Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

EDITOR’S NOTE: All the credit card offers mentioned in this article are expired and are no longer available

Your credit score is a measuring stick of how financially responsible you are and for decades, the FICO credit score issued by Fair Isaac has been the score lenders use most often to determine creditworthiness.

Over the last several years, there’s been an uptick in the number of credit card issuers and banks offering free FICO scores to their customers but there was always a catch — you had to have a credit card or a checking account to get your score.

Discover is changing things up by offering a free FICO credit scorecard to anyone, you don’t to be a Discover accountholder to qualify.

Here’s the rundown on how the new credit scorecard works and what you should know about it.

Discover free credit scorecard

Getting a look at your Discover credit scorecard and free FICO score is a relatively simple four-step process. There’s no credit card needed and in just a minute or two, you can see how your score adds up.

To sign up, you need give the following information:

- Your name

- Mailing address

- Email address

- Social Security number

This is just one way Discover verifies your identity. There’s no hard pull on your credit report, which could hurt your credit score.

You’ll have to create a username and password, answer four questions to confirm your identity and set up a security question of your own to complete the process. Once your account is verified, you’ll be taken to your credit scorecard.

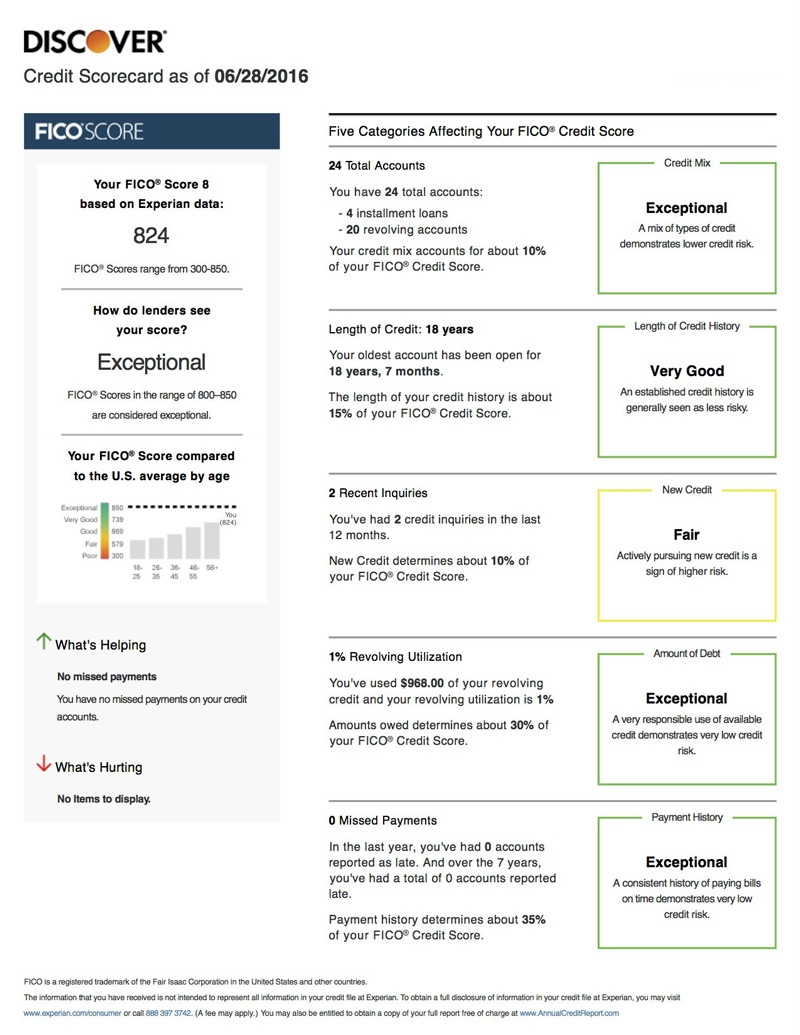

This is a screen grab of my actual Discover scorecard:

What’s included with the Discover free credit scorecard?

Your dashboard gives you a snapshot of your credit, which includes your free Experian FICO credit score, along with a breakdown of how you appear to lenders. For instance, my FICO score earned me an overall credit rating of “good,” according to Discover.

The scorecard listed the factors that are helping my score and the ones that are hurting it. In my case, an exceptionally low utilization ratio and a lengthy credit history offered the biggest boost.

The credit scorecard also tells you how many accounts you have total, the length of your credit history, the number of inquiries on your credit, your credit utilization and how many missed payments you have.

