Credit Sesame on the “buy now” approach to beat inflation.

“Buy now” is a common sales pitch when inflation is high, and there’s some logic to it. When prices are rising quickly, consumers are penalized for delaying certain purchases.

However, the “buy now” mentality isn’t always a good response to beat inflation. In fact, if taken to extremes it can be counterproductive.

When does it make sense to speed up certain purchases to avoid higher prices, and when does rushing to buy only add to the inflation problem?

Rising prices create a sense of urgency to beat inflation

For a dozen years from the beginning of 2009 through the end of 2020, the Consumer Price Index rose by an average of 1.79% per year.

Under those conditions, there isn’t much of a price difference if you buy something now or wait a year. You can feel comfortable saving up to make things more affordable, and waiting for good bargains before you pull the trigger on large purchases.

Now consider price conditions over the past year. Through the end of September 2022, consumer prices had risen by 8.2% over the previous 12 months.

That’s enough of a change to make people worry that prices may be significantly higher if they put off making a purchase till later. It seems safer to buy now.

This mentality is one reason why inflation can be so hard to cure. When prices are rising rapidly, consumers feel a sense of urgency to buy before prices go up yet again.

That sense of urgency fuels demand. This is why inflation is often associated with an overheating economy. When consumers are in a hurry it can make them less choosy about finding bargains. It can also create shortages.

Of course, that type of behavior only adds to inflation pressures. So this becomes a vicious cycle. Inflation makes consumers desperate to buy now. The resulting buying frenzy adds to inflation. Then consumers feel even more pressure to accelerate their purchases.

Consumers are seeing purchasing power shrink

That feeling of pressure to buy now is not irrational. Consumers are seeing the purchasing power of their income and savings shrink due to inflation. Why not buy now instead of getting less for their money in the future?

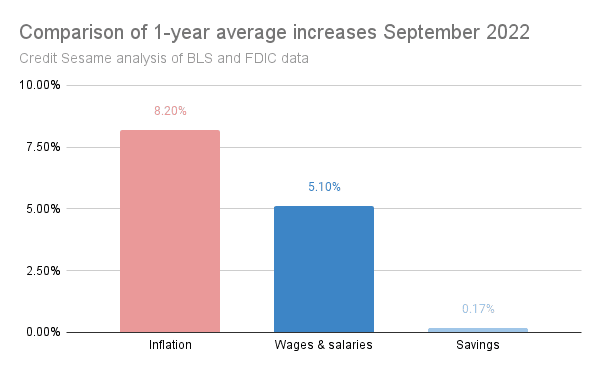

This chart summarizes how inflation is shrinking purchasing power:

Neither wages nor interest on savings have kept up with the 8.2% inflation rate over the past year. According to the Bureau of Labor Statistics, the average 12-month increase in wages and salaries was just 5.1% through the end September. Meanwhile, FDIC figures show that the average savings account was yielding just 0.17% a year.

When the purchasing power of income and savings is shrinking, things are becoming harder to afford every day. That’s why the “buy now” mentality is understandable.

Rising debt levels reflect the “buy now” mentality

A good indication of how powerful the “buy now” mentality has become can be found on Americans’ credit card statements.

Federal Reserve figures show that credit card debt is at an all time high of $1.15 trillion dollars. This is not a new problem. Credit card debt has been rising steadily for decades.

What is new is that Americans have picked up the pace of debt accumulation. Over the past fifty years, total credit card debt has grown at an average pace of 10.16% a year. Over the past year, borrowers are taking on credit card debt at a much faster pace..

Total credit card debt has grown by 15.32% during the last year. People seem determined to do more than just get the most they can out of their incomes and savings before prices rise. They are willing to borrow more heavily than usual so they can buy now.

Consumer debt is often counter-productive

This is where the “buy now” mentality becomes a problem. If you have a dollar in your pocket and inflation is high, it’s rational to spend that dollar now rather than wait until things get more expensive. However, it’s a different story if you have a credit card in your pocket.

Of course, using a credit card as a cash substitute is no different from spending a dollar bill. This applies if you pay your credit card in full every month and so avoid interest charges.

However, the fast-rising level of credit card debt shows that as a rule, Americans are not paying off their credit card bills every month. Instead, they’re accumulating debt, and that creates two problems:

- High interest rates mean people are getting less for their money. The logic behind the “buy now” mentality is that you get more for your money if you buy before prices rise. However, that logic breaks down if you rely on credit card debt. Credit card interest rates are more than twice the rate of inflation. So, if buying something adds to your credit card balance, you end up paying more over the course of a year than if you’d waited until you could afford to pay cash.

- Rising debt subtracts from the money you have available in the future. Unless you’re buying something like a house or a car that has long-term value, borrowing diminishes your wealth. The debt you owe subtracts from the money you have available in a year’s time. That’s going to make inflation even harder to deal with, not easier.

Inflation makes budget discipline especially important

In short, an urgency to buy now can be a rational approach to inflation if you’re able to pay out of pocket. If you have to borrow to buy something now, it makes less sense; especially at high credit card rates.

Instead, a more rational approach to inflation is to follow two simple rules:

- Keep spending within limits that don’t require borrowing. This allows you to avoid adding to the inflation problem by incurring interest charges.

- Keep your credit in top condition. High levels of credit utilization could cause your credit score to fall. This only makes things worse, because people with lower credit scores pay higher interest rates.

In short, a sense of urgency to “buy now” is a natural response to trying to beat inflation. Whether that response actually makes sense depends on whether you can do it without borrowing.

If you found Should You “Buy Now” to Beat Inflation? you may also enjoy:

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.