Credit card debt in America is no secret. Half of American households carry a balance from month to month. That’s tens of millions of people who for whatever reason don’t follow the basic, practical advice to only charge what they can afford to pay off at the end of the month.

Some folks say credit cards are evil. It’s not the credit cards that are evil – it’s the debt. But credit cards can be a gateway to debt if you’re not careful, so let’s talk about credit card dangers inherent to credit card use. Awareness is the first step in protecting ourselves from falling victim to them.

1. Credit cards entice us to spend money we don’t have.

Credit card spending is nearly effortless. Shoppers are far more inclined to make purchases on credit than with actual cash. It’s so easy to swipe a card or enter the number online. Handing over a stack of bills, on the other hand, makes most people stop and reconsider the purchase. Some websites, like Amazon, make one-click purchasing a pleasant, painless experience in which the buyer hardly even notices the dollar amount. Indeed, credit cards are blank checks, up to the credit limit on the card. No matter what your employment situation, no matter how much money you have in the bank, you can easily spend up to the maximum credit limit on your card (or cards) at this very moment.

Protection measures: Leave credit cards at home, safely put away. If the temptation to use a credit card is too great, use a debit card for everyday purchases instead. Create a specific and achievable repayment plan in advance of any large credit card purchase. Disable single-click shopping. Don’t save credit card information on websites.

2. Carrying a balance keeps us spinning our wheels.

It’s not uncommon to see a minimum payment amount of just $100 on an account that accrues $50 or more per month in interest charges. When a consumer only makes minimum payments, he or she ends up spending exponentially more money on the items purchased. Any discount or sale enjoyed at the time of purchase is eaten up many times over by the interest charges on that item’s unpaid balance.

One of the biggest problems with carrying a balance is that it’s easy to become numb to it, allow it to grow, or at the very least, allow it to remain steady. Once we start carrying a balance, it feels normal to do so.

Protection measures: If you can’t pay off the balance in full when the bill arrives, pay as much as you possibly can and make a plan for paying off the rest as soon as possible. Never brush off the significance of carrying a balance. Always consider it cause for alarm and an unacceptable condition that must be rectified as soon as possible.

3. We *must* have a credit card to live a normal American life.

Society pushes us to have and use credit cards. If everyone at the office goes out to lunch and all you have in your wallet is a credit card, it’s very easy to join the group and charge the lunch even if you can’t afford it.

You can’t rent a car without a credit card, even in person. Obviously, online shopping is nearly impossible with a credit or debit card. We are extremely dependent on cards and we see others using them everywhere we go.

Protection measure: Use cash more often. Use a debit card when cash won’t work, such as online or for large purchases. A debit card is linked directly to your personal bank account. The money is withdrawn from your account immediately upon completing the transaction. If you don’t have enough money in the bank to use your debit card, seriously consider postponing the purchase. Keep a credit card on hand for those rare occasions that require one, such as for a large temporary deposit so that the funds in your bank account aren’t placed on hold.

Credit card aficionados will argue that credit cards are wonderful, earn rewards and offer myriad benefits that debit cards do not. If you are not a savvy money manager but are prone to running up a credit card balance, do not try to play the rewards game and use a credit card in order to earn points, especially on everyday purchases like groceries. Many other benefits are virtually the same for credit and debit cards, such as extended warranties, price protection, rental car loss damage waiver and so on.

It’s true that credit cards offer a layer of protection that debit cards, by their nature, cannot. When a fraudulent charge is made on your credit card, you can dispute it before sending in a penny of your own money. If you dispute a charge on your debit card, however, your money is in limbo while the complaint is investigated. Furthermore, if you don’t notice the fraudulent debit card transaction within two days, you could be liable for up to $500 in losses. The solution is to monitor your bank account regularly, review all transactions, and set up various alerts and notifications that will work for you.

Owning and using credit cards is not inherently evil. Of course not. But credit card dangers exist. Credit cards open the door to overwhelming debt, and each of us is responsible for choosing to engage in credit card behavior that doesn’t lead us through that door.

Con artists have gotten extremely savvy at swiping credit-card account information. They’re so successful, in fact, that 42 percent of American cardholders (prepaid, credit, and debit) report that they’ve been the victims of fraud, according to a 2012 survey from ACI Worldwide and Aite Group.

Here, three of the newest scams—and how to reduce your vulnerability.

