Credit Sesame on why you should maximize your credit card payments to minimise your costs.

The Brookings Institute, a public policy think tank, recently published a paper criticizing the way credit card companies bill their customers. The paper claims that credit card industry practices are prolonging debts and costing customers billions in extra interest.

Their critique is well-timed, because the problem is about to get worse. A combination of record high debt levels and rising interest rates are likely to cost credit card customers more interest than ever.

Unless you want to be stuck with part of that bill, you should take notice of what the Brookings Institute has to say. While Brookings advocates rule changes to address the problem, there’s no reason you have to wait. You can implement the changes they advocate starting with your next credit card bill.

Minimum credit card payments leads to maximum expense

The Brookings Institute’s beef is with minimum payments on credit card bills. What may surprise you is that their complaint is that credit card companies are billing customers too little. When you look at the issue though, the concern with this practice becomes clear.

Ironically, minimum payments on credit card bills are designed to maximize debt and interest expense.

Credit card payments are flexible, meaning that consumers have a wide range of choice in how much they pay each month. You can even pay off the entire balance every month. Many customers do this, and by doing so enjoy the convenience of credit cards without the interest expense.

However, another type of credit card customer takes longer to pay off their credit card balances. According to the Brookings Institute, roughly half of credit card customers carry over balances from month to month. As a result, they pay interest on those balances.

Here’s where the problem comes in. The more slowly you pay off a credit card balance, the more interest you will pay. And the minimum payments on credit card bills are designed to make customers pay off their balances very slowly.

The Brookings Institute found that in the 1980s and 1990s, it was common for credit card companies to base their minimum payment requirements on a formula of 5% of the balance outstanding plus any fees an interest for the period. Today, a more common formula is 1% of the balance plus fees and interest.

Credit card companies didn’t lower those minimum payments to be nice. They determined it was more profitable to slow the rate at which debt was paid off in order to increase the amount of interest paid in the meantime.

The cost of slower repayment

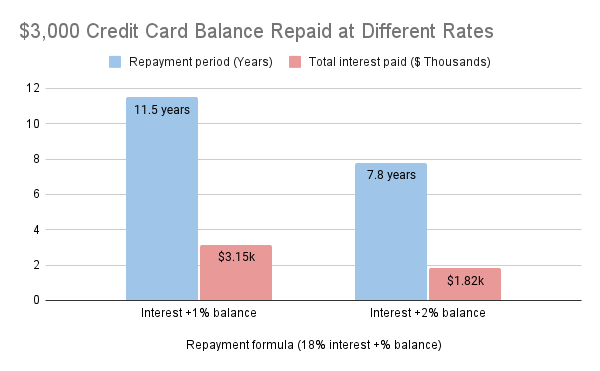

The Brookings Institute paper includes an example that illustrates just how costly this practice is for consumers. Start with a $3,000 balance on a credit card with an 18% interest rate. Assume a fairly typical formula for calculating the monthly minimum payment: the larger of $35 or 1% of the balance plus fees and interest for the period.

By making the minimum monthly credit card payments, it would take 11.5 years to pay off that $3,000. In the meantime, you would pay $3,154 in interest. So, that $3,000 debt would end up costing you a total of $6,154 to repay.

Simply raising the percentage in the minimum payment formula from 1% to 2% would significantly shorten the repayment period and reduce the interest expense:

Of course, 2% is still a very small amount. Larger payments would produce even shorter repayment periods and greater interest savings.

Credit card debt hits an all-time high

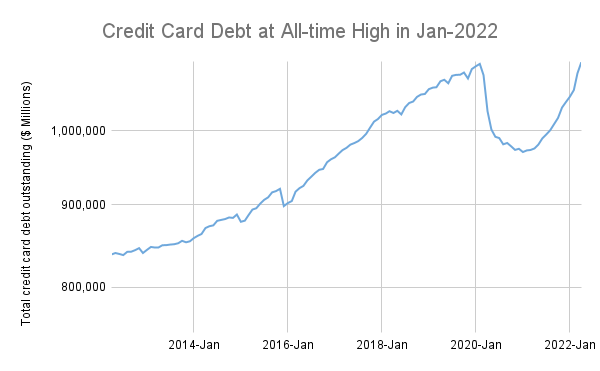

Getting control of credit card debt has never been more urgent, because the amount of that debt is higher than ever.

As you can see from the chart below, in the early months of the pandemic Americans temporarily reversed the long rise in total credit card debt outstanding. A combination of reduced spending and emergency government aid helped people pay down debt.

More recently though, the trend has reversed. Credit card debt has risen back to pre-pandemic levels and beyond.

Rising interest rates make the problem worse

The high level of credit card debt outstanding is a problem because it’s a particularly expensive form of debt. Credit card interest rates are generally much higher than mortgage rates, auto loan rates and personal loan rates.

This is getting worse because interest rates are rising. Federal Reserve rate hikes have already pushed rates higher. High inflation is expected to prompt more rate hikes before the year is over.

Unless you welcome the idea of paying more and more interest to your credit card company, it’s time to get aggressive about paying down credit card debt. That starts with making sure you pay more than the minimum payment on each credit card bill.

Don’t wait for rule changes to change your credit card payments

The paper by the Brookings Institute advocates for regulatory changes to stop credit card companies from prolonging consumer debt. However, it’s not a sure thing that such changes will be enacted, and in any case they are likely to take a long time.

Fortunately, you don’t have to wait for rule changes. You can reduce the cost of your credit card debt by making it a practice to pay more than the minimum payment on each credit card bill.

That credit card bill may already show you a good way to do this. The Credit CARD Act of 2009 requires credit card companies to show how long it would take customers to pay down their credit card balances by making the minimum payment. They also have to show an alternative model of how much a customer would need to pay each month to get rid of that balance in just three years instead.

Try using this three-year payoff amount as your payment instead of the minimum. If you can even pay more than that you certainly should. But at the very least, shooting for the three-year payoff amount will cut down your interest payments much faster than just making the minimum payments required.

With interest rates rising and credit card debt at record highs, there couldn’t be a better time to stop letting credit card companies prolong your interest payments.

You may also be interested in How to Build Credit with Credit Cards.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.