If you’ve recently found out you have an 800 credit score or if you’ve heard that an 800 credit score is the holy-grail of credit scores, this article will explain what that means. In this article, we look at what an 800 credit score really is, how to achieve it, and more.

The basics of the 800 credit score

At the most basic level, your credit score is a three-digit number that helps lenders gauge your creditworthiness. As you can see from the data below, FICO scores (the most common scoring model) range from 300 to 850. While it’s just short of the elusive “perfect” 850, an 800 score is considered to be excellent and will likely qualify you for all the same benefits and interest rates that someone with an 850 receives.

FICO credit score ranges

| Credit Score Ranges | Credit Score Values |

|---|---|

| Exceptional Credit Score | 800 & Above |

| Very Good Credit Score | 740 - 799 |

| Good Credit Score | 670 - 739 |

| Fair Credit Score | 580 - 669 |

| Poor Credit Score | 580 & Below |

Description: Your FICO credit score is classified as one of five categories. Each category represents a numerical range within your credit score and is determined by several factors.

Source: Fair Isaac Corporation (myFICO.com).

But, what does a person with an 800+ credit score really look like? Below, we’ve put together a snapshot of the average consumer with an 800+ credit score.

Snapshot of Average Consumer with specific credit score range

| Credit Score Ranges | 800+ credit score |

|---|---|

| Average Total of Credit Card Limits | $30,000 |

| Average Credit Utilization | <15% |

| Average Length of Credit History | 17 years |

| Average Mortgage Interest Rate | 4.545% |

| Average Auto Loan | 3.60% |

Source: Credit scores were calculated from 5,000 Credit Sesame members on 3/11/18.

As you can see, people with an 800+ credit score are really “excelling” in each of the main factors that make up your credit score (more on that later). They’re keeping their credit utilization low, they have a long history of credit usage and, as a result, they’re getting excellent interest rates.

Let’s look at what else you can expect with an 800 credit score.

What can you expect if you have an 800 credit score?

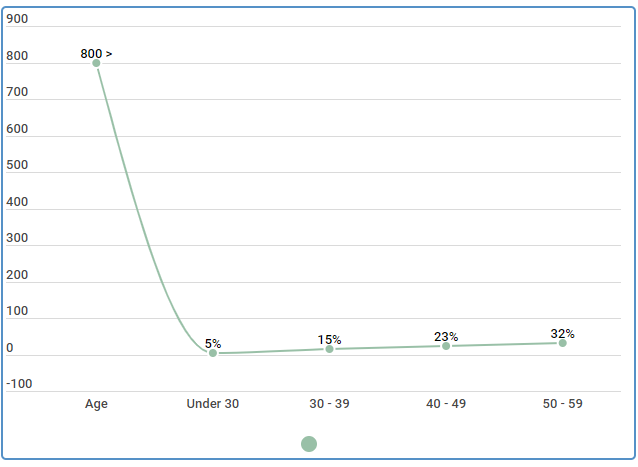

Having a credit score of 800+ puts you in a fairly elite tier of borrowers since only a small portion of the population falls into this range. As you can see from the data below, only 5% of the population under 30-years-old has an 800 or higher.

U.S. Population with excellent credit score

| Age | 800 > |

|---|---|

| Under 30 | 5% |

| 30 - 39 | 15% |

| 40 - 49 | 23% |

| 50 - 59 | 32% |

Source: We ran a survey of 550 US consumers in different age groups on 9/26/2018 to understand which credit score ranges they fell into.

It should be noted, however, that the percentage of the population that has an 800 or above increases with age. Of people aged 50 to 59-years-old, roughly 32% have an 800+ score. Some of that is no fault of the younger generations, as it is impossible to have a long history of credit when you have only had the ability to have a credit card for a year or two.

If your score is an 800 or above, you will certainly enjoy better interest rates on big purchases like mortgages and car loans. We’ll look at these rates in more detail shortly.

