Opinions expressed here are author’s alone, not those of any bank, credit card issuer, airlines or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

One of the most important parts of anyone’s financial life is their credit report. Without a good credit report (and a corresponding good credit score), it becomes a lot harder to get approved for credit when you need it. You may not be able to buy things like cars, homes, or even a good education—and, if you are approved, you’ll pay a lot more for them.

Why do we have credit bureaus?

Before we had the giant credit bureau conglomerates we have today, things worked differently. Small businesses and banks extended credit to customers directly, through their own vetting processes. This worked well in small communities where everyone knew everyone else, and consumers couldn’t hide from their creditors. Over time, cities became larger and people moved around more, so it became harder for business owners to know who was likely to pay back their bills.

Vetting people for credit became a big problem, and some folks stepped up to the challenge of solving it. Merchants, trade guilds and financial groups developed lists of trustworthy customers that they passed around to members for a price. If you didn’t pay your bills, there’s a good chance you’d be blacklisted, literally, and you’d have a hard time getting credit from anyone who paid for one of those lists.

Over time, these credit groups grew into for-profit companies that developed, expanded and merged, so that what we have left today are the three giant consumer credit reporting agencies: Experian, Equifax, and TransUnion. They are usually called the “credit bureaus.” (Other credit reporting companies do exist; later on in this post we’ll point you to a list of entities that may have a file on you.)

Credit bureau definition

There is no single federal credit bureau. Instead, each credit bureau operates as a for-profit company separate from the others. They each collect and store financial data about you that is submitted to them by creditors with whom you’ve had a relationship in the past, like banks and loan companies, and even utility companies, healthcare providers, and property managers.

The credit bureaus use this data to generate reports that they sell to creditors and others who are interested in your credit history (and who have permission to obtain a copy), like lenders, landlords, insurers and potential employers.

In days past, more credit bureaus competed for consumer credit business. Today, general consumer credit reporting is overwhelmingly dominated by the big three.

