A guide to understanding your credit score

A credit score is a 3-digit numerical representation of your creditworthiness. It is based on various factors such as payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries. Lenders and creditors use credit scores to assess your lending risk.

Get your free credit score

Start today. The sooner you know your baseline score, the sooner you can start to build credit history.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

- ON THIS PAGE

- What is a credit score?

- What are the types of credit scores?

- How are credit scores calculated?

- What is the relationship between credit score and credit report?

- Who uses my credit score?

- What are some benefits of having a credit score?

- Who keeps my credit score on file?

- When do credit scores typically get used?

- In a nutshell

Share this

What is a credit score?

A credit score is usually a number ranging from 300 to 850. It is an essential financial tool lenders and creditors use to assess an individual’s creditworthiness. Your credit score reflects your credit history and helps predict your ability to repay borrowed funds.

Credit scores are calculated based on credit report information, which contains data about your credit accounts, payment history, public records, and inquiries. The most commonly used credit scoring models are the FICO® Score and VantageScore, though other specialized models exist.

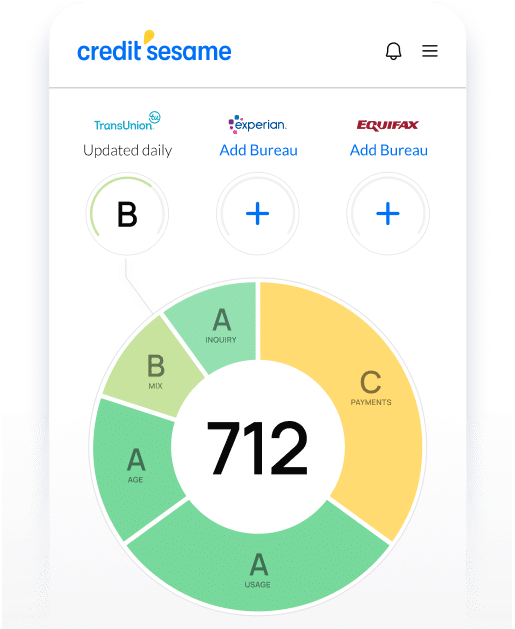

Factors contributing to the calculation of credit scores include payment history, which indicates how consistently and responsibly debts are repaid; credit utilization, which measures the amount of credit used compared to the total available credit; length of credit history, which assesses the duration of an individual’s credit accounts; credit mix, which considers the types of credit used (e.g. credit cards, loans); and recent credit inquiries, which reflect recent applications for credit.

A higher credit score suggests lower credit risk; you are more likely to get credit approval and favorable interest rates. Lenders and creditors use credit scores to evaluate loan applications, determine credit limits, and set interest rates. Insurance companies, landlords, and employers may also consider credit scores when assessing risk or making decisions.

Regularly monitoring and maintaining a good credit score is important for financial well-being. It can be achieved by making timely payments, keeping credit utilization low, maintaining a mix of credit types, and being cautious with new credit applications. Understanding credit scores empowers individuals to take control of their financial health and make informed decisions about borrowing and credit management.

What are the types of credit scores?

Lenders and creditors use several types of credit scores to assess your creditworthiness. The two most widely recognized credit scoring models are the FICO Score and VantageScore.

FICO® Score

The FICO Score is developed by the Fair Isaac Corporation and is widely used by lenders. It is based on a scale ranging from 300 to 850, with higher scores indicating lower credit risk. The FICO Score considers various factors, including payment history, credit utilization, length of credit history, credit mix, and recent credit inquiries. The FICO Score has different versions, with FICO Score 8 being one of the most commonly used.

VantageScore

VantageScore is a credit scoring model developed by the three major credit bureaus: Experian, Equifax, and TransUnion. It also uses a scale ranging from 300 to 850, with higher scores indicating lower credit risk. VantageScore takes into account factors similar to the FICO Score, such as payment history, credit utilization, credit age and mix, and inquiries.

Apart from these widely used credit scoring models, there are other specialized credit scores that cater to specific industries or purposes. These include:

- Industry-specific scores. Certain industries, such as the auto and mortgage industries, have their own credit scoring models tailored to assess creditworthiness for specific types of loans.

- Educational scores. Educational credit scores are designed for educational purposes, providing consumers with an estimate of their creditworthiness based on specific criteria.

- Internal scores. Some lenders or financial institutions may develop their proprietary scoring models to evaluate credit applications and determine lending terms. These scores are specific to the institution and may consider factors beyond traditional credit data.

It’s important to note that the specific credit scoring models used by lenders may vary, and different models can generate different credit scores for the same individual. However, the fundamental principles and factors considered in most credit scoring models remain consistent.

How are credit scores calculated?

Credit scoring models, such as the FICO Score and VantageScore, analyze the information in your credit report to assign a credit score. These models consider various factors to determine your score:

- Payment history. The timeliness of past payments, including any missed or late payments, is a crucial factor. Consistent on-time payments have a positive impact on your credit score.

- Credit utilization or usage. This is the ratio of credit used compared to the total available credit. Lower credit utilization, typically below 30%, is generally viewed positively by lenders and can contribute to a higher credit score.

- Length of credit history. The length of time you have had credit accounts is considered. A longer credit history demonstrates stability and responsible credit management, which can positively impact your credit score.

- Types of credit. The mix of credit accounts, such as credit cards, loans, and mortgages, can influence your credit score. A diverse credit mix may indicate responsible borrowing behavior.

- Recent credit inquiries. Recent applications for new credit can have a temporary negative impact on the credit score, particularly if there are multiple inquiries within a short time period. However, credit scoring models generally allow for rate shopping, where similar inquiries within a specified window are treated as a single inquiry.

