Credit Sesame discusses how a changing job market may hit recent graduates the hardest.

This year’s graduating classes left school to join a booming job market. For some, though, their introduction to the workplace may not be quite so welcoming.

While the job market remains strong, certain areas show signs of weakness. Recent college graduates may find they are the most vulnerable part of the workforce.

A realistic view of job prospects in the months ahead is critical for new grads who want to prevent a bumpy start to their careers from turning into longer-term financial problems.

Labor remains in high demand

In many ways, this year’s job-seekers have a lot going for them.

In August, the U.S. job market posted its 32nd straight month of growth. This brought the total number of jobs to an all-time high.

In fact, there aren’t enough workers to fill all of today’s jobs. According to the Bureau of Labor Statistics (BLS), there are currently ten job openings for every seven people looking for work.

All of this seems as though it should be a very welcoming environment for anyone entering the job market. However, as most people who’ve ever looked for work have experienced, the job market isn’t quite that simple.

Signs the trend may be changing

One of the tricky things about economic trends is that they are constantly changing. Numbers that measure where the economy is now are less important than where those numbers are going in the months ahead. There are reasons to believe recent strong employment trends may not last.

While employment overall may remain high, what matters to people just entering the job market is how fast that market is creating new jobs. Even if the number of jobs doesn’t start shrinking, a slower pace of job growth would mean fewer new opportunities. That affects people looking to start their careers much more than it does people who are already working.

That’s why new grads need to be realistic about things that may slow job growth in the months ahead.

A winning streak can’t go on forever

As mentioned above, the job market has now grown for 32 straight months. That may sound great, but it’s also scary when you consider that job markets are cyclical.

While the number of jobs has grown over time, it hasn’t risen in a straight line. The economy has typically gone through phases where the number of jobs grows, followed by periods when it shrinks.

In the case of the job market, the idea that a winning streak can’t go on forever is more than just a numbers game. It reflects the reality that there are practical limits to how quickly companies can hire new workers. After periods of rapid hiring, it usually takes some time to assimilate the added workforce before the next hiring binge. This is especially true if the economic outlook makes employers more cautious about taking on new headcount.

The economy is slowing

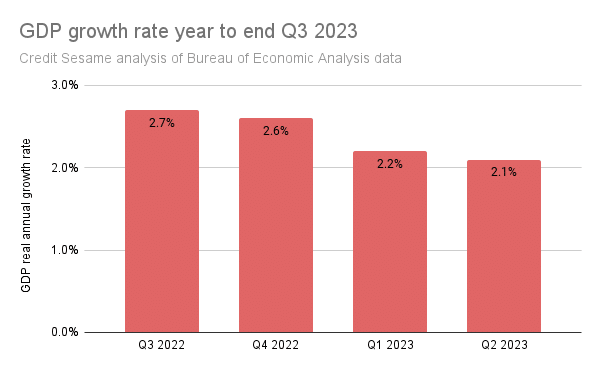

The economy is giving employers a reason to be more cautious. The most recent data from the Bureau of Economic Analysis show how the inflation-adjusted growth rate of the economy has slowed over the past year:

GDP growth is still in positive territory, but it’s not heading in an encouraging direction. Besides the recent numbers, the reasons behind those numbers give many economists cause for concern. A record amount of consumer debt has sustained economic growth. Now that higher interest rates have made that debt increasingly more expensive, it’s questionable how long this pace of borrowing – and the growth it supports – can continue.

Hiring managers are getting more cautious

Doubts about the economy may not yet be enough for most employers to start cutting jobs – though there have been some high-profile mass layoffs so far this year. However, when they become concerned about the economy, the easiest thing for hiring managers to do is to slow the pace of new hiring.

According to the latest corporate management survey from the Business Roundtable, that’s exactly what hiring managers plan to do.

The survey found that overall, more CEOs expect their workforces to shrink over the next six months than expect them to grow. When the decision-makers plan to cut jobs, it’s not just job seekers who have to worry. Recent hires should also be concerned, as many companies take a last-in, first-out approach to handling layoffs.

Employment varies depending on where you look

Not only might recent graduates face slower job growth in the months ahead, but some may have to be concerned about the types of available jobs.

According to a recent jobs report from the BLS, some of the strongest areas of the job market include hotel, restaurant and healthcare jobs – perhaps not the careers most college students had in mind.

Besides differences by type of job, there are also significant differences in the strength of the job market from one state to the next.

According to the BLS, the state-level unemployment rate ranges from a low of 1.7% in Maryland to a high of 5.4% in Nevada. A slowing economy may widen some of these regional differences. Depending on where they live, new grads may have to be flexible about relocating to pursue their chosen career.

Graduating to financial challenges

New grads will need to make the best of the changing job market because they will face challenging financial realities.

First, student loan payments have resumed. For recent grads, those payments start coming due six months after leaving college. To be prepared, students should check how much their payments will be and research options like income-driven repayment plans.

While their classroom days might be ending, many recent grads will have to learn new lessons about managing credit responsibly in the months ahead. Along with their diplomas, graduates can expect to receive a flood of credit card offers for the first time. When considering those offers, they should keep the uncertainties of the job market in mind.

According to the Federal Reserve Bank of New York, young adults (18 to 29 years) are becoming seriously late on credit payments faster than any other age group. Over the past year, they also had the biggest increase in the rate of serious delinquencies of any age group. These payment problems are worse for credit cards than for any other payment type.

If, as the plans of CEOs seem to indicate, the job market is on the verge of weakening, recent grads should be especially cautious about using credit. Learning to budget for repayment before borrowing money is key to having positive first experiences with credit cards.

If you enjoyed Changing job market may hit recent grads the hardest you may like,

Disclaimer: The article and information provided here is for informational purposes only and is not intended as a substitute for professional advice.