 30% | 54% |

Source: We surveyed 650 US consumers on 9/5/18 during a time period of 2 weeks.

Once you’ve checked your credit score and you see those three digits, what do they mean?

For the purpose of this article, we’ll look at the FICO score, which is the most common and widely-used score. A FICO score that falls between 670 and 739 is generally considered to be good credit.

Why is understanding good credit important?

Understanding your credit score is important for a number of reasons, as that three-digit number can have a big impact on many of the large purchases you will make throughout your lifetime.

For example, let’s say that you want to buy a home. A poor credit score may get you a 6 percent interest rate, while a good credit score may get you a 4 percent interest rate. This can translate into thousands of dollars in interest over the course of your mortgage.

What’s more, knowing your credit score and where you fall in the credit range is the first step in taking control of your financial wellbeing.

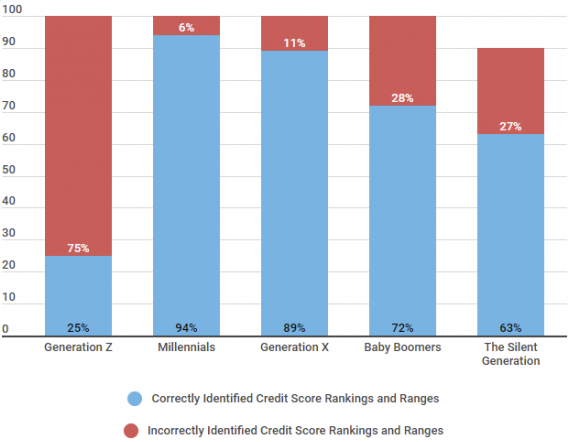

As you can see from the data below, however, a large part of the population (particularly those in Generation Z) was unable to correctly identify various credit score rankings and ranges.

Percent of Americans Who Understand Credit Scores

| Age Group | Correctly Identified Credit Score Rankings and Ranges | Incorrectly Identified Credit Score Rankings and Ranges |

|---|---|---|

| Generation Z | 25% | 75% |

| Millennials | 94% | 6% |

| Generation X | 89% | 11% |

| Baby Boomers | 72% | 28% |

| The Silent Generation | 63% | 27% |

Source: Credit Sesame quizzed 600 Members with a multiple choice test. The results illustrate which participants correctly answered the entire poll. Incorrect answers often included partially correct results. The survey was conducted April 2015 for two weeks.

Now that we know the importance of understanding your credit score, let’s jump a bit deeper into what a good credit score really is.

What is a good credit score?

To understand what a good credit score is, it’s important to know how it’s calculated. Each financial decision you make is either helping or hurting your score; by knowing how these decisions impact your score, you can make strategic moves to improve your credit.

Your credit score is made up of a variety of factors, some that impact it more than others.

FICO Scoring Model Calculation (Weight) Factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: Data found September 26, 2018. Boeing Employees Credit Union website. Understanding Your FICO Score. Retrieved from https://www.becu.org/articles/understanding-your-fico-score

As you can see from the graph above, your payment history accounts for roughly 35% of your score, your credit utilization makes up about 30% of your score, the age of your credit makes up 15%, and the mixture of the credit accounts you hold and the number of credit inquiries you’ve had recently each account for roughly 10% of your score. But what do those factors mean?

Here are some quick definitions to help you understand these factors:

- Payment history—Looks at whether or not you’ve been paying on time.

- Credit utilization—Looks at how much of your available credit you’re using.

- Credit age —Looks at the average age of your open credit accounts.

- Different types of credit —Looks at the mix of your various credit types.

- Number of inquiries—Looks at the number of inquiries into your credit history.

