Credit Sesame discusses the recent Fed fund rate announcement and what it means.

The Federal Reserve made news by doing nothing. After raising interest rates in 10 straight meetings, the Fed announced it left rates unchanged after its most recent session. This decision made headlines, and the stock market responded with a strong rally the next day.

Doing nothing was greeted as big news because it signaled a possible end to the Fed’s war on inflation, which it has waged for well over a year. It would be good news for the economy if the period of fast-rising prices and higher interest rates is in its final stages.

Still, it is wise not to celebrate prematurely. The Fed is holding off raising rates again now, but there are clear reminders that the fight against inflation isn’t over.

Present and future fed funds rates

The Federal Open Market Committee (FOMC), the subgroup of the Fed that sets interest rates, is currently aiming to keep the Fed funds rate in a range of 5.0% to 5.25%.

Things were very different just a year and a half ago when the target range was 0% to 0.25%. Beginning in March of 2022, the FOMC raised interest rates by varying amounts in ten consecutive meetings for a total increase of 5.0%.

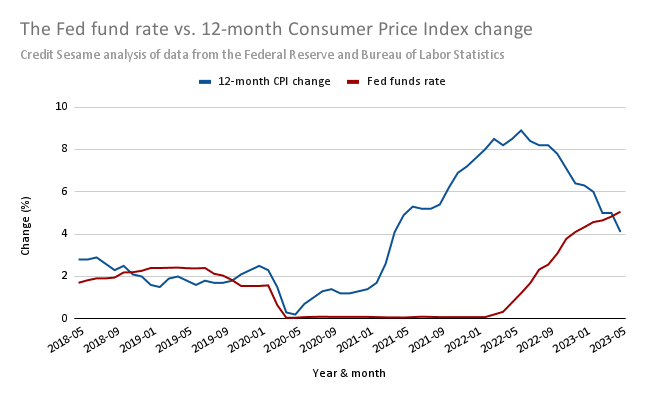

While that sounds like a steep increase, the Fed was trying to catch up with an even steeper rise in inflation. The 12-month Consumer Price Index (CPI) increase rose from a placid 0.2% as of May 2020 to a raging 8.9% in June 2022.

As the Fed has ratcheted rates higher, the inflation rate has begun to subside. With the Fed’s last rate hike in early May and a further drop in that month’s inflation rate, the Fed funds rate finally rose above the inflation rate.

May 2023 marked the first time since October 2019 that the Fed funds rate got on top of the inflation rate. Historically, the Fed funds rate has been higher than the inflation rate, but the past few years have been an exception. First, an usually low Fed funds rate and soaring inflation let the inflation rate get ahead. This didn’t change until just last month.

While the decline in the inflation rate is encouraging, the Fed may not be finished raising rates. Its economic projections for the remainder of this year show the Fed funds rate rising to 5.6%. This will depend on economic developments over the months ahead.

The Fed’s impact and its limits

The Fed’s interest rate increases are designed to take the edge off of inflation by cooling economic demand. There are limits to how much impact this has.

For one thing, consumers don’t always respond rationally to interest rate changes. For example, credit card debt reached a record high last year despite the Fed’s repeated interest rate increases.

Also, the Fed has to be cautious not to raise rates so much that it causes a recession. With anemic growth in the first quarter, the economy is fragile.

Another limitation of the Fed is that it does not control all consumer interest rates. While many credit card rates are set based on the Fed funds rates, loans generally are not. In particular, mortgage rates will be sensitive to signs of inflation regardless of what the Fed does. Given how long most mortgages are, lenders are very cautious about locking themselves into a rate of interest that might not keep up with inflation.

Fed funds rate and inflation

The key to the future of interest rates is not so much the Fed as inflation. That determines the decisions of the Fed and private lenders.

The downward trend of inflation is encouraging. In June of last year, the 1-year inflation rate was 8.9%. As of this May, it had fallen to 4.1%. So far this year, it’s running at a rate of just 3.5%.

Still, 3.5% is well above the Fed’s target of 2%. Also, inflation would be even higher except for a significant decline in energy prices. The energy component of CPI declined by 11.7% over the past year. That helped mask how stubborn inflation in other sectors is proving to be.

Food prices, for example, are up 6.7% over the past year. So-called core inflation, which excludes the food and energy sectors, is up by 5.3%. A high core CPI rate indicates that inflation has spread into many sectors of the economy. That will make it harder to tame.

The evolving role of credit risk

As influential as inflation is in driving interest rates, credit risk can also have a significant impact. That’s bad news since credit risk may be on the verge of playing a bigger role in the months ahead. Credit risk is the risk that borrowers won’t pay what they owe. If lenders think credit risk is high, they will demand higher interest rates to make up for it.

Credit risk hasn’t been much of a problem in recent years. Ironically, this was somewhat due to the pandemic. At first, the pandemic did a lot to suppress consumer spending. Then, government assistance was spread so widely that it included vast numbers of people whose incomes hadn’t even been affected by the pandemic. This allowed consumers to pay down debt.

As a result, credit risk measures such as credit card delinquency and charge-off rates fell sharply in 2020 and 2021. However, this started to reverse last year, and credit risk is returning to pre-pandemic levels. However, both interest rates and the amount of consumer debt are now much higher than before the pandemic. This heavier debt burden may push credit problems even higher.

Layering credit risk on top of persistent inflation means two things. First, it creates another reason for interest rates to remain elevated. Second, it makes it even more urgent for consumers to protect their credit scores. The people charged the highest rates will be those lenders view as the most risky.

If you enjoyed Fed hits pause on Fed funds rate: what now? you may like,

- What is the impact of inflation on consumer credit?

- Why Have Mortgage Rates Decreased and Credit Card Rates Increased?

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.