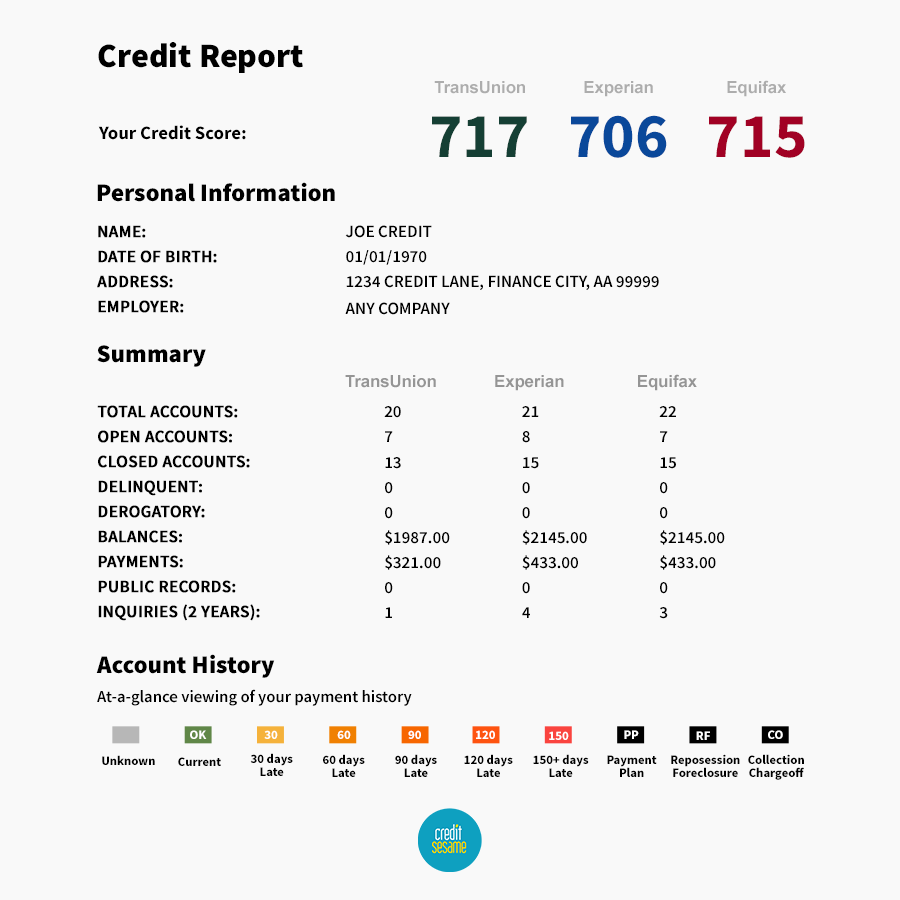

Since each credit bureau is its own business, they each operate in their own way. They collect different information, for example. TransUnion reports extensive data about your employment, including your employer’s name, your position, and the dates that you were employed. The other two agencies report the employer’s name.

To add even more complexity to the equation, none of your creditors are required to report data about you to any of the credit bureaus. They report voluntarily. As a result, many report to just one or two, but not all three credit bureaus. Credit bureaus even use multiple credit scoring algorithms, some of which are company-specific.

The result is a patchwork of data about you that is very likely to vary depending on which report you look at and which method is used to calculate your score. This is why it’s important to keep an eye on your credit report from each of the credit bureaus, to make sure the data is accurate.

Watch Credit Sesame spokesperson Lynnette Khalfani-Cox, The Money Coach, explain the key differences between Equifax, Experian, TransUnion credit reports.

How do I know if my information on the credit bureau reports is accurate?

You can get a full copy of your credit report for free from each of the credit bureaus every year. The government-authorized site where you can request a copy of your credit report is AnnualCreditReport.com. It is not a national credit bureau, but rather a portal through which you can visit the individual bureaus for the purpose of retrieving your annual copies.

Another way to get a 3-bureau credit report is to purchase it. FICO® sells it, as does Experian.

You can also check Credit Sesame at any time for a free credit report card, which contains data, updated monthly, as reported to TransUnion.

Here’s what you can expect to see from your credit report. Keep in mind, this is an example, not an actual credit report.

You can request your free copies from all three bureaus at once, or you can stagger them. By staggering your requests across the year (i.e., requesting a credit report from one credit bureau every four months), you can keep closer tabs on your data and catch any suspicious activity before it’s more than a few months old.

It’s especially helpful to check your credit report just before applying for any credit, a new job, or a new apartment as well, to ensure accuracy and avoid surprises.

In some cases, you are entitled to more than one free copy of your credit report from a bureau within a year. If you are denied credit, you have the right to request a copy of the credit report on which the decision was based (the creditor must provide you with the name and contact information of the credit bureau) within 60 days.

You can also request additional copies if you’re unemployed and looking for work, if you receive welfare benefits, or if you’re a victim of fraud or identity theft.

What do I do if the information on my credit report isn’t accurate?

If you find inaccurate information on your credit report, it could either be a simple error, or it could be a sign of fraudulent activity. Errors are generally much more common: a 2012 Federal Trade Commission study found that 20% of Americans have errors on their credit reports, and for a quarter of this group, the errors are large enough to impact their ability to get credit!

If you find a credit report error, it’s important to notify each of the three credit bureaus via a formal dispute process. Credit bureau disputes sound intimidating, but they’re not that difficult to do. Credit Sesame has a handy guide on how to dispute information on credit reports.

If you find an error while viewing your credit report online, you can dispute it by clicking the dispute button near the top of the report. Otherwise, you’ll need the credit bureau contact information. They can all be reached either online, by phone, or by mail.

Who do I contact to set up a fraud alert with the credit bureaus?

Identity theft and credit card fraud is a huge problem: in 2014 alone, 7% of people in the U.S. became victims of identity theft. If you think you are a victim of fraud or you might become one (because you’ve lost your wallet), it’s extremely important to set up a fraud alert right away. The credit bureaus are responsible for maintaining accurate data, and they can’t do that if someone is out there buying Ferraris under your name. Moreover, setting up a credit bureau fraud alert can stop criminals before they even have a chance to harm you.