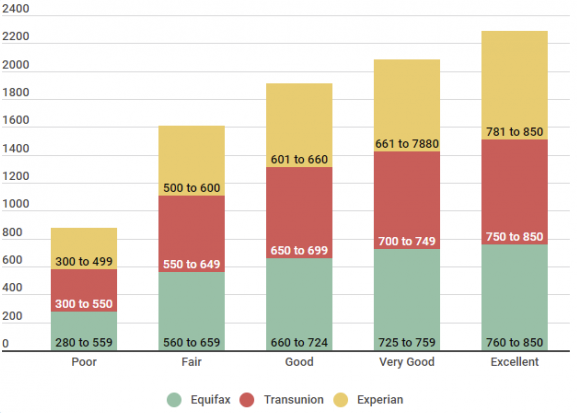

Now that you know what factors play into your score, let’s look at what “good credit” means from the three credit bureaus.

Credit Score Ranges: TransUnion (VantageScore 3.0), Equifax, Experian

| Rank | Equifax | Transunion | Experian |

|---|---|---|---|

| Poor | 280 to 559 | 300-550 | 300-499 (Deep Subprime) |

| Fair | 560 to 659 | 550-649 | 500-600(Subprime |

| Good | 660 to 724 | 650-699 | 601-660(Near Prime) |

| Very Good | 725 to 759 | 700-749 | 661-780(Prime) |

| Excellent | 760 to 850 | 750-850 | 781-850(Super Prime) |

Source: Data found October 3, 2018. Experian Information Systems website. Credit Score FAQs. Retrieved from https://www.experian.com/blogs/ask-experian/credit-education/faqs/credit-score-faqs, Equifax website. Equifax Credit Score Range ™ US Only. Retrieved from https://help.equifax.com/s/article/Equifax-Credit-Score-ranges-US-only, TransUnion VantageScore 3.0 model.

U.S. Population Categorized by the Five FICO Ranges for Credit Scores

| Age | < 580 | 580 - 669 | 670 - 739 | 740 - 799 | 800 > |

|---|---|---|---|---|---|

| Under 30 | 29% | 38% | 17% | 11% | 5% |

| 30 - 39 | 35% | 24% | 10% | 16% | 15% |

| 40 - 49 | 26% | 24% | 10% | 17% | 23% |

| 50 - 59 | 19% | 22% | 10% | 17% | 32% |

Source: We ran a survey of 550 US consumers in different age groups on 9/26/2018 to understand which credit score ranges they fell into.

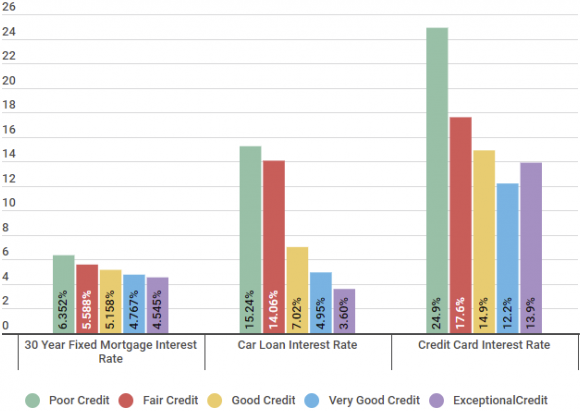

With all this being said, what is the real-world application? What does a good credit score get you when compared to those with poor or even excellent credit?

Good credit scores: Good for your wallet

While a good credit score isn’t the highest you can achieve, you’re still in a relatively good position when it comes to securing good interest rates and terms on some of life’s biggest purchases.

As you can see from the data below, someone with good credit can get good interest rates for a mortgage, car or credit card —but someone with very good or exceptional credit gets even better rates.

Average Interest Rates Divided by Credit Score Range

| Type of Loan | Poor Credit | Fair Credit | Good Credit | Very Good Credit | Exceptional Credit |

|---|---|---|---|---|---|

| 30 Year Fixed Mortgage Interest Rate | 6.352% | 5.588% | 5.158% | 4.767% | 4.545% |

| Car Loan Interest Rate | 15.24% | 14.06% | 7.02% | 4.95% | 3.60% |

| Credit Card Interest Rate | 24.9% | 17.6% | 14.9% | 12.2% | 13.9% |

Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning in January 18, 2018.

