Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.

EDITOR’S NOTE: The Chase Slate® credit card, and the Chase Freedom® credit card offers mentioned in this article are expired and are not available through CreditSesame.com

People who tend to carry a high balance each month may find a low interest rate card a compelling tool to help you stay on budget, pay on time and pay in full, and most important, keep your credit healthy. A no-frills, low-interest rate credit card may be worth a look, however you may be selling yourself, your financial needs and your credit short by failing to consider a card with both a low interest rate and some other perks that are hard to pass up.

Those with excellent credit may be considered for a low interest credit card however understand that lenders, credit card issuers, and other financial institutions use a variety of different types of credit score models and other criteria to make credit and lending decisions. Having a credit score in a particular range is not by any means a guarantee that you will be approved for credit or a loan or for the terms you applied for.

Interest rates can be one of the main culprits for keeping one stuck in a cycle of debt, so it’s hard to pass up considering a credit card with a low – or sometimes, 0% – introductory Annual Percentage Rate (APR) attached to it. Other questions to ask yourself before making a decision do you make frequent balance transfers? Are you looking for consistently low fees, or a one-time bonus?

Take a look below at some of our top picks for credit cards that offer a zero percent introductory Annual Percentage Rate (APR) –fortified with extras.

Best for Balance Transfers: Chase Slate® credit card

EDITOR’S NOTE: The Chase Slate® credit card offer mentioned in this article has expired and is not available through CreditSesame.com

A balance transfer card, if used responsibly by you, can be the lifeline you need to dig yourself out of the debt: transfer your high-interest credit card balances to a lower-interest balance transfer card and get out of debt much faster.

The Chase Slate® credit card’s introductory offer is a 0% introductory APR on purchases and balance transfers for 15 months from account opening. Then after that, a variable APR will apply. What truly sets this card apart from the pack is the introductory balance transfer offer – transfer balances with an introductory fee of $0 during the first 60 days your account is open. After that, the fee for future balance transfer transactions is 5% of the amount transferred, with a minimum of $5. Another plus is this card has no annual fee.

Chase Slate® credit card features we want to call out:

- 0% introductory APR for 15 months on purchases and balance transfers from account opening

- Introductory balance transfer fee of $0 during the first 60 days your account is open. After that, the fee for future balance transfer transactions is 5% of the amount transferred, with a minimum of $5.

- $0 annual fee

Another benefit – checking your score does not affect your credit score with Credit Journey℠ which gives you unlimited access to your credit score and more. It’s free, even if you’re not a Chase customer.

There is a foreign transaction fee of 3% of each transaction in U.S. dollars. This card has no annual fee.

Terms apply.

Best Rewards: Chase Freedom® credit card

EDITOR’S NOTE: The Chase Freedom® credit card offer mentioned in this article has expired and is not available through CreditSesame.com

If pressed between the Chase Slate® credit card and other credit cards in Chase’s lineup, the Chase Freedom® credit card may win over new Cardmembers who want to take advantage of a generous rewards program.

The Chase Freedom® credit card’s rewards calendar changes each quarter, making it a good choice for earning cash back in specific spending categories at certain times of the year. Cardmembers earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. There are new 5% categories each quarter. Earn unlimited 1% cash back on all other purchases. Bonus categories may sometimes include purchases made at gas stations, grocery stores, restaurants or other merchants.

Chase Freedom® credit card features we want to call out:

- 0% introductory APR for 15 months from account opening on purchases and balance transfers, then a variable APR will apply.

- When you transfer a balance during the first 60 days your account is open, there is a 3% intro balance transfer fee, with a minimum of $5.

- The ongoing balance transfer fee is either $5 or 5% of the amount of each transfer, whichever is greater.

- Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. There are new 5% categories each quarter. Earn unlimited 1% cash back on all other purchases.

- There is no annual fee

Chase Freedom® may benefit Cardmembers who are able to max out the spending categories. But if you use your cash back card mainly for purchases made at gas stations or grocery stores, for example, you may not be able to unlock the card’s full cash back potential during the times of the year those categories are not part of the bonus categories. However, there is no guarantee that the bonus categories will include purchases made at gas stations or grocery stores.

