Chances are good that you’ve heard the term FICO Score, but do you really know what it is? Did you know that your FICO Score is only one version of a credit score? Or that FICO stands for Fair Isaac Corporation and that their algorithm produces your FICO Score? In this article, we’ll explore your FICO Score, including how it’s calculated, why it’s important, and more.

What is a FICO score?

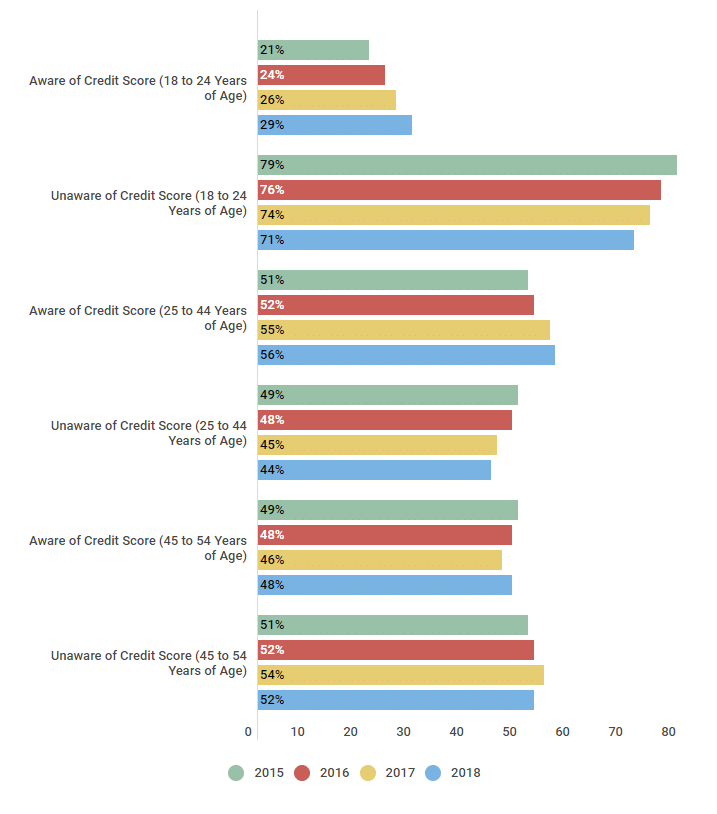

Your credit score can impact everything from the interest rates on your credit card to whether you get approved for a new apartment. And yet a significant portion of the population is completely unaware of their credit score and what it really means. Take a look at the numbers below:

Percent of Americans Who Know Their Credit Scores per Age Group and by Year

| Age Groups & Awareness | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|

| Aware of Credit Score (18 to 24 Years of Age) | 21% | 24% | 26% | 29% |

| Unaware of Credit Score (18 to 24 Years of Age) | 79% | 76% | 74% | 71% |

| Aware of Credit Score (25 to 44 Years of Age) | 51% | 52% | 55% | 56% |

| Unaware of Credit Score (25 to 44 Years of Age) | 49% | 48% | 45% | 44% |

| Aware of Credit Score (45 to 54 Years of Age) | 49% | 48% | 46% | 48% |

| Unaware of Credit Score (45 to 54 Years of Age) | 51% | 52% | 54% | 52% |

Source: We surveyed 200 participants in each age group, total of 600 participants yearly between 1/10/15 and 9/25/18.

Per our survey, in 2017, only 26 percent of 18- to 24-year-olds knew their credit score. The survey also showed this lack of awareness is not generational, as less than half (46 percent) of 45- to 54-year-olds were aware of their credit score.

Let’s take a look at what your credit score really means and why it is so important.

What is a FICO Score and why is it important?

The FICO Score was developed by FICO, a company that specializes in predictive analytics. Your FICO Score is based on information in your credit report and is calculated as a three-digit score that ranges from 300 to 850. This number tells potential lenders how likely you are to pay back money in a timely fashion.

What makes up your FICO Score?

To make matters more interesting, each of the main credit bureaus (TransUnion, Equifax, Experian) produce their own versions of a credit score, all of which are based on either the FICO model or a model they created, the VantageScore. Regardless of the model used, some common factors go into calculating your score. Let’s look at those below.

FICO Scoring Model Calculation (Weight) Factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: MyFico.com https://www.myfico.com/credit-education/whats-in-your-credit-score

Data found September 26, 2018. Boeing Employees Credit Union website. Understanding Your FICO Score. Retrieved from https://www.becu.org/articles/understanding-your-fico-score

It’s important to note that the scoring calculation behind FICO scores changes every few years. Although a new version may roll out in a certain year, that doesn’t necessarily mean that all lending organization will automatically switch over to the latest version overnight.

Payment history

Your payment history accounts for 35 percent of your score, making it the single biggest contributor. For this reason, it is important to always pay your bills on time. Even one payment that is 30 days late can have a significant negative impact on your score. How much you pay is not a factor–as long as you pay at least the minimum amount due–and consistently paying on time will put you on the path to building a solid credit score.