The specific weight assigned to each factor may vary between credit scoring models. Different lenders may also have their own criteria and cutoffs for creditworthiness.

A higher credit score indicates lower credit risk, making you more likely to be approved for credit and qualify for favorable interest rates. It’s important to regularly monitor credit scores, maintain a positive payment history, keep credit utilization low, and address any errors or discrepancies in credit reports to improve or maintain a good credit score.

What is the relationship between credit score and credit report?

Your credit scores are derived from the information contained in your credit reports.

Credit reports are comprehensive records of an individual’s credit history compiled by credit bureaus. They include details about credit accounts, payment history, public records, and inquiries. A credit report serves as a repository of information that lenders, creditors, and other entities use to assess an individual’s creditworthiness.

Your credit score is a numerical representation of your creditworthiness based on this information. It is calculated using a specific scoring model, such as the FICO Score or VantageScore, which takes into account the information from the credit report. The credit scoring model applies a set of algorithms and weights to the various factors in the credit report to generate the credit score.

In summary, a credit report contains the detailed information about your credit history, while the credit score is a numerical summary derived from that information. The credit score serves as a standardized measure of creditworthiness and is used by lenders and creditors to make decisions about granting credit, setting interest rates, and determining loan terms.

Who uses my credit score?

A number of people and entities can legally request a copy of your credit report, which is the information that feeds into your credit score. For example, according to the Consumer Financial Protection Bureau (CFPB), this list includes:

- Businesses you owe money

- Government agencies

- Landlords

- Employers

- Insurance providers

- Banks and financial providers

- Legal entities (in the event of court orders, for example)

- Others you have authorized in writing to receive a copy

Although these people and organizations might never see your credit score, they depend upon the information in your credit report to make decisions. For example, these entities might review your credit report to answer questions such as:

- Can I trust this person to pay their monthly rent on time and at the rate we’ve agreed upon?

- At what interest rate should I extend this bank loan to my client?

- Is this person eligible to participate in a state or federal government program I manage?

- Can I confirm this job candidate’s identity and confidently extend a job offer?

- Is this person in a position to pay the child support they owe?

Requests for credit reports are common and generally serve as a tool for verifying your information. They also help others make an informed decision about the terms and conditions for extending credit and working with you in other financial capacities in the future.

What are some benefits of having a credit score?

There are several positive reasons to have a credit score. A credit score serves as shorthand for your overall financial history. When you share your credit score with a trusted financial adviser or a prospective lender, they can immediately place you on the scale for that score—for example, somewhere between 300 and 850 in the case of the FICO Score.

Although this information is limited without a closer review of your credit report, it enables the other party to arrive at some general impressions of your financial health. For example, a higher score could signal you have used debt wisely in the past. You have kept an appropriate balance of available credit and credit actively in use. You’ve made payments on time and avoided making too many requests for new credit.

A lower credit score might signal you have faced financial challenges. For example, you may have maxed out some of your accounts. You might have lost a job or encountered other issues that led to missed payments.

The good news about a credit score is that it changes all the time. If you have a higher score, you can maintain and improve it with the right financial habits. If you have a lower score, you can focus on making timely payments and paying down balances you’ve had on file for some time. There are always new opportunities to improve the building blocks of your credit report, which rolls into your credit score.

Who keeps my credit score on file?

Your credit score can be found in several places. One of the most common ways to get your score is to review your online or print statements from a credit card or a loan in your name. Increasingly, financial organizations are posting this information for your customers. Your lender is an example of a company that keeps your score on file.

Several types of nonprofit financial advisers can also help you access your credit report and corresponding credit score. For example, nonprofit credit counselors and even some federally approved housing counselors can support you in reviewing this information to get the answers you need.

Make sure any credit score you obtain is the same kind of score that a lender would use to evaluate whether you are eligible for a loan. Some groups can provide you with an educational credit score. These aren’t preferred because often, they aren’t the same number that a financial institution would use to make a decision involving credit.

When do credit scores typically get used?

Credit scores most commonly get used by individual consumers who want to understand their own personal financial health. They might also be preparing for a major life decision, such as opening a business or starting college. A credit score can provide them with a greater understanding of the terms they’re likely to be offered when they apply for a loan or credit card.

At other times, credit scores might be used by another party, such as a bank, to determine whether to extend a loan. They might also evaluate a credit score to determine interest rates and terms they will apply. In many cases, a credit score isn’t included with your credit report—thus, it’s often invisible to third parties. Because of this, it is a good idea to focus on taking steps that can improve your overall credit portfolio and credit report. These data points are available for others to access, and they contribute directly to your credit score.

In a nutshell

Having good credit doesn't necessarily take a lot of hard work. It's more about developing good habits. The more you know about what can help or hurt your credit score, the easier it is to develop the habits that lead to a good credit score.

Don't wait till you need credit to worry about your credit score. Building a good credit record takes time. Be aware of your credit score and work to maintain a good score at all times. You never know when you might need it or when someone is making decisions about you based on it.

Do more with your FREE score™

Check your score right away and see the factors impacting your credit

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.

Share this

More related articles

Check your credit score for FREE

Checking your score to see where you stand is FREE and does not impact your credit.

What is a credit score

How to establish credit

What's a good credit score?

See your score.

Reach your goals.

See your score. Reach your goals.

Begin your financial journey with Credit Sesame today.

Get your FREE credit score in seconds.

By clicking on the button above, you agree to the Credit Sesame Terms of Use and Privacy Policy.