What do credit repair companies do?

A legal credit repair organization in the USA is a business that operates within the regulatory framework set forth by the Credit Repair Organizations Act (CROA) and other applicable laws. It offers services to help consumers improve their credit profiles by disputing inaccuracies, negotiating with creditors, and providing advice.

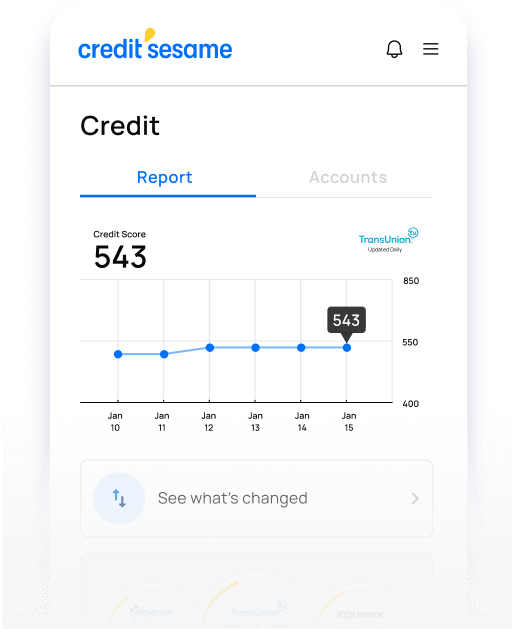

Get your FREE credit report summary

See the factors impacting your credit score and what you can do about it. 100% free.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- Is Credit Sesame a credit repair company?

- What is credit repair?

- What is unfair credit information?

- Credit Sesame vs. credit repair companies

- What credit repair companies can't do

- Can you repair your own credit?

- How much does professional credit repair cost?

- Credit repair scams

- The value of legitimate credit repair professionals

- In a nutshell

Share this

Is Credit Sesame a credit repair company?

Credit Sesame is a financial technology company that provides free and premium credit management services, including credit score, credit monitoring, credit report data and information, and personalized financial recommendations. Credit Sesame is not a credit repair organization as defined above. It does not directly engage in credit repair activities or negotiate with creditors on behalf of consumers. Rather, it provides smart tools and services that can enable customers to manage their own credit.

What is credit repair?

What is unfair credit information?

The Fair Credit Reporting Act (FCRA) requires credit bureaus to remove unfair, inaccurate or unprovable information from your credit reports if you call it to their attention.

Does “unfair” mean it is not true? Not exactly. It means the entry is true, but the way it is reported may be excessively and unfairly damaging. For example, a single bad debt can pass through many hands; the original creditor, a collection agency and perhaps multiple debt buyers. If every debt buyer reports the same account, it can impact your credit score every time. You can have the excess entries deleted.

“Unverifiable” refers to items that cannot be proven. If a collection agency or debt buyer can’t document the original debt that you supposedly still owe, you can force the credit bureaus to remove it.

Credit Sesame vs. credit repair companies

The significant difference between a credit repair organization and Credit Sesame lies in the scope of services and level of involvement.

Credit Sesame is a financial technology company that primarily offers credit monitoring and financial management tools. It provides consumers with access to their credit scores, credit reports, and personalized recommendations for improving their financial situation. Credit Sesame does not directly engage in credit repair activities or negotiate with creditors on behalf of consumers. Instead, it empowers individuals with information and insights to make informed decisions about their credit and finances. The responsibility for taking action, such as disputing inaccuracies, generally rests with the consumer.

Credit repair organizations typically work actively on behalf of consumers to address inaccuracies, errors, and negative items on their credit reports. This involves communicating with credit bureaus, creditors, and collection agencies, initiating disputes, and negotiating with relevant parties to resolve credit-related issues. Credit repair organizations aim to improve clients’ credit profiles by taking specific actions and advocating on their behalf.

It’s important to note that the level of involvement and services provided by credit repair organizations can vary. Some may offer more comprehensive assistance, while others may focus on specific aspects of credit repair. Consumers should carefully research and evaluate the services, reputation, and compliance of any credit repair organization they consider working with.

There may be value for consumers in working with both Credit Sesame and a reputable credit repair organization. Although, Credit Sesame makes it easy for you to understand and take actions to actively manage your credit scores.

What credit repair companies can't do

Credit repair companies cannot promise to remove accurate information that does not fall under unverifiable or unfair exceptions. The CROA says that companies cannot request or receive payment until they have completed the credit repair services promised.

Can you repair your own credit?

