Wondering how to build your credit at 18? From what goes into your credit score and how to build your credit, to tips to keep your great score, we’ve got you covered. Read on to find out more.

Building your credit score at 18

Turning 18 is one of those major rites of passage in life. You’re finally an adult, you can vote… and you can get your first credit card. Sounds great, right? The problem is that in order to get credit, you usually have to have credit — so where do you begin?

Why should you know how to build your credit?

At the most basic level, your credit scores tell potential lenders how trustworthy you are, based on your history with spending. More than that, your credit score will play a large role in just about every large purchase throughout your adult life — everything from buying a car or a house to applying for a job can be impacted by your credit score. As such, it’s crucial that you know how to build and maintain a good, solid credit history.

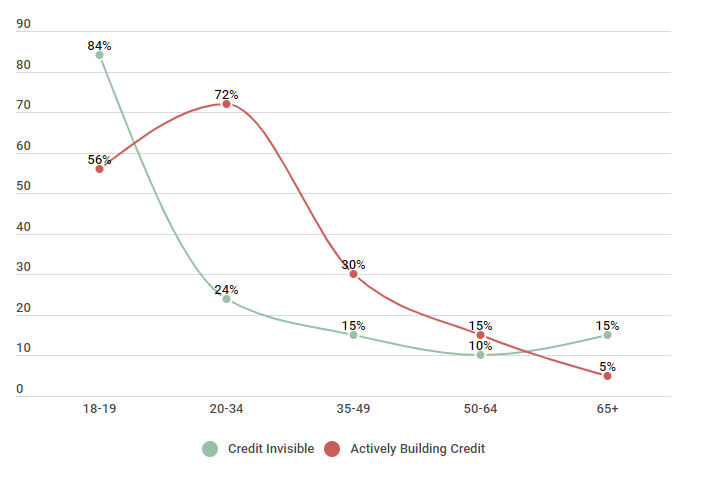

Americans without a Credit Score & Those Working to Build Credit

| Age | Credit Invisible | Actively Building Credit |

|---|---|---|

| 18-19 | 84% | 56% |

| 20-34 | 24% | 72% |

| 35-49 | 15% | 30% |

| 50-64 | 10% | 15% |

| 65+ | 15% | 5% |

Source: The CFPB Office of Research, “Data Point: Credit Invisibles.” https://files.consumerfinance.gov/f/201505_cfpb_data-point-credit-invisibles.pdf

However, as you can see above, the vast majority of 18-year-olds are credit-invisible, meaning that they have no credit history established with any of the 3 major credit bureaus (Equifax, Experian, and TransUnion). This can present a major problem when trying to finance any large, expensive item or even rent an apartment.

How to build your credit at 18

If you’re 18 and trying to build your credit, good for you. This is an important first step toward a secure financial future. Fortunately, there are some simple tips that you can use to make sure that you get off on the right track.

The average credit score for 18-year-olds is 631. Let’s take a closer look at how this number compares to various generations below.

Comparing Credit Score by Generation

| Age Group | Avg. Credit Score |

|---|---|

| Gen Z | 631 |

| Millennials | 634 |

| Gen X | 655 |

| Baby Boomers | 700 |

| Silent Gen | 730 |

Source: We surveyed 2,500 people in the United States on 9/2/2018.

So, what are some steps you can take to help build your credit quickly? Here are a few tried and true tips you may want to try.

Become an authorized user

While your age doesn’t have a direct effect on your credit score, it does mean that you won’t have a lengthy history. Becoming an authorized user on someone else’s account, such as a parent, means that you will automatically benefit from the age of their credit history.

The primary cardholder is still responsible for making the payments, so choose someone who has good credit and proven responsible credit history. You should also make sure that the credit card company reports authorized user activity to the credit bureaus, so that you get credit.

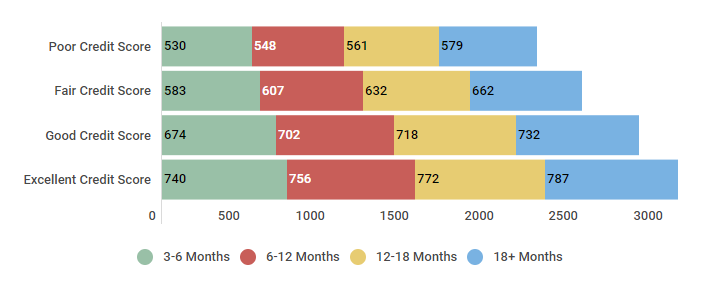

Building credit as an authorized user

| Credit Score over time | 3-6 Months | 6-12 Months | 12-18 Months | 18+ Months |

|---|---|---|---|---|

| Poor Credit Score | 530 | 548 | 561 | 579 |

| Fair Credit Score | 583 | 607 | 632 | 662 |

| Good Credit Score | 674 | 702 | 718 | 732 |

| Excellent Credit Score | 740 | 756 | 772 | 787 |

Source: Review of individuals who used specific methods to build credit

As you can see from the chart above, this is a great strategy to use — especially if you are starting out with a fair credit score. Credit Sesame members in this range saw their credit score jump nearly 80 points in just 18 months by using this strategy.