How to achieve an 800 credit score

| Free fico score |

|---|

| Free credit score |

| Wow to increase your credit score quickly |

| Best way to build credit |

| Excellent credit score |

| 650 credit score |

| Free credit report summary |

| Free annual credit reports |

If you aren’t a member of the 800+ club just yet, there is still time. Improving your credit score is actually easier than you may think. There are five main factors that contribute to the calculation of your credit score. As you can see below, each of these factors contributes differently.

For example, your payment history makes up 35% of your score, adversely number of inquiries only account for 10%.

FICO scoring model calculation (weight) factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: https://www.myfico.com/credit-education/whats-in-your-credit-score

If you focus on improving these factors above you will see an increase in your score. Here is a quick synopsis on what each of those factors mean:

- Payment History. Your payment history is the single biggest factor that contributes to your credit score. This shows potential lenders how often your payment have been on time — or if they have been late or missed.

- Credit Utilization. While this may sound complicated, your credit utilization is simply the percentage of your total available credit that you are currently using. This number is expressed as a percentage and, to keep the best score, you’ll want to keep your number below 30%.

- Credit Age. The age or length of your credit history also contributes to your score. To make the most of this factor, make sure to keep your oldest accounts open and in good standing.

- Credit Mix. Potential lenders like to see a mix of different credit types on your report, such as credit card accounts and an auto or mortgage loan.

- Number of Inquiries. While checking your credit score won’t hurt your account, hard inquiries, such as when you apply for a new credit card, will. Limit the number of hard inquiries on your credit to keep your score high.

If you’re interested in improving your credit score, we’ve written several articles that are more detailed about the various strategies you can use to see improvement.

Do you need an 850 credit score?

While it’s certainly ambitious to strive for a better credit score, nothing truly magical will happen if you jump your credit score from 800 to 850. With an 800 credit score, you’re essentially in the same “tier” as those with an 850—getting all the same interest rates and perks.

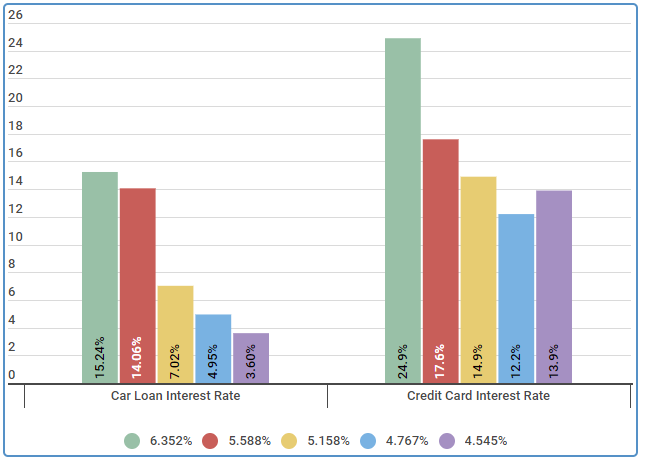

Interest Rate Ranges for Different Credit Score Ranks

| Type of Loan | Poor Credit | Fair Credit | Good Credit | Very Good Credit | Exceptional Credit |

|---|---|---|---|---|---|

| 30 Year Fixed Mortgage Interest Rate | 6.352% | 5.588% | 5.158% | 4.767% | 4.545% |

| Car Loan Interest Rate | 15.24% | 14.06% | 7.02% | 4.95% | 3.60% |

| Credit Card Interest Rate | 24.9% | 17.6% | 14.9% | 12.2% | 13.9% |

Source: Credit Sesame asked 400 members about their interest rates during a three week period beginning in January 18, 2018.

As you can see, people with an 800+ score are certainly achieving better rates than those with fair or even very good credit, yet there is little to no difference between 800 and 850, other than bragging rights.

Who has an 800 credit score?

Now that you know how to achieve an 800+ credit score and if you really need one, let’s take a deeper look into who actually has an 800 credit score.

