Credit Sesame on how U.S. economic headwinds may be a natural consequence of government support during the COVID-19 pandemic.

The U.S. economy has staged a remarkable comeback from the worst of the pandemic. The steepest economic contraction on record and widespread supply chain tangles resulted in some extraordinary measures by the federal government. This was followed by a swift bounce-back and relative normalcy.

The economy now faces several threats to this feel-good story. The government stimulus is wearing off, and there might be more challenging times in the year ahead. Over the next few quarters, the people of America will find out what life and the economy are like without that extra government assistance.

Americans are burning through pandemic savings

Personal saving rates got a massive boost in 2020 and 2021. The combination of federal stimulus checks and restricted spending opportunities helped Americans bank an unprecedented portion of their income.

The Bureau of Economic Advisors data on personal saving rates goes back to January 1959. Since that time, the personal saving rate has averaged 8.5%. Over most of the past decade, it’s generally been much lower than that. In the early months of the pandemic, the personal saving rate soared, peaking at 32% in April 2020. Personal saving rates remained in double digits every month from March 2020 through April 2021.

At the end of 2021, with the worst of the pandemic over, the economy began to transition. Commerce and travel reopened, and one by one, special government assistance programs were discontinued. Consumers had more opportunities to spend and less supplemental income from the government. The saving rate since the beginning of 2022 has averaged 3.9%.

Not only have Americans saved less, but many have begun using up the savings accumulated during the pandemic. Total deposits at U.S. banks have declined for ten straight months, the longest such streak on record.

Credit scores may revert because of economic headwinds

Not only did individuals enjoy a temporary boost to savings from pandemic assistance programs, but they benefitted from increased credit scores, too. A recent study by the Federal Reserve Bank of St. Louis showed that the share of consumers whose credit scores improved soared during the pandemic. Soon after, delinquency rates on credit card payments rose. Consumers who had recently improved their credit scores saw an especially steep rise in delinquency rates.

Typically, people with recent credit score improvement tend to have declining delinquency rates compared to the general population. Given the timing, the coincidental credit score improvement may result from government aid. Judging by the rise in delinquency rates, that improvement will not be sustainable. For some individuals, now that special government assistance has dried up, credit scores may stagnate or even decrease.

Student loan payments will curtail spending

One particular pandemic assistance program that ended recently was the moratorium on federal student loan payments. There are 43 million holders of federal student loan debt, and so this is bound to impact the economy. A significant chunk of the money previously available for consumer spending will now go toward student loan payments.

Just how much money this will take out of the economy remains to be seen. Borrowers still in school do not need to start making payments just yet. Others may be eligible for payment deferrals based on their occupations. Some of those who are out of school can sign up for income-driven repayment programs that reduce their monthly payments.

Considering these adjustments, the impact of these payments is estimated to be a 0.3% to 0.7% reduction in Gross Domestic Product (GDP).

The economy has little momentum left

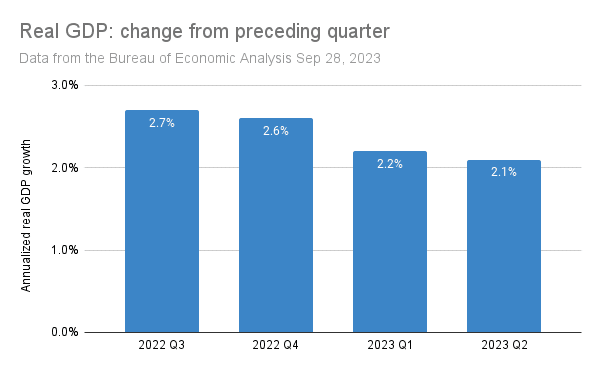

A reduction of 0.3% to 0.7% in GDP may seem minor. However, the GDP doesn’t have room for maneuver. The graph below shows GDP growth over the past four quarters (figures for the third quarter of 2023 are not yet available):

Even before student loan payments kicked in, GDP growth was low and declined in the past three quarters. The prospect of a government shutdown, elevated interest rates, high consumer debt, and tightening lending standards had already created headwinds to continued growth. Adding student loan payments to the mix is just one more drag on the economy.

Inflation makes the economic headwinds more challenging

Inflation is a complicating factor that proves to be frustratingly stubborn, even if some progress has been made. Since peaking at 8.9% in June 2022, the year-over-year Consumer Price Index increase declined steadily, reaching 3.1% in June 2023. However, it has risen for the last two months. Oil producers have cut output in an attempt to boost prices, and various labor disputes are creating wage pressures throughout the economy. These forces can make inflation highly persistent.

Cutting interest rates can help a flagging economy, but the Fed raised interest rates in an attempt to fight inflation. The Fed has indicated that it plans another rate hike before the end of 2023. With inflation proving hard to kill, the Fed seems more likely to implement a rate hike than a rate cut in the near future.

This may result in slow economic growth in the months ahead with no government support on the horizon. The silver lining is that slow growth may be what it takes to calm inflation.

If you enjoyed US economic headwinds as the pandemic stimulus wears off, you may like,

- Federal government Secure 2.0 Act for gig workers

- How the poor vs. rich were affected by the economy in 2022

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.