A fraud alert lasts for 90 days. Identity theft victims can extend the alert for up to seven years. With a fraud alert in place, the creditor will have to take extra steps to verify your identity before opening a new account in your name. Fraud alerts are free for anyone who thinks or knows they are a victim of identity theft, and for active duty military.

Another option is to place a credit freeze on your file. You’ll have to contact each bureau separately, and in some cases pay a fee to freeze, and later to thaw, your file. With a freeze in place, your credit file will not be released to anyone who requests it (creditors you already do business with will still have access to your file).

Since virtually all creditors require a credit check before extending credit, a freeze stops new accounts from being opened in your name. When you do want to allow a legitimate application for credit to get through, you can temporarily thaw your file (via your online account or by phone). Some consumers find a credit freeze to be inconvenient, but it is one of the most effective ways to thwart identity theft before it happens.

What you need to know about your Experian credit report

The way to get your Experian free credit report is to visit AnnualCreditReport.com once every year. If you visit Experian.com, you will find credit reports and scores for sale, not for free. You can get an additional copy if your Experian credit report was used in a decision to deny your credit application.

When you do get a copy of your report, check it carefully for accuracy. If you come across any errors, follow Experian’s instructions to dispute them and, ultimately, have them removed from your file. The simplest way to file an Experian dispute is to click through the dispute process while viewing your report online. Experian also provides other dispute methods, including an opportunity for you to submit supporting documentation. Information about that process will be noted on your credit report.

If you find, through your credit report review or any other way, that your identity has been compromised, it’s absolutely essential that you take immediate action to lock down your credit file and prevent any further damage. Place a fraud alert on your file right away, and consider freezing your credit long term.

Experian credit score

If you purchase your Experian credit score, it is a FICO® 8 Score. The Experian credit score range is 300-850, and it is the score used in lending decisions by many, but not all lenders. Experian also provides many other versions of both FICO® Scores and VantageScores, depending on who requests it, and other scores, such as business credit scores, that are not marketed to consumers.

Experian Credit Tracker℠

Experian Credit Tracker℠ is a service sold by Experian. It includes a copy of your Experian credit report, your FICO® Score, daily credit monitoring with email alerts, fraud resolution support and a dedicated phone hotline. This service is sold as a monthly paid subscription.

What you need to know about your TransUnion credit report

When you receive your report, check it carefully for accuracy. If you come across any errors, follow TransUnion’s instructions to dispute them and have them removed from your file. The simplest way to file a TransUnion dispute is to click through the dispute process while viewing your report online. TransUnion also allows you to file a dispute in other ways, and guidance will be noted on your credit report.

You can place a TransUnion fraud alert or credit freeze and TransUnion will notify the other two bureaus of a fraud alert, but not a freeze.

TransUnion Credit Lock is a freezing service offered as part of TransUnion’s credit monitoring service (sold as a monthly paid subscription).

TransUnion SmartMove®

TransUnion SmartMove® is a tenant screening service for smaller-scale property managers and landlords. Renters can use it to keep their personal information private while they submit rental applications (SmartMove® sends the screening report directly to the authorized landlord). SmartMove® background checks do not have any impact on your credit score. They are “soft” inquiries.

TransUnion credit score

TransUnion generates FICO® Scores, VantageScores, company-specific educational scores, and business scores that are not marketed to consumers. There are many versions of the FICO® Score and the VantageScore currently in use, and TransUnion offers them all. The credit score offered for sale on the TransUnion website is an educational score and may not be the same number a creditor sees. This TransUnion credit score range is 300-850.