Credit utilization

The second most important factor in your score, with 30 percent of the total is your credit utilization. Credit utilization can be thought of as a simple ratio—the total amount of debt you owe compared with the total amount of your combined credit limits. The lower your credit utilization, the higher your credit score—and the more appealing you will be to potential lenders. We suggest keeping this number lower than 30 percent. In fact, the best credit scores often reflect a credit utilization of less than 10 percent.

Credit age

Your credit age or the average age of your open accounts also plays into your score. Potential lenders like to see a long-standing and responsible use of credit, so it’s good to demonstrate a solid use of the same accounts over a number of years.

Credit mix

Lenders also like to see a mix of different types of credit on your report. It’s good to show a history of responsibly using more than one type of credit, such as credit cards and an auto loan or a student loan. While it only represents 10 percent of your total score, having a good credit mix is an easy way to bump it up.

Number of credit inquiries

The number of hard inquiries you have contributes to the final 10 percent of your credit score. Hard inquiries occur when a lender checks your credit report in response to your request for a loan or a new credit card. Hard inquiries have a negative impact on your score. However, when you check your own credit, you are performing a soft inquiry, which does not have any effect on your score. In fact, we recommend checking your credit regularly.

FICO Score vs. credit score: What’s the difference?

Now that you have a better understanding of a FICO Score, you may wonder how it differs from other types of credit scores. The short answer is, your credit score is the product, and FICO is the brand. Consider tissue: regardless of the brand, many people refer to tissue as Kleenex; however, Kleenex is a brand name, just like FICO is. So while all Kleenex are tissues, not all tissues are made by Kleenex.

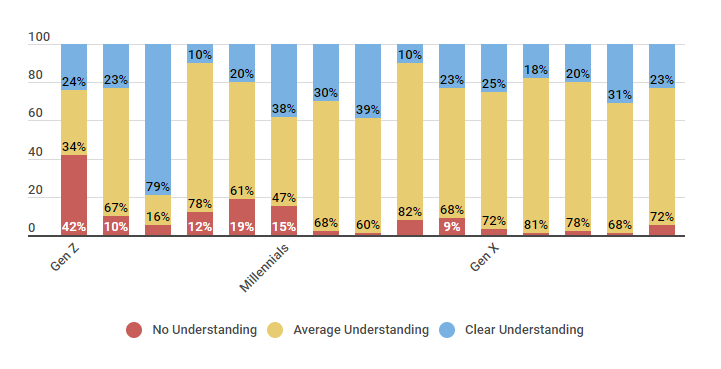

The data below shows consumers’ understanding of the FICO Score model and the various factors that contribute to it.

Percentage of Americans Who Understand FICO Scores

| Generation | Credit Concept | No Understanding | Average Understanding | Clear Understanding |

|---|---|---|---|---|

| Gen Z | Credit Utilization | 42% | 34% | 24% |

| Account Age | 10% | 67% | 23% | |

| Payment History | 5% | 16% | 79% | |

| New Credit | 12% | 78% | 10% | |

| Credit Mix | 19% | 61% | 20% | |

| Millennials | Credit Utilization | 15% | 47% | 38% |

| Account Age | 2% | 68% | 30% | |

| Payment History | 1% | 60% | 39% | |

| New Credit | 8% | 82% | 10% | |

| Credit Mix | 9% | 68% | 23% | |

| Gen X | Credit Utilization | 3% | 72% | 25% |

| Account Age | 1% | 81% | 18% | |

| Payment History | 2% | 78% | 20% | |

| New Credit | 1% | 68% | 31% | |

| Credit Mix | 5% | 72% | 23% |

Source: We surveyed 300 US consumers on 9/5/18 during a time period of two weeks; each generation we surveyed had 100 participants.

The understanding of the specifics of the model tends to trend upward — in other words, the older generation seems to have a better understanding of the various factors. For instance, only 3 percent of Gen X has no understanding of credit utilization, but 42 percent of Gen Z report having no understanding of what that means.

FICO’s biggest competitor is VantageScore, which has its own algorithm for calculating scores, although FICO is by far the most widely used and accepted model.

Commonly Asked Questions

Credit Sesame Member: Jim S.

Location: Boise, Idaho

Member Since: 6/18/2016

| What's | the | difference | between | a | FICO | score | and | a | VantageScore? |

|---|---|---|---|---|---|---|---|---|---|

| FICO and VantageScore are two different models that calculate credit scores, but they each do it using their own methods, with different factors and weights. | |||||||||

| Why are there so many FICO Scores, and what are they used for? | |||||||||

| FICO uses different equations based on the type of loan you are seeking. They are always used to assess your credit by looking at your history with loans, credit cards, and lenders. | |||||||||

| How | are | the | FICO | Scores | calculated? | ||||

| The FICO Scores are calculated based on your payment history, the amount owed, length of history, new credit and types of credit used. This is why it's so important to make payments on time and to have a good credit mix. | |||||||||

| What | doesn't | go | into | my | FICO | Score? | |||

| Discriminatory criteria, such as your age, your employment history, your interest rates, your address, and whether or not you are receiving credit counseling have no impact on your FICO Score. |

What are the FICO Score ranges?

