When you’re trying to buy a house, mortgage lenders tend to rely heavily on your credit score in determining whether or not you will qualify for a mortgage loan. Typically, lenders consider scores in the mid-700s and above to be quality scores for lending purposes; however, qualifying for a mortgage and purchasing a house with a lower credit score, such as 550, is possible. Read on to find out more, including some tips to help you get qualified.

Buying a house with a 550 credit score

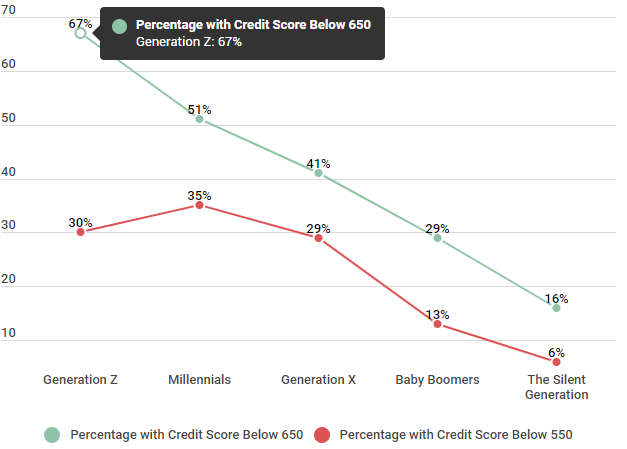

As you can see from the data below, there is a large number of Americans who have below-average credit. If you’re in this group and are trying to purchase a home, rest assured that not all hope is lost. While qualifying for a mortgage and purchasing a house will likely prove to be more challenging, it is still entirely possible to qualify for a loan under these conditions.

If you have a low credit score, you are not alone, in fact depending on age, upwards of 35% have credit that is considered bad.

Consumers with a Credit Score Below 650 Categorized by Generation

| Age Group | Percentage with Credit Score Below 650 | Percentage with Credit Score Below 550 |

|---|---|---|

| Generation Z | 67% | 30% |

| Millennials | 51% | 35% |

| Generation X | 41% | 29% |

| Baby Boomers | 29% | 13% |

| The Silent Generation | 16% | 6% |

Source: A poll was conducted among 750 American consumers. The study was conducted between February of 2017 and December of 2017.

Wondering how to qualify for a mortgage loan with a credit score of 550? Here are some things you should keep in mind.

Things to consider for home loans with a 550 credit score

Fortunately, there is a lot more than just a credit score that goes into purchasing a house. There are lenders that will loan you money with this type of score, but you will almost certainly need to meet their other criteria. Read on to find out more about purchasing a home with your 550 credit score.

Shop around for your mortgage

The first thing you will want to do is to call several mortgage lenders (make sure they are licensed in your state). In doing your research, shop around to get the best deals — in other words, the best interest rates and the lowest closing costs.

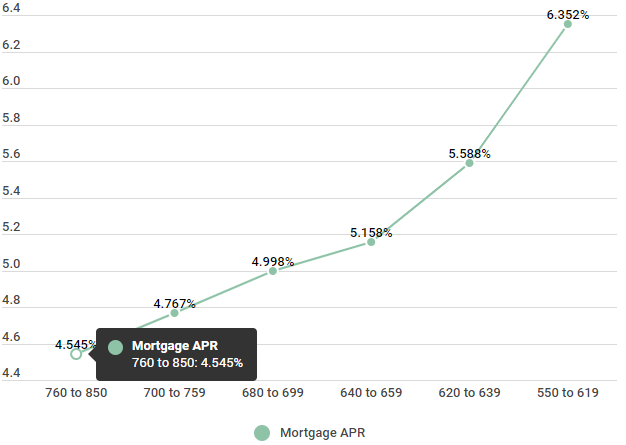

Here’s an idea of what you can expect to pay in interest, based on your current FICO score. As you can see, with a credit score of 550, you are paying a significant amount more in interest than someone with very good or excellent credit — for the very same house.

Mortgage Interest Rates & FICO Score Ranges

| FICO Score | Mortgage APR |

|---|---|

| 760 to 850 | 4.545% |

| 700 to 759 | 4.767% |

| 680 to 699 | 4.998% |

| 640 to 659 | 5.158% |

| 620 to 639 | 5.588% |

| 550 to 619 | 6.352% |

Source: We asked 1,000 Americans on 3/14/2018 who monitor their FICO score and requested they provide their credit score and starting APR rate when they got their mortgage.

2 percent may not seem like a lot, but when you look at it over the span of a 30 year loan, it can mean over $100,000 extra in interest fees. With this in mind, it’s easy to see why your credit score is so important. If you are able to improve your credit score, you can also consider refinancing your mortgage — with better terms and interest rates.

Consider an FHA loan

When talking to potential lenders, be sure to ask them if they originate loans insured by the Federal Housing Administration. The loans, backed by the FHA, are available to any borrower with a credit score of 500 or higher. In other words, if your score is 550, you can apply for an FHA loan that only requires a down payment of 10 percent of the home’s purchase price.

Keep in mind, however, that mortgage lenders don’t have to automatically approve you for this type of loan even if you do meet the requirements and guidelines set by the federal government. Lenders reserve the right to reject your loan application if they feel you are an especially risky borrower.

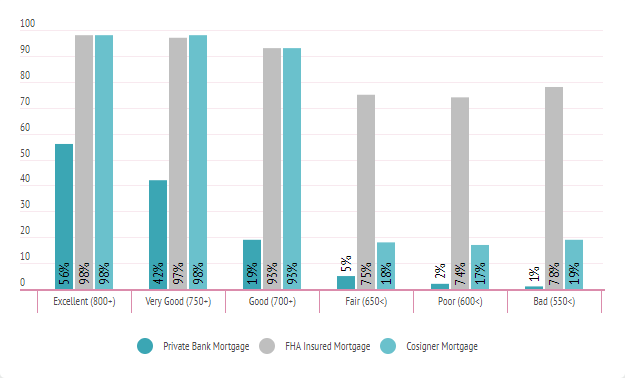

To give you an idea of the options that are on the market, we looked at some of the mortgage loan options that are available to consumers with low credit scores, as well as the percent of applicants who were approved with various credit score ratings.

It’s easy to see that, across the board, FHA insured mortgage loans offer the highest qualifications, regardless of your credit score. For instance, 78% of consumers with a credit score of 550 (or lower) were approved for an FHA insured mortgage loan — while only 2% of these same consumers were approved for a private bank mortgage.

| Free credit score |

|---|

| Auto loan rates by credit score |

| Buying a house with bad credit |

| Personal loan with 520 credit score |

| Whats the highest credit score |

| What is an excellent credit score |

Mortgage Loan Options for Consumers with Low Credit Scores

| Credit Ranking | Private Bank Mortgage | FHA Insured Mortgage | Cosigner Mortgage |

|---|---|---|---|

| Excellent (800+) | 56% | 98% | 98% |

| Very Good (750+) | 42% | 97% | 98% |

| Good (700+) | 19% | 93% | 93% |

| Fair (650<) | 5% | 75% | 18% |

| Poor (600<) | 2% | 74% | 17% |

| Bad (550<) | 1% | 78% | 19% |

Source: The survey included 600 Homeowners with credit scores of 650 and below. The study divided respondents by credit ranking and asked them about how they financed their homes. The poll was taken in June of 2016.

Gather your documents

Before meeting with a lender, you will want to make copies of all important financial documents — this way, lenders can use them to verify your reported totals for gross monthly income and monthly debts. Documents you will want to include are:

- Your last 2 pay stubs (or more)

- At least 2 months worth of account statements from your bank

- Your income tax returns from the past 2 years

- Your most recent credit card statements/bills

If you have a lower credit score, these documents will be especially important. Typically, lenders will want to see that the sum of your monthly debts (including your potential new mortgage payment) equals no more than 36 percent of your gross monthly income. If your debts are higher, lenders may fear that you’re at greater risk of defaulting on your mortgage loan, making it less likely for you to be approved.

But don’t take our word for it. Here’s what Credit Sesame member, Sam, had to say about how an FHA insured mortgage loan helped him buy a home with poor credit.

How a FHA Insured Mortgage Helped Sam Buy a Home With Poor Credit

Member Since: April 20, 2017

We interviewed Sam on January 14, 2017; he earns $54,000 a year is 30 years old and lives in Columbus, Ohio. He is single and doesn’t have kids and is currently working as a data analyst.

| What sort of loan did you go with for your house (FHA, other, etc)? | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| I had really poor credit (558) but I’d been saving for a down payment on a house since I graduated from college. I had above 16 percent of my down payment ready to go. I decided to go with an FHA loan because it seemed the most likely way to be approved for a mortgage. My low credit score and down payment made me a prime candidate for a Federal Housing Administration insured mortgage. The lender did warn me that I could pay up to six percent in closing costs which reduced my down payment to 10 percent. | ||||||||||||

| What | sort | of | documents | did | you | bring | when | meeting | with | your | mortgage | lender? |

| There was so much paperwork. I brought my pay stubs, bank statements (debit and savings), my driver’s license, passport, and a rental history document. | ||||||||||||

| Did they ask for anything that you didn’t have? | ||||||||||||

| I didn’t realize they needed copies of my monthly utility bills and proof of residence. I ended up dropping those off after the initial meeting with the mortgage lender. My lender told me that different types of mortgage loans have different document requirements. |

Get a statement from your employer

If you are concerned about your chances at qualifying for a loan, another thing you can do is ask your supervisor or your HR department to write a statement on your behalf. Explain the situation to them, and ask them to prepare or even just sign a statement that gives your current job title, your length of employment, and your current salary.

Lenders like to see a solid employment history with the same company or within the same industry for at least 2 years. If you can provide this information, you’ll have a better chance of convincing a lender to work with you — despite your lower credit score.

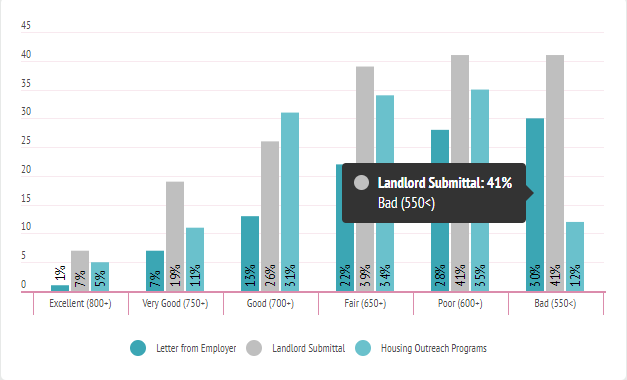

We talked to a large group of homeowners with approved mortgages to find out if they used any alternative means or methods to prove their creditworthiness. As you can see, a letter from an employer is a popular method, with 30% of approved borrowers with a 550 (or lower) credit score utilizing this strategy. Even individuals with excellent credit at times need additional documentation in order to qualify for a home loan.

Home Buyers with Poor Credit Proving Credit Trustworthiness

| Credit Ranking | Letter from Employer | Landlord Submittal | Housing Outreach Programs |

|---|---|---|---|

| Excellent (800+) | 1% | 7% | 5% |

| Very Good (750+) | 7% | 19% | 11% |

| Good (700+) | 13% | 26% | 31% |

| Fair (650+) | 22% | 39% | 34% |

| Poor (600+) | 28% | 41% | 35% |

| Bad (550<) | 30% | 41% | 12% |

Source: The survey included 600 Homeowners with approved mortgages. The study divided respondents by credit ranking and asked them if they used alternative means of proving credit worthiness through an employer statement, landlord submittal to the credit reporting companies, and through housing outreach programs funded by non profit organizations or state government funded agencies like REACH or Habitat for Humanity. The poll was taken in June of 2016.

Invest your own money

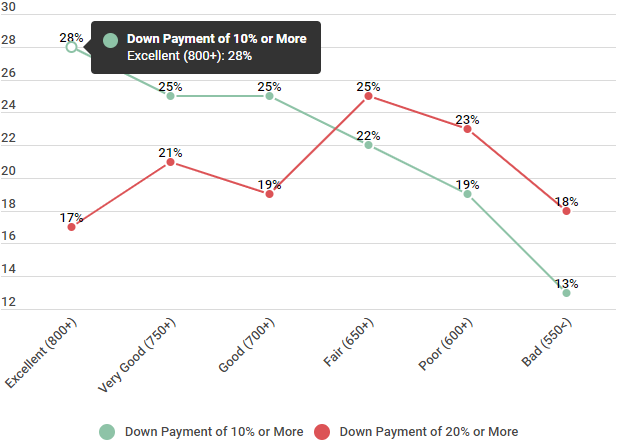

Another great way to qualify for a home loan despite a low credit score is to make a larger down payment. By investing more of your own money up front, lenders may feel you’re more invested in your home — and therefore less likely to stop making your mortgage payment.

A larger down payment may help you to overcome your lower credit score.

From the data below, you can see that among those approved borrowers with a 550 (or lower) credit score, of those approved, 18% were able to provide 20% down.

Approved Home Buyers and Down Payment amounts

| Credit Ranking | Down Payment of 10% or More | Down Payment of 20% or More |

|---|---|---|

| Excellent (800+) | 28% | 17% |

| Very Good (750+) | 25% | 21% |

| Good (700+) | 25% | 19% |

| Fair (650+) | 22% | 25% |

| Poor (600+) | 19% | 23% |

| Bad (550<) | 13% | 18% |

Source: The survey included 600 Homeowners with approved mortgages who made a 10 percent or higher down payment and those who made a 20 percent down payment or higher. The participants were then divided among credit score ranking. The study took place in November of 2016 and concluded September of 2017.

Conclusion & summary

The most important thing to keep in mind is that, if you have a 550 credit score, you’re not alone — and it doesn’t mean that you won’t be able to purchase a home. Shop around for your mortgage, weigh your options, and if possible, consider making a larger down payment. By thinking outside the box, you can use any of these strategies to help improve your chances of being approved for a mortgage loan.

And remember — you can always improve your credit score. Smart financial habits can help you quickly see an increase in your score, even as soon as a few months. Once your score is improved, you could consider refinancing your mortgage — for even better terms.