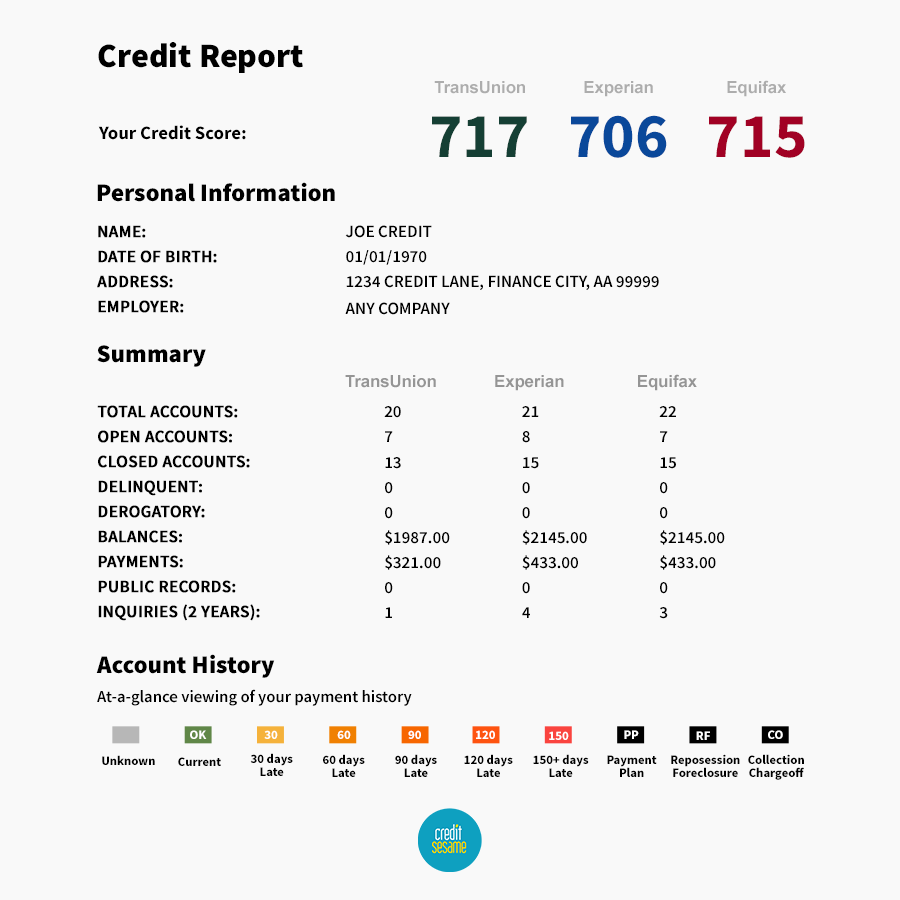

You can’t, however, see the details for each of your individual credit accounts. For that, you’ll need to check your credit report, which you can do for free at AnnualCreditReport.com.

Here is what you can expect to see on your credit report; as you can see it offers a more detailed look at your credit history.

Discover refreshes your FICO score and credit scorecard every 30 days so you can keep track of how your score goes up or down over time.

[Related: Experian vs. TransUnion vs. Equifax: What’s the Difference?]

What’s the catch?

With Discover’s free FICO score, there’s no catch. You don’t need to be a cardmember, and as long as you are willing to submit your personal information, you can see your score for free. This is most likely a result of a trend that’s happening within the financial industry, with respect to free credit scores.

Since the CARD Act was passed in 2009, there were several financial institutions that have made credit scores free to their customers, and perhaps Discover is just following the trend.

Discover’s decision to open up the FICO score arena to everyone is designed to benefit people who were previously in the dark about their credit.

Discover’s executive vice president and chief marketing officer Julie Loeger said in a statement, “Discover recognizes how important it is for consumers to have a clear understanding of their credit health. That’s why we have provided our cardmembers with FICO scores for free since 2013. Now, we’re extending this benefit to everyone.”

We’ve included a handy table below that lists which providers offer which scores.

| Issuer | Type of Credit Score | Availability |

|---|---|---|

| American Express | FICO | Free for cardmembers only |

| Bank of America | FICO | Free for cardmembers only |

| Barclaycard US | FICO | Free for cardmembers only |

| Capital One | VantageScore 3.0 (TransUnion) | Free for anyone |

| Chase | FICO | Free for Chase Slate® cardmembers |

| Citi | FICO | Free for customers with selected accounts |

| Credit Karma | VantageScore 3.0 (TransUnion and Equifax) | Free for anyone |

| Credit Sesame | VantageScore 3.0 (TransUnion) | Free for anyone |

| Discover | FICO | Free for anyone |

| U.S. Bank | Not available | Not available |

| Wells Fargo | FICO | Free for those with consumer credit accounts, excluding mortgages and home equity products |

Capital One was the first to do so and back in May, and over the last few years, they’ve been joined by Bank of America, Chase, Citi and others, which all provide various free credit scores to their customers.

Get your free credit report summary and analysis from Credit Sesame

While Discover’s free FICO score and credit score card is certainly good news if you’re looking for a way to monitor your credit at no cost, it’s not the only option.

Credit Sesame also offers a free credit report summary, which includes your TransUnion VantageScore 3.0 credit score and an analysis of your credit report.

There’s no credit card needed to sign up so it’s a great opportunity to view your credit from a different angle without paying anything out of pocket.

Independent Review Disclosure: All the information about the Chase Slate® credit card has been collected independently by CreditSesame.com and has not been reviewed or provided by the issuer of this card. The Chase Slate® credit card is not available through CreditSesame.com.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which Credit Sesame receives compensation. This compensation may impact how and where products appear (including, for example, the order in which they appear). Credit Sesame provides a variety of offers, but these offers do not include all financial services companies or all products available.

Credit Sesame is an independent comparison service provider. Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. All images and trademarks are the property of their respective owners.

Editorial Content Disclosure: The editorial content on this page (including, but not limited to, Pros and Cons) is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer.

Provider’s Terms: *See the online provider’s application for details about terms and conditions. Reasonable efforts have been made to maintain accurate information, however, all information is presented without warranty or guarantee. When you click on the “Apply Now” button, you can review the terms and conditions on the provider’s website. Offers are subject to change and the terms displayed may not be available to all consumers.

The information, including rates and fees, presented in this article is believed to be accurate as of the date of the article. Please refer to issuer website and application for the most current information. Verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Reviews: User reviews and responses are not provided, reviewed, approved or otherwise endorsed by the banks, issuers and credit card advertisers. It is not the banks, issuers, and credit card advertiser’s responsibility to ensure all posts are answered. The Credit Sesame website star ratings are an average based on contributions from independent users not affiliated with Credit Sesame. Banks, issuers and credit card advertisers are not responsible for star ratings, nor do they endorse or guarantee any posted comments or reviews.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.