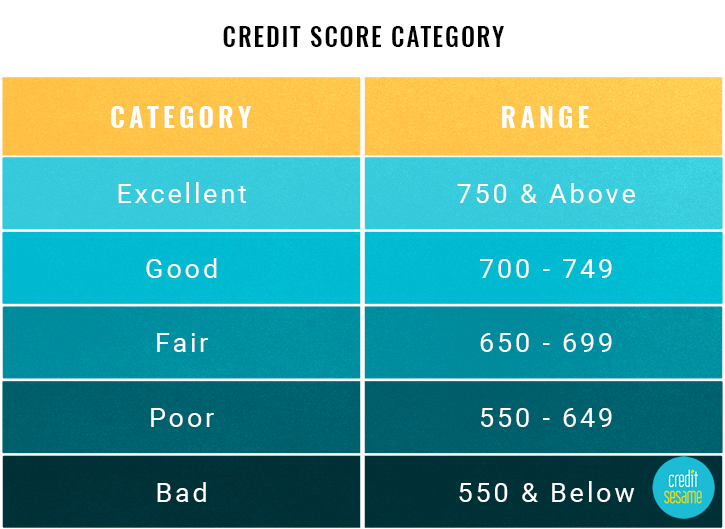

This table below explains the general number ranges for excellent to bad credit scores.

Equifax credit report

To get your Equifax free credit report, visit AnnualCreditReport.com once every year. If you visit Equifax.com you will find credit reports for sale, not for free.

To file an Equifax dispute, click the dispute button while viewing your credit report online. If you received a paper copy of your credit report or you need to submit copies of documents, follow Equifax’s instructions for filing a dispute by mail. Any time you file a dispute by mail, send copies, not original documents, and keep a copy of everything you send.

Equifax credit score

Like the other two bureaus, Equifax provides FICO® and VantageScores, and can calculate your score according to many different scoring models. The Equifax credit score range depends on the score being calculated. The most current FICO® and VantageScores range from 300 to 850. Note that the credit score offered for purchase on Equifax’s website is based on the Equifax Credit Score model and is not the same score used by creditors. The range is 300 to 850.

Equifax Complete™

Equifax Complete™ is a credit monitoring service offered as a monthly paid subscription. It includes credit scores, credit reports, a credit freeze and alerts.

Are there other credit reports out there on me?

Hundreds of credit reporting agencies still operate in niche markets, such as business credit, tenant screening, employment screening and so on. Here is a list of other consumer credit reporting companies, and information about how to get a copy of your report from each one. You should save this list. Anytime someone (an employer, a landlord, a creditor) obtains a report on you, ask what company provided the report so that you can obtain your own copy to check for accuracy.

What’s a VantageScore?