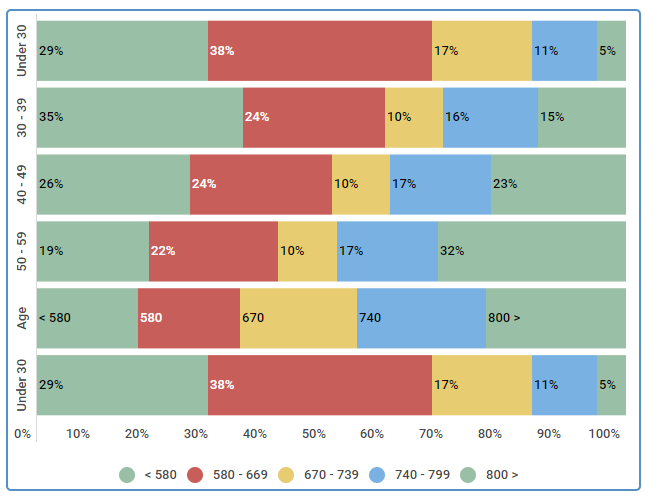

As we mentioned previously, only a small portion of the population achieves an 800+ score. The data below suggests that much more of the population actually has a score that falls below 669.

U.S. Population Categorized by the Five FICO Ranges for Credit Scores

| Age | < 580 | 580 - 669 | 670 - 739 | 740 - 799 | 800 > |

|---|---|---|---|---|---|

| Under 30 | 29% | 38% | 17% | 11% | 5% |

| 30 - 39 | 35% | 24% | 10% | 16% | 15% |

| 40 - 49 | 26% | 24% | 10% | 17% | 23% |

| 50 - 59 | 19% | 22% | 10% | 17% | 32% |

Source: We ran a survey of 550 US consumers in different age groups on 9/26/2018 to understand which credit score ranges they fell into.

Those who have a score of 800 or higher are generally in the 50 to 59-year-old range. This is not to say that you can’t achieve an 800+ earlier in life, however. Roughly 20% of the population that achieves an 800 or higher is under 39-years-old.

Benefits of an 800 credit score?

There are many benefits to having excellent credit. You’re more likely to have your financial applications approved. You’ll likely qualify for lower interest rates for loans and credit cards. You could pay little to no interest with some introductory credit card offers. You may be able to skip paying deposits on things like utilities or new cell phone contracts.

But, sometimes we learn better from real life stories. We spoke with Andrea to learn more about how her 800 credit score benefits her. Here’s her story.

Andrea has an 800 credit score and loves it

We spoke to Credit Sesame member, Andrea after she worked with Credit Sesame to increase her credit score to 800. Here she explains how she did it.

Member Since: 4/16/2017

| What | benefits | have | you | seen | from | having | an | 800 | credit | score? | ||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I was able to get a lower interest rate on my credit cards which allowed me to save money and therefore decrease the overall credit utilization which then improved my credit even more. I also was able to save up money from having a better interest rate so that I could take a two-week long trip with my family. I closed the newest card that I had and that was the final step to getting over 800, when I did that I treated myself to the car of my dreams. With such great credit, the interest on the used car loan was great and now I am driving everywhere in it. | ||||||||||||||

| Would | you | say | it’s | worth | it | to | try | to | improve | your | credit | score | to | 800? |

| Yes, it may have taken some time, and I had to learn how to do some things, but boy was it worth it. The trip that I took with my family and friends was so worth it. I also got to buy the car that I have wanted since I was young because of my hard work. | ||||||||||||||

| Are | you | actively | trying | to | improve | your | credit | score | (why | or | why | not)? | ||

| Not anymore, I took the trip that I had been dreaming about for so long, and I just bought the car of my dreams last month because of my great credit score. Am I going to just let it fall? No, but I am not going to actively work on it like I over the last year. |

Andrea’s story is a great example of how an 800 credit score can benefit you in more ways than you could probably imagine. For her reaching 800 was a means to an end to achieve specific goals. For others it is a never ending goal of just seeing how high you can get your credit score. Regardless of why you want to improve your score, Credit Sesame can help.

Conclusion & summary

To sum things up, an 800 credit score is considered to be excellent—the top tier of FICO scores. If you have an 800 credit score or higher, you’re in a great position for getting the best interest rates on big purchases like cars and homes, and certainly on credit cards. While only a small portion of the population falls into this score range, if you don’t yet have an 800 credit score, there are steps you can take to see improvement.