Individuals can repair or improve their own credit without help from a credit repair organization. Here’s what you might need to do to repair your own credit:

- Request your credit reports from Equifax, Experian and TransUnion for free at annualcreditreport.com, the only credit reporting site maintained by the federal government.

- Work your way through each report and flag damaging entries. Determine which are accurate (but possibly reversible), inaccurate, unfair or unverifiable.

- Collect the information or documents needed to prove your case. That might be canceled checks or bank statements proving you made a payment, a statement showing a closed or paid account, or a validation notice from a collection agency.

- Contact the bureau(s) and complete their online forms disputing the information. Experian, Equifax and TransUnion make it easy to file your dispute on their websites and upload documents. Or you can call or do it by mail.

- Give the credit bureaus 30 days to investigate your claim.

- Recheck your credit reports to make sure the disputed items have not reappeared.

- Monitor your credit reports to ensure the errors don’t reappear.

Free and paid Credit Sesame membership helps source and organize much of this information, but you stay in control of when and how you take actions that can have positive effects on your credit.

How much does professional credit repair cost?

The cost of credit repair services operating legally under the CROA varies depending on several factors, including the specific services offered, the complexity of the credit issues, and the credit repair company you choose to work with. Credit repair organizations may charge different fee structures, such as a monthly fee, a one-time setup fee, or fees based on specific services provided.

The cost of credit repair can range from around $50 to several hundred dollars per month, depending on the extent of the services provided and the complexity of the credit issues being addressed. Some individuals choose to pursue self-directed credit repair, which can be done at little to no cost, by reviewing their credit reports, disputing inaccuracies themselves, and adopting positive credit practices.

If you are considering credit repair services, it is advisable to research and compare the costs and services of different companies, ensuring they are reputable and transparent in their pricing structure.

Credit repair scams

Not all credit repair services are legitimate. Some indulge in illegal practices that might work in the short term but could get you into big trouble.

One popular scammy tactic is the “new credit identity.” They promise to make your questionable past disappear by helping you apply for a new social security number. However, there are only a few legal reasons for doing this, such as identity theft. Filing a police report for nonexistent identity theft is illegal. Any strategy deployed for the purpose of misleading creditors is against the law.

Another shady trick is spamming credit bureaus with disputes for every derogatory entry because these have to be deleted after 30 days if they cannot be proven. However, they reappear if they are legit, and the bureaus are allowed to ignore your disputes if they are frivolous.

Disreputable credit repair companies may also recommend that you purchase “tradelines” or “authorized user accounts.” There are services out there that rent credit information from consumers with good credit. They add you as an authorized user to their accounts, and then their payment history populates your credit report. A line of on-time payments can improve your score. Many parents do this for their adult children to help them establish credit, but this is not the same. Apart from the cost, Experian warns that paying to piggyback on a stranger’s credit card and misrepresenting your true creditworthiness to a lender is bank fraud, and you could pay a steep price, especially if you later default on the loan.

Other scammy companies simply take your money upfront and do very little or nothing to help repair your credit. If a firm demands upfront payment, it is probably a scam.

The value of legitimate credit repair professionals

Legitimate credit repair can save you time and aggravation and can sometimes help you clear accurate derogatory entries using debt validation and goodwill letters. They may also help you reestablish good credit the right way.

Firms operating legally will tell you you have the right to review your contract before signing. They must also disclose that you can repair your credit yourself. Dodgy companies might fudge important numbers like the cost of their services.

Look for reputable outfits displaying good ratings with the Better Business Bureau, TrustPilot and other review sites. Make sure you understand what services are provided, any guarantees and the cost.

In a nutshell

Credit repair organizations offer services aimed at improving individuals' credit profiles. They work on behalf of consumers to address inaccuracies, negotiate with creditors, and provide guidance. While some consumers may find value in the assistance provided, choosing reputable organizations is essential, being aware of potential costs, and understanding that self-directed credit repair is also a viable option.

Whether opting for professional credit repair services or pursuing self-help methods, the ultimate goal remains the same: to improve your credit standing. It's crucial to approach credit repair cautiously, conduct thorough research, and consider your particular circumstances. By taking informed steps, you can work towards rebuilding your credit and achieving better financial well-being.

Get your FREE credit report summary

See your credit score and get insight into what’s impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Get your FREE credit report summary

Understand your credit better with a free credit report summary

How to get a credit report

Value of credit reports

Reporting to credit bureaus

See your score and

credit report

summary.

See your score and credit report summary.

See the factors impacting your credit score

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.