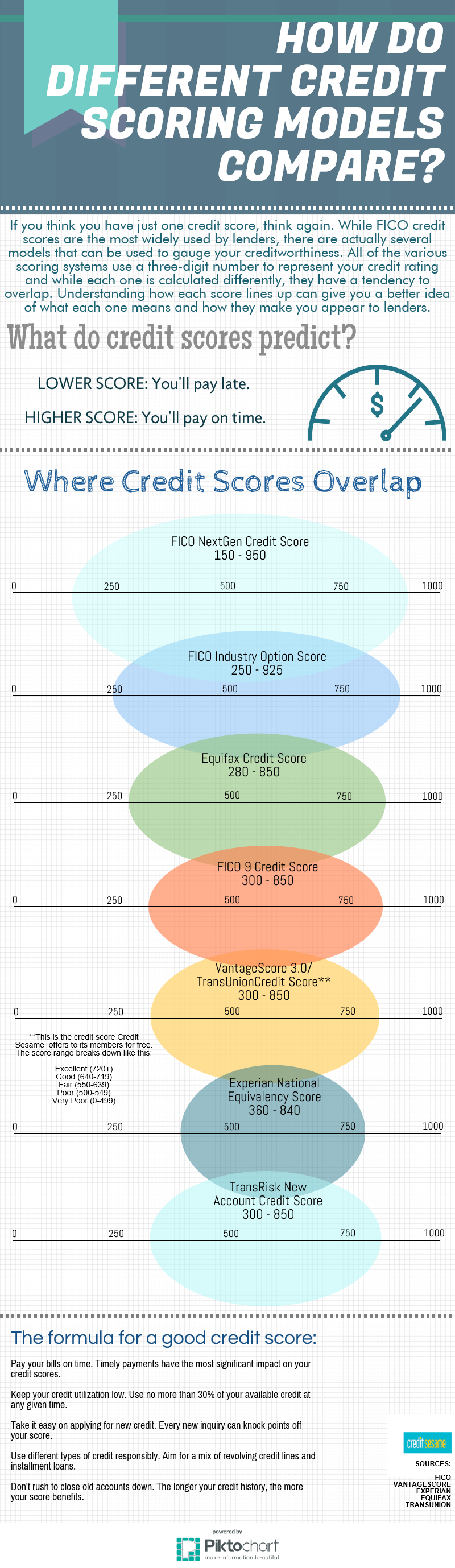

The credit scoring system most consumers are familiar with is the FICO® Score, a proprietary formula licensed by FICO®, formerly the Fair Isaac Corporation. A consumer’s FICO® Score is calculated by each credit bureau based on the information that has been reported to it. In recent years, a new credit scoring model has emerged, developed by the credit bureaus themselves based on their own research into the consumer credit information they have on file. This newer credit score is called the VantageScore.

A VantageScore takes different information into account, and places different weight on the various components of a customer’s credit profile. Originally, the VantageScore even used a different scale, between 501 and 990, compared to the FICO® Score range of 300 to 850. However, the current VantageScore 3.0 model uses the same credit score range of 300 to 850 used by the traditional FICO® Score.

What’s a free FICO® Credit Score?

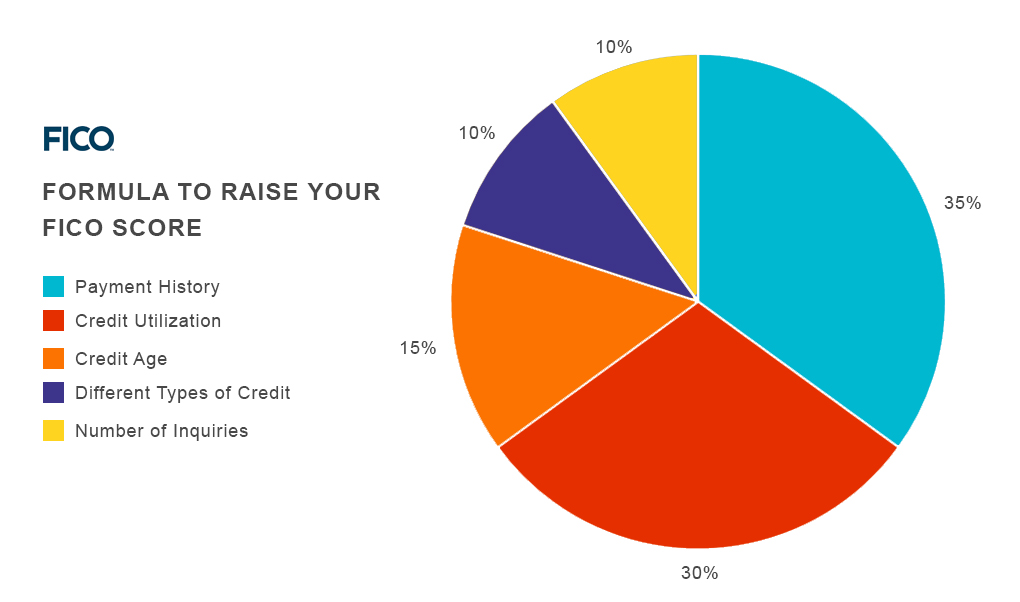

The first question is simple: what is a FICO® Credit Score? While the credit bureaus are responsible for collecting accurate information from banks and consumers about their credit profile, they’ve traditionally licensed out the work of synthesizing that information into a single credit score to FICO®.

Since each credit bureau uses the FICO® formula to calculate a consumer’s FICO® Score based on the information it has available, each bureau’s FICO® Score can be slightly different from the others. For example, a credit card company may check your Equifax credit report, but not your TransUnion or Experian credit reports. If different accounts are reported to the other two bureaus, your Equifax FICO® Credit Score may not be the same as the FICO® Scores produced by the other two bureaus.

What is the highest FICO® Score?