Cramming

This rip-off has been around for a while, mainly affecting cellular customers. But recently, it’s been targeting plastic users, too. Those hit have small charges they didn’t make appear on their statement. “There might be $10 here or $20 there charged by a company you’ve never heard of,” says Beverly Harzog, credit-card expert and author of the forthcoming Confessions of a Credit Junkie.

Scammers hope that you won’t notice the charges since they are for negligible amounts. As a result, the fraud is hitting consumers hard: More than 20 million victims have been charged more than $24 million in fake fees, according to the Federal Trade Commission (FTC).

How to stay safe: The best way to combat cramming “is to check every line of your statement,” says Harzog. “If there’s a charge you don’t recognize, don’t pay it and call your bank.”

Interest rate reduction robocalls

If you’re deep in credit-card debt, you might receive a call promising to lower your interest rate. The catch? You’ll be required to pay a fee in order to get the lower APR. According to the FTC, these calls “claim that the lower interest rates are available for a limited time and that you need to act now. Some even use money-back guarantees as further enticement.”

How to stay safe: Harzog advises consumers to ignore these calls and phone their card issuer themselves to ask for a better rate. “There’s no need to pay a fee,” she says.

Over-the-shoulder photography

The advent of cell-phone cameras has enabled thieves to steal your credit card information right at the checkout counter. How does this happen? “Someone stands behind you in line (or nearby) and snaps photos of your credit card,” explains Harzog. “A lot of smartphones have exceptional cameras…the focus can be sharpened so they can see your account number, name, and expiration date.”

How to stay safe: “Be aware of the people who are nearby,” advises Harzog. And while it may sound obvious, it bears repeating to keep your card face down when making a purchase. That way, a crook can’t see your personal information—even if they have a paparazzi-style camera.

Credit card fraud is an all too common crime: who hasn’t at least once in their life received a letter or email notification of a security breach that “may have” compromised their credit card number or account information? Sony is only the latest in a long list of retailers and companies whose databases (in this case, the PlayStation network) have been compromised in a hack attack.