While the difference in interest rates may not seem that large, there is a big financial impact over the term of the loan. Say you’re applying for a 30-year mortgage for a $244,368 home. If you have fair credit, you could expect an interest rate of 5.588 percent —but if you have good credit, that interest rate drops to 5.158 percent.

While 0.4 percent doesn’t sound like much, it actually adds up to more than $22,000 over the lifetime of the loan —money that’s essentially flying out of your bank account thanks to your credit score.

If you have good credit and you still want to improve your score, there are some tried-and-true strategies to help make those improvements. Let’s look at a few in more detail.

| Related to " Good Credit Score " |

|---|

| Check your free Credit Score in less than 2 minutes. |

| Easily learn about how to freeze your credit from different bureaus. |

| Learn about the differentcredit score range models from different bureaus. |

| Learn about what the discover score card is and how it works. |

| Understand what qualifies as a good FICO score. |

| Learn how to fix your credit quickly in less than 90 days. |

How to improve a good credit score

Whether you’re trying to improve your credit score or simply want to employ some best-practices in order to keep your score in tip-top shape, there are a number of different strategies you should know. Below is a quick digest of some of the top strategies.

- Make consistent on-time payments —your payment history makes up roughly 35% of your FICO score and has the biggest impact on your score’s calculation.

- Improve your credit utilization —this is the amount of credit your using versus what’s available to you. Most experts agree that 10% is optimal, but you should strive to never go above 30%.

- Consider your mix of credit —your score also takes into account your mix of credit. This includes credit cards, store cards, mortgage loans, auto loans, etc.

- Keep your oldest accounts open —you may be inclined to close old accounts, but the age of your credit matters. In most cases, you should keep your oldest accounts open.

For more detailed strategies on how to improve your credit, you can read our recent article.

Sometimes, however, we learn better from example. Let’s take a look at how Credit Sesame member, Jeff, was able to improve his already good credit score.

How Jeff improved his already good credit score

Member Since: 1/19/2015

| We interviewed Jeff on May 2, 2017; he earns $63,000 a year is 43 years old and lives in Buffalo, New York. He is married and doesn’t have kids and is currently working as a videographer. |

|---|

| How were you able to improve your credit score? |

| My credit score wasn’t terrible to begin with (712) because I’ve been improving my credit score since before I bought my home in 2015. I improved my credit by researching how people with similar scores brought up their credit scores with the credit reporting companies. |

| What strategies did you use? |

| I decided to lower my credit utilization and pay down my debts in larger payments over a six month period. I was approved for a small loan from my local bank which had significantly lower rates than my credit cards, so I switched. I saved almost $8000 with this decision. The loan allowed me to free up my credit cards and reduced the debt-to-credit-ratio which gave my credit a small eight-point boost. The bank also agreed to report my regular payments to Experian, Equifax, and TransUnion which improved my score a couple points every few months. The most effective strategy by far is consistent, regular payments, budgeting, and patience. It took nearly three years for my credit score to reach its peak of 756. |

| How long did it take you to see a difference in your score? |

| My credit score moved up pretty fast after I shifted my credit card balance to a bank loan. It improved to 729 after about eight weeks. The untraditional reporting that my bank agreed to do for me aided in nudging my credit score up to its current position which took a total of 34 months to reach 761. |

Jeff’s story is a great example of how, even when we already have good credit, we can take steps to achieve an even better credit score.

Benefits of learning what a good credit score is

The benefits of learning about your good credit score and understanding your report are many. For one, if you understand your score, you’re able to make strategic improvements to boost your credit score into the next credit score range.

Furthermore, there is truth to the expression that “knowledge is power” —having an understanding about your good credit can place you a step ahead in trying to improve that score and will also give you the knowledge you need to make sound financial decisions.

TLDR; about the good credit score

A good credit score, using the FICO model, falls between 670 and 739. If you have a good credit score, you can easily get approval for various loans and credit cards, but you may pay a higher interest rate when compared to those who have very good or excellent credit.

Lenders will look at your score to make a judgment on your financial wellbeing, so it’s in your best interest to constantly work to improve your score. Understanding the definition of what a good credit score is —that’s just the beginning!