The highest score assigned by the FICO® Credit Scoring Model is 850, although a “perfect” 850 credit score is an anomaly. A high credit score is a sign that a consumer uses a range of credit products responsibly. But one component of the FICO® Credit Scoring Model is the number of recent credit inquiries on a consumer’s credit report. In other words, as soon as someone attempts to take advantage of their “perfect” 850 FICO® Credit Score, it will go down a few points!

[Related: How to Build Credit Fast or Easy Way to Improve Your Credit Score]

Credit score chart

What’s a good FICO® Score?

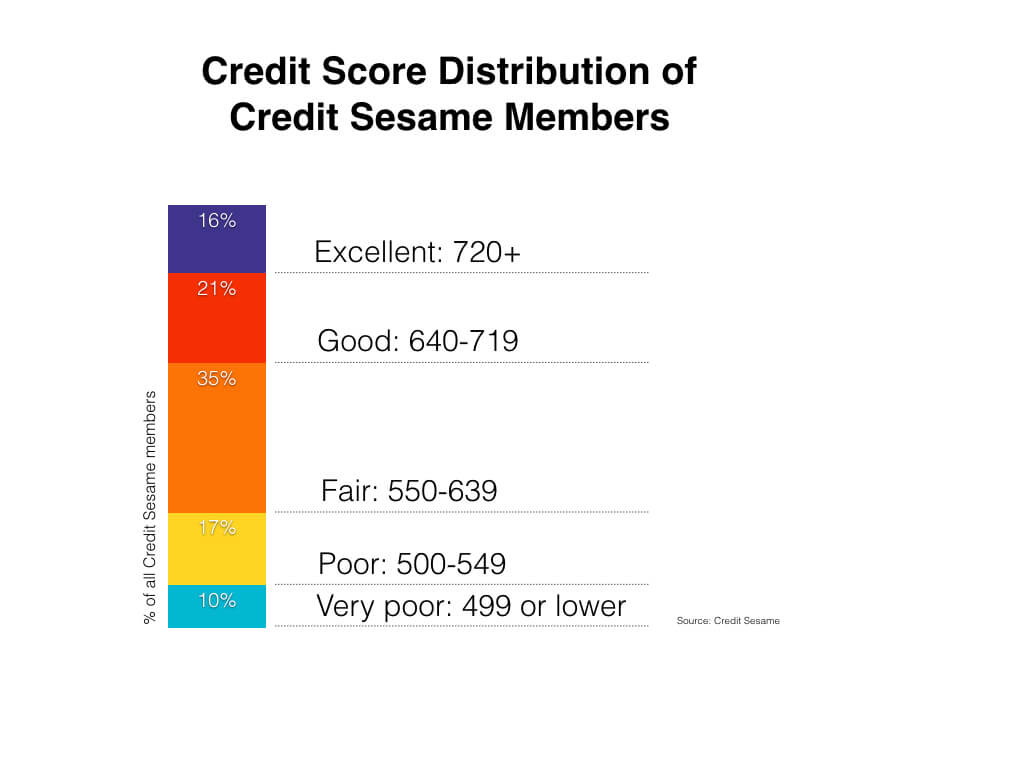

Much more important than your particular FICO® Credit Score is where your score falls along the FICO® Credit Score range of 300 to 850. A good FICO® Score is one between 640 and 719. A 720 FICO® Credit Score or higher is considered an excellent credit score by most lenders. Depending on the contributing factors of your credit report, a good FICO® Score may make you eligible for the most competitive interest rates on car loans and mortgages and some exclusive credit cards.

Highest FICO® Score

While the highest possible FICO® Credit Score is 850, only a tiny number of consumers have an 850 credit score.

Among active Credit Sesame members, the highest credit score is 839, and just 0.006% of members have that score! As you can see from the table, most Credit Sesame members fall within the range of 550 to 639 range, which is considered “fair” credit, per the TransUnion scoring model.