There are nearly 50 versions of FICO Scores, and each version serves a unique purpose. Typically, FICO Scores range from 300 to 850, with higher scores representing less risk to the lender.

FICO Credit Score Ranges

| Credit Score Ranges | Credit Score Values |

|---|---|

| Excellent Credit Score | 800 & Above |

| Very Good Credit Score | 740 - 799 |

| Good Credit Score | 670 - 739 |

| Fair Credit Score | 580 - 669 |

| Poor Credit Score | 580 & Below |

Source: Fair Isaac Corporation (myFICO.com), sourced October 2018.

When it comes to credit score ranges, falling into the Good range versus the Fair or Poor range can have a profound impact on your ability to get a loan or a good interest rate. An increase or decrease in your score does not have a significant impact if your score remains in the range. That said, if you are at the bottom of the range, any drop in score may move you to a lower range, which will impact your score. If you’re at the top of the range, you’re very close to the next range, so a small improvement will help you get better rates.

| Related to "FICO Credit Score" |

|---|

| Main Credit Bureaus |

| Improve Your Credit Score |

| Good Credit Score |

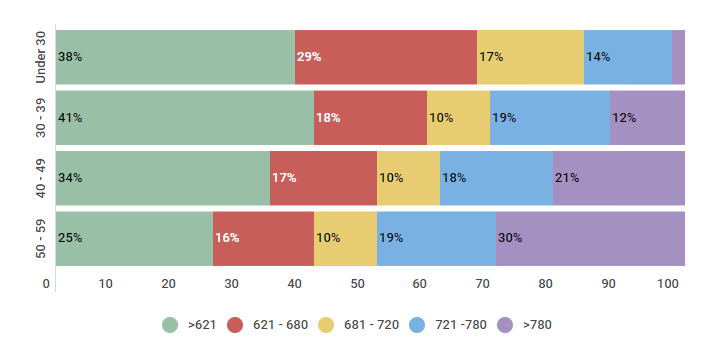

FICO Scores by age: How do you compare?

If you’re wondering how your FICO Score compares with others in your age bracket, the data below may help. As you can see, wisdom and correlating and higher FICO Scores seem to come with age. Most U.S. consumers under the age of 30 have an average FICO Score of less than 621. Similarly, most consumers under 49 fall into that same FICO range as well.

U.S. Population Divided by FICO Score Ranges

| Age | >621 | 621 - 680 | 681 - 720 | 721 -780 | >780 |

|---|---|---|---|---|---|

| Under 30 | 38% | 29% | 17% | 14% | 2% |

| 30 - 39 | 41% | 18% | 10% | 19% | 12% |

| 40 - 49 | 34% | 17% | 10% | 18% | 21% |

| 50 - 59 | 25% | 16% | 10% | 19% | 30% |

Source: Credit Sesame surveyed 550 US consumers in different age groups on 9/26/2018 to analyze their credit score ranges.

What is a good FICO Score?

Generally speaking, a FICO Score of 669 or higher is considered a Good credit score. Consumers with a score of 740 or above will get the lowest rates when borrowing money and, depending on the state of residence, may also get the best insurance rates.

How long does it take to move from one credit tier to another?

If you’re thinking about taking actions to improve your credit score, it can be helpful to understand how long, on average, it takes to move from one credit range to another. According to results of a Credit Sesame survey, the fastest move is from average Good to Excellent credit at seven months. It takes a bit longer to move from Fair to Good credit, topping out at 14 months (on average). Of course, if your credit score is on the border of two ranges, then it’s much quicker to jump into the next range.

Average Time to Move from One Credit Range to Another

| Credit Score Range (Start) | Credit Score Range (End) | Average Time Taken |

|---|---|---|

| Poor Credit Score | Fair Credit Score | 8 Months |

| Fair Credit Score | Good Credit Score | 14 Months |

| Good Credit Score | Excellent Credit Score | 7 Months |

Source: We surveyed 455 consumers over the course of 24 months (2/15/2016 to 2/15/2018) to understand on average how long it takes to move between credit ranges.

These numbers are dependent on many factors. One of the reasons why the average length is longer for those with Fair credit is because items found on credit reports may not be such that have quick resolutions. If you have Good credit, then you are already on the way towards improving, and so by changing tactics a small bit can show a dramatic improvement, which may not be possible with lower credit scores.

Benefits of learning about your FICO Score

To recap, your FICO Score gives potential lenders an idea of your creditworthiness. By learning about your FICO Score and all of the factors that contribute to it, you will be better prepared to make sound decisions with your credit.

TLDR; what’s a FICO score and why does it matter?

Creditors and lenders use credit scores to help them both evaluate prospective customers and better manage their current customer base. Understanding your credit score will help you build better credit, which can help you save money by getting the best rates and terms on a loan or a credit card.