There is a foreign transaction fee of 3% of each transaction in U.S. dollars. This card has no annual fee.

Terms apply.

How to find low interest rate credit cards

Check with your financial provider, like your bank or credit union, to see what kinds of low interest cards they carry. Read the reviews on CreditSesame.com to find which out credit card providers offer low-interest cards or introductory APR offers that may be a fit for you.

Investigate the cards in this article; each one comes with a low introductory interest rate and potentially manageable APRs for Cardmembers who don’t tend to carry a balance. Focus on building and maintaining great credit now and in the future so that the lowest possible interest rates may be available to you.

To be considered for the lowest interest rates, one item you’ll typically need to have, for example, a FICO® score of at least 720, so maintain lines of revolving and installment credit and always pay your bills on time. Check your score for free today to see where you stand.

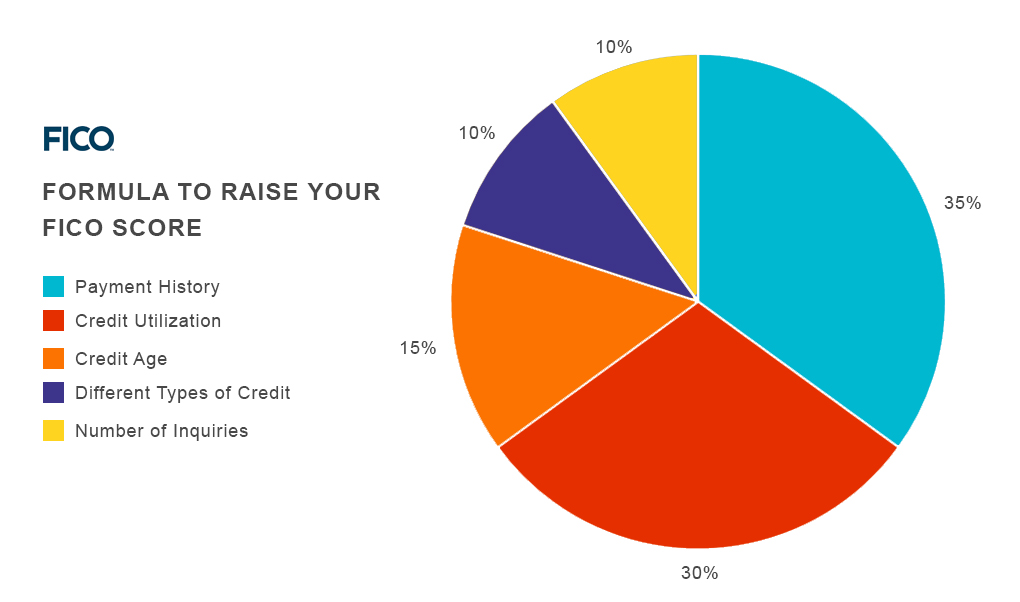

If you aren’t sure how FICO® calculates credit scores, check out the pie chart below.

Above all, pay off your balance each month on time so that the interest rate basically becomes irrelevant.

Q&A

What is the Difference Between APR and Monthly Interest Rates?

First of all, let’s clarify that when we talk about interest, we’re usually talking about nominal interest. The nominal interest rate is the cost you pay to borrow money. So if you have a $1,000 loan at a nominal rate of 10%, you will pay $100 per year in interest.

For a loan an annual percentage rate, or APR, typically may include other costs, like closing costs or other fees associated with the loan. Credit cards typically don’t have an APR that is higher than the interest rate, but mortgages do. For a home loan, if the closing costs and fees are spread out over the life of the loan, the amount you have to pay each year is more than the actual interest charges. Your APR will reflect that, and will be a tiny bit higher than your nominal interest rate.

An APR is calculated annually. The $100 you pay on a $1,000 loan is split into twelve payments, or $8.33 per month. This example is oversimplified because as your balance goes down, your interest charges should as well.