[Related: Credit Score Chart]

To find out your own FICO® Score for free, you have a range of options. You can check with your credit card issuer and see if they offer access for you to get a FICO® Score based on the information in your Experian credit report. Your credit card issuer may also provide a breakdown of some of the information contributing to your FICO® Credit Score.

You can also check if you can receive a FICO® Score based on your TransUnion credit report, although they may only provide you with the “key factors” that go into your credit score, rather than providing a detailed breakdown.

If your consumer credit card offers a FICO® Score be aware that it may not provide a detailed credit report so you shouldn’t rely on it to check for mistakes in your credit report.

VantageScore vs. FICO® Score

This can create problems for young people who don’t have yet have a history of using and repaying credit cards and car loans. Additionally, consumers who have had loans sent to a collections bureau but have paid the debt in full don’t have those paid collections factored into their VangageScore. (FICO® newest Scoring Model, FICO® 9, also ignores paid collections, but is not widely used yet.)

Nonetheless, the FICO® Credit Score remains the most popular among lenders themselves, so it’s important to be aware of your FICO® Score, you can do so by regularly checking one or more of the free FICO® Scores options that are available. Free FICO® Credit reports are not offered. The FICO® Credit Scores provided by some of the credit card issuers may use the FICO® 8 Credit Scoring Model.

A final resource for comparing your FICO® Credit Score to the scores of people applying for credit cards, mortgages, and car loans is the FICO® forum, an independent resource where members discuss their own experiences applying for credit. The open forum makes it easy to see whether members with similar FICO® Credit Scores were approved for the credit products you are interested in.

Take a look at the graphic that outlines how your credit scores overlap from the different bureaus.

Helpful links and resources

The credit bureau phone numbers, addresses, and online dispute resolution centers are as follows:

P.O. Box 740256

Atlanta, GA 30348

1-866-349-5191

Experian Information Solutions, Inc.

P.O. Box 4500

Allen, TX 75013

1-866-200-6020

P.O. Box 2000

Chester, PA 19022

1-800-916-8800

For a fraud alert, you only need to contact one bureau and that bureau will notify the other two.

- Equifax, 1-888-766-0008

- Experian, 1-888-397-3742

- TransUnion, 1-800-680-7289

Experian fraud alert and credit freeze

- You can place an Experian fraud alert, and afterwards, Experian will notify the other two bureaus.

- You can place an Experian credit freeze, however, unlike fraud alert, a credit freeze must be placed with each bureau.

- Experian customer service is offered online.

Equifax fraud alert and credit freeze

- You can request a fraud alert on your Equifax credit file, and Equifax fraud alert will also result in a fraud alert at the other two bureaus.

- You can request an Equifax security freeze. Equifax customer service is offered almost exclusively online, except for customers who have purchased a product. Those customers may log in to the Equifax Member Center for assistance.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which Credit Sesame receives compensation. This may include receiving compensation when you click on a link, when an application is approved, or when an account is opened. This compensation may impact how and where products appear (including, for example, the order in which they appear). Credit Sesame provides a variety of offers, but these offers do not include all financial services companies or all products available. Credit Sesame is an independent comparison service provider.

Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. All images and trademarks are the property of their respective owners.

Editorial Content Disclosure: The editorial content on this page (including, but not limited to, Pros and Cons) is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer.

Provider’s Terms: *See the online provider’s application for details about terms and conditions. Reasonable efforts have been made to maintain accurate information, however, all information is presented without warranty or guarantee. When you click on the “Apply Now” button, you can review the terms and conditions on the provider’s website. Offers are subject to change and the terms displayed may not be available to all consumers.

The information, including rates and fees, presented in this article is believed to be accurate as of the date of the article. Please refer to issuer website and application for the most current information. Verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Reviews: User reviews and responses are not provided, reviewed, approved or otherwise endorsed by the banks, issuers and credit card advertisers. It is not the banks, issuers, and credit card advertiser’s responsibility to ensure all posts are answered. The Credit Sesame website star ratings are an average based on contributions from independent users not affiliated with Credit Sesame. Banks, issuers and credit card advertisers are not responsible for star ratings, nor do they endorse or guarantee any posted comments or reviews.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.