Take out a credit builder loan

A credit builder loan, available from a bank or credit union, allows you to borrow money that sits in a savings account, which you will have access to at the end of your loan term. You will need to be able to show an income as proof that you can afford the payments, so consider choosing a small loan. As you make your payments on time toward your loan, the bank will report your activity to the credit bureaus. Not only will you end up with better credit in the long run, you’ll also end up with nice savings — and who couldn’t use that?

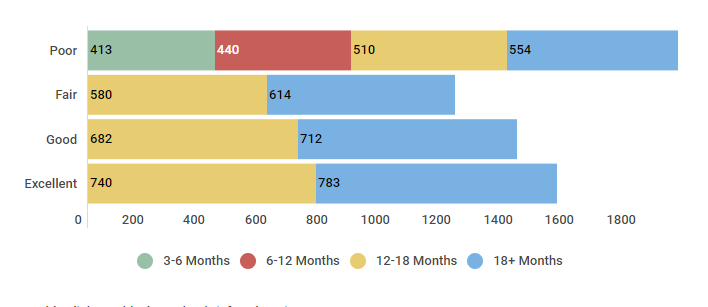

Building credit with a credit building loan

| Credit Score over time | 3-6 Months | 6-12 Months | 12-18 Months | 18+ Months |

|---|---|---|---|---|

| Poor | 413 | 440 | 510 | 554 |

| Fair | N/A | N/A | 580 | 614 |

| Good | N/A | N/A | 682 | 712 |

| Excellent | N/A | N/A | 740 | 783 |

Source: Review of individuals who used specific methods to build credit.

Based on the data, it’s clear that this strategy can take some time to work, especially if you have fair, good, or excellent credit. However, if you have poor credit, this can be a good way to jump-start your score, with users in this range reporting an improvement of nearly 100 points in just 12-18 months.

| Related to "Build Credit at 18" |

|---|

| Free Credit Score |

| FICO Score |

| Building Credit |

| What's a Credit Score |

| Whats The Highest Credit Score |

| Good FICO Score |

Get a secured credit card

While they look just the same, a secured credit card is very different from a regular credit card in that it requires an upfront, refundable deposit, usually somewhere between $200 and $2,000, that will become your credit limit. If you default on your payments at any point, the financial institution simply takes the amount out of your deposit.

To avoid paying additional interest fees and to build your credit as quickly as possible, be sure to pay off your full balance each month. Once you have a score that is in the mid 600s or higher, you can apply for a traditional, unsecured credit card.

Be sure to ask the financial institution if they report account activity to the credit bureaus — you want to make sure they do; otherwise, this won’t be any benefit to you.

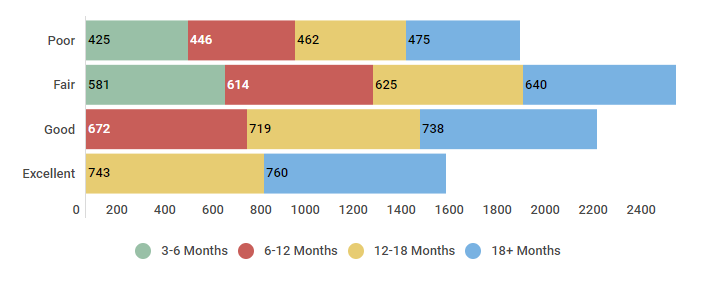

Building credit with a secured credit card

| Credit score over time | 3-6 Months | 6-12 Months | 12-18 Months | 18+ Months |

|---|---|---|---|---|

| Poor | 425 | 446 | 462 | 475 |

| Fair | 581 | 614 | 625 | 640 |

| Good | N/A | 672 | 719 | 738 |

| Excellent | N/A | N/A | 743 | 760 |

Source: Review of 400 individuals who used specific methods to build credit. Study conducted February 2015 until March of 2017.

A secured credit card can be a great way to build credit, especially if you currently have fair credit. In 18 months, these consumers saw an average increase in their credit score of nearly 60 points.

Factors in your credit score

Now that you’re working to build your credit history, keep in mind that there are several factors that contribute to your credit score. For the purposes of this article, we’re going to look at the factors that contribute to your FICO score, since it is the most commonly known and widely used scoring method. Your FICO score is based on the following factors:

- Payment history. Your payment history is the single biggest factor that contributes to your credit score, so it’s important to take it seriously. For the best credit score, make all of you payments on time — every time.

- Credit utilization. Your credit utilization also plays a large role in your credit score. Basically, your credit utilization is the percentage of your total credit that you’re currently using. Experts recommend keeping this number below 30%, although the best scores typically have a credit utilization below 10%.

- Credit age. The age of your credit also impacts what score you will have. Lenders want to see a long-standing and established history with credit, so always keep your oldest accounts open.

- Different types of credit. Lenders also want to see a healthy mix of credit types. For instance, if you only have a student loan, consider adding a credit card. Alternatively, if you only have credit cards, consider adding an auto loan or a credit builder loan.

- Number of inquiries. While it only contributes to 10% of your score, the number of inquiries on your credit can have a negative impact on your score. While checking your credit yourself, known as a soft inquiry, won’t harm your credit, a hard inquiry, such as when you apply for a new credit card does. Always try to limit the number of your credit applications for the best score.

Here’s a breakdown of how these factors stack up to each other:

FICO scoring model calculation (Weight) factors

| Credit Factors | Credit Score Weight |

|---|---|

| Payment History | 35% |

| Credit Utilization | 30% |

| Credit Age | 15% |

| Different Types of Credit | 10% |

| Number of Inquiries | 10% |

Source: https://www.myfico.com/credit-education/whats-in-your-credit-score

Now that you know what goes into a credit score and how to build your best score, let’s look at how to maintain your score.

Tips to maintain a good credit score

So now you’ve established your credit history and you’ve got a good score, you may be wondering how you keep it there. Fortunately, following a few simple steps can help ensure that your credit score stays where you want it.

Make sure you make all of your payments on time, keep your credit utilization low, carry a mix of different credit types, hold on to your oldest accounts, and keep your hard credit inquiries to a minimum.

Also be sure to check your credit on a regular basis, as this will help you spot any inaccuracies or outdated information and you can take care of it before the error does too much damage. You can do this for free through Credit Sesame.

We talked to Credit Sesame member, Keilani, about how she’s already working to build her credit at 18. Here’s her story.

Keilani at 18 is already building her credit

Member Since: 9/1/2018

| We interviewed Keilani on September 25, 2018; she is 18 and lives in Honolulu, Hawaii. She works part-time at the international marketplace before college starts and makes $10.10 an hour. | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| We noticed you just joined, what prompted you to build your credit? | ||||||||||||

| I took a business class in high school when I was 16 and learned about the importance of credit scores and how they can influence your entire financial life. I did not want to be dependent on someone else for loans or credit cards so I set a goal to have a good credit score by the time I graduated. I heard from a customer about Credit Sesame and so I decided to check it out. I am so happy I did. | ||||||||||||

| What | is | your | credit | score | and | how | have | you | been | building | your | credit? |

| My credit score right now is 752, which is very good but not where I want it to be. I would like it to be excellent, but I understand with my limited credit history that would be difficult. After my class, I talked to my parents about adding me as an authorized signer on their credit card, which they did, somewhat reluctantly. They had every right to be worried, not all teenagers are responsible with money. Last summer I began working and at the beginning of my senior year, I asked my parents to co-sign on a very small loan for a car. Because of the money I saved up, I was able to make payments every month, and now it is almost paid off. | ||||||||||||

| So | what | do | you | plan | to | do | to | continue | building | your | credit? | |

| I plan on living at home during at least the first year of college, so I am going to save money that way. I am also going to apply for my own credit card. Because college is expensive I had to take out a student loan, which with my other loans will help to diversify my credit portfolio, and will continue to build my credit. I know it won’t be easy, but my goal is to have excellent credit before I graduate college so I can do anything I want. |

Keilani’s story is important because it shows the clear benefits of having a plan to establish and build credit early on.

Benefits of building your credit early

As we mentioned earlier, and as Keilani referenced, your credit history and your credit score touch nearly all aspects of your adult life. Whether you want to buy a new car, lease an apartment, buy a house, sign up for a credit card (and more), you will need an established credit history.

Building your credit early will give you a head start — not only will it give you greater purchasing power, you will also enjoy the benefits of lower interest rates and better loan terms, saving you a significant amount of money.

Conclusion & Summary

To sum it up, establishing good credit early on is one of the smartest decisions that you can make for your financial future. Fortunately, there are a number of ways to get your credit history moving in a positive direction — applying for a secured credit card, becoming an authorized user on your parents’ existing account, keeping your credit utilization low, and making all of your payments on time. With a little hard work and dedication now, you will be enjoying the benefits of your good credit for years to come.