The way it works on credit cards is this. The interest charges to your credit card balance are typically calculated monthly using a Daily Periodic Rate by dividing your card’s APR by 365, then multiplying that number by your average daily account balance and the number of days in the current month’s billing cycle.

A monthly interest rate is something very different. As its name implies, it is calculated monthly. If you borrow $1,000 at a monthly rate of 10%, you’ll actually pay an annual rate of 120%. Monthly rates are common in the title loan and payday loan industries. If you see a title loan advertised for 36%, you’re really paying an APR of 432%!

What is prime rate, and what does it have to do with credit cards?

Prime Rates are not the best rates that card providers give to customers with the best credit, but rather the lowest current short-term rate at which banks lend to one another or to other large, stable businesses. This rate is set by banks and reported publicly by the Federal Reserve Board. Many credit card issuers tie their interest rates to the Prime Rate which fluctuates – varies.

If your credit card has a variable interest rate, that means the rate will go up or down along with the index your credit card interest rate is tied to, for example, but not limited to, Prime Rate or LIBOR (London Interbank Offered Rate).

What do I need to know about APRs?

Credit cards are offered at different APRs. Where one may offer a 0% Intro APR for an introductory period, another may not. But the second card might offer a lower APR overall. Most card issuers generally impose higher interest rates on consumers with lower credit scores, as well as other factors as already mentioned, and generally offer the best interest rates to consumers with higher credit scores, as well as other factors as already mentioned.

There are a couple of things you may want to know about APRs:

1. The better your credit is, as well as other factors considered, the likelihood that your rate will be better is increased. Consumers with outstanding credit may get loans at a lower cost. Consumers with fair or poor credit pay a much larger amount of money for the privilege of borrowing. In fact, the higher interest rates may make some loans not affordable.

2. The purchase APR may be irrelevant if you live within your means and pay off your balance every month. You could potentially never pay a dime in interest charges on your purchases, even while you have credit available in case an emergency arises.

Independent Review Disclosure: All the information about the Chase Freedom® credit card, and the Chase Slate® credit card has been collected independently by CreditSesame.com and has not been reviewed or provided by the issuer of these cards. The Chase Freedom® credit card, and the Chase Slate® credit card are not available through CreditSesame.com.

Advertiser Disclosure: Many of the offers that appear on this site are from companies from which Credit Sesame receives compensation. This compensation may impact how and where products appear (including, for example, the order in which they appear). Credit Sesame provides a variety of offers, but these offers do not include all financial services companies or all products available.

Credit Sesame is an independent comparison service provider. Reasonable efforts have been made to maintain accurate information throughout our website, mobile apps, and communication methods; however, all information is presented without warranty or guarantee. All images and trademarks are the property of their respective owners.

Editorial Content Disclosure: The editorial content on this page (including, but not limited to, Pros and Cons) is not provided by any credit card issuer. Any opinions, analysis, reviews, or recommendations expressed here are author’s alone, not those of any credit card issuer, and have not been reviewed, approved or otherwise endorsed by any credit card issuer.

Provider’s Terms: *See the online provider’s application for details about terms and conditions. Reasonable efforts have been made to maintain accurate information, however, all information is presented without warranty or guarantee. When you click on the “Apply Now” button, you can review the terms and conditions on the provider’s website. Offers are subject to change and the terms displayed may not be available to all consumers.

The information, including rates and fees, presented in this article is believed to be accurate as of the date of the article. Please refer to issuer website and application for the most current information. Verify all terms and conditions of any offer prior to applying.

Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Reviews: User reviews and responses are not provided, reviewed, approved or otherwise endorsed by the banks, issuers and credit card advertisers. It is not the banks, issuers, and credit card advertiser’s responsibility to ensure all posts are answered. The Credit Sesame website star ratings are an average based on contributions from independent users not affiliated with Credit Sesame. Banks, issuers and credit card advertisers are not responsible for star ratings, nor do they endorse or guarantee any posted comments or reviews.

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.