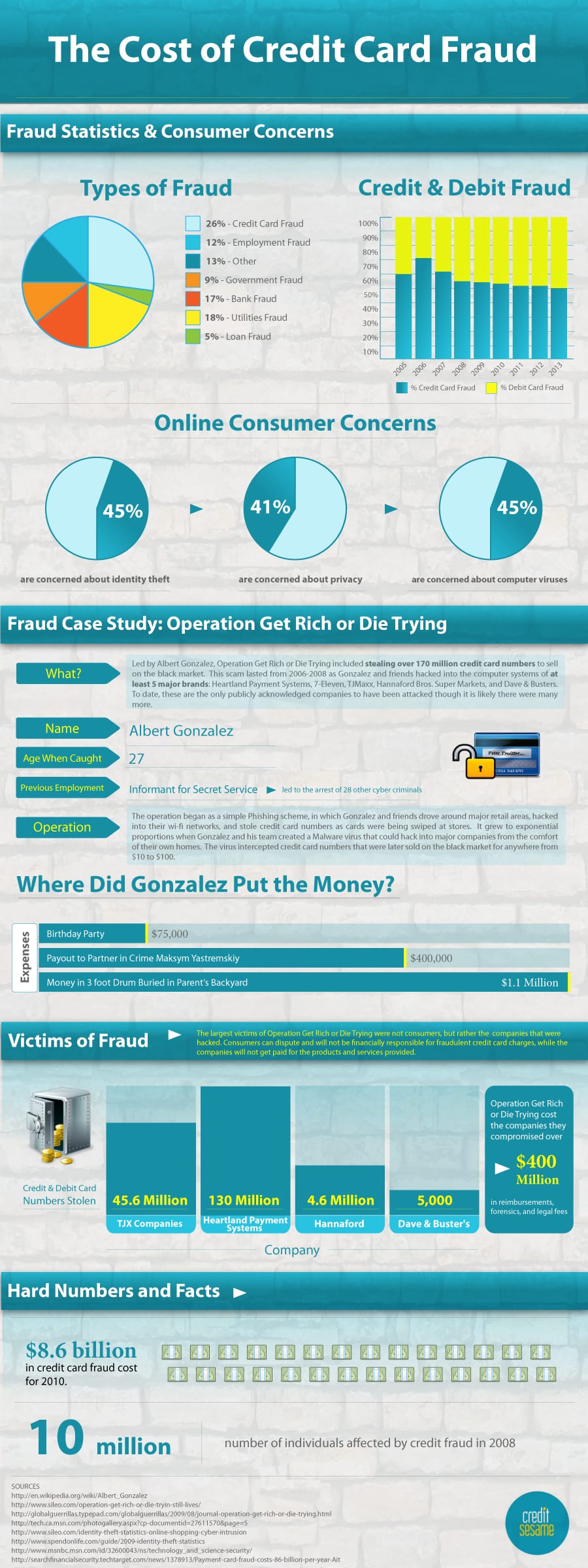

While the good news is that, in most cases, consumers incur little to no costs when their credit card numbers are misused, the bad news is that the banks and retailers that do have to absorb the fraudulent charges pass along those costs to consumers in one form or another. In this infographic, we give you the basic statistics around credit card fraud, as well as details on one of the largest fraud cases in history, “Operation Get Rich or Die Trying.”

How to prepare yourself against fraud

Check your credit report card annually

Say a scammer has applied and opened three credit cards using your name and Social Security number. There’s no way for you to know this—unless you’re checking your credit report summary. Verifying all the information on it every 12 months is the easiest way to find out if there are errant or fraudulent accounts listed on your credit history.

Once a year, you can get a free credit report from each of the three major credit bureaus (Experian, TransUnion, Equifax) by going to AnnualCreditReport.com. Or, you can monitor your account on an on-going basis by clicking here.

Know what to write on the back of your card

Sign the back of your credit card and it’s much easier for a thief to copy your name. Leave the signature area blank and a criminal could forge your name and start racking up charges on it. But this doesn’t mean you should leave the white strip blank, either. Instead, write “Ask me for photo ID.” This method is the safest option because in most situations, it requires the cardholder’s driver’s license in order to complete the purchase. (If the strip is blank, a store clerk is supposed to ask for identification.)

Watch your online behavior

Consumers spent more than $225.5 billion (!) shopping online last year, according to the U.S. Commerce Department. As a result, the World Wide Web is undoubtedly a place where scammers can make big money on unsuspecting consumers. To help reduce your risk of fraud, only enter your credit-card information on secure websites—you’ll know this is the case if the website address begins with https:.

Additionally, be wary of any emails you receive that appear to be from your card issuer. They could be part of a phishing scam, which is a common way that crooks trick you into giving them your sensitive information, including account numbers and passwords. If you receive one of these messages, do not click on any link in it. Instead, go directly to your issuer’s website and log in directly.

The bright side of credit

While there are certainly a number of things you need to be aware of when it comes to credit, they aren’t all bad! Credit card price protection coverage, which accompanies many cards (including ones from Discover, Chase and MasterCard), enables you to receive a refund for the difference in price on something you bought if it decreases. While good, these programs do have some limitations (which are typically buried in your credit card’s fine print) that you should keep in mind. Read on to learn about the most common, and be sure to check with your issuer for the specifics of your own card.

Price drop minimums

To receive a refund, you typically must provide printed, dated proof (i.e. an advertisement) of the lower price, the original receipt, and your credit-card statement to your card issuer. While these requirements are fairly straightforward, some plans also have a price difference minimum that must be satisfied in order to get money back. If your price drop falls short of this, unfortunately, you’re simply out the cash.

Ineligible merchandise

It’s fairly common for certain items to be excluded from this coverage. While each issuer determines which purchases qualify, it’s quite common for motorized equipment (boats, automobiles) and their parts to be exempt. Additionally, jewelry, antiques, firearms, transit tickets, services, live plants and live animals, works of art, and gift cards are often ineligible, too.

Limits on annual refund amounts

While most refunds are likely to be fairly small, if you’ve bought something large, like an appliance, you could be entitled to a stack of cash. However, many price protection programs have a per claim cap on refunds—think: $250 to $500—and some even have an annual limit, too. Additionally, some programs only allow so many claims per calendar year. If yours only permits just a couple, you might want to think again about claiming that $4 refund for a sweater that’s now 10% off now if you think you might have several bigger payouts later on.

Eligibility windows

In the days and weeks immediately following your shopping spree, be diligent about watching the cost of what you purchased. Most plans have time limits (typically ranging from 30 to 90 days) on how long you can claim a refund. So keep your eye out for after Christmas holiday deals, then use your price protection benefit to land refunds on previous purchases now. Otherwise, if you wait too long, you could be out of luck.