Credit reports can be quite confusing to people because there are three credit reporting agencies that provide different credit scores.

The main agencies in the United States are Experian, TransUnion and Equifax. Any time you go to the bank and apply for a loan, they will check your social security number through one of these credit agencies in order to determine your credit score. This will help them decide whether or not you are trustworthy and responsible enough to handle more debt.

But what’s the difference between Equifax, Experian and TransUnion? The credit reports that each agency issues may contain information in which the other two don’t have. Most of the information should be the same, but there could be differences caused by omitted or misreported data. The only way you are really going to know your true credit score is if you get a credit report from all three credit agencies and compare the information on each one together. By doing this, you can figure out which credit bureau has the inaccuracies and then file a request to have them changed.

Experian Credit Report

There are a few differences in the way Experian reports data versus the way the other two agencies report data. For example, people who pay their rent on time will have the payments reflected on their Experian credit report. But with the other two credit bureaus, these payments won’t be on their reports. The only data regarding rent payments that will show up is negative rent data, which is data that reflects missed rent payments. Of course, the property management company has to report the rent data for it to show up on any of them.

If you signed a lease with an obligation to make monthly payments for a specified period of time, then it will most likely show up on Experian. Experian credit reports also contain details about each transferred or closed account that you’ve had. These details include the month and year that these accounts will be taken off the credit report.

In other credit reports, the only date listed for closed accounts is the last reported status date on the account. To figure out when the closed account gets taken off the credit report, you need to add 10 years to its last reported status date. Experian saves you the trouble of having to add 10 years to figure this out. Visit Experian.com for more information.

TransUnion Credit Report

TransUnion provides credit reports that offer more details about employment than any other credit bureau’s credit report. The other two credit reports will just list the name of the applicant’s employer and nothing else.

TransUnion credit report will contain their employer’s name, position currently held and date they were hired. This information is important because it shows lenders how long the applicant has been with their current employer.

If you were to try and obtain a mortgage to purchase a house, the mortgage company is going to check the TransUnion credit report to see if you’ve worked at the same company for at least two years. They won’t get this information from Equifax or Experian credit reports because the date you were hired is not on those. Visit TransUnion.com for more information.

Equifax Credit Report

An Equifax credit report lists closed and open accounts separately from each other. As for the other two credit reporting agencies, they put all of the accounts together in alphabetical order.

People who are unsure of their financial situation will want to have an Equifax credit report, so they can clearly see which accounts are open and which accounts are closed. This will help them determine their total debt by examining all of the open accounts together.

The details of closed accounts can also be seen, such as why the account was closed in the first place. This helps lenders understand the outcome of the applicant’s past loans and debt obligations. Visit Equifax.com for more information.

Why do I have so many different credit scores?

If you thought having three different credit reports was confusing, try having hundreds of different credit scores! There are so many different credit scoring models out there, some more popular than others, but they all take your financial information into account in slightly different ways. This is why you have different scores. Let’s see how this affects you as a consumer.

Why you and your lenders are seeing different credit scores

If you and your lenders are seeing different credit scores then there’s a much simpler explanation. The likely reason your scores were different is either:

A) The credit reports pulled came from different credit bureaus and that means different credit data and a different credit scoring model, or…

B) If pulled from the same credit bureau it’s likely that two different scoring model versions were being used to calculate the scores.

Why you have so many different scores

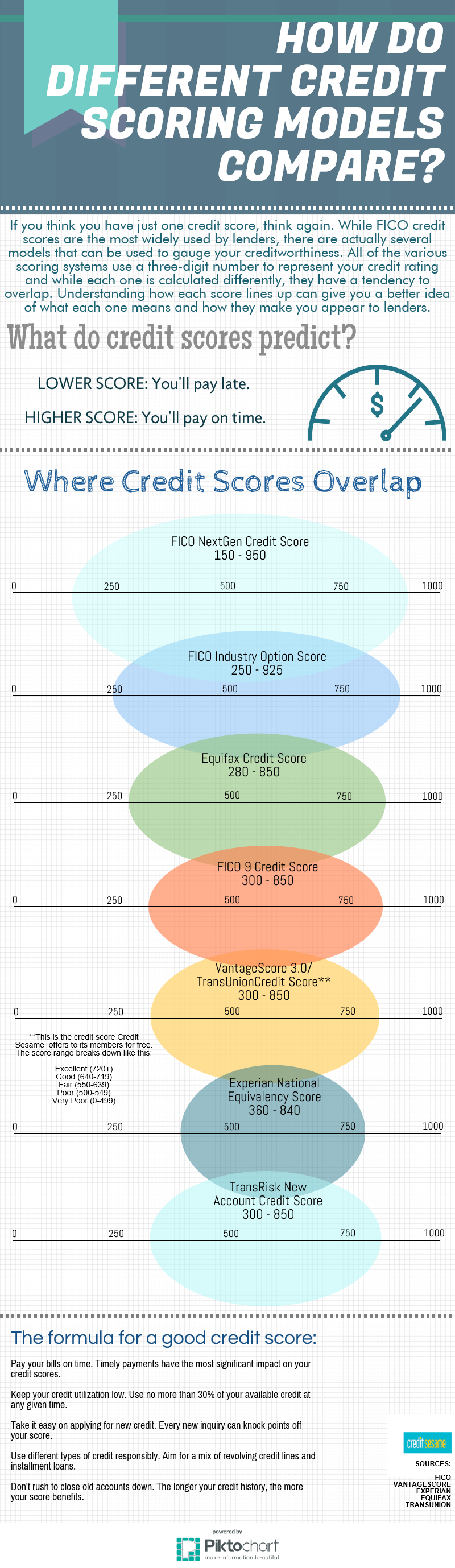

This will be easier to understand as I address the first portion of your question on why you’re getting different scores. The truth of the matter is that regardless of what you’ve heard, you have dozens of credit scores at each of the credit reporting agencies. In fact, there are some 60 different FICO score versions on the market, and several more built by VantageScore Solutions and the credit bureaus themselves.

There are several different generations of scoring software installed at each of the credit bureaus. Add to that the fact that there are several different score varieties in each generation and the number of score options starts to add up very quickly.

Which score and bureau a lender uses varies by lender

Lenders choose which credit bureau they’re going to use and they also choose the credit score brand and generation they’re going to use. The frustration is understandable, but the chances of you (or anyone else) seeing the exact same credit score as any of the lenders with whom you do business with, is remote.

Add to that the fact that as soon as something changes on your credit reports, like a balance on a credit card, all of your scores are likely to change.

Credit scoring models are similar, but definitely not the same

Think of the last time you went to your local grocery store and walked down the potato chip aisle. You have dozens or maybe even hundreds of options to choose from. They all, however, fall into the category of “chips.” And if you were to take a stroll down the aisle of a competing grocery store chain the selection might be similar, but definitely not the same.

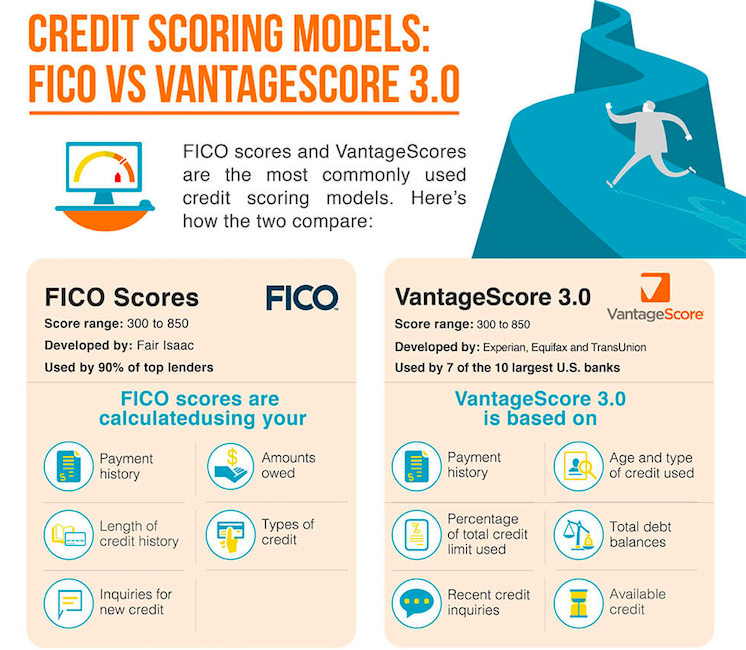

This is exactly how it is with credit scoring models. There are three “stores” that sell them (the credit bureaus) and the selection of scoring options is different at each of the three. You hear the phrase “FICO score” and “VantageScore” thrown around a lot but that only describes the brand name of the score — not the generation, score variety or credit bureau that provides it. So let’s explore those meanings a bit more.

FICO Score

You’ve probably heard of FICO, as it is one of the more recognized credit scoring models because it is used by many lenders. FICO’s credit scores are used by lenders and other types of companies as part of their risk and marketing practices. What you may not realize, however, is that you don’t have just one FICO score — you actually have closer to 65 FICO scores.

VantageScore

Another score you may have heard of is VantageScore, a credit score model built by VantageScore Solutions. VantageScore is used by some 2,000 lenders and one billion VantageScore scores were pulled by lenders in 2014. What you may not realize, however, is that you don’t have just one VantageScore score — you actually have nine VantageScore scores.

Equifax, TransUnion & Experian credit scores

In addition to these two commonly used scoring platforms you have to also include each of the credit bureaus’ own proprietary credit scores. Equifax has one called “ERS” (the Equifax Risk Score), TransUnion has one called the TransRisk score, which is more recently simply called the TransUnion Score, and Experian has one called the National Risk Score. Add up just the scoring models I’ve outlined so far and we all have 77 different credit scores.

TransUnion’s suite of scoring models includes 17 different scores, not including the FICO scores and VantageScores that they sell. Equifax’s suite includes eight different scores, not including the FICO and VantageScores that they sell.

Custom model credit scores

You also have to consider the hundreds of custom developed scoring models that lenders use, which are not the same as the various credit bureau based scores addressed above. The larger the lender, the more of these custom models they use. Some lenders use dozens of them. Multiply that by thousands of lenders and you can see how the number starts to spin out of control.

Free credit scores

The scores that you’re being given for free are FICO scores, VantageScore scores, TransRisk scores, or Experian National Risk Score scores. All of them are real credit scores, not the so-called “educational” or “FAKO” scores. They are all used by lenders as part of their risk management practices.

The right credit score to check

You ask, “Which is the right one to check?” The answer is — all of them are the right credit scores to check. The likelihood that you’ll get the exact same score and the exact same number that some lender in the future is going to get when you apply for credit is practically nil. You shouldn’t try to hit that bulls eye because you’re wasting your time.

Tip: Instead, you should claim as many free scores as you possibly can because they all tell a story about your creditworthiness. And, if you have a good credit report then every single one of your credit scores will be strong. If you have poor credit reports then all of your scores will be poor. And at the end of the day that’s really what’s important, not trying to find some mythical number that your auto lender is going to see in five months when you apply for a car loan.

To gain a better understanding of you scores, here is a helpful infographic that shows different credit